The Financial Hardship Defense

There is also a hardship defense that applies to the failure to pay penalty. It is found in Treas Reg. § 301.6651-1, which says that:

failure to pay will be considered to be due to reasonable cause to the extent that the taxpayer has made a satisfactory showing that he exercised ordinary business care and prudence in providing for the tax or would suffer an undue hardship if he paid on the due date. In determining whether the taxpayer was unable to pay the tax in spite of the exercise ordinary business and prudence in providing for payment his tax liability, consideration will be given to all the facts and circumstances of the taxpayers financial situation, including the amount and nature the taxpayers expenditures in light of the income he could, at the time of such expenditures, reasonably expect to receive prior to the date prescribed for the payment the tax.

The IRSs IRM explains that:

An undue hardship may support the granting of an extension of time for paying a tax or deficiency . Treas. Reg. 1.6161-1, provides that an undue hardship must be more than an inconvenience to the taxpayer. The taxpayer must show that he or she would sustain a substantial financial loss if required to pay a tax or deficiency on the due date.

The IRSs IRM goes on to say that the following factors are to be considered in evaluating undue hardship:

Fortunately The Penalty For Filing Federal Taxes Isnt Stacked

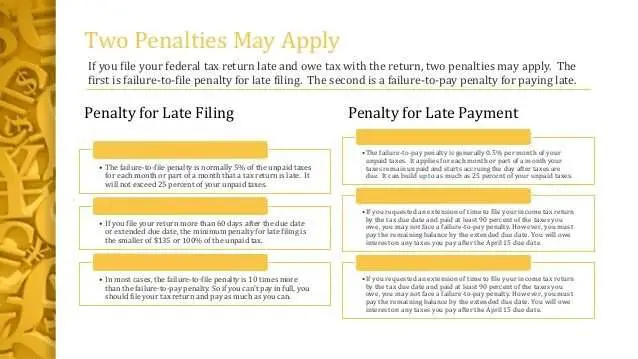

If you owe the failure-to-pay penalty and the failure-to-file penalty, youll only owe 5% per month, not 5.5% per month. But once youve reached that 25% maximum failure-to-file penalty, the failure-to-pay penalty can keep on accumulating. Your maximum penalty for filing Federal taxes late could reach 47.5% , plus interest.

With such a steep penalty for filing Federal taxes late, its smart to look at the alternatives. As soon as you know you owe taxes, you can start figuring out how youll quickly resolve the issue and pay back the money the IRS is asking for. With a little work, you can quickly minimize your penalty for filing Federal taxes late, and get on the path to repayment.

For more information on penalties, .

What Happens If I’m Late Filing My Tax Return

If you are more than 60 days late, the minimum fine is $100 or 100% of the refund tax due, whichever is less. Feeding the extension removes the penalty. TurboTax Easy Extension is a quick and easy way to send an extension directly from your computer.

Aitx stock newsHow much does aitx stock cost per share? Shares of AITX can currently be bought for about $$. How many employees have AI technology solutions? Artificial intelligence technology solutions employ 50 people around the world. Where is the headquarters of AI solutions?Who is the CEO of aitx, HENDERSON, NV, July 6, 2021 Artificial Intelligence Technology Solutions, Inc. (OTCPK: AI

You May Like: Home Improvement Cost Basis

How To Appeal Hmrc Penalty Charges

The appeal process varies depending on the penalty youve received. You should usually appeal within 30 days of the date on your penalty notice. However, if you were affected by coronavirus and your penalty was issued before 1 October 2021, then HMRC will allow an additional three months for you to send an appeal.

What Are The Consequences Of Filing Your Tax Return Late

Failure to file your tax return on time can result in a much higher tax penalty. For each month that you are late with your refund, you will be charged 5% of the unpaid tax, but no more than 25% of the balance. For example, if you owe $1,000 in tax, the penalty for not applying is $50 per month, up to a maximum of $250.

You May Like: Do You Have To Report Plasma Donations On Taxes

Is The Penalty For Paying Late The Same As The Penalty For Filing Late

The penalties for paying late and filing late are two separate penalties and the combined penalty maxes out at 25%. The late payment penalty is 0.5% of the unpaid taxes per month up to a total of 25% of the unpaid taxes. However, if both the late filing and late payment penalty apply in a month, the maximum penalty added for that month is 5%.

How Much Is The Failure To File Penalty

The penalty for failing to submit documents is usually 5% of the amount of unpaid taxes for each month or part of the months of delay, up to 25% of the amount of unpaid taxes. If the refund is more than 60 days late, the minimum fine is $135 or 100% unpaid tax, whichever is less.

How to put a lien on a houseCan you put a Lein against your own house? If you don’t pay money to someone you owe money to, your house could get a mortgage. If you can’t pay your card debt or medical bill, you may have a lien on your home. The same is true if you have unpaid IRS taxes, child support, or a court order against you.How do you find a lien on Your House?To find out if your home has a lien, check the state property records in

You May Like: Doordash Tax Percentage

Pay Taxes Due Electronically

Those who owe taxes can pay with IRS Direct Pay, by debit or credit card or apply online for a payment plan . For more electronic payment options visit IRS.gov/payments. They are secure and easy to use. Taxpayers paying electronically receive immediate confirmation when they submit their payment. With Direct Pay and the Electronic Federal Tax Payment System , taxpayers can opt in to receive email notifications about their payments.

Reasonable Excuse And Coronavirus

The government may consider the coronavirus pandemic as a reasonable excuse for late filing. You can also set up a payment plan if you need more time to pay.

If you can prove that youve been impacted by Covid-19, you may be able to make a successful appeal against HMRC. As this will be considered on a case-by-case basis its a good idea to speak to HMRC before the deadline to clarify whether you have a reasonable excuse and to pay on time if you can.

Recommended Reading: Efstatus/taxact

False Statements And Tax Evasion

If the CRA determines that you have knowingly made false statements on your tax return, you would be charged a penalty of at least $100 or 50 percent of your unpaid tax or falsely claimed credits.

Additionally, the CRA has a number of alternative ways to reassess tax returns. If the agency notices that your lifestyle is grossly inconsistent with the amount of income you report, you may face criminal convictions, fines, and even jail time for unreported income and tax evasion.

Ohio Interest For Failure To Pay

If you do not pay the full amount of tax you owe to Ohio Treasurer of State by the tax deadline, an interest rate of 3% will apply. If you file a federal extension and have paid 90% or more of your total Ohio Income Tax, the 3% interest may not apply. If the interest is applied, it will be charged from the deadline the tax should have been paid. Typically, the deadline is April 15.

Read Also: Appeal Taxes Cook County

Interest Relief For 2020 Income Taxes Owing

For income taxes owing for 2020 there could be some relief from interest accruing on those taxes you owe, if you struggled to pay them on time .

The criteria is that your earned income from all sources in 2020 could not exceed $75,000, and you must have been in receipt of one of the COVID-19 emergency or recovery benefits in 2020. The final requirement is that you have filed your 2020 tax return.

If you meet all of those criteria, then you will qualify for interest relief on taxes owed for 2020 only, until April 30, 2022.

If you dont qualify for the above but are struggling to pay outstanding taxes owing, review the options available to you as part of the the Taxpayer relief provisions.

How Long Is My Extension Good For

If you filed an extension by April 18, 2022 , it extends your filing deadline to .

- An extension of time to file your return does not mean an extension of time to pay your taxes.

- If you expect to owe money, you’re required to estimate the amount due and pay it with your Form 4868. As long as you do that, the extension will be granted automatically.

You May Like: Do You Have To Claim Plasma Donation On Taxes

What Happens If You Miss The October 15th Tax Extension Deadline

The IRS tells taxpayers they have an October 15 deadline to file their taxes and get approval. Taxpayers must pay estimated taxes by April 15 of each year. You can avoid the risk of penalties, interest, fees, and foreclosure by understanding the drawbacks of missing the October 15 extended filing date.

What Are The Penalties For Filing Your Tax Return Late Today

The Tax and Customs Administration thinks along with you. The penalty for late filing is typically 5 percent of the unpaid tax for each month or part of the month that the tax return is late. This penalty starts on the day after filing the tax return and does not exceed 25 percent of unpaid taxes.

Also Check: 1040paytaxcom

Why Do I Need To File On Time

If you file after the due date, youre considered a late filer and you could be charged a penalty.

Now, you might be thinking: what if I dont owe the CRA any money? Do I still have to file on time?

Think about this: after tax season, what if the CRA finds an extra slip you forgot to include in your tax return? Suddenly you owe money.

Since you filed late, you would be charged a late-filing penalty on top of the new balance. Its good practice to always file your taxes on time.

Even if you cannot pay your balance owing, you should still file on time to avoid being charged the late-filing penalty.

- Individuals: File and pay your 2020 taxes by April 30th, 2021

- Self-employed and spouses: Pay your 2020 taxes by April 30, 2021 and file by June 15th, 2021

Deadlines For Business Owners

If your business is a sole proprietorship or partnership your business income is declared on form T2125, which is part of the T1 Personal Income Tax Return. The penalties for these types of business owners who file taxes late are the same as they are for individuals, although, as you see above, these business owners have until June 15th to file their taxes.

Read Also: Www.1040paytax.com Official Site

Is There A Penalty For Filing Taxes Late If I Owe Nothing

There are generally two types of penalties: the failure-to-file and failure-to-pay penalties. If a taxpayer doesnt owe anything, they still have to pay the failure-to-file penalty if they filed their taxes 60 days after the deadline.

The only time the IRS revokes a penalty is if the taxpayer can present a reasonable cause for their inability to file or pay on time. However, this is only for extreme cases. You should never abuse this leeway. The IRS will know if youre lying or not.

What Is The Irs Penalty For Paying Taxes Late

The IRS is authorized to impose a penalty if you pay your taxes late. This is often referred to as the IRS late payment penalty or underpayment penalty.

If you owe taxes when they are due, the IRS will assess this penalty.

This late payment penalty is one of the most common penalties the IRS imposes.

If you have been charged a late tax payment penalty and are trying to determine whether it is valid and how to get out of the penalty, this page is for you. It is also for you if you are wondering, what is the penalty for paying taxes late or if you are thinking, I havent done my taxes.

This underpayment penalty is different than the penalty for filing taxes late and the estimated tax penalty .

Also Check: How Do I Get My Doordash 1099

How To Avoid The Irs Underpayment Penalty

- 80% rejection. In late March, the IRS announced that this tax season alone, taxpayers who paid at least 80% of their tax amount in 2018 could avoid the underpayment penalty.

- Last year’s tab. If you do not qualify for the 80% exemption, the next step is to verify your tax return submitted last year.

- Deposit method.

How long do collections stay on credit report

Penalties And Fees For Paying Ohio Income Tax Late

mail_outline

The tax deadline passed this year, and you have not filed your Ohio State Tax Return. You are not alone. Many taxpayers procrastinate. It is easy to get busy and put your taxes to the side, while you wait to receive all the necessary forms. Before you know it, the deadline has rolled past. Now, that you have missed the deadline, it can feel easy just to forget about filing. They are already late, right? If you are filing your taxes past the deadline, it is important you file as quickly as possible to reduce the penalties and fees for paying your Ohio Income Tax late. Luckily, an experienced tax preparer can hep prevent missed deadlines in the future, saving you money. You can also use our tax planning documents for free to ensure you are ready on time for the next tax season.

You May Like: Doordash Write Offs

Negotiate Your Tax Bill

If your tax assessment is too high, you may be able to negotiate a better deal. Penalties may represent 25% of what you owe to the IRS. Getting these removed can make a real difference. File Form 843 to request an abatement of taxes, interest, penalties, fees, and additions to tax.

You might consider a Partial Payment Installment Agreement where the IRS agrees to accept less than the total you owe. The IRS will only agree to a PPIC if it’s clear that the monthly payments you can make will not cover your total taxes due for many years.

Another option to reduce your total tax liability is an offer in compromise . If the IRS accepts an OIC, it acts as an agreement between a taxpayer and the IRS to settle a taxpayer’s tax liabilities for less than the full amount owed. If you can fully pay your liability through an installment agreement or other means, you won’t generally qualify for an OIC.

Why File For An Extension

Filing an extension automatically pushes back the tax filing deadline and protects you from possible penalties. Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that you’re late.

- For example, if you owe $2,500 and are three months late, the late-filing penalty would be $375. x 3 = $375

- If you’re more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

- Filing for the extension wipes out the penalty.

TurboTax Easy Extension is a fast and easy way to file your extension, right from your computer.

You May Like: Doordash How Much Should I Set Aside For Taxes

If Youre Trying To See How Long Can You Go Without Filing A Tax Return

Its a risky proposition. While the government usually has just six years to charge you with criminal tax evasion, it has forever to collect the taxes you owe and assess penalties. In addition to the failure-to-file penalty, these things could happen to you when the IRS catches up to you:

-

Failure-to-pay penalty: If you dont pay the taxes you owe by the deadline, the IRS can penalize you 0.5% of the unpaid balance every month, up to a total of 25%.

-

Interest: On top of the failure-to-pay penalty, interest accrues on your unpaid taxes.

-

A substitute return: If you fail to file but the IRS has some information needed to calculate your taxes, such as your W-2 form, you may be notified by mail that it has filed a return on your behalf. It wont consider the tax credits, deductions or other tax breaks you may have taken if youd done your taxes.

-

Lost refunds: You may be missing out on money youre owed. In most cases, the IRS gives you a three-year window to file previous years returns. Once this window closes, you forfeit your tax refund.

The Irss First Time Abate Policy

The failure to pay penalty can often be removed pursuant to the IRSs first-time abate policy. If it applies, this is the easy way to get the penalty removed.

The first-time abate policy is intended to give taxpayers who have a good track record of compliance a break. It applies if the taxpayer has not had any penalties, other than the penalty at issue, for the immediately prior three years.

The IRS only applies this policy to returns that are regularly filed, not to one-time returns. Estate tax returns are an example. Each individual only dies once and their estate files one estate tax return . Thus, the IRS cannot look to their compliance history for this one-time return to determine whether they have a good track record for filing the return.

This remedy can be had by calling or writing to the IRS and asking that the IRS apply the policy and remove penalties. The IRS will not voluntarily apply this policy. You have to actually call or write to the IRS.

It is often best to wait until the tax balance is paid before requesting this type of abatement. Otherwise, the penalty will continue to accrue.

Also Check: Ccao Certified Final 2020 Assessed Value