How You Can Affect Your Wisconsin Paycheck

The decisions you make when completing your Form W-4 play a big role in determining the size of your paycheck. To avoid owing money to the IRS in April, you may want to opt for an additional dollar withholding from each of your paychecks. There is a line on the W-4 that allows you to enter the extra amount you want withheld. While this will result in smaller checks for now, it will reduce your bill come tax season, or even turn it into a refund.

Another option for Wisconsin taxpayers is to put more of your paycheck into tax-advantage accounts like a 401 or 403 retirement account. You can also put money an HSA or FSA, which are two accounts that can be used for medical expenses. The money that you contribute to these accounts is deducted from your paycheck prior to taxes being withheld. So by increasing your contribution, you can lower your taxable income and possibly save some money in taxes. Keep in mind, however, that the funds you put into your FSA may not all roll over from year to year. If you dont use them in time, youll lose them.

Give Your Employer Accurate Information

When you start a new job, you must complete the TD1 Personal Tax Credits Return. Your employer uses this form to calculate how much tax to deduct from your pay cheque, based on the non-refundable tax credits you are entitled to. Examples: spousal amount, caregiver amount, tuition and education amounts.

A Warning For Freelancers

One really important thing to note is if you accept a freelance job, you have to ask if your employer is taking taxes out of your paycheck or not.

If they are, the above calculations are a fairly good gauge of your take-home pay, though you probably won’t have deductions for a 401 or health-care benefits.

If your employer doesn’t take taxes out, then you’ll need to manage those payments yourself. Typically, that means making quarterly estimated tax payments. You’ll also pay both the employee and employer portions of the taxes for Social Security and Medicare. Advisors recommend setting aside about one-third of your gross 1099 income in a separate account to pay your taxes. If it’s separate, it will be ready when your tax bill comes due.

Since your take-home pay is actually less than your gross pay, Bera said she recommends negotiating your salary even if it’s your first job out of college.

“A lot of times people are afraid to negotiate. And I think: It’s worth the ask, right?” Bera said. “It’s worth asking, ‘Hey, here are some things that I bring to the table.'”

You would be surprised. Most hiring managers go in prepared to negotiate and don’t give you their highest offer. So, if you ask for more money, and make the case for why you deserve it, you just might get it!

And, it’s important to make sure you’re enrolled in direct deposit, so your paychecks are automatically transferred to your bank account.

Also Check: How Do You Do Taxes For Doordash

How Tax Brackets Add Up

In 2020, the IRS collected close to $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 53.6% of that total.

The agency processed more than 240 million individual and business returns a whopping 81.3% of returns were filed electronically. Of roughly 148 million individual tax returns, 94.3% were e-filed.

Individuals and businesses claimed more than $736.2 billion in refunds. The vast majority of these totals more than $664 billion went to individuals.

What Counts As Unemployment Benefits

In most cases, you will apply for and receive unemployment insurance payments from your state. However, there are many different types of benefits funded by the federal government but paid through your state that also fall under the category of unemployment.

For instance, programs such as Pandemic Unemployment Assistance temporarily expanded unemployment benefits to self-employed workers, independent contractors, freelancers, and part-time workers impacted by the pandemic. Another program, Pandemic Emergency Unemployment Compensation, expanded unemployment benefits under the CARES Act after regular unemployment was exhausted.

Other programs provide unemployment insurance to specific industries, such as railroad unemployment compensation benefits and unemployment assistance under the Airline Deregulation Act of 1978. There are also programs for federal employees and ex-military service members.

Quick tip: All unemployment assistance you receive should be added to gross income. If youâre unsure whether to include a payment, use the interactive tool on the IRS website.

You May Like: Tn Unemployment Benefits Application

Recommended Reading: Www.michigan.gov/collectionseservice

How To Calculate Gross Pay For Salaried Employees

Employees who receive a fixed amount each year are salaried employees. The Fair Labor Standards Act considers salaried employees exempt under U.S. federal law.

Whether a salaried employees pay schedule is weekly, biweekly or monthly, the formula to calculate their gross income remains the same. Use this formula to calculate gross pay for a salaried worker:

Annual gross salary ÷ number of pay periods = gross pay for salaried employees

For example, if a salaried employees gross pay is $40,000 and you want to calculate their monthly or weekly pay, divide $40,000 by 12 or 52, respectively. Thus, a $40,000 salary results in gross pay of $3,333 monthly or $769 weekly.

Key Actions For Withholding Requirements

For withholding purposes, you need to get the employee’s:

- Full name

- Total number of exemptions, and

- Any additional withholding amounts the employee requests to have withheld.

You should also withhold income from tips. Tips are considered part of an employee’s pay and must be taken into account when determining withholding. Employees must report tips from any one job totaling $20 or more in any given month to their employers by the 10th day of the following month. You should use this reported amount to calculate withholding by adding the reported tips to the employee’s pay.

Employees must report the above-listed information on a Form M-4 – Employee’s Withholding Exemption Certificate and claim the proper number of exemptions. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases. If the number of exemptions , they need to file a new certificate within 10 days.

If an employee has more than one job, they may claim exemptions only with their principal employer. Employees who receive other income that is not withheld from can ask their principal employer to withhold extra taxes to cover the additional tax that will be due on that income.

Also Check: Does Doordash Tax Your Earnings

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2021 tax year, due April 15, 2022

- Single filers: $12,550

- $12,550

- Heads of households: $18,800

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

How Is Federal Income Tax Calculated

Canadian federal income tax is calculated using the following tax bracket.

| Tax rate |

|---|

How do tax brackets work?

When looking at tax brackets, remember that the tax rate is only applied to that specific tax rate. To take just federal taxes as a simplified example, someone who makes $100,000 per year will pay 15% on the first $49,020, 20.5% on the income from $49,021 to $98,040, and 26% on the remaining $1,960.

This works out to $17,912, which is much lower than the $26,000 one might assume. In reality, with tax deductions, it is likely to be even lower.

Read Also: Do You Have To Pay Taxes On Plasma Donations

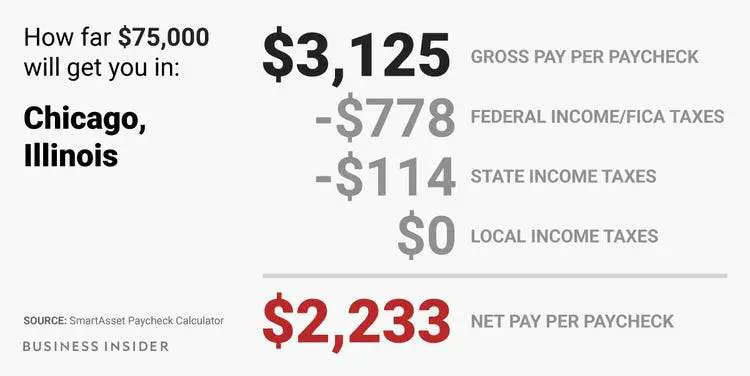

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

Wisconsin Median Household Income

| 2010 | $49,001 |

Previously, Wisconsin had some of the highest state income and property taxes nationwide. Beginning in 2013 and 2014, the state made significant tax cuts that have reduced, and will continue to reduce, rates. These cuts have had the most significant effect on the lowest of the four income brackets. The top state income tax bracket stayed the same, though.

As a single earner or head of household in Wisconsin, you’ll be taxed at a rate of 3.54% if you make up to $12,120 in taxable income per year. Singles and heads of household making $266,930 or more in taxable income are subject to the highest tax rate of 7.65%. The tax rates are the same across all filing brackets, but the income levels change based on filing status. There are no additional local income taxes anywhere in the Badger State.

If youre thinking about buying a home in the state, or if youre looking to refinance a property, you might want to check out our Wisconsin mortgage guide to make sure youre familiar with the rates and details of getting a mortgage there.

Recommended Reading: Doordash Stripe 1099

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Is A Good Salary In Ontario

What is considered a good salary in Ontario will be different for everyone. It depends on the composition, the local cost of living, housing costs and much more.

The average annual salary of someone over the age of 16 in Ontario is $50,200.

$50,200 may be a good annual salary for one person, but may not be enough to make ends meet for another. Someone who co-habits with another earner and has paid off their home has very different needs than a single parent who lives in an expensive area.

Read Also: Tax Preparer License Requirements

How Your California Paycheck Works

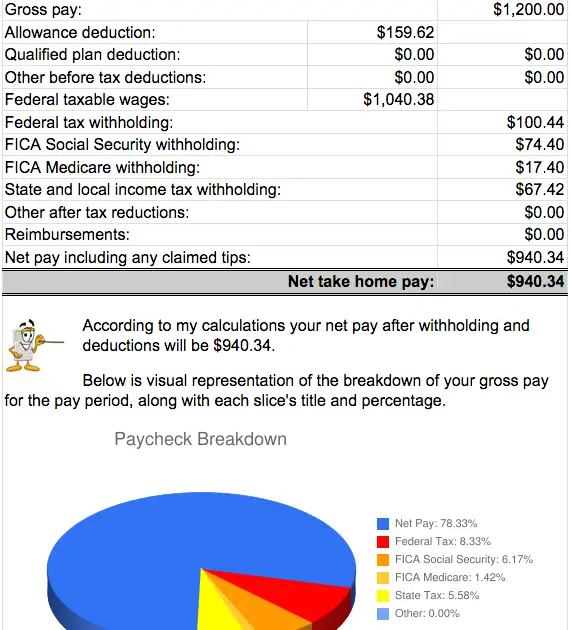

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

How Do I Calculate My Tax Manually

Now, one pays tax on his/her net taxable income.

Recommended Reading: Do I Have To Report Plasma Donations On Taxes

Do I Have To Claim My Severance Pay On My Tax Return If I Already Paid Taxes

- Severance pay is a lump-sum payment received from a company when you are terminated due to job closings, company reductions, or even company closures. These payments are typically based on time in service and/or job performance, and as such are taxable as wages. This payment will have the usually Social Security, Medicare, federal and state taxes withheld, which will be reflected on your W-2.

Fatten Your Paycheck And Still Get A Tax Refund

OVERVIEW

If you usually get a tax refund, but would like to start putting more money in your pocket every month, we can help. Yes, you still have to fill out a W-4 form. But we’ve developed a quick and easy guide to assist you.

|

Key Takeaways To fatten your paycheck and receive a smaller refund, submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. To receive a bigger refund, adjust line 4 on Form W-4, called “Extra withholding,” to increase the federal tax withholding for each paycheck you receive. Tax withholding calculators help you get a big picture view of your refund situation by asking detailed questions. |

When you file your taxes and get a tax refund, most people celebrate. But have you ever taken a second to think about what a refund means? Over the course of the year, you paid more federal income tax than you owed. In other words, you gave Uncle Sam an interest-free loan.

If you’d rather have a fatter paycheck and a smaller refund, you can control this. All you have to do is submit a new Form W-4 to your employer to adjust your federal income tax withholding.

Also Check: How Much Are Taxes For Doordash

Add The Employees Pay Information

You should see fields that say pay type, pay rate, hours worked, pay date,and pay period. Start with pay type and select hourly or salary from the dropdown menu.

If the employee is hourly, input their hourly wage under pay rate, and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for additional pay.

If the employee is salaried, both the pay rate and hours worked fields will disappear. Instead, youll need to know how much the employee makes each pay period. Youll put that into the field labeled amount.

Then select the pay date and the employees pay frequencyor, rather, if you pay them weekly or every two weeks.

Adjusting Your Withholding Could Move Your Refund To Your Paychecks

If getting your refund throughout the year rather than at tax time sounds appealing, you can adjust your withholding today. To do so, you’ll need to fill out a new Form W-4 and submit it to your employer.

This form requires you to fill in a few sections depending on your situation. The more accurately you complete the form, the more precise your withholding should be.

- For those with multiple jobs or that have a spouse that works, you’ll need to complete Step 2.

- Otherwise, you can use Step 3, claiming dependents, and Step 4, other adjustments, to make changes to your withholding.

- These options allow you to reduce the tax withheld through claiming tax credits or deductions.

- They also let you add other sources of income or extra withholding if you find you want more money withheld from your paycheck.

Tools, such as withholding tax calculators, can help you figure out what to fill in on the various steps of Form W-4. You’ll have to answer questions about your tax situation before the calculator will tell you how to fill out your Form W-4.

TurboTax Tip: For best results, make your W-4 adjustments as soon as possible, preferably before the start of the tax year. If you make adjustments in the middle of the year, your results may vary.

Also Check: How To Get A Pin To File Taxes