Buy And Hold Qualified Small Business Stocks

Qualified small business stock refers to shares issued by a qualified small business as defined by the IRS. This tax break is meant to provide an incentive for investing in these smaller companies. If the stock qualifies under IRS section 1202, up to $10 million in capital gains may be excluded from your income. Depending on when the shares were acquired, between 50% and 100% of your capital gains may not be subject to taxes. It’s best to consult with a tax professional knowledgeable in this area to be sure.

Max Out Retirement Accounts And Employee Benefits

In both 2020 and 2021, taxable income can be reduced for contributions up to $19,500 to a 401 or 403 plan. Those 50 or older can add $6,500 to the basic workplace retirement plan contribution. For example, an employee earning $100,000 in 2020 or 2021 who contributes $19,500 to a 401 reduces taxable income to only $80,500.

Those who dont have a retirement plan at work can get a tax break by contributing up to $6,000 to a traditional individual retirement account in 2020 and 2021. Taxpayers who do have workplace retirement plans may be able to deduct some or all of their traditional IRA contribution from taxable income, depending on their income.

The deduction is phased out for adjusted gross incomes at different levels, higher in 2021 than in 2020, depending on whether claimed by on a single taxpayers return, joint return, married individual filing separately as well as taking into account any participation by a taxpayer in another plan. The IRS has detailed rules about whetherand how muchyou can deduct.

Before the SECURE Act, 401 or IRA account holders had to withdraw required minimum distributions in the year they turned age 70½. The SECURE Act increases that age to 72, which may have tax implications, depending on the tax bracket the account holder belongs to in the year they withdraw. The bill also eliminates the maximum age for traditional IRA contributions, which was previously capped at 70½ years old.

Fund Your 401 Beyond Your Employer Match

For most people with a full-time job, a 401 account is the first investment they’ll come across as an adult. It’s a 403 account if they work in education or a non-profit organization. And a 457 account if they work in a government position. In any case, it is an opportunity to save on your taxes.

Many people choose to take advantage of the employer match but don’t increase their contributions beyond that. The contribution limit for this account in 2019 is $19,000. Most people save far less than that. At a minimum, most experts suggest saving at least 10% to 15% of your annual gross pay in a retirement savings account.

401s, 403s and 457 accounts use pre-tax dollars. That means you don’t pay any income tax on the amount you contribute to the account. Instead, you pay tax in retirement, presumably at a lower tax rate when you don’t have a full-time job.

Recommended Reading: How Can I Make Payments For My Taxes

Giving Appreciated Shares To Charity

If you are charitably inclined, giving shares of appreciated stocks, ETFs, mutual funds or other types of investments to charity can help avoid paying capital gains taxes and can potentially provide a charitable deduction as well.

The shares can be given directly to the charitable organization if they are able to receive these types of gifts directly. Another alternative is to give the shares to a donor advised fund. These funds are offered by a number of popular investment custodians like Fidelity, Vanguard and others. The gift is treated as a charitable donation in the year you give the stock. The money is then invested, and you can make gifts to qualified organizations over time. Each fund has its own rules so be sure to check on these before making a donation.

Besides eliminating any capital gains taxes that would have been due if the investment had been sold, the market value of the investment on the date of the donation can be claimed as a charitable deduction for tax purposes if you are able to itemize deductions on your taxes.

How To Avoid Capital Gains Tax On Stocks

Last updated May 14, 2021| ByRoger Wohlner| Edited ByBecca Borawski Jenkins

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Capital gains are incurred when shares of a stock are sold for more than you paid for them. The exact taxes on these gains will depend upon how long the shares were held.

Understanding how capital gains taxes work can help you manage the tax bill incurred from stock sales, which is a smart money move when youre trying to build wealth. When investing money you should always understand how it could be taxed.

Heres how capital gains tax works with taxes, and how you might avoid a big capital gains tax bill.

DiversyFund – Our pick for getting started in real estate

- $500 minimum investment

Read Also: How Can I Make Payments For My Taxes

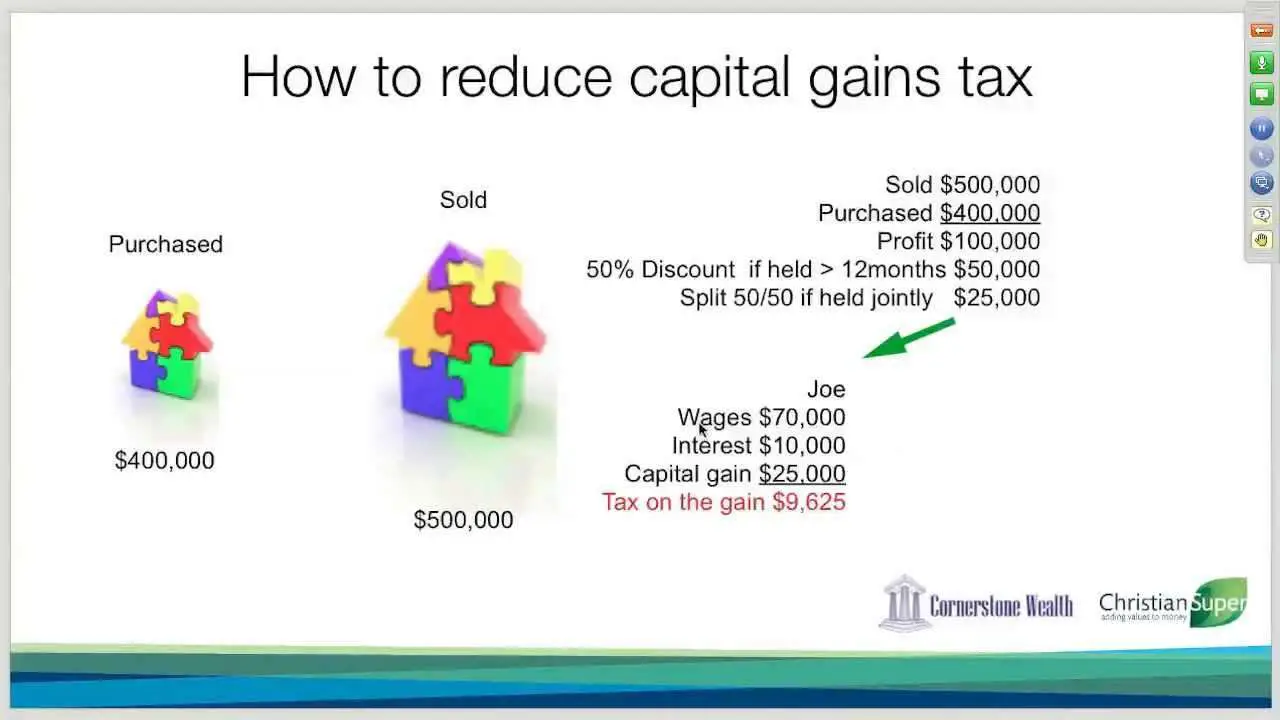

What Is The Capital Gains Tax Rate In Canada

Go rooting in the Income Tax Act and you’ll struggle to find something called capital gains tax. That’s because there’s no special tax relating to gains you make from investments and real estate holdings. Instead, you pay the income tax on part of the gain that you make.

In Canada, 50% of the value of any capital gains are taxable. Should you sell the investments at a higher price than you paid you’ll need to add 50% of the capital gain to your income. This means the amount of additional tax you actually pay will vary depending on how much you’re making and what other sources of income you have.

If you have both capital gains and capital losses, you can offset the capital gains with capital losses until you reach zero. If you only have capital losses, the CRA allows you to use the capital loss to offset a capital gain you originally declared in the previous 3 years, or you are allowed to carry forward the capital loss into the future. How far into the future, right now it’s indefinitely, so don’t lose the paperwork! That said, rules can change and so it’s best to check with your tax professional before taking any action.

Taxes On Mutual Fund Shares

Many investors choose to own stocks through a mutual fund. Instead of selecting the stocks to own, you purchase a portfolio of stocks chosen by the fund manager. This is a classic way to achieve instant diversification of your holdings, thereby reducing your overall risk due to a loss on a particular stock. While mutual funds offer investors several advantages, they do make it harder to avoid capital gains tax. The reason is that each year, a mutual fund must distribute all of its realized capital gains to shareholders.

You receive capital gain distributions even if you havent sold your mutual fund shares, which would create a separate short- or long-term capital gain or loss. Automatically reinvesting the capital gain distribution in additional mutual fund shares does not diminish your tax liability. Nor does exchanging shares of one mutual fund for another.

However, the other methods of reducing taxes on stock gains can be used with mutual fund shares, including the use of tax-sheltered accounts and tax lot selling of losing positions. You can also choose to sell your mutual fund shares just before the capital gains distribution date. While this will allow you to sidestep the taxes on the distribution, it will generate a capital gain on the sale of any shares for more than their adjusted cost bases.

Recommended Reading: Michigan Gov Collectionseservice

Treatment Of Capital Losses

Capital losses can be used to offset capital gains. This provides another method to avoid taxation on your stock profits. If you can sell some stocks for losses in the same year you harvest a profit from winning stocks, you can reduce or eliminate your tax bill on your gains. You offset long-term losses against long-term gains first, and then against short-term gains. Short-term losses follow the same pattern of offsetting like gains first. Remaining losses can offset up to $3,000 of ordinary income, and any additional excess losses can be carried forward to offset future gains.

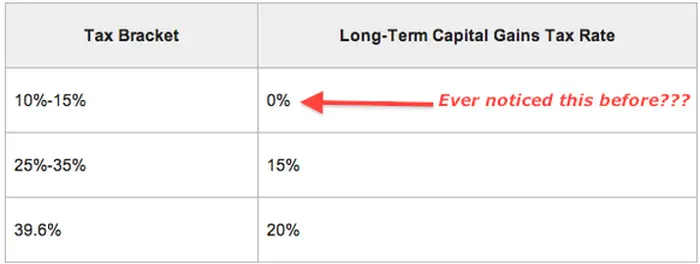

You Fall Into A Lower Tax Bracket This Year

If your pay fluctuates from year to yearwhich may be the case if youre self-employed, on sabbatical, or work part-timea lean year could provide an opportunity to realize tax-free long-term gains. Individuals who have taxable income of less than $40,400 in 2021 fall into the 0% long-term capital gains tax bracket .

In this situation, you would look to realize just enough long-term capital gains to stay within the 0% tax bracket. For example, if youre married and your combined taxable income for 2021 is $72,000wages of $97,100 less the $25,100 standard deductionyou could realize up to $8,000 in long-term gains at the 0% rate. Note that this applies only to long-term capital gains short-term gains on assets held one year or less are taxed as ordinary income.

This example is hypothetical and for illustrative purposes only.

Don’t Miss: How To Buy Tax Liens In California

Whats Considered A Capital Gain

If you sell an asset for more than you paid for it, thats a capital gain. But much of what you own will experience depreciation over time, so the sale of most possessions will never be considered capital gains. However, youre still liable for capital gains taxes on anything you purchase and resell for a gain.

For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain.

Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. These gains specify different and sometimes higher tax rates .

And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes.

Consider Donating Appreciated Assets

If you are charitably inclined, donating stocks that have appreciated in value to a charity can be a great way to reduce capital gains and income taxes. Instead of selling the stock first and incurring capital gains, gift the stock itself to a charity. This way, you avoid the capital gains on the stock and also get an income tax deduction.

Don’t Miss: Does Contributing To Roth Ira Reduce Taxes

Percent Capital Gains Rate For Certain Real Estate

However, the rules differ for investment property, which is typically depreciated over time. In this case, a 25 percent rate applies to the part of the gain from selling real estate you depreciated. The IRS wants to recapture some of the tax breaks youve been getting via depreciation throughout the years on assets known as Section 1250 property. Basically this rule keeps you from getting a double tax break on the same asset.

Youll have to complete the worksheet in the instructions for Schedule D on your tax return to figure your gain for this asset, or your tax software will do the figuring for you. More details on this type of holding and its taxation are available in IRS Publication 544.

If youre considering a real estate investment, compare mortgage rates on Bankrate.

Gains And Losses In Mutual Funds

If you’re a mutual fund investor, your short- and long-term gains may be in the form of mutual fund distributions. Keep a close eye on your funds’ projected distribution dates for capital gains. Harvested losses can be used to offset these gains.

Short-term capital gains distributions from mutual funds are treated as ordinary income for tax purposes. Unlike short-term capital gains resulting from the sale of securities held directly, the investor cannot offset them with capital losses.

Find out more on Fidelity.com: Mutual funds and taxes

Recommended Reading: Efstatus.taxact 2014

Monitor Mutual Fund Distributions

If youre a mutual fund investor, you could be subject to capital gains taxes at the end of each year. Mutual funds acquire capital gains and income distributions throughout the year as they trade in and out of investment positions. Some years, a mutual fund may have sufficient losses to take to cover realized gains. In other years, capital gains will need to be passed through to shareholders this can be more common when markets continually hit new highs over a prolonged period.

Toward the end of the year, investors can check a mutual fund companys estimates for capital gains distributions. If the distributions are significant for a fund you hold, it may be worthwhile to swap into another fund to try to sidestep that capital gain distribution.

Consider Real Estate Investments

Real estate investing offers the potential for both current income , as well as capital appreciation in the form of rising property values. It also offers three major tax advantages:

- A positive cash flow is typically offset by depreciation for income tax purposes.

- The value of the property can rise for many years but will not be subject to income tax until the property is sold.

- Once the property is sold, it will have the benefit of qualifying as a long-term capital gain, subject to lower income taxes.

Real estate isnt the most liquid asset, but it has been a solid performer over the past half-century. And the combination of tax advantages it offers can be comparable to a tax-sheltered portfolio.

Read Also: How Much Is Payroll Tax In Louisiana

Lifetime Capital Gains Exemption

If you own a business or operate a farm or fishing property successfully over an extended period, it may increase in value and you may, at some point, want to sell it. When this is the case, you would incur substantial capital gains tax.

Canadian residents who operate active businesses, farms or fishing properties and whose business is primarily Canadian may reduce their capital gains by the amount of the exemption when they sell these businesses or properties.

The lifetime capital gains exemption which is for small business corporation shares and for qualified fishing and farming properties, is aimed at reducing the amount of this tax.

For example if in 2020 you sell your business for $2 million and your adjusted cost base representing the amount of capital you have invested is negligible, you have a $2 million capital gain. You deduct your exemption of $$883,384 to get a $1,116,616 taxable capital gain. The inclusion rate is 50%, so you add half of that gain to your total income for the year.

Because businesses have to use at least 90% of their assets in an active business operating primarily in Canada to qualify, consider selling the business at a time when it can fulfill these requirements. To qualify for the farming or fishing property exemption, you must be able to show that farming was your primary source of income or that you operated a fishing business.

When To Sell Properties And Investments

While you can open registered accounts to shelter investments and use the principal-residence exemption to reduce capital gains tax on residential property, choosing the time of sale for your other investments can be a powerful tax reduction tool.

If youre planning to sell investments that have made a profit, consider postponing the sale until after January 1st of the next year. You will incur capital gains tax that year and only have to pay by April 30th of the following year.

If your income varies, selling during a year when it is low may save you money. If you have investments that have lost money, selling them in the same year as profitable ones lets you apply the loss against the profits and reduce your overall capital gains tax.

Also Check: Cook County Assessor Deadlines

What Are The Best Ways To Reduce Taxes On Investments

Investing is the process of growing your financial assets. There are various ways to do this: investing in assets that provide a cash flow, rising prices, or both, is only the most obvious way. Another way, one that complements a growing investment portfolio, is keeping investment expenses low. But possibly the biggest single investment expense is income tax. So what are the best ways to reduce taxes on investments?

Canada Revenue Agency: How To Pay Zero Taxes On Stock Market Gains

Andrew Button| December 16, 2019|More on: SHOPSHOPXIU

Did you know that the easiest way to maximize stock market gains doesnt involve picking stocks at all?

Studies show that the vast majority of mutual fund managers fail to outperform the market, and if that holds for professionals, it probably holds for the average Joe. In light of this, trying to maximize gains by beating the market may be a difficult feat to pull off.

However, theres one way to maximize your stock market returns thats so easy anybody could do it:

Minimizing your tax burden.

By holding your stocks in registered accounts, you dramatically reduce the taxes you ultimately pay on them. As a result, you ultimately realize a higher return. While it may sound hard to believe, theres one way to actually pay zero capital gains taxes on your entire portfolio.

This strategy does leave you with dividend taxes , but it can completely eliminate the need to realize capital gains.

You May Like: Will A Roth Ira Reduce My Taxes

Strategy #: Create Tax Deductions

Another strategy to reduce the amount of capital gains tax owed is to seek out and trigger capital losses or find and claim tax deductions.

To offset capital taxes owed, consider selling stock or assets at a loss. The capital loss can be used to reduce capital gains and reduce taxes owed on those earnings.

There are a few rules when it comes to applying this strategy:

Another option is to use tax shelters to help minimize taxes paid.

For example, if you were to take the extra cash earned from the sale of a real asset, such as an investment property or stock, and use it to make a larger RRSP contribution, you could offset the tax paid with the tax rebate from the contribution. This strategy is particularly useful when an individual has significant unused RRSP contribution room from prior years.