What Type Of Taxes Will I Pay In The United States On An H1b

As an H1B worker in the US, you can expect to pay between 20-40% of your wages in federal and state and local taxes, depending on your income level. These taxes will include:

- Federal income tax

- Federal payroll tax

- State income tax

- Local income tax

You may also pay these taxes while living in the United States: sales tax, property tax, transfer tax, capital gains tax, inheritance or estate tax, gas tax, hotel or lodging tax.

Related Article:Can I volunteer while I am on an H1B Visa?

Which States Don’t Tax Retirement Distributions

Twelve states do not tax retirement distributions. Illinois, Mississippi, and Pennsylvania don’t tax distributions from 401 plans, IRAs, or pensions. The remaining nine states are those that don’t levy a state tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alabama and Hawaii also don’t tax pensions, but they do tax distributions from 401 plans and IRAs.

How Much Severance Pay You May Receive

Severance pay is money your employer pays you when you lose your job through no fault of your own.

Your employer may also offer you benefits when you lose your job. Your employer may call it a severance package, severance agreement or retiring allowance.

The federal, provincial and territorial governments make regulations about severance pay. In some cases, you may not be eligible for severance pay. For example, you may not be eligible for severance pay if youve worked for your employer for only a short time.

To find out what severance pay to expect, review documents that outline your salary and terms of dismissal.

These documents may include:

How much money youll receive depends on the following:

- regulations in your province or territory

- your unions collective agreement

- how long you worked for your employer

- why you lost your job

The federal government regulates some industries, such as banks and air transportation. If you work in one of these industries, federal law will decide how much money your employer may owe you.

Also Check: Do I Pay Taxes On Plasma Donations

Florida Communication Services Tax

In addition to the above taxes, Florida also collects a special communication services tax on all phone, internet and television services. The total tax rate is 7.44%, but service providers are only allowed to directly bill consumers for 5.07% of that. For the remaining 2.37%, consumers must report and pay the tax independently.

For satellite-based services like DirecTV, the rate is even higher at 11.44%. So if you are a big spender on high-speed internet, multiple phone lines and the top-of-the-line cable TV packages, expect a slightly higher price-tag when it comes time to pay up.

What Is The Tax Rate For Lottery Winnings

When it comes to federal taxes, lottery winnings are taxed according to the federal tax brackets. Therefore, you wont pay the same tax rate on the entire amount. The tax brackets are progressive, which means portions of your winnings are taxed at different rates. Depending on the number of your winnings, your federal tax rate could be as high as 37 percent as per the lottery tax calculation.

State and local tax rates vary by location. Some states dont impose an income tax while others withhold over 15 percent. Also, some states have withholding rates for non-residents, meaning even if you dont live there, you still have to pay taxes to that state.

You May Like: How Much Money Should I Save For Taxes Doordash

How Your Florida Paycheck Works

Living in Florida or one of the other states without an income tax means your employer will withhold less money from each of your paychecks to pass on to tax authorities. But theres no escaping federal tax withholding, as that includes both FICA and federal income taxes. FICA taxes combine to go toward Social Security and Medicare. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Every pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. Note that if youre self-employed, youll need to pay the self-employment tax, which is the equivalent of twice the FICA taxes – 12.4% and 2.9% of your earnings. Half of those are tax-deductible, though. Earnings over $200,000 will be subject to an additional Medicare tax of 0.9%, not matched by your employer.

Your employer will also withhold money from every paycheck for your federal income taxes. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. The rate at which your employer will apply federal income taxes will depend on your earnings on your filing status and on taxable income and/or tax credits you indicate W-4 form.

What Is The 2 Out Of 5 Year Rule

Those two years do not need to be consecutive. In the 5 years prior to the sale of the house, you need to have lived in the house as your principal residence for at least 24 months in that 5 year period. You can use this 2 out-of-5 year rule to exclude your profits each time you sell or exchange your main home.

Recommended Reading: Efstatus Taxact Online

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last years federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

You May Like: How To Pay Oklahoma State Taxes

Paying Taxes When You Are Unemployed

Unless the federal and/or state governments act to change the law, youll likely have to pay federal income tax on the unemployment compensation you receive while out of work because of COVID-19.

You have multiple options for paying your taxes when youre unemployed.

You can choose to have federal income taxes withheld from your unemployment compensation when you apply for unemployment benefits, or you can choose not to do so and just pay estimated taxes each quarter to avoid a tax bill when you file your return.

Of course, you could also wait until you file your taxes and pay any tax you owe at that time. But you may want to think long and hard before choosing that option, especially if youre worried you may continue to struggle financially even after the COVID-19 crisis subsides. The federal tax system is pay-as-you-go, so youre supposed to pay taxes on income as you receive it throughout the year. If you dont pay enough throughout the year, a big tax bill in April might not be your only worry. You could also face a penalty for underpaying your estimated taxes.

If your total income for the year including wages, unemployment benefits, interest, retirement distributions and all other income you made is less than the standard deduction for your filing status, you normally arent required to file a tax return, says Christina Taylor, senior manager of tax operations for Credit Karma Tax®. In that case, you might not need to have tax withheld from your unemployment.

Also Check: Csl Plasma Taxes

What Can Disqualify You From Receiving Unemployment Benefits

Each state has its own unemployment criteria and rules. Unemployment programs typically require you to be unemployed through no fault of your own and meet work and wage requirements. If you quit or were fired for cause, you usually dont qualify for unemployment. Self-employed people and contract workers usually arent eligible for unemployment benefits, but the CARES Act allowed states to extend unemployment benefits to these individuals.

Helpful Paycheck Calculator Info:

Florida joins the list of just a handful of states with no state income tax, which is why its popular amongst retires and tax-adverse workers. In addition to the 0% Florida state income tax, no city or county charges local income taxes either, which is usually a welcoming gift to new Florida residents. It is important to keep in mind that no state is entirely tax-free. Florida makes up for the lack of state income tax with its property taxes if you own a home in Florida, or other purchases that will be subject to a 6% base sales tax rate, plus any county sales taxes.

Looking for managed Payroll and benefits for your business?

You May Like: Filing Taxes For Doordash

Calculating Your Futa Tax Liability

You must pay unemployment taxes if:

- You paid wages of $1,500 or more to employees in any calendar quarter of a year, or

- You had one or more employees for at least some part of a day in 20 or more different weeks during the year.

You must count all employees, including full-time, part-time, and temporary workers. Dont count partners in a partnership, and dont count wages paid to independent contractors and other non-employees,

You must pay federal unemployment tax based on employee wages or salaries. The FUTA tax is 6% on the first $7,000 of income for each employee. Most employers receive a maximum credit of up to 5.4% against this FUTA tax for allowable state unemployment tax. Consequently, the effective rate works out to 0.6% .

Also Check: Esd Wa Gov Unemployment Have This Information Ready

How Do You Claim Unemployment Benefits

Unemployment benefits are offered at the state level. Youll need to contact your states unemployment insurance program and follow its instructions for applying. In general, youll need to complete an application that explains your situation and details where you worked, how long you worked there, how much you made, and why youre no longer employed. Your states unemployment program will review your application and approve it, request additional information or an interview, or deny it. You can appeal if your claim is denied.

Also Check: 1040paytax

You Can Figure Out How Much Federal Income Tax You Will Pay Using A Chart Like This:

| Tax Rate | |

|---|---|

| over $300,000 | over $500,000 |

The US has marginal tax rates which means that you do not say the same percentage on all of your income. It works like a step function. If your 2018 income is $49,000 and your status is single, the first $9,325 will be taxed at 10%. The income between $9,326 and $38,700 will be taxed at 12%. The rest of your income will be taxed at 22%.

State And Local Income Taxes

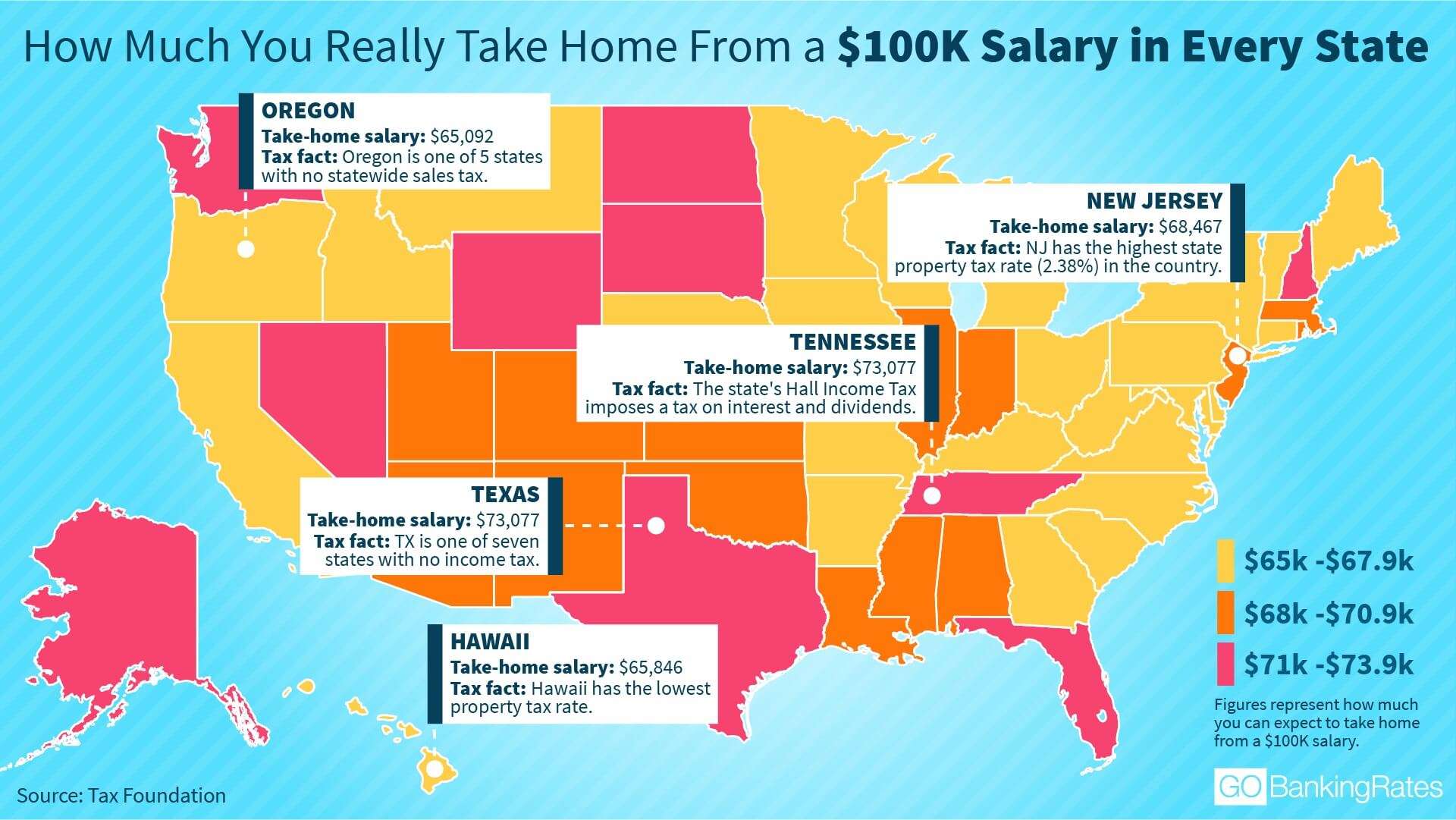

Most states, and a number of municipal authorities, impose income taxes on individuals working or residing within their jurisdictions. Most of the 50 states impose some personal income tax, with the exception of Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, which have no state income tax. New Hampshire and Tennessee tax only dividend and interest income. Few states impose an income tax at rates that exceed 10%.

Also Check: Are Plasma Donations Taxable

State Income Taxes On Unemployment Benefits

It may not be just the IRS you have to worry about. Many states tax unemployment benefits, too. There are several that do not, though California, Montana, New Jersey, Pennsylvania, and Virginia do not charge taxes on unemployment benefits. Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021.

Eight states dont tax any income at all, so youll be spared if you live in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming. New Hampshire doesnt tax regular income it only taxes investment income.

Also Check: Va Disability Unemployability

How Much Can A Small Business Make Before Paying Taxes

If you operate a small business, you must pay taxes on the income, regardless of the profit and loss. The tax return you must file depends on how your business is structured. For example, if you have a sole proprietorship youll file the schedule C with your personal tax return.

If youre a freelancer, you must also pay self-employment taxes for income more than $400. These taxes cover Medicare and social security taxes.

Sole proprietors must file IRS Form 1040, Schedule C and Schedule SE if your net income is greater than $400. If you have an employee, you will need to withhold federal and state income taxes and Social Security and Medicare taxes for each employee.

Recommended Reading: Is Donating Plasma Taxable

Personal Income Tax Rates

For individuals, the top income tax rate for 2021 is 37%, except for long-term capital gains and qualified dividends .

P.L. 115-97 reduced both the individual tax rates and the number of tax brackets. P.L. 115-97 sunsets after 2025 many individual tax provisions, including the lower rates and revised brackets, in order to comply with US Senate budget rules.

You May Need To Adjust Your Spouses Income Tax Withholding

One way you can increase your current after-tax income, if you and your spouse were both working, is to have your spouse adjust his or her income tax withholding.

If your spouses withholding is based on the assumption you both earned an income, he or she is almost certainly having too much withheld for your current circumstances.

The working spouse should file a new Form W-4 with his or her employer to adjust the amount of income tax withheld.

Dont Miss: Unemployment Eligibility Tn

Don’t Miss: Www 1040paytax

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employees province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employees salary.

For more information and examples, see Chapter 1, General Information in Guide T4001, Employers Guide Payroll Deductions and Remittances.

How Unemployment Taxes Work

In brief, the unemployment tax system works as follows:

- Employers pay into the system, based on a percentage of total employee wages.

- You dont deduct unemployment taxes from employee wages.

- Most employers pay both federal and state unemployment taxes.

- Employers must pay federal unemployment taxes and file an annual report.

- The tax paid goes into a fund that pays unemployment benefits to employees who have been laid off.

Dont Miss: How To Apply For Va Individual Unemployability

Recommended Reading: Efstatus.taxact.com

Tax Withholding: How To Get It Right

Note: August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool.

FS-2019-4, March 2019

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. This includes anyone who receives a pension or annuity. Heres what to know about withholding and why checking it is important.

Depending on your situation, there are a few inputs for this question.

- For a past job, we will ask for federal income tax withheld year-to-date.

- For current jobs, we will ask for federal income tax withheld per pay period and year-to-date. The per pay period input refers to federal income tax withheld per paycheck.

- If youre filling this out in January and your most recent pay period ended in December of the previous year, then please input the federal income tax withheld per pay period in the last paycheck input.

How do I input a bonus that I have not yet received?

The application is designed to handle withholding on a bonus. For a bonus not yet received, enter the amount in the any bonuses you expect to receive later this year field. Then, you may select a checkbox right under that field if you know that your employer will withhold tax on the bonus for you.

What date shall I select for the pay period end date question?

When Will Unemployment Tax Refunds Be Distributed

The IRS has begun distributing payments already, starting with those who filed the simplest returns , and then moving on to those with more complicated returns like married couples who filed jointly. Payments will continue to be made throughout the summer, with the goal of distributing all the unemployment refunds by the fall. We will keep you updated as the payments are distributed.

Read Also: Njuifile Net Direct Deposit

Don’t Miss: Door Dash Taxes

You May Have To Pay Local Income Tax On An H1b

- Some local towns and cities have a local income tax, often 1-4% of gross income

- In most instances, local income tax will be withheld on your paycheck by your employer as long as your address on your W4 form is up to date

- If you accidentally put the wrong address on your W4 form, you may pay incorrect local taxes! A financial advisor like MYRA can help you pay taxes to the proper locality and get back erroneously paid local taxes

- During tax season, you will need to file a local income tax return. These forms are usually very simple but if you find it confusing, MYRA can help!