Irs Rules Regarding Your Age

As the table above indicates, individuals younger than age 65 must file if they make certain amounts. The earnings threshold amounts go up a bit for individuals 65 and up.

For married couples that file separate tax returns, the earnings target is based on the age of the older spouse.

In most situations, your age for tax purposes depends on how old you were on the last day of the year. But when it comes to determining whether you have to file a return, the IRS says that if you turned 65 on New Years Day, you are considered to be 65 at the end of the previous tax year. The one-day grace period allows you to use the higher-income thresholds to determine whether you must file a tax return.

Plan For Tax On Your Small Business

Self-employed individuals have special challenges paying enough income tax through the year.

Their income may be sporadic, and it can be difficult to know how much they will owe in taxes after business deductions.

And no one deducts tax from their pay. Naturally, its harder to find money for taxes than it is to have it deducted from a persons pay in the first place.

The only way self-employed taxpayers can be sure they are setting aside enough money for taxes is to maintain good records throughout the year.

Once a quarter, calculate your net income and estimate the amount you owe in taxes. Dont forget self-employment tax.

If you have trouble making your estimated tax payments, consider opening another bank account just for taxes.

Every time you deposit money into your business checking account, transfer the appropriate amount to the tax account.

Then, consider that money untouchable for anything but your federal taxes.

Refigure Your Tax Liability And Withholding As Needed

Making sure youre having enough tax withheld or paid in estimated taxes is never a finished task.

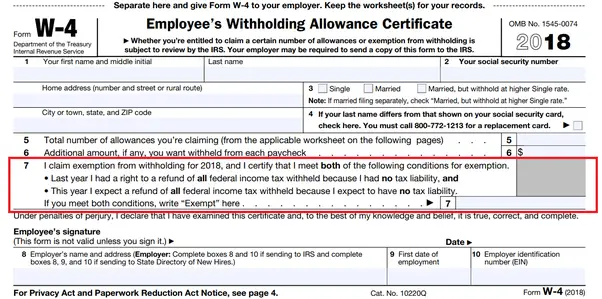

Whenever your situation changes you get married or divorced, you take on a freelance project, for example recalculate your income if necessary and go through the Form W-4 section under the Next Year main tab in TaxAct again.

Its a little more work than just paying too much or hoping for the best, but it pays off by giving you a lot more peace of mind about your standing with the IRS.

Recommended Reading: Pay Taxes On Plasma Donation

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You Changed Up Your Hsa Or Fsa Contributions

This year many doctors, dentists and optometrists have deferred non-emergency appointments and exams because of the coronavirus pandemic. But for many Americans, that means the funds they set aside for these routine health expenses have been languishing unused in flexible savings accounts.

So much so, the IRS announced earlier this year that it would allow employees to make mid-year changes to their health-care benefits. Under the new guidelines, employees can change health insurance plans and sign up for a plan if they previously waived coverage, as well as alter contribution levels to the health and dependent care FSA plans.

Even if altering your contribution level was the right move, you need to understand that it could alter your tax responsibilities as well, Roberge says. “If you are contributing to a health savings account…that actually reduces your taxable income,” he says.

Typically, you’re going to pay less in taxes if you’re putting money into these types of accounts. So if you suddenly stop or lower your contribution levels, it could increase your taxable income.

Read Also: Irs Employee Lookup

Why Do I Owe So Much In Taxes What Can I Do About It

While some taxpayers prefer to have more in their paycheck vs. receiving a refund, many of us look forward to getting money back at tax time.

- If you owe taxes this year and hoped for a refund instead, you can update your withholding. Its likely that youll owe again next year unless you complete a new Form W-4 and increase your withholding. The sooner in the year you submit this change to your employer, the sooner your new withholding will take effect on your paycheck. We can help you understand how to fill out a new Form W-4. Plus, our W-4 calculator is a great resource.

- If you owe the IRS money and cant pay, there are options. We can help you understand how you can pay back taxes if your tax bill is too much to pay right now. H& R Block specializes in helping taxpayers in this situation and our tax pros can explain the steps to take.

Specific Rules For Self

There is a growing number of taxpayers earning money through self-employment as more and more types of work become available online. Millions of people now earn at least a portion of their income from the comfort of their own home. If you perform some kind of work in a self-employment setting, you will need to conform to the tax rules that govern such work.

If you do work as a self-employed individual, you may need to file a tax return even if you earn nowhere near the $12,400 threshold mentioned earlier. This is because of the self-employment tax. When you work for yourself, you are responsible for taxes that would otherwise be paid by an employer. These are taxes that go toward Social Security and Medicare. As long as you had net earnings of $400 or more, you will need to report those earnings and pay the associated self-employment tax.

The information in this article is up to date through tax year 2020 .

Also Check: How Much Should I Set Aside For Taxes Doordash

Take Extra Steps If You Want A Big Tax Refund

Typically, financial planners would suggest that it’s better to get your money upfront and not use your income tax withholding as some sort of forced savings account.

But many people bank on big refunds every year if they’re trying to save for a vacation or home improvements.

It’s always possible to have extra dollars withheld to ensure a large refund, Steber said. If needed, you can submit another W-4 form in a given year to reach the amount of withholding that you’d want.

You’d need to look for a line for “extra withholding” on the new W-4, if you want more money withheld from each paycheck. That’s under Step 4, Line C.

A quick trick to update withholdings is to divide what you owe in for income taxes by the number of remaining paydays in the year and enter this amount on line 4C of the W-4 form, Steber said.

For example, if a taxpayer owed $3,000 and they have 22 paydays left this year, they should divide $3,000 by the 22 and request to have an additional $136.36 each payday.

“This wont guarantee a refund next year, but if there is a balance due it will be small and not subject to an under-withholding penalty,” he said.

ContactSusan Tomporat313-222-8876 or . Follow her on Twittertompor. Read more on business and sign up for our business newsletter.

Why Do I Owe Taxes This Year Changes In 2020

By April 15 you should have filed your taxes.

Now, that’s not the same as saying that you will have paid your taxes. In fact you pay taxes all the time – provided you make the minimum amount required to file a tax return. That will vary depending on your filing status .

Most Americans pay their income taxes every two weeks through automatic federal and state withholding from each paycheck. And while many taxpayers will get some of that money back, everyone who earns an income pays the FICA tax that funds Social Security, Medicare and Medicaid.

Then there are sales taxes, property taxes and import taxes, which Americans pay all the time. In the end, although we think of April 15 as Tax Day, paying taxes is a day-to-day feature of life in a modern economy.

That doesn’t make April 15 any less complicated, and that’s particularly true this year.

Most Americans get a refund when they file their taxes. The system is designed that way. This year, though, tax refunds are down way down. By the beginning of April 2019 the IRS had issued about 1.64 million fewer refunds than it had by that same period in 2018. Individual refunds have only gone down by an average of $20 per taxpayer, but a lot fewer people are getting them. In fact, many Americans actually owe money on April 15 for the first time in their working lives.

Here’s why.

Recommended Reading: Pastyeartax

Learn About Claiming Education Credits

An education credit helps you pay education expenses by reducing the amount you owe on your tax return. There are two types of education credits:

-

The American Opportunity Tax Credit helps with expenses during the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student. If the credit lowers your tax to zero, you may get a refund.

-

The Lifetime Learning Credit can be used toward tuition payments and related expenses. To use the credit, you must attend a qualifying educational institution. Use the LLC for undergraduate, graduate, and professional degree course expenses. Or, use the credit to help pay for classes that improve job skills. You can claim up to $2,000 per tax return, and there is no limit on the number of years you can claim the credit.

You must meet income limits to be eligible for these credits. And you cant claim both credits for the same student and the same expenses.

Tips To Cut Your Tax Bill This Year

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

An unexpected tax bill can ruin anybody’s day. To help avoid that unpleasant surprise, here are 12 easy moves many people can make to cut their tax bills. In many cases, you must itemize rather than take the standard deduction in order to use these strategies, but the extra effort may be worth it.

The W-4 is a form you give to your employer, instructing it on how much tax to withhold from each paycheck.

-

If you got a huge tax bill this year and dont want another surprise next year, raise your withholding so you owe less when it’s time to file your tax return.

-

If you got a huge refund, do the opposite and reduce your withholding otherwise, you could be needlessly living on less of your paycheck all year.

-

You can change your W-4 any time.

Less taxable income means less tax, and 401s are a popular way to reduce tax bills. The IRS doesnt tax what you divert directly from your paycheck into a 401.

There are two major types of individual retirement accounts: Roth IRAsand traditional IRAs.

There are limits to how much you can put in an IRA, too:

This FSA with a twist is another handy way to reduce your tax bill if your employer offers it.

Read Also: Roth Ira Reduce Taxable Income

Filing As A Dependent

If you are being claimed as a dependent on another tax return, the requirements for filing your own return will change. As a dependent, you cant claim your own standard deduction because that is used by the individual claiming you as a dependent.

Instead, your standard deduction as a dependent in 2020 is either $1,100, or your earned income plus $350 whichever is more. In the latter case, your deduction cannot be greater than the standard deduction for your status.

Why Do I Owe Taxes For 2015

imtiaz3 wrote: Hi Everyone,I just got my T4 and upon inputting the numbers on simple tax, I am yet again owing money this year. I’m baffled and trying to understand why.I make $56000 a year without overtime. With my overtime, the money I made comes to $73000. A big increase with overtime, yet from my understanding, for 2015, i fall within the 2nd tax bracket below, whether that’s $56000 and $73000, this tax bracket should not change.Canadian Tax Brackets 201515% on the first $44,701 of taxable income22% on the next $44,702 of taxable income 26%on the next $89,402 of taxable income 29% of taxable income over $138,586looking at my paystubs, the amount that is being deducted from me exceeds the percentages above. Even in 2014, I didn’t make as much overtime, but still owed money, less than 2015.I don’t have a good understanding of how this works, just the basics as i cited above, so some input as to why this is the case would be most helpful. If i owe and i understand why, that’s cool, i’m ok with that, but from what I know it seems like I should not unless i’m not taking something into account, or perhaps not claiming something i should be.FYI I only started RRSP contributions last year, when i factor that into my taxes my amount owing reduces significantly, however I still am under the impression without the RRSP i shouldn’t owe anything.

You May Like: Taxes For Doordash

Back Up What Exactly Is Gross Income

Its all the money youve made in the tax year. For most people, that mainly includes earned income from your salary, wages, tips or bonuses. It also includes unearned income, like dividends and accrued interest, as well as any gambling winnings. It does not include tax-exempt income, such as child support payments, most alimony payments, workers comp, and more.

Gross income should not be confused with your adjusted gross income or your taxable income. You can determine your AGI by taking your gross income and subtracting certain deductions, including contributions to a traditional IRA, 401 and other qualified retirement plans, interest paid on student loans and contributions to a health savings account. Taxable income is your AGI minus your standard deduction or any itemized deductions you claim.

So if my gross income falls below those minimums, I dont have to file a tax return? Correct. But it might be a good idea to file anyway. Thats because you may qualify for certain tax credits and get a little extra cash from Uncle Sam, even if you owe nothing.

What Can You Do If You Owe Money On Your Taxes

The IRS offers several options when you owe money and can’t pay right away. If that’s you, start with the following steps:

- File On Time: Don’t delay your taxes, and don’t confuse filing for an extension with permission not to pay. You won’t do yourself any favors by putting this off. File your taxes on time.

- Pay Something If Possible: Pay as much of the bill as you can without incurring hardship. Your tax bill will accumulate some fees and interest until it’s paid off, so the more you can get out of the way up front the better.

- File For A Short-Term Payment Plan: The I.R.S. offers several payment plans for taxpayers who owe less than $50,000. The easiest option is the short-term payment plans. This is a 120-day extension to pay your taxes in installments. For most taxpayers acceptance is automatic. The payment plan will charge some fees and interest, but it’s unlikely those will amount to much over four months.

- File For A Long-Term Payment Plan: If your bill is too large to pay off quickly a long-term payment plan is likely your best option. The I.R.S. allows taxpayers to create installment plans that can last for years. Setting up this plan will cost a small flat rate and the government will charge you fees and interest over time, but it’s better than going broke up front.

For more information, see the I.R.S. payment options website here.

Don’t Miss: How Does Doordash Do Taxes

Video: Why Do I Owe On My Tax Return

OVERVIEW

If you finish your tax return and are confused as to why you need to send the IRS a check, there is only one possible explanation for this: you paid less tax during the year than you owed for your income level. Watch this video to find out more about why you may owe money of your tax return.

Beginning in 2018, dependent exemptions are no longer taken as a deduction from your income.

Fill Out A Sample Tax Return

Another option is to complete a sample tax return for the year, by either using tax software or downloading the forms you need from the IRS website and filling them out by hand.

This method should give you the most accurate picture of your annual tax liability.

If youre using last years tax software or IRS forms, make sure that there havent been significant changes to the rules or the tax rates that would affect your situation.

How To Get The Most Money Back On Your Tax Return

Read Also: Doordash Tax Percentage