How Do I Know If I Filed My Taxes Last Year

Can you help me to see if my taxes filed for last year

For last year’s refund, you will need to reach out to the IRS directly. To get to a live agent, please see the below instructions:

To call the IRS: 800-829-1040 hours 7 AM – 7 PM local time Mon-Fri

- Listen to each menu before making the selection.

- First choose your language. Press 1 for English.

- Then do NOT choose the first choice re: “Refund”, or it will send you to an automated phone line.

- Instead, press 2 for “personal income tax”.

- Then press 1 for “form, tax history, or payment”.

- Then press 3 “for all other questions.”

- Then press 2 “for all other questions.” It should then transfer you to an agent.

Refund Delays Due To Error

There was probably an error on your tax return if receiving your refund is taking longer than you think it should. that couldnt be easily cleared up. Even a small mistake can slow things down if the IRS must reach out to you for clarifying information. The IRS will never email you or phone you in this case. It will notify you and request the information by mail through the U.S. postal system.

Always double- and triple-check your tax return for mistakes if you prepare it yourself. Its especially important to make sure youve included your correct Social Security number. Make sure youve attached all necessary forms.

Make sure you check your direct deposit information and your math because many returns are delayed based on those two things. Even choosing the wrong standard deduction for your age and filing status could slow things down.

What You Need To Know For The 2021 Tax

Ottawa, Ontario

Canada Revenue Agency

This year, the COVID-19 pandemic may have affected your tax-filing situation and may also affect the way you usually file your income tax and benefit return. Over 30 million returns were filed last season, and the Canada Revenue Agency wants to help you get ready to file your return this year.

Heres what you need to know for this tax-filing season, including filing options, COVID-19 benefits, and whats new.

Also Check: What Taxes Do Employers Pay For Employees

How Do I Check If My Taxes Were Filed

The wait can seem like an eternity when you’re expecting a tax refund. Youll likely find you have to wait at least a couple of weeks to see that money in your bank account even if you file early in the tax season. But the IRS makes it easy to check on the progress of your tax return. It provides a website specifically designed for that purpose.

You can begin watching the site for confirmation that your return has been received once you’ve filed. It will also tell you when it’s been approved and submitted for processing. Understanding the timeline can give you a rough idea of when you can realistically expect your money.

Tips

-

Youll receive a receipt confirmation from the IRS immediately if you file electronically. You can monitor the status of your refund through the IRS Refund Status page after that point.

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

Recommended Reading: How To Avoid Capital Gains Tax On Property

Filing A Paper Return

To file a paper return, you must choose Mail Paper Return in the Filing step in TaxAct. Follow ALL of the steps presented. During this process, you will be prompted to print a paper copy of your tax return. You will also be prompted to print the filing instructions .

To complete the paper filing process, print your return and follow the filing instructions to include any necessary attachments. Then mail your return to the address specified in the filing instructions.

What Do These Irs Tax Return Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

You May Like: When Is Oklahoma State Taxes Due

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

What Edition Of Turbotax Is Right For Me

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

You can always start your return in TurboTax Free, and if you feel the need for additional assistance, you can upgrade to any of our paid editions or get live help from an expert with our Assist & Review or Full Service. But dont worry, while using the online version of the software when you choose to upgrade, your information is instantly carried over so you can pick up right where you left off.

Don’t Miss: What Refinance Costs Are Tax Deductible

About Tracking Your Refund

How fast will I receive my refund?

How quickly you receive your tax refund depends on when you file, how you file, how you choose to receive your refund, and whether you claim certain credits and deductions.

When you file your return electronically, most refunds are funded within 21 days of filing, according to the IRS. That clock starts after the IRS begins processing tax returns for the year.

Please note that due to tax laws in place to reduce fraudulent claims for refunds, taxpayers who claim the EITC or refundable Child Tax Credit will not receive a refund before February 15th.

How fast can I get my refund?

If you chose direct deposit, your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

You may receive your refund as early as the same day it was sent by the IRS up to two days faster* than standard direct deposit if you chose to have it loaded onto an American Express Serve® Card.

How can I check the status of my return on the MyJH account I created?

You’ll be able to see your return status!

How can I access my tax documents on the MyJH account I created?

Its Not Too Late To File Your Tax Return

Although the regular tax season is over, you can still file a late tax return until October 15, 2022. If you do not file you may miss out on a refund or any tax credits for which you may be eligible.While theres no penalty for filing late if you do not owe taxes, you could face fees and penalties if you do owe for 2021. The information below can help you navigate this process and complete your return before the final deadline.

Also Check: How Long Should I Keep Tax Records

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2021 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

You May Like: Where Can I Find My Tax Return From Last Year

Stage : Refund Approved

This means the IRS has processed and approved your return. This usually happens about three weeks after the IRS indicates theyâve received your return.

Once the IRS processes your return, youâll see an estimated date for when the money will be deposited into your bank account, like so:

If you donât receive your refund by the date mentioned on this page, the IRS suggests contacting your bank first, to make sure there arenât any problems with your account.

How Can I Track My Refund Using The Where’s My Refund Tool

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Don’t Miss: What Is The Penalty For Filing Your Taxes Late

More Info For Check The Status Of Your Ma Income Tax Refund

Most tax filing errors can be avoided by filing your tax return electronically.

When you file your tax return electronically:

- Calculations are done for you

- The correct schedules are included, and

- Processing is faster, resulting in faster refunds.

Electronically filed returns take up to 6 weeks to process.

Paper returns take up to 10 weeks.

If you file on paper, please avoid these common mistakes.

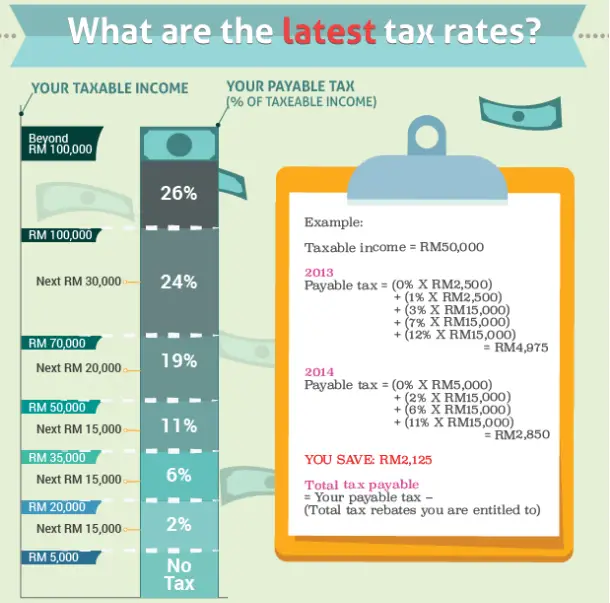

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

Read Also: What’s The Minimum Income To File Taxes

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserve’s recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as “accepted.”

Of course, any IRS interest you receive with your refund is considered taxable income.

Refund Delays Due To Fraud

Fraudulent activity connected with your Social Security number can also cause a delay in processing. You likely wont even be aware of this until you file.

Fraudulent tax activity occurs when someone uses your Social Security number to file a return and get a refund. The agency will know that something is afoot when you try to file your own return and they already have one filed on your behalf.

Read More:What Happens If You Don’t File Taxes?

Also Check: How Long Will It Take For My Tax Return

To Follow Up On Your Submitted Return:

You should receive an email within 24-48 hours indicating that your return has been received by TaxAct and transmitted to the IRS. Later, you will receive a second e-mail indicating the status of your return .

After transmitting your return, it is your responsibility to ensure that it is accepted by the IRS or state agency. If you do not receive an email confirmation or acceptance, you can check the status of your electronically filed returns using the TaxAct E-File and Tax Refund Status webpage.

Income Tax Refund Information

You can check the status of your current year refund online, or by calling the automated line at 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at to check on your refund. Remember to include your name, Social Security number and refund amount in your e-mail request.

If you’re expecting a tax refund and want it quickly, file electronically – instead of using a paper return.

If you choose direct deposit, we will transfer your refund to your bank account within a few days from the date your return is accepted and processed.

Electronic filers

We usually process electronically filed tax returns the same day that the return is transmitted to us.

If you filed electronically through a professional tax preparer and haven’t received your refund check our online system. If not there, call your preparer to make sure that your return was transmitted to us and on what date. If sufficient time has passed from that date, call our Refund line.

Paper filers

Paper returns take approximately 30 days to process. Keep in mind that acknowledgment of the receipt of your return takes place when your return has processed and appears in our computer system.

Typically, a refund can also be delayed when the return contains:

- Math errors.

- Missing entries in the required sections.

- An amount claimed for estimated taxes paid that doesn’t correspond with the amount we have on file.

Check cashing services

Splitting your Direct Deposit

Also Check: How Do I Track My Taxes

How To Check If Your Return Was Filed

Bookmark the IRS Refund Status page when you’ve filed your tax return. It can be found at irs.gov/refunds. Youll also see a link to the refund page on the main IRS site.

Provide your Social Security number, your filing status and the exact amount of the refund youre expecting to check your refund status. The site should have information about your return 24 hours after you submit it electronically. The information updates every 24 hours, usually overnight. You probably wont see any data on the IRS Refund Status page for at least four weeks if you mail in a paper return.

The IRS updated taxpayers by phone on refund status before it set up this status page. You can still call the IRS for these updates, but the most current information is provided on the refund status page. The agency continues to experience delays with live phone support during the ongoing COVID-19 pandemic.

The IRS recommends calling only if it’s been 21 days or more since you e-filed or six weeks or more since you mailed in your return unless the IRS Refund Status page tells you that you should contact the IRS. Otherwise, the website is the best resource.

Read More:The Federal Gift Tax and Holiday Giving

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Read Also: How Do I Pay Estimated Quarterly Taxes