Illinois Payroll Tax Rates

Now that were done with federal taxes, lets look at Illinois state income taxes. Youll also need to withhold state taxes before youll be ready to send your employees home with their paychecks.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. According to the Illinois Department of Revenue, all incomes are created equal: Employers are responsible for deducting a flat income tax rate of 4.95% for all employees. No cities within Illinois charge any additional municipal income taxes, so its pretty simple to calculate this part of your employees withholding.

Youll also need to consider each employees exemptions, which is $2,000 per year. Additional exemptions are allowed if the employee is over 65 years old and/or legally blind.

Taxes paid to the state of Illinois must be paid on an ongoing basis using these forms:

Illinois State Salary Examples

If you are in a rush or simply wish to browse different salaries in Illinois to get an idea of how Federal and State taxes affect take home pay, you can select one of our pre-built salary example for Illinois below. alternatively, use the Illinois State Salary Calculator and alter the filing status, number of children and other taxation and payroll factors as required to produce your own, detailed salary illustration.

More Guidance On The Illinois State Income Tax Rate

While figuring out your Illinois state income tax rate may be straightforward, not everything tax-wise is.

Because of this H& R Block can help with H& R Block Virtual! With this service, well match you with a tax pro with Illinois tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your IL taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find Illinois state tax expertise with all of our ways to file taxes.

Related Topics

Learn how workers compensation could impact declaring head of household with advice from the tax experts at H& R Block.

You May Like: 1040paytax.com Official Site

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

How To Calculate Salary After Tax In Illinois In 2022

The following steps allow you to calculate your salary after tax in Illinois after deducting Medicare, Social Security Federal Income Tax and Illinois State Income tax.

You May Like: How Does Doordash Do Taxes

What Is The Illinois Income Tax Rate

The Illinois income tax rate is 4.95%. Flat tax makes for simplified a tax filing Illinois residents dont have to figure out complicated state tax tables. Conversely, the flat rate has a negative. Low wage earners can expect to pay more in Illinois than in many other states that have a progressive income tax.

How Do I Claim Prizes From $601 Up To $10000

If your winning ticket is from $601 up to $10,000, winners now have three options to claim their prizes:

- Fill out a claim form and questionnaire and mail italong with the signed ticketto the Central Lottery Office in Springfield. Sending the documents via certified mail with receipt acknowledgment is highly recommended.

- Visit one of the Lottery Claim Centers listed below to receive winnings up to $25,000 immediately . For prizes over $25,000 but less than $1,000,000, the Claims Centers will deliver your claim form and ticket to the Central Lottery Office in Springfield. The Department of the Lottery is not responsible for lost or misdirected claims. Click here to schedule an appointment:

- Winners can claim their prizes by completing the e-Claim and attaching the required documents. This process allows a player to submit a claim securely without having to send in their winning tickets through the mail. Once processed, your prize will be mailed to the winner at the address specified in the claim process.

For prizes of $1 million or more, please call the Central Lottery Office at 1-217-524-5147 for assistance.

Please note: When you visit a Claim Center and file a claim for any prize amount, you will be required to present a government-issued photo ID AND proof of your Social Security number .

Read Also: Is Plasma Donation Money Taxable

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

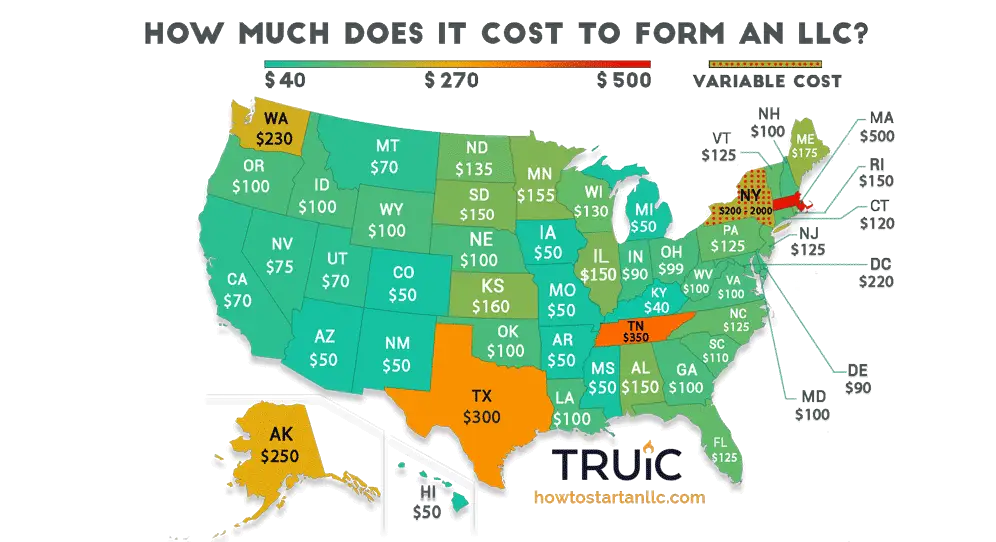

It Can Cost You Thousands Of Dollars Each Year If You Fail To Consider State And Local Taxes Before Moving Your Family From One State To Another

If you pull up stakes and move from one state to another, your federal income tax bill won’t change just because you crossed a state line. But the same can’t be said about your overall state and local tax liability. Moving from a low-tax state to a high-tax state can literally cost you thousands of dollars each year. Your income, sales, property, and other state and local taxes can all be higher in your new location. That’s why people who are contemplating a move to a different state need to do their homework before hiring the movers.

If you don’t want to end up in a state with higher taxes than the one you’re in right now, one of the first things you need to know is which states to avoid. And we can help with that. When creating our State-by-State Guide to Taxes on Middle-Class Families, we estimated the overall income, sales, and property tax burden in each state and the District of Columbia for a hypothetical married couple with two children, combined wages of $77,000, $3,000 of other income, and a $300,000 home. That information also allowed us to cobble together the following list of the 10 least tax-friendly states for middle-class families . So, if you and your family are considering packing your bags and moving to another state, make sure you check out the list before finalizing your decision. It might make you think twice before relocating.

See the final slide for a complete description of our ranking methodology and sources of information.

1 of 11

Also Check: Internal Revenue Service Tax Returns

How Are Bonuses Taxed

Just as your employer holds back a portion of your regular paycheck to prepay your taxes, it must take money out of your bonus check, too. These funds are sent to the IRS on your behalf. This process is known as tax withholding.

When it comes to bonuses, employers are allowed to calculate your tax withholding in one of two ways: the percentage method or the aggregate method.

What Is Illinois Tax On Lottery Winnings

4.7/5winningsIllinoisLottery taxablelottery winningsIllinoistaxTaxwinningsTax

Also question is, what percentage of taxes are taken out of lottery winnings?

Secondly, how long does it take to get your lottery winnings in Illinois? Prizes won in Pick 3, Pick 4, Lucky Day Lotto®, Lotto, Powerball® or Mega Millions® must be claimed within one year after the drawing date. Instant Ticket prizes must be claimed within one year after the game’s announced end date.

In this manner, can Illinois pay lottery winners?

The Illinois Lottery announced Tuesday that, without a budget or any special legislation, it won‘t be able to pay anyone winning $25,000 or more come July 1. As for those winning more than $25,000, they’ll have to press their luck for lawmakers and the governor to authorize payments, with no timetable set for that.

What is the taxes on $1000000?

The average tax rate for taxpayers who earn over $1,000,000 is 33.1 percent. For those who make between $10,000 and $20,000 the average total tax rate is 0.4 percent. (The average tax rate for those in the lowest income tax bracket is 10.6 percent, higher than each group between $10,000 and $40,000.

So, whether you’ve already won or you’re about to, here are the LottoExposed top 6 tax strategies for lottery winners.

Recommended Reading: Employer Tax Id Lookup

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: Claiming Home Improvement On Taxes

How To Calculate Illinois State Tax In 2022

Illinois tax is calculated by identyfying your taxable income in Illinois and then applying this against the personal income tax rates and thresholds identified in the Illinois state tax tables . Please note that certain states do not collect State Income tax, these include Alaska, Florida, Nevada, South Dakota, Washington and Wyoming.

Taxable Income in Illinois is calculated by subtracting your tax deductions from your gross income. Incredibly, a lot of people fail to allow for the income tax deductions when completing their annual tax return inIllinois, the net effect for those individuals is a higher state income tax bill in Illinois and a higher Federal tax bill. So why do people choose not to claim income tax deductions in Illinois? The sad truth is that a lot of people fear making a mistake on their Illinois tax return and subsequently facing fines and issue with the IRS and or Illinois State Government tax administration. Clearly, declaiming deductions can really reduce your tax bill in Illinois but this is a personal choice, itemised deductions for the combined Federal and Illinois State tax return include Office expenses, Property Maintenance and Repairs, certain trades and jobs are provided special allowances. A full list of tax exemptions and elements which can be claimed as part of an itemised Illinois state tax return is available on the Illinois Government website.

Where Does That Money Go

Illinois could collect $400-$600 million in annual taxes when the industry is mature. That tax money, as well as licensing fees, will pay for cannabis regulations and social welfare projects.

The Department of Revenue uses tax revenue to pay for the direct and indirect costs of the Cannabis Regulation and Tax Act, which covers functions across several Illinois state departments.

Of the remainder, 1/12th goes into a Cannabis Expungement Fund to pay the states costs of clearing old records.

Of the remainder of that:

- 2% goes to the Drug Treatment Fund

- 8% to the Local Government Distributive Fund

- 25% to the Criminal Justice Information Projects Fund

- 20% to the Department of Human Services Community Services Fund

- 10% to the Budget Stabilization Fund

- 35%, or the remaining balance, to the General Revenue Fund

Each of these funds tackles different aspects of restoring justice after the end of the war on cannabis.

For example, the 25% Criminal Justice allocation goes to a program dubbed Restore, Reinvest, Renew , good for tens of millions of dollars in grants to community groups to decrease gun violence and concentrated poverty.

The Illinois legislature has the power to review as adjust tax rates as needed.

Read Also: 1040paytax

How Much Tax Do You Pay On A $10000 Lottery Ticket

Income Taxtaxlotteriestax

Overview Of Illinois Taxes

Illinois has a flat income tax of 4.95%, which means everyones income in Illinois is taxed at the same rate by the state. No Illinois cities charge a local income tax on top of the state income tax, though.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: 1040paytax Irs

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.