Canadian Capital Gains Tax Is On The Minds Of Investors As Markets Rise Following The 2020 Covid

There are three main forms of investment income in Canada: interest, dividends and capital gains. The government taxes each differently. Heres a reminder of how smart investors use their knowledge of taxation rates, especially in the case of Canadian capital gains tax.

With stocks, you only pay capital gains tax when you sell or realize the increase in the value of the stock over what you paid.

Several years ago, the Canadian government cut the capital gains inclusion rate from 75% to 50%.

For example, if an investor purchases stock for $1,000 and then sells that stock for $2,000, they will have a $1,000 capital gain. Investors pay Canadian capital gains tax on 50% of the capital gain amount. This means that if you earn $1,000 in capital gains, and you are in the highest tax bracket in, say, Ontario , you will pay $267.65 in Canadian capital gains tax on the $1,000 in gains.

The other forms of investment income are interest and dividends. Interest income is 100% taxable in Canada, while dividend income is eligible for a dividend tax credit in Canada. In the 53.53% tax bracket, youll pay $535.30 in taxes on $1,000 in interest income you will pay $393.40 on $1,000 in dividend income.

Does that make sense so far? If you need more of a primer on investing basics like these, download The Canadian Guide on How to Invest in Stocks Successfully . If not, lets talk about three capital-gains strategies.

Three capital-gains strategies

Three RRSP strategies

Places With The Savviest Investors

SmartAssets interactive map highlights the places in America with the savviest investors. Zoom between states and the national map to see where in the country the best investors live.

| Volatility | Post-Tax Return |

|---|

Methodology Our study aims to find the places in the country with the savviest investors. We wanted to find where people are not only seeing good returns on their investments but where they are doing so without taking too much risk.

In order to find the places with the savviest investors we calculated investment returns and portfolio volatility over the last year. We focused on data of user portfolios provided by our partner Openfolio.

We calculated the risk-adjusted return of the stocks using the Sharpe Ratio. The Sharpe Ratio is the stock return minus the risk-free rate divided by volatility.

We indexed and ranked each of the locations based on this risk-adjusted return to find the places where people were seeing the best returns for the least risk.

Finally, we calculated the amount of money investors were taking home after paying both federal and state capital gains taxes.

Sources: Openfolio – “Openfolio is a free and open network that lets people share their portfolios – but no dollar amounts, only percentages. The idea is that sharing will help everyone be better informed, like with this map.”

How Stocks Are Taxed

The IRS taxes individuals for earned and unearned income. Earned income comes from things like your wages, salary, or tips. Unearned income comes from the gains you make from the sale of stocks and even dividends you are paid. Yes, not even dividend investors will escape the Eye of Sauron that is the IRS.

While some of the top stock brokers dont charge investors commissions, taxes are unavoidable. Uncle Sam dipping into your profits can seriously suck, but the upside is the costs can be calculated and prepared for.

Stocks are going to be taxed based on the gains they generate. If you saw your holdings appreciate in 2020 and then sold them for more than you paid for them, thats again you will owe taxes on the profits.

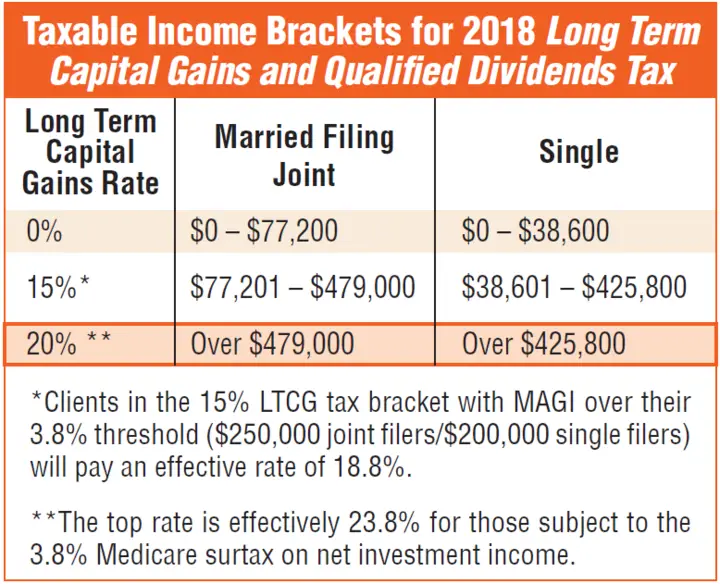

Capital gains tax rates are categorized as either long-term or short-term. Generally, long-term investments are those that have been held longer than 365 days and they have a lower tax rate than earned income and short-term investments.

Don’t Miss: How To Buy Tax Lien Properties In California

What You Pay It On

You may have to pay Capital Gains Tax if you make a profit when you sell shares or other investments.

- units in a unit trust

- certain bonds

Youll need to work out your gain to find out whether you need to pay tax. This will depend on if your total gains are above your Capital Gains Tax allowance for the tax year.

Carry Over Losses To The Next Year

Remember capital losses offset capital gains. If you have both capital gains and capital losses in the same tax year, you must use them to offset the capital gain. However, if you only have a capital loss, or you don’t have capital gains from the prior 3 years that you could amend and offset, you can carry those capital losses forward to offset future capital gains. You might need to consult a tax professional to follow the proper steps to do this.

Article Contents11 min read

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

You May Like: Is Plasma Donation Taxable Income

How Do Day Traders Pay Taxes

How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. Youre required to pay taxes on investment gains in the year you sell. You can offset capital gains against capital losses, but the gains you offset cant total more than your losses.

The Bottom Line: Talk To A Professional About Your Investing Tax Strategy

Forbes Advisor encourages you to seek professional advice from tax experts to help you optimize your tax strategy when it comes to investing. Licensed tax professionals can be invaluable advisors for determining capital gains tax scenarios you face, the reporting that will be required for any decisions you make and filing any appropriate documentation that the IRS may require.

| Partner Offer |

|---|

Read Also: Where Is My State Tax Refund Ga

Interest Income: When You Earn Interest On Cash Or Bonds

The final type of income to note for investing and taxes is interest income, which is typically taxed as ordinary income. This includes interest payments you receive on fixed-income investments you own, as well as any interest your brokerage pays on cash balances in your account.

One big exception is municipal bonds. Generally speaking, the interest paid by municipal bonds is exempt from taxation.

As An Early Step Toward Passing Down Wealth

If youre thinking about your legacy, gifting stocks can be a valuable tool, as opposed to liquidating and paying capital gains taxes. The IRS allows you to gift up to $15,000 per year, per person including stock.

This $15,000 limit isn’t bound by familial or marital ties. So technically, you could give $15,000 in stock to all of your children, grandchildren, in-laws, friends and neighbors each year.

About the author:Chris Davis is a NerdWallet investing writer. He has more than 10 years of agency, freelance, and in-house experience writing for financial institutions and coaching financial writers.Read more

Read Also: Is Past Year Tax Legit

How Can I Reduce The Investment Income That I Have To Claim On My Taxes

Use the following strategies to reduce the amount of tax on stock gains in Canada you need to pay.

- Use tax advantaged accounts. Hold your investments in a tax-free account such as an RRSP or TFSA to reduce the amount you pay for taxes on stocks in Canada.

- Engage in tax-loss harvesting. Sell your investment off to trigger a capital loss so that you can use this to offset losses in previous, current or future years.

- Donate assets to charity. Transfer the ownership of stocks to a registered charity to rebalance your portfolio without triggering a capital gain.

- Take advantage of taxation laws. Buy dividend-paying stocks in Canada to avoid losing out on tax credits and put higher-taxed investments into registered accounts.

- Claim your deductibles. Claim fees and other expenses that you pay to set up an account, manage your investments and access expert advice.

Stock In Retirement Plans

If you own stock through a tax-deferred retirement plan like an IRA or 401, its tax treatment is special. Rather than paying tax on capital gains or dividends as you buy, sell and hold stocks and funds, you pay tax on funds you take out of the account.

If you make withdrawals before you turn 59 1/2, special 10 percent tax penalties generally apply. These penalties can be waived if you use the money for an approved purpose, including some medical expenses, health insurance when you’re unemployed or higher education expenses for yourself and your family. First-time homebuyers can withdraw up to $10,000 for home-related expenses from an IRA without any tax penalty.

Once you reach age 70 1/2, you must begin withdrawing money from the account at a minimum schedule published by the IRS or face a significant tax penalty of 50 percent of the funds you were required to withdraw every year.

Don’t Miss: How To Get Tax Preparer License

Donate Stocks To Charity

Donating shares of stock to a charity offers two potential tax benefits:

Capital Gains Taxes Aren’t All Bad

For most Americans, and especially those who are investing in the shorter-term, it makes sense to use a regular brokerage account.

While getting hit with a tax bill isn’t fun, it isn’t a reason to avoid trading stocks or other assets if it’s of interest to you, according to Jariwala. If you do think you’ll get a capital gains tax bill, you should set aside money to cover it ahead of time, she said.

And, even if you do get a tax bill, that isn’t a bad thing, Gorman said.

“If you pay tax on a capital gain, it means you made money,” she said. “And that’s the point of investing.”

Don’t Miss: Mcl 206.707

Do I Have To Pay Taxes On Stocks

October 9, 2020 By john

Stocks are a great way to build an investment and to gain more financial security about your future. It is important to note, however, that there are still taxes that apply to your stocks so hopefully, youre not surprised during tax season. The profit that you make on your stocks is taxable up to 20% that amount will need to be paid back. It is important to understand how taxes on stocks work though as seen below.

Taxes on Capital

If you sell shares of stocks to earn money in a brokerage account, you have to pay taxes on these capital gains. The short-term tax is for any capital that you had for less than a year and are based on your tax bracket. Long-term taxes are for capital that you have had over a year that either has a 0% tax or up to a 20% tax. The longer you hold your capital, the less taxes that you will have to pay on these gains come the time for tax season.

Dividend Taxes

In almost every circumstance, dividends will always have taxes that have to be paid on them. Ordinary, or nonqualified, dividends will have taxes that are based on your bracket. Qualified dividends, however, will have less taxes, and you could pay nothing on taxes or up to 20% on them. When you came into ownership of the investment that pays dividends will have a significant effect on how much you have to pay on your taxes though. Every dividend will have its own unique set of rules according to the IRS to help you determine how much your tax payments are.

Pay Less

Capital Gains Taxes: When You Sell A Stock For A Profit

Here’s the first thing you should know about investing and taxes as a new investor: If you own a stock and the price goes up, you don’t have to pay any taxes. Warren Buffett owns more than $80 billion in Berkshire Hathaway stock and he’s never paid a dime in taxes on any of his shares.

In the United States, you only pay taxes on investments that increase in value if you sell them.

The profit you make when you sell a purchased asset is called a capital gain. For investing and taxes, capital gains generally occur when you buy a stock or other investment at one price and later sell it at a higher price.

For example, if you buy stock for $2,000 and sell it for $2,500, you have a $500 capital gain. That gain is subject to taxes.

Capital gains taxes apply if you profit from the sale of a range of investment types, including bonds, mutual funds, ETFs, precious metals, cryptocurrencies, and collectibles. Even real estate sold at a profit can be considered a capital gain for investing and taxes, though the rules are a bit more complicated.

The IRS classifies capital gains into two main categories for investing and taxes: long-term capital gains and short-term capital gains. Long-term capital gains occur when you sell an asset you’ve owned for longer than a year. Short-term capital gains occur when you sell an asset you’ve owned for a year or less.

Also Check: How To Appeal Cook County Property Taxes

What Is The Capital Gains Tax On Property Sales

Again, if you make a profit on the sale of any asset, its considered a capital gain. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules.

For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. In this case, you can exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly.

If youre just flipping a home for a profit, however, you could be subjected to a steep short-term capital gains tax if you buy and sell a house within a year or less.

Keep Records Of Your Losses

One strategy to offset your capital gains liability is to sell any underperforming securities, thereby incurring a capital loss. If there arent capital gains, realized capital losses could reduce your taxable income, up to $3,000 a year.

Additionally, when capital losses exceed that threshold, you can carry the excess amount into the next tax season and beyond.

For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. The additional $1,000 loss could then offset capital gains or taxable earnings in future years.

This strategy allows you to rid your portfolio of any losing trades while capturing tax benefits.

Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets otherwise, the transaction becomes a wash sale.

A wash sale is a transaction where an investor sells an asset to realize tax advantages and purchases an identical investment soon after, often at a lower price. The IRS qualifies such transactions as wash sales, thereby eliminating the tax incentive.

Read Also: How Do I Amend My State Tax Return

What Is A Capital Gain Or Capital Loss

In simple terms, a capital gain is an increase in the value of an investment or real estate holding from the original purchase price. If the value of the asset increases, you have a capital gain and you need to pay tax on it. That might sound bad but trust us, making money on your investments is never a bad thing.

Capital gains can be realized or unrealized. A realized capital gain occurs when you sell the investment or real estate for more than you purchased it for. An unrealized capital gain occurs when your investments increase in value, but you havent sold them. The good news is you only pay tax on realized capital gains. In other words, until you lock in the gain by selling the investment, it’s only an increase on paper.

A capital loss occurs when the value of your investment or real estate holding decreases in value. If the current value of the investment or holding is less than the original purchase price, you have a capital loss. Capital losses can be used to offset capital gains and reduce the overall tax you will pay. You can carry capital losses back 3 years or forward into future years.

If you have investments in registered plans such as a Registered Retirement Savings Plan , Registered Retirement Plan or Registered Education Savings Plan , you dont have to worry about capital gains and losses because the investments are tax-sheltered. That means your investments can grow and you dont have to worry about changes in value until you withdraw the funds.