Temporary Flat Rate Method

You can use this method if you had worked from home more than 50% of the time in a 4 consecutive week periods. Claim $2 for each day that you worked at home during that period, plus any other days you worked at home in 2021 due to COVID-19, up to a maximum of $500. You dont need any supporting documents for this method, nor do you need a signed T2200. Claim the amount on line 22900 of your tax return.

Tax Tips For Teachers 2021 What You Can And Cant Claim For

Over the last 12 months, schools have continued to switch in and out of remote learningin response to COVID-19, with educators working from home. As teachers and school leaders in Australia begin to prepare their 2020-21 tax returns, heres our annual Q& A with the Australian Taxation Office about what to keep in mind when calculating your expenses this year, and examples of what you can and cant claim for.

This year has been another mix of remote and face-to-face teaching. At the time of publishing this article, Victoria is in another lockdown and, apart for certain students, schools have again switched to a period of remote learning. What tax claim options are there for educators working from home?

There are three methods to calculate your working from home expenses. The method you use will depend on your circumstances . The methods available for Tax Time 2021 are:

- Temporary shortcut method an all-inclusive rate of 80 cents per work hour

- Fixed rate method 52 cents per work hour which covers additional running expenses such as . You need to separately work out your phone and internet, computer consumables, stationery and depreciation on your computer, phone and any other devices you use for work.

- Actual cost method the actual work-related portion of all your running expenses, which you incurred as a result of working from home.

For further information on working from home expenses see ato.gov.au/home

1) You must have spent the money yourself

Track Your Teaching Expenses And Save Your Receipts = More Tax Deductions For Teachers

Stay on top of your record keeping, year-round. Keep it simple and keep your records organised. If you dont keep your receipts, it is likely that items that you could have claimed as teacher tax deductions will be missed. And if you dont have a receipt to prove a teaching-related expense, dont claim the expense. That might sound a bit harsh, but the solution is easy: Put all of your work-related receipts in a folder for your tax agent at the end of the financial year.

Another way to save tax receipts is with your smartphone. Using a simple mobile app like the one from Etax Accountants, you can snap your receipts year-round and save them directly into your next tax return. Later, at tax time, your tax return will be easy to finish online and an Etax accountant will check the details before your tax return is lodged with the ATO. So easy to do, youll never miss another cash-saving tax deduction.

Read Also: How Much Do You Pay In Taxes For Doordash

You Can Claim $500 In Expenses If You Worked From Home Due To Covid

The federal government continues to support working Canadians during the COVID-19 pandemic. For tax year 2021, the CRA has increased the claim amount for the work-from-home tax credit to $500 with the flat rate method, which allows Canadians working from home due to COVID-19 to deduct home office expenses on their taxes.

We at TurboTax want to ensure you have all of the information you need to make a claim for this expense.

Qualifying For The Deduction

You must be a teacher, aide, instructor, counselor, or principal to qualify for the educator expense deduction, and you must have worked at least 900 hours during the school year in a school that’s certified by your state. The school can be a public, private, or religious institution.

Only grade school and high school educators qualify. People with homeschool, preschool, or college educator costs don’t qualify for this deduction.

If you begin your teaching career in September, you most likely would not be able to claim the deduction in that year because you wouldn’t reach 900 hours by December 31.

Also Check: Irs Company Lookup

The Top 14 Teacher Tax Deductions:

Here are some expenses that you may be able to claim, include:

- Teaching supplies: teaching resources or materials that were not paid for or reimbursed by your school

- Teaching registration fees and related costs

- Working with children/Blue card applications

- Uniforms including laundry costs

- Self-education that relates to your current teaching role

- Some travel and meal expenses

- Any relevant overnight stay costs

Are There Any Other Teacher Tax Deductions

Your accountant is your best bet for personal deductions beyond the standard teacher deductions after all, you may have a side gig we dont know about! But if youre a teacher who has gone back to school to pursue additional education, be aware that there are deductions for tuition that may exceed that $250 limit.

Want to know more? Check out the IRS Educator Exemption. And dont forget to load up on our favorite financial literacy resources for teachers!

Don’t Miss: Laurie Kazenoff

Unreimbursed Expenses Related To Employment

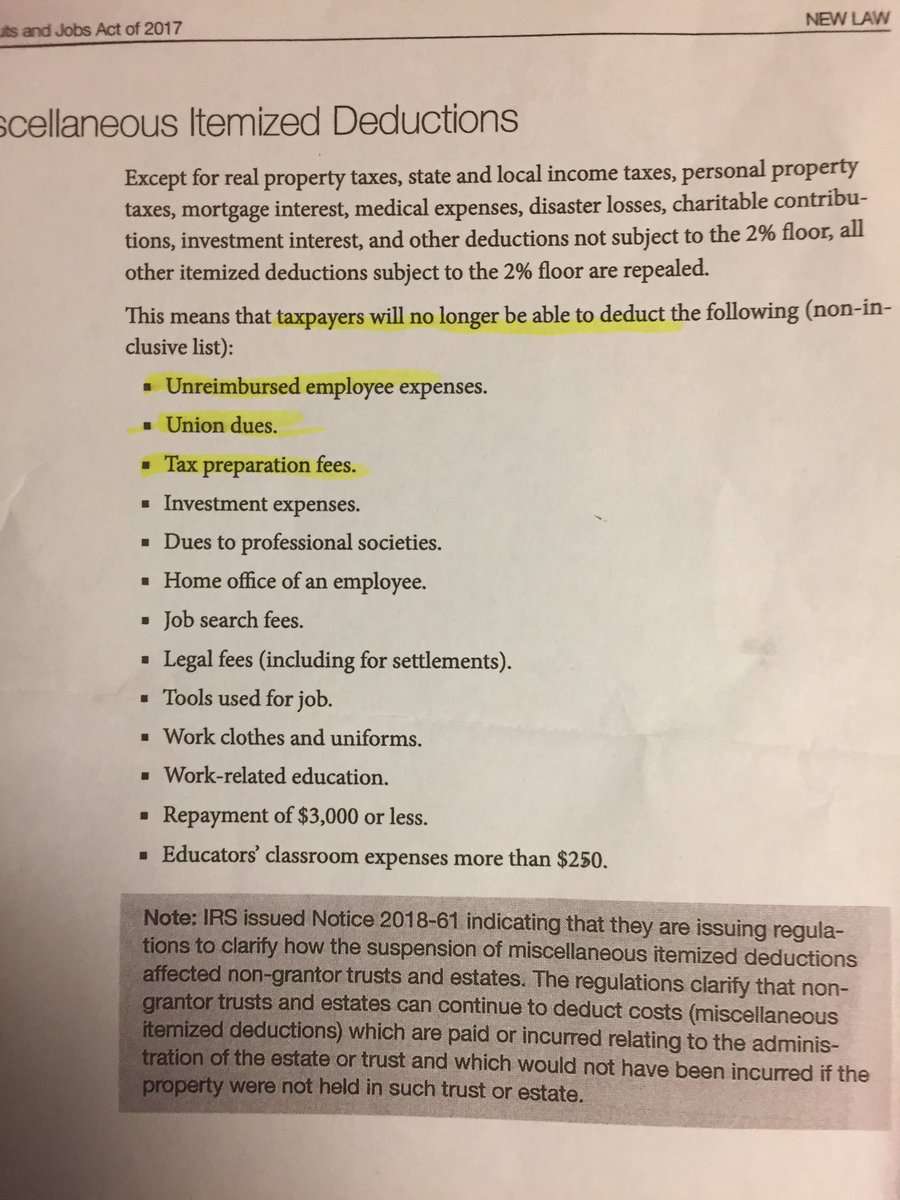

As noted above, the itemized deductions for employee expenses beyond the $250 have been eliminated in the tax reform, so that federal deduction is no longer available.

Despite the fact that educators have had to work at home during the coronavirus pandemic, there has been no change in eligibility for the home office deduction. The 2017 tax reform eliminated educator expenses beyond the $250 above-the-line deduction, which had been used to cover some home-office expenses. There has been no legislation providing subsequent tax relief for home use during COVID.

Rules for deducting expenses for a home office for self-employed individuals are fairly strict . The home office space must be used exclusively for work purposes, which is a tough criterion to meet.

How Do I Claim Tax Relief

Also Check: How Do You Pay Taxes With Doordash

Teacher Specific Expenses You Can’t Claim As Deductions

-

Self education, if your study is only related in a general way or is designed to help you get a new job, eg you can’t claim the cost of study to enable you to move from being a teacher’s aid to being a teacher.

-

Home office expenses related to the cost of rates, mortgage interest, rent and insurance

-

The cost of car trips between home and work, even if you live a long way from your usual workplace or have to work outside normal business hours eg parent-teacher interviews.

-

Gifts you purchased for students

-

Meeting students’ personal expenses for example, paying for lunch, excursions or school books

How Do I Know If I Qualify

The deduction is only available to qualified educators who meet certain requirements for the tax year for which theyre filing. Specifically, you need to be a K12 teacher, instructor, counselor, principal or aide for at least 900 hours during the school year.

Also, your school must provide elementary or secondary education as determined under your states law.

Don’t Miss: Do Doordash Drivers Get Taxed

What Can Teachers Write Off On Taxes In 2022 A Dive Into Deductions

When tax time comes around, its natural for teachers to start scrounging for those receipts for all of those classroom supplies theyve purchased out of pocket during the year. But hold up: Is it worth it to pull out all those receipts? What can teachers write off on taxes in 2022? What if I have to buy masks to teach or classroom supplies?

We crunched the numbers and came up with some tips for teachers on maximizing the 2022 teacher tax credit!

I Worked From Home In 2021 Do I Automatically Qualify For The $500 Claim

Yes. This claim is available for people whether they used to work at the work location and due to COVID-19, they had to work from home, or if they work from home as a job requirement regardless of COVID.

In the case when your job requires you to work from home regardless of the COVID pandemic, you can claim more than $500 flat rate of employment expenses if your employer provides you with a signed T2200 Declaration of Conditions of Employment. In this case, you will be required to fill the T777 Statement of Employment Expenses form and file it with your tax return.

Recommended Reading: Tax Preparer License Requirements

Who Can Claim The Educator Expense Deduction

To claim the educator expense deduction, you must work as a teacher, instructor, counselor, classroom aide, or principal in a school that provides elementary or secondary education . You also must work with students in kindergarten through grade 12 for at least 900 hours during the school year.

Save On Tax Prep Software With Your Nea Membership

As an NEA member, you can earn cash back when you purchase tax prep products and services, such as TurboTax, H& R Block and more, through NEA Discount Marketplace. Look under Office Supplies, then click on Tax Preparation to find the offers available to members during this tax season.

NOTE: All of the information in this article is accurate as of January 4, 2022.

You May Like: Doordash How Much Should I Set Aside For Taxes

Teacher And Early Childhood Educator School Supply Tax Credit

The Eligible Educator School Supply Tax Credit is a refundable credit that Teachers and Early Childhood Educators may claim if they have out of pocket expenses for teaching supplies. Educators can claim a refundable credit for up to $1,000 in eligible supplies they have purchased, which could then result in up to a $150 refund on their tax return.

Who Can Take The Tax Deduction And What Can They Take It For

K-12 teachers, principals, counselors, and aides who worked in schools for at least 900 hours a year can currently take the tax deduction.

They can deduct up to $250 annually for books, supplies, computer hardware and software, and other supplementary materials that they purchased for their classrooms and were not reimbursed for by their district. They can also deduct for any out-of-pocket professional-development expenses. Health and physical education teachers can also use the deduction for athletic supplies.

Two educators who are married and filing jointly can deduct up to $500 a year .

The deduction is somewhat unusual in that its above the line, meaning teachers dont have to itemize to get it. It comes directly off of their taxable income.

The only other professions specifically mentioned on the tax form as being entitled to certain above-the-line breaks are National Guard and Reserve members, performing artists, and fee-basis government officials .

That said, its important to understand that the educator benefit is not a credit, which would reduce how much money a person owes the government dollar-for-dollar. As an IRS spokesman explained, there are some situations where a tax deduction is more advantageous than a creditin particular when it moves someone into a lower tax bracket.

Read Also: H& r Block Early Access W2

Teacher Specific Expenses You Can Claim As Deductions

-

Self-education expenses if your course or conference relates directly to your current job eg a course in working with children with special needs.

-

Running costs of your home office if you have to work from home, including depreciation of office equipment, work-related phone calls and internet access charges, and electricity for heating, cooling and lighting costs.

-

Equipment purchased specifically for your work such as computers, laptops, tablets, mobile phones and printers and it costs more than $300, you can claim a deduction for this cost spread over a number of years .

-

Expenses for your car when you:

-

Drive between separate jobs on the same day eg travelling from your job as a teacher to a second job as a musician

-

Drive to and from an alternate workplace for the same employer on the same day eg driving from your school to another school to moderate exam results.

There are limited circumstances where you can claim the cost of trips between home and work, such as where you carry bulky tools or equipment for work eg a set of sporting equipment needed for a carnival. The cost of these trips is deductible only if:

-

Your employer requires you to transport the equipment for work

-

The equipment was essential to earning your income

-

There was no secure area to store the equipment at the work location, and

-

The equipment is bulky at least 20kg or cumbersome to transport.

I Was Contracted Last Year And Was Informed That I Will Be Receiving A T4a Instead Of T4 For My Income Can I Claim Employment Expenses

No. If you receive a T4A instead of a T4, this means that you were contracted as a self-employed, not as a salaried or commissioned employee. You file a T2125 Statement of Business or Professional Activities form to claim your expenses instead of T777 or T777-s.

TurboTax software offers an easy step-by-step to report your income and claim employment expenses. Consider TurboTax Live Assist & Review if you need further guidance, and get unlimited help and advice as you do your taxes, plus a final review before you file. Or, choose TurboTax Live Full Service* and have one of our tax experts do your return from start to finish.

*TurboTax Live Full Service is not available in Quebec.

Read Also: 1099 Nec Doordash

What Is The $250 Educator Deduction Or Education Expense Deduction

The Educator Deduction allows you to deduct up to $250 in school-related expenses from your income. If you and your spouse are educators and you file jointly, both of you can claim up to $250 each .

If you have more than $250 in educator related expenses or if you dont qualify for the deduction, then you may be able to deduct a portion of your unreimbursed expenses for school supplies. Just be sure to speak with your tax advisor if this is your scenario.

Can I Do This Myself Or Should I Use An Agent

There are many organisations out there who will offer to help you get your tax refund but then will charge you a hefty fee. Tax refund companies sometimes charge fees of up to 40 per cent or 50 per cent of the value of the refund.

This in itself is not illegal, but the pricing structure can sometimes incentivise poor practice e.g. putting in inflated or fraudulent claims. As HMRC have a process now/check later system, irregularities with claims may not come to light for several years. Not all refund companies are like this, some people find using a refund company beneficial as it saves time. The important thing is that you research the company, ensure that you fully understand any fees and make sure that they understand any other information about your circumstances that may be affected by any claim for example if you do any self-employed work.

In the case of employment expenses, it is simple and easy for a person to apply for their refund themselves without having to pay any fee at all. It could take a bit of time for HMRC to process, but the important thing to note is that tax refund companies do not have an inside track with HMRC, so using one will not speed things up.

Some tax refund companies pay referral fees to get you to encourage your friends or colleagues to use their services. You should be aware that referral fees are taxable income and will need to be declared to HMRC. They will probably be viewed as miscellaneous extra income .

Also Check: Efstatus.taxact.xom

Teachers Tax Deductions Can Really Boost Your Tax Refund

Im a teacher. What tax deductions will the ATO allow?

Like many professionals, teachers often pay for work related expenses out of their own pockets. In most cases, these items can become valuable tax deductions for teachers. As a teacher, the tax deductions you claim back can significantly improve your tax refund if you know what youre doing. You just need to adopt a few good habits we cover some of those below. But lets start with the top 14 teacher tax deductions: