Internet And Phone Bills Deduction

Regardless of whether you claim the home office deduction, you can deduct the business portion of your phone, fax, and Internet expenses. The key is to deduct only the expenses directly related to your business. For example, you could deduct the Internet-related costs of running a website for your business.

If you have just one phone line, you shouldnt deduct your entire monthly bill, including personal and business use. According to the IRS, You cant deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home. However, you can deduct 100% of the additional cost of long-distance business calls or the cost of a second phone line dedicated solely to your business.

Choosing Whether To Itemize

You must choose whether to itemize or take the standard deduction each year. The IRS won’t tell you what’s in your best interestit doesn’t care if you make the wrong choice and overpay your taxes. You must decide. Obviously, you should itemize only if it will give you a larger total deduction than the standard deduction for that year.

You will likely be able to itemize only if you:

- had large uninsured medical and dental expenses during the year

- paid substantial interest and taxes on your home

- had significant uninsured casualty losses due to a federally declared disaster, or

- made large charitable contributions.

Through careful planning, you can often increase your deductible expenses for a given year so that it pays to itemize that year. For example, you can bunch your charitable contributions in one year instead of spreading them over two or more years. This will give you a bigger deduction for the bunched year and might enable you to itemize. The same strategy can be used for discretionary medical expenses.

Contributions To A Health Savings Account

Health savings accounts form tax-exempt accounts that you can use to reimburse or pay for specific medical expenses. These contributions are made with after-tax dollars, which makes the deduction unavailable for donations made directly from your paycheck.

For contributions made into your account, you can claim a tax deduction of up to $2,700 every year.

Contribution limits vary depending on your age, high-deductible health plan, and when you become eligible. If you qualify for the tax deduction, claim it on Schedule 1.

Don’t Miss: Dasher 1099

How Many Allowances Should I Claim On Form W

Youre about to start a new job. But before you can get to work, your new employer hands you a Federal W 4 Withholding Allowance Certificate, filling you with the dread of completing yet another tax form you dont quite understand.

Dont worry were here to help! Below, we explain what W4 allowances are, what to claim on your W4 and how best to fill out that form and get your new career started on the right foot.

How To Claim Investment Fees On Your Tax Return

If you invested money in a non-registered account in 2021 , you may be able to deduct some investment-related fees from your taxable income.

This claim falls under the Carrying Charges and Interest Expenses deduction. It can include fees for certain investment advice, such as guidance on buying or selling a specific share or security, as well as fees for managing your non-registered investments. Note that the principal business of the financial professional you use must be providing advice on whether to buy or sell specific shares , so fees paid to a financial planner are likely excluded. Also, commission fees or embedded fees, like management expense ratio are not eligible for the deduction.

Whos eligible: Taxpayers who paid fees to an investment advisor to earn income from non-registered assets.

How much you could save: It depends on the total amount of your eligible investment fees but, for example, a deduction of $1,000 would save you $150 if your income is in the lowest tax bracket, and $330 if youre in the highest income tax bracket.

How to claim it: Report your total eligible fees on line 22100 of your return.Read more about the investment fees you can claim.

You May Like: Cook County Appeal Property Tax

Know Where You Can Save Money And Grow Your Profits

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Over the years, legislators have written numerous lines into the tax code to soften the blow of the extra costs that self-employed taxpayers must shoulder as they do business. The Tax Cuts and Jobs Act , effective as of the 2018 tax year, made several changes to self-employed tax deductions. Many of these changes are temporary and set to expire in 2025, but others are permanent.

The law affects small businesses in many ways, particularly via a qualified business income deduction for pass-through businessesthose that pay taxes as an individual taxpayer rather than through a corporation. For owners of sole proprietorships, partnerships, S corporations, and certain trusts, estates, and limited liability companies , this deduction provides a great benefit. Eligible taxpayers can deduct up to 20% of their QBI. A pass-throughs QBI is the net amount of qualified items of income, gain, deduction, and loss from a qualified trade or business.

Standard Deduction For Dependents

If someone else claims you on their tax return, use this calculation.

1. Enter your income from: line 2 of the “Standard Deduction Worksheet for Dependents” in the instructions for federal Form 1040 or 1040-SR.

3. Enter the larger of line 1 or line 2 here

4. Enter amount shown for your filing status:

- Single or married/RDP filing separately, enter $4,803

5. Enter the smaller of line 3 or line 4 here and on Form 540, line 18. This is your standard deduction.

Recommended Reading: Do They Take Taxes Out Of Doordash

State Local And Foreign Taxes

You can claim certain taxes as itemized deductions. Apart from state and local sales taxes, you can also deduct:

- Local and state personal property taxes, if the tax amounts are based on the value of the property

- Local and state real estate taxes based on the value of the property

- Foreign, local and state income taxes

The 10 Most Overlooked Tax Deductions

OVERVIEW

Don’t overpay taxes by overlooking these tax deductions. See the 10 most common deductions taxpayers miss on their tax returns so you can keep more money in your pocket.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Apple Podcasts | Spotify | iHeartRadio

Read Also: Ntla Tax Lien

What Is The Homestead Property Tax Credit

Michigan’s homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit.

The credit, for most people, is based on a comparison between property taxes and total household resources. Homeowners pay property taxes directly and renters pay them indirectly with their rent.

Given that each taxpayer has unique circumstances that determine their eligibility for the credit, the Michigan Department of Treasury encourages you to review the information below and/or contact a tax professional.

Doing Well By Doing Good

You donated your skinny jeans and wagon-wheel coffee table to Goodwill which, in turn, reduced your taxes by increasing your charitable deductions. The Internal Revenue Service requires that you provide a qualified appraisal of the item or group of items when you make a physical donation worth more than $5,000. For items such as electronics, appliances, and furniture, you may need to pay a professional to assess the value of your donation.

Individuals can elect to deduct donations of up to 100% of their 2020 AGI . Corporations may deduct up to 25% of taxable income, up from the previous limit of 10%. Additionally, section 2204 of the CARES Act permits eligible individuals who do not itemize deductions to deduct $300 of qualified charitable contributions as an “above-the-line” deduction, i.e., as an adjustment in determining AGI, for the 2020 tax year.

Capital gains property donations, such as appreciated stock, are limited to 30% of AGI, and you may no longer claim a deduction for contributions that entitle you to college athletic seating rights.

Taxpayers who do not itemize their deductions are also allowed up to a $300 deduction for charitable contributions, thanks to the CARES Act. The 60% AGI limitation is suspended for itemizing taxpayers who donate to charity in 2021.

You May Like: Www.myillinoistax

Transferred And Pooled Credits

In some cases, tax credits may have no effect on a taxpayers return, such as when they are already in refund status. In the case of families, many of these credits all or the surplus portion may be transferable to another family member, provided that this individual is either the childs parent, or your spouse/common-law partner , or was the individual claiming an amount for the eligible child. In a situation like this, the child care expenses most often must be claimed by the person with the lower net income the only variable is if one of the situations listed in Part C or Part D of form T778 applies.

The tuition tax credit can be claimed or carried forward by the student or may be transferred to the students parent, grandparent or spouse, or students spouses parent or grandparent. For more details, go to this CRA link.

Medical expenses may be declared on family totals. To qualify, expenses must exceed the current level set by the CRA or 3 percent of net income, whichever amount is lower. For more details, go to this CRA link.

Staying On Top Of Your Deductions

As a small business owner, it can be difficult to know what deductions are relevant to you.

Many people struggle to stay on top of their deductions year round and instead try to piece things together at year end and run in to difficulties. Remember that restaurant expense you incurred in January last year? Most people donât, and therefore they miss this tax write off. Add them all up and youâre missing out on a lot of tax savings.

Thatâs where bookkeeping comes in.

To claim these deductions, youâll need to keep accurate records and stay on top of your monthly bookkeeping.

Ongoing bookkeeping is critical to help you tally up your deductions. If you donât have a good DIY setup youâre happy with, check out Bench. Weâll do your bookkeeping for you.

When Bench does your bookkeeping, we catch these deductions every month so you have confidence youâve caught everything and minimized your tax liability. Then at year end, send Benchâs books to your accountant. Or, let us take tax filing off your plate for good with Bench Taxâweâll do your bookkeeping and tax filing for you. Consider your tax season headache free!

Recommended Reading: Appeal Cook County Property Taxes

How To Use Schedule A To Lower Your Taxes

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Itemized tax deductions give many American wage earners a chance to pocket more income, rather than hand over their hard-earned cash to the government. For those who keep good records, deductions have long meant more money for them and less for the Internal Revenue Service .

How Do You Keep A Mileage Log

The IRS is strict about how you must log miles for tax deductions, so its important to plan out how you will keep records before you start driving. Here are some tips that can help you:

Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. You will also be able to look back to your bank and credit statements for records as youre filing your taxes. Regardless of how you record your miles, this separation of accounts can aid your recordkeeping.

Record mileage on paper or in a spreadsheet. One option is to write down the details for each trip you make.

To record your mileage for each trip, you will need to note the following items:

- Date

Recommended Reading: Protesting Property Taxes In Harris County

How To Claim Canadian Political Contributions

Well, it was an election year, so chances may be greater that you made a federal political contribution in 2021 and can claim a tax credit.

The Federal Political Contribution Tax Credit is one of the most generous non-refundable credits around, as you can save nearly 50% or more on eligible donations of up to $1,275.

Whos eligible: Taxpayers who donated amounts to a registered federal political party or a candidate for election to the House of Commons.

How much you could save: You can claim 75% of the contributions up to $400 50% for amounts between $400 and $750 , and 33.5% for any amounts between $750 and $1,275 .

How to claim it: Enter your total federal political contributions on line 40900 of your return, and the calculated credit amount on line 41000.

Deductions That Are Ineligible:

On the CRA website, you can find a number of deductions that are not eligible for the medical expense tax credit. Among these are:

- Medication is available without a prescription, even over-the-counter.

- clubs that offer fitness facilities.

- Surgical cosmetics

- Diaper service providers

- Personalized response systems

It is not a violation to include them. The cost of these items is not deductible, so the CRA will reject these claims. The list has some exceptions that might keep it from being rejected. Reconstructive surgery, for example, may be required to fix a specific flaw, accident or disease, so it may be OK to pay for it.

You May Like: Cook County Board Of Review Deadlines

How To Claim Tax Deductions

You can claim a tax deduction when you file your income taxes every year. Different deductions appear on different forms, so you must either hire a tax professional, use tax software or follow IRS instructions yourself to determine exactly where to file them.

One of the most important considerations when filing your taxes is whether you should claim the standard deduction or if you should itemize your deductions. Heres the distinction between the two:

- Standard deduction: The standard deduction is a dollar-for-dollar reduction of your taxable income. Nearly all taxpayers are entitled to this deduction. For tax year 2021, the standard deduction is $25,100 for those with the tax status of married filing jointly. Single filers are entitled to a standard deduction of exactly half this amount. For tax year 2021, you can claim your standard deduction on Line 12 of your Form 1040.

- Itemized deductions: Itemized deductions are expenses that qualify as deductions against your income. Most of the deductions listed in this article are itemized deductions. If your total itemized deductions exceed your allowable standard deduction, youre usually better off claiming your itemized deduction and forgoing your standard deduction. You must claim your itemized deductions using Schedule A, which then transfers to Line 12 of your Form 1040.

Health Coverage Tax Credit

Workers may be able to claim the HCTC if they lost their jobs due to the negative effects of global trade. Such workers are eligible to receive HCTC benefits under the Trade Adjustment Assistance Program, which covers workers whoâve lost international trade jobs. Workers between 55 and 64 years old can also qualify if their pension plans were taken over by the Pension Benefit Guaranty Corporation .

The HCTC credit covers 72.5% of health insurance premiums, including COBRA coverage, a program that allows workers to keep their employerâs health insurance plan after leaving the job. Use Form 8885 to claim the HCTC. This credit is set to expire after 2021, unless Congress extends it.

Also Check: Amended Tax Return Online Free

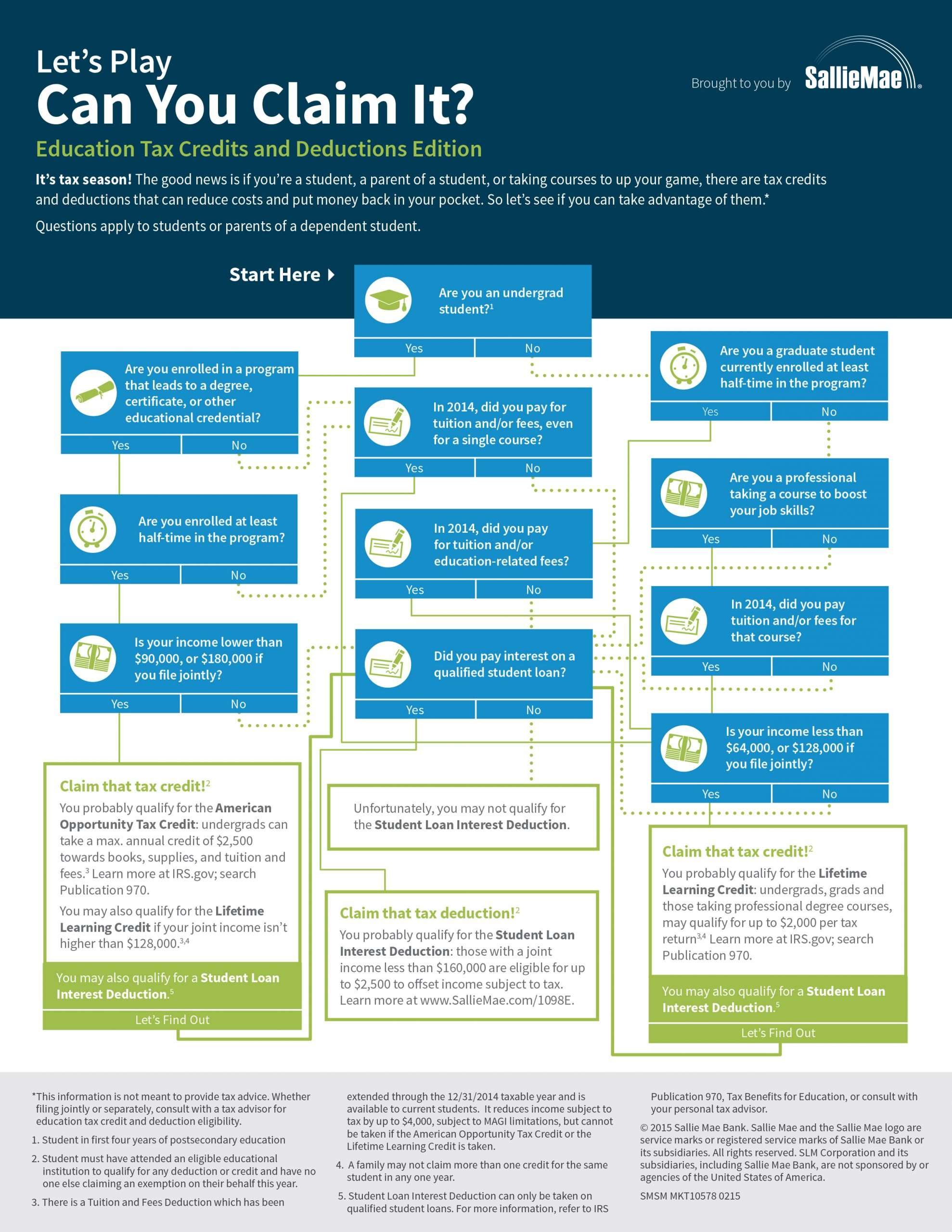

Student Loan Interest Deduction

Taxpayers with student loans can deduct up to $2,500 of interest incurred. You can also include interest via credit card debt that came from helping to pay for education. Loans qualify as long as you paid for them and they were for yourself, a spouse or a dependent. You canât get the deduction if your filing status is married but filing separately. Your available deduction also decreases once your modified adjusted gross income hits $70,000 or $145,000 .

What Can You Deduct At Tax Time

Knowing what you can deduct when youre doing your taxes each year is important if you want to reduce your tax liability. Some common deductions, like the mortgage interest tax deduction, are well known, but if youre going to do itemized deductions, you should know all the details. For help on your taxes and other financial questions, consider working with a financial advisor.

Recommended Reading: How To Get Doordash Tax Form