Tips To Minimize 401 Taxes

All the plans we create at Self Directed Retirement Plans LLC contain the ROTH provision. Please contact us at 866 639 0066 and we can answer your questions.

Take control of your financial future now.

Withdrawal Taxes: How To Minimize Them

You wont be able to get out of paying taxes on the funds you withdraw from your 401. However, there are a couple of tips and tricks that might help you lower the total tax you pay. Be sure to check with a tax expert or financial advisor if you want to be sure of the best course of action for your specific situation.

If you happen to hold stock of your company within your 401 account, you could potentially treat the appreciation of that stock as a capital gain rather than ordinary income. The long-term capital gain tax rate is 0%, 15% or 20%, depending on your tax bracket. For many investors, this means a lower tax rate than their ordinary income tax rate. To actually pull this off, youll need to transfer the stock into a taxable brokerage account. Dont be afraid to consult with an expert if you want to take advantage of this strategy.

The other factor to consider is your tax bracket. If your 401 distributions will put you in the lower end of one tax bracket, see if you can start distributions earlier, spreading things out and potentially dropping you into a lower bracket. As long as you start after age 59.5, you could save on your total tax bill with this method.

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Recommended Reading: Notice Of Tax Return Change Revised Balance

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

How Federal Taxes Work For Single Filers

Your 2020 tax would be calculated like this if your taxable income is $72,000 and you’re single:

- The first $9,875 is taxed at 10%, so you pay $987.50 on that amount.

- The next $30,250 is taxed at 12%, so you pay $3,630 on that portion.

- And the last $31,875 is taxed at 22%, so you pay $7,012.50.

- You owe a total of $11,630 in taxes.

Your your highest tax bracketis 22%, but only $31,875 of your income is taxed at that rate. Your effective tax rate, which is your taxes paid divided by your taxable income, works out to about 16.2%.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Thinking Of Relocating Consider The Best States To Retire In For Taxes

Most of the wisdom shared above is most relevant to federal taxes. However, state taxes can take a big bite out of your retirement nest egg as well.

If you are considering relocating for retirement, you might as well look at states that have the most favorable tax rates for retirees. These 10 locations are the best states to retire in for taxes.

The NewRetirement Planner estimates your states taxes based on where you live now and in the future.

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You May Like: How Do I Protest My Property Taxes In Harris County

Retirement Effective Tax Rate

In the above example, the Smiths are still working and earning a wage. The bulk of their income is from their jobs and taxed at ordinary income rates. But what happens when they retire? Remember that original 15 percent effective tax rate? Now that number may actually be representative of what they would pay overall. Luckily, retirees typically get to stop paying Social Security taxes, Medicare taxes, and in many places around the country, they get a break on state and local taxes too.

Dont forget that the Smiths 15 percent effective tax rate was based upon their earnings of $110,000 a year. Its most likely their income will be lower once they enter retirement, which can also bring down their effective tax rate. Additional good news is that if youve had your Roth account for at least five years and youre over the age of 59 ½, withdrawals will be tax-free, as will accessing the principal from savings and investments. Long term capital gains are taxed at lower rates or can even reduce your other taxes if youre selling at a loss.

Amidst this comforting news, just keep in mind that taxes are tricky and no one is ever completely out of the woods. Youll still be taxed on pension income, any rental, business, and wage income you have, and withdrawals from taxable retirement accounts. Social Security is taxed at ordinary income rates but luckily only part of it is taxable.

- Show CommentsHide Comments

Taxes When You Make Withdrawals

In a traditional 401, your contributions and your investment growth are tax-deferred. However, you have to pay taxes when you start making withdrawals from the account. In the case of a Roth 401, since you already pay taxes upfront while making the contributions, you dont owe any taxes when you withdraw from the account.

Your Retirement, Your Way!

You May Like: How Do I Get My Pin For My Taxes

What To Expect If You Do An Early Withdrawal

The IRS defines an early withdrawal as taking cash out of your retirement plan before youre 59½ years old. In most cases, you will have to pay an additional 10 percent tax on early withdrawals unless you qualify for an exception. Thats on top of your normal tax rate.

If you quit your job, you can roll over your 401 to an Individual Retirement Account or you can cash it out. If you cash it out, that qualifies as an early withdrawal, and its subject to an additional 10% tax as a penalty. That penalty could eat up thousands of dollars. Worse, youd lose out on interest and market growth.

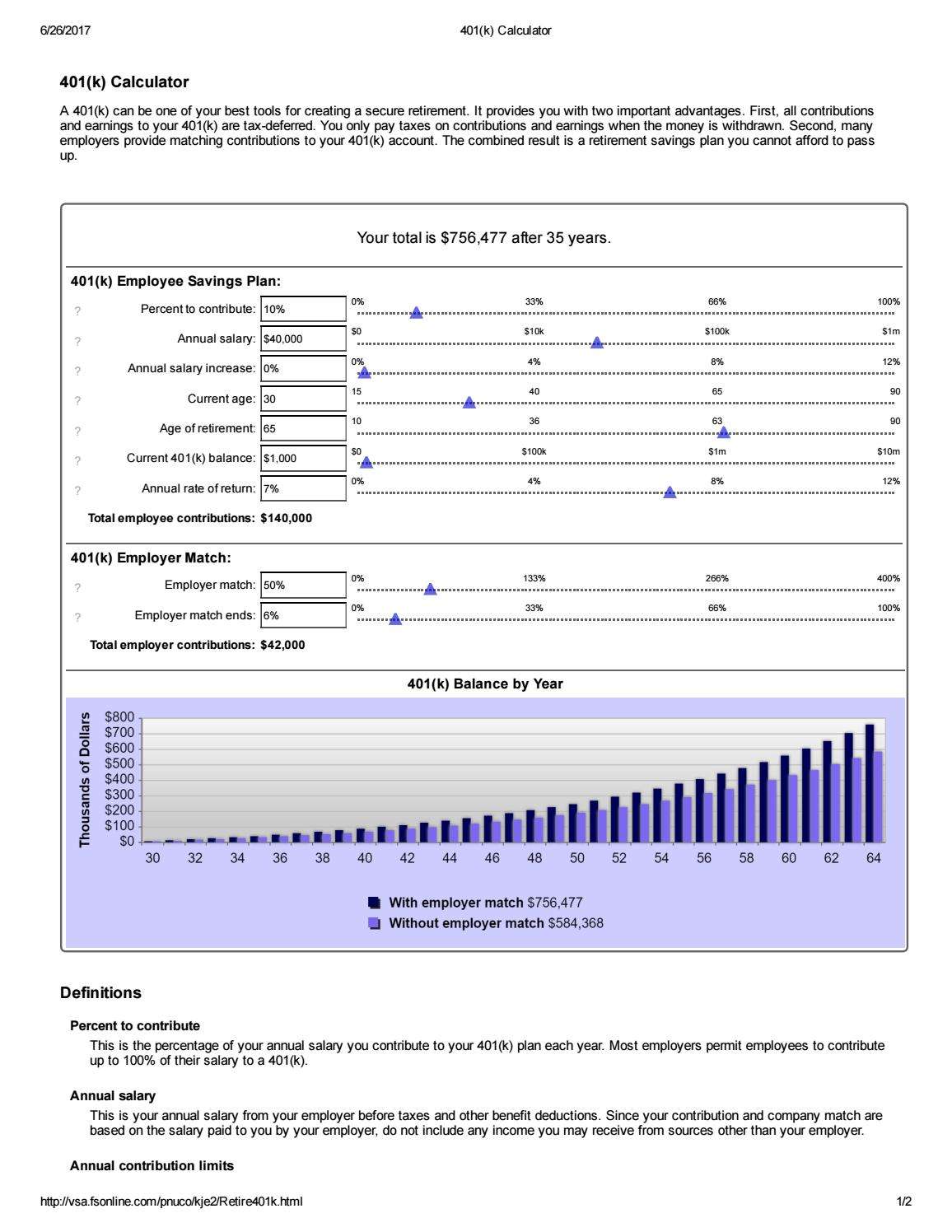

Pretend you are 30 years old and have a 401 balance of $10,000. Even if you made no more contributions and earned annual returns of 6%, your 401 would be worth $60,371 by the time you were 60. Without doing anything, your money would grow by over $50,000. If you instead cashed out at your 401 at 30, youd lose out on all that money.

If at all possible, its wise to skip the early withdrawal and to keep your money working for you in your 401 until you reach retirement age.

What Is The Tax Rate For Long Term Capital Gains In 2021

Long-term capital gains rates are 0%, 15%, or 20%, and married couples who deposit together fall into the 0% bracket for 2021 with taxable income of $ 80,800 or less .

What is the capital gains tax rate for 2020 21?

The tax rate on most net capital gains is no more than 15% for most individuals. Some or all of the net capital gain may be taxed at 0% if your taxable income is less than $ 80,000.

What is the capital gains tax rate for 2021 on real estate?

Your income and deposit status mean that your real estate capital gains tax rate is 15%.

Read Also: Efstatus.taxact

How Much Do You Have To Withdraw From Your Rrif Each Year

Converting your RRSP into an RRIF is a popular option for many Canadians. Once you convert your balance, you will no longer be able to continue your monthly or yearly contribution. Instead, you will have to begin withdrawing money.

The minimum amount you are required to withdraw is based on your age. If you are below 70 years old, your yearly minimum withdrawal amount will be 5% of your account balance or lower. Each year, this amount will increase. By age 80, your minimum withdrawal amount will be 6.82%. At age 90, this will rise to 11.92%. Aged 95 or older, you need to withdraw 20% of your account value annually.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

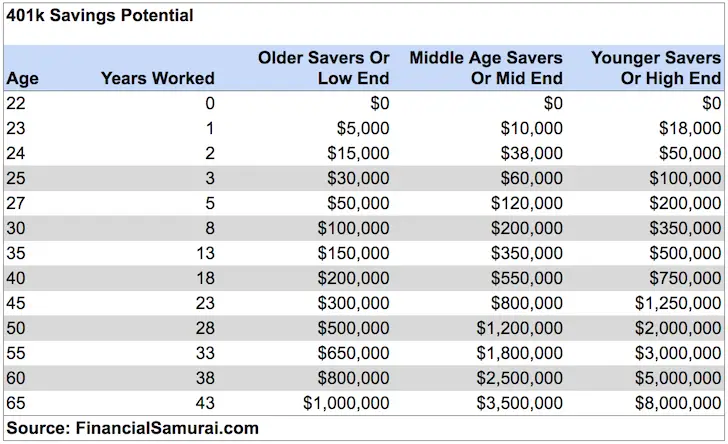

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

You May Like: Where Do I File My Illinois Tax Return

What Are The Disadvantages Of An Ira

Disadvantages of an IRA rollover

- Risks related to the protection of creditors. You can get credit and bankruptcy protections by leaving funds in a 401k, as creditor protection varies by state under IRA rules.

- Loan options are not available.

- Minimum distribution requirements.

- Tax rules on withdrawals.

What is the downside of a IRA?

A major drawback of Roth IRA contributions are made with after-tax money, which means that there is no tax deduction in the year of the contribution. Another drawback is that withdrawals should not be made until at least five years have passed since the first contribution.

What is a IRA What are the pros and cons of an IRA?

An IRA is a tax-efficient savings vehicle for retirement. You control how your savings are invested. IRAs are easy to set up and maintain. You dont need permission to use your money. If you withdraw the money before the age of 59 and a half, it is subject to ordinary income tax plus a 10% penalty tax.

Convert Assets To Roth Accounts

Lets say youre usually in the 22% tax bracket. This year you might have a unique situation where youll only be in the 10% tax bracket for a year.

You can use this opportunity to convert traditional retirement account assets into a Roth retirement account.

Now:

Youll have to pay income tax on the conversion based on the marginal income tax rate each dollar of the conversion falls in.

However, if you only convert enough assets to keep yourself in a lower tax bracket, you pay less in income taxes now. Then, you can withdraw the money tax-free later when youre in a higher tax bracket.

Consult a professional before you do this. It can be complicated. Once you convert assets, you may not be able to hit an undo button if you make a mistake.

Recommended Reading: When Do We Start Filing Taxes 2021

Explore Net Unrealized Appreciation

If you have company stock in your 401, you may be eligible for net unrealized appreciation treatment if the company stock portion of your 401 is distributed to a taxable bank or brokerage account, says Trace Tisler, CFP®, owner of Epic Financial LLC, a northeastern Ohio financial planning firm. When you do this, you still have to pay income tax on the original purchase price of the stock, but the capital gains tax on the appreciation of the stock will be lower.

So, instead of keeping the money in your 401 or moving it to a traditional IRA, consider moving your funds to a taxable account instead. This strategy can be rather complex, so it might be best to enlist the help of a pro.

Retirement May Be A Good Time To Consult A Tax Expert

The process of trying to figure out where to take funds out of to minimize the impact of taxes is pretty complicated, especially when you throw in Social Security taxes and income from other sources, in some situations. You might need an expert on the topic, Kornblatt points out.

Every person has a unique tax situation and an advisor can customize an approach to ensure you have enough money to live on in as tax efficient a way as possible, she says.

Recommended Reading: Is Past Year Tax Legit

Taxable Iras Pensions And Annuities

Taxable income from IRA distributions, IRA withdrawals, pensions, and annuities all impact your tax bracket calculations.

Not all IRA distributions are taxable. For instance, Roth IRA distributions are usually tax-free.

Pensions and annuities may or may not be taxable depending on your situation and the particular pension or annuity.

Can You Reverse An Ira Withdrawal

You can only cancel an IRA contribution once every 12 months. Check your IRA statement or call the trustee for the exact amount of the distribution. You must return exactly what you have withdrawn within the 60 day window to avoid taxation. Find the date of the original distribution.

Can you put money back into a traditional IRA after withdrawal?

In this case, you can return the amount withdrawn in the same or another IRA before the 120 day period expires, and there will be no tax consequences.

Can I return a 401k withdrawal?

If you make a withdrawal: No refund is required. There is no withdrawal penalty. It will initially be taxed as income, although you can claim a refund if you pay off the distribution in three years.

Don’t Miss: Where’s My Refund Ga

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.