Should You Try To Keep Your Tax Bracket Low

A lower tax bracket generally means a lower tax bill, but is trying to lower your tax bracket always the best thing for your financial health?

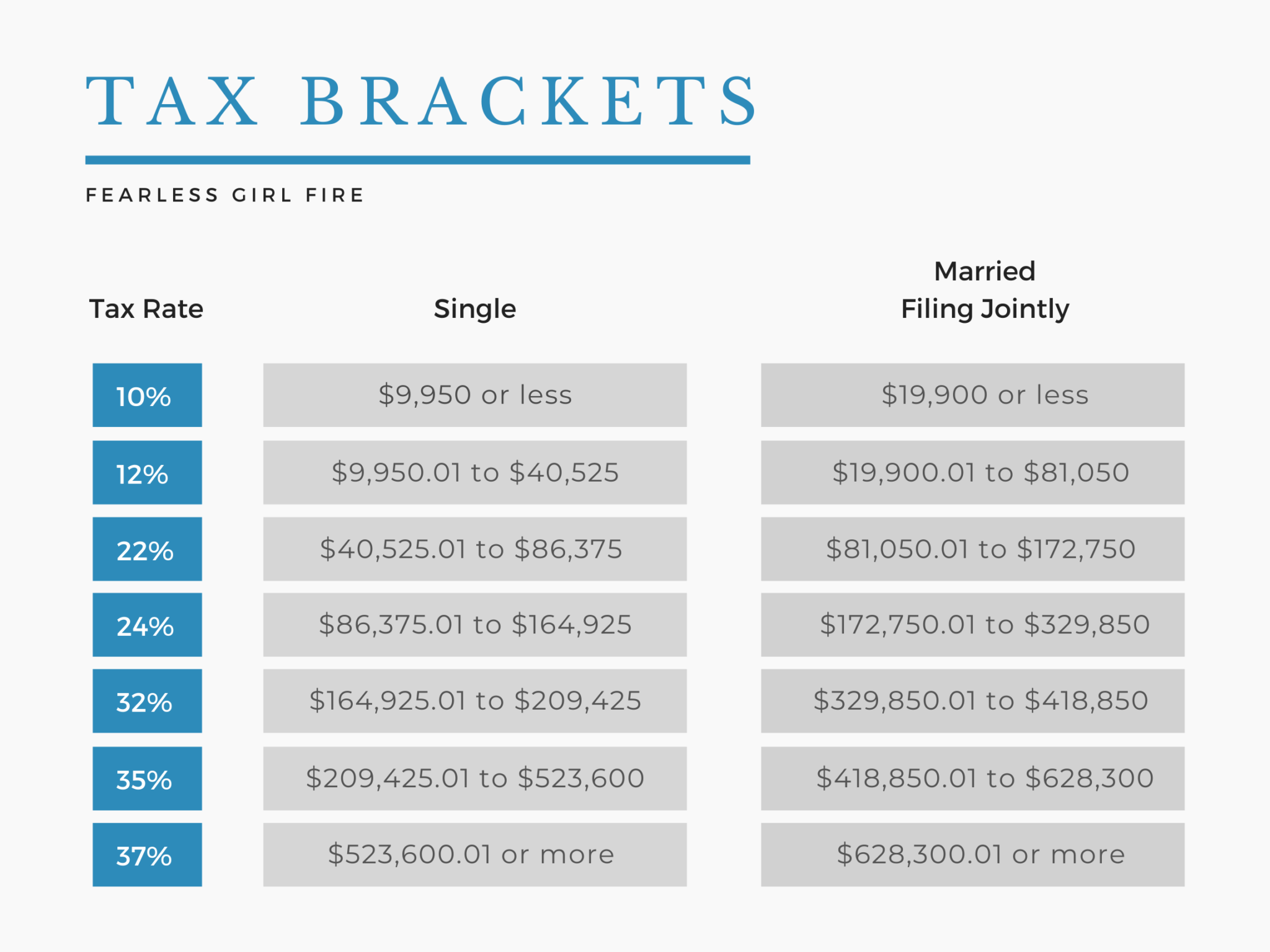

Let’s go back to our original example. Your $97,050 in taxable income has tipped you into the 24% tax bracket. You would rather stay in the 22% tax bracket, but to do so, you’ll need to “lose” $7,975 in income. You decide to add $7,975 to your annual 401 contribution to drop your taxable income back into the 22% tax bracket.

Here’s how this decision could impact your finances:

- You will not pay taxes on the $7,975 you contributed to the 401 this year. This saves you 24% of $7,975or $1,914in taxes. Remember that you will pay taxes on this money when you withdraw it in retirement, but that’s a math problem for another day.

- The taxes you would have owed on the $7,975 if you had simply kept the money and paid taxes on it at the 24% tax bracket would have been just $160 more than what you would have paid if this money were taxed at 22%.

If staying in a lower tax bracket motivates you to make a good financial choice, there’s no harm in it. But if the $7,975 you put into your 401 channeled money away from your monthly budget or other financial goals like saving for a down payment or paying off student loan debt, you need to weigh the pros and cons. Staying in a lower tax bracket shouldn’t be your only consideration when making money decisions.

Contribute To A 401 Or Traditional Ira

One of the easiest, and potentially most beneficial ways to reduce your taxable income, is to contribute to a pre-tax retirement account such as an employer-sponsored 401 or traditional IRA. With either of these tax-advantaged investment accounts, money from your paycheck ) or bank account goes in before getting taxed.

With pre-tax contributions, you are also essentially taking out less from your disposable income now, which is better for your immediate cash flow. Your money grows tax-deferred, however, and later in retirement you will have to pay income tax on the funds you withdraw.

In 2022, the contribution limit for a 401 is $20,500, with an additional $6,500 available for those 50 and older. The annual contribution limit for IRAs is $6,000 , with an additional $1,000 available for those 50 and older.

With a traditional IRA, your contributions may also be tax-deductible, depending on your income, tax filing status and whether or not you have a retirement plan through your employer.

“Many people are eligible to deduct their traditional IRA contributions, which can help reduce their tax liability,” says Corbin Blackwell, a CFP at Betterment, a robo-advisor offering traditional, Roth and SEP IRAs. “Not all IRA contributions are tax deductible, however, so be sure to work with your tax preparer to understand your situation.”

Taxable Income Over $80k Married $40k Single

High-income filers need to find ways to drain income from the top tax brackets.

For example, using the tax brackets at the top of this article, for a married couple, if you had $86,850 of taxable income, the top $6,600 of that income will be taxed at 24%. You will pay $1,584 of tax on that $6,600 of income.

Use the following ideas to shift income to a lower bracket:

Don’t Miss: Are Tax Returns Delayed This Year

Let An Attorney Help You Lower Your Taxes

There are a number of ways to reduce your tax exposure, but these can shift as laws change. As you sit down to work on your tax planning, having a qualified tax attorney at the table with you can make all the difference. Get your questions answered and start the process of lowering your tax burden by speaking with a local tax law attorney.

Thank you for subscribing!

What If You Already Filed Your Taxes

If you already filed your taxes but still want to add to any tax-deductible accounts for 2020, you will need to file an amended return. This requires a Form 1040-X. Remember, you have until April 15th, or Tax Day, to contribute to IRAs and HSAs.

This is also the deadline for filing your taxes, so dont push this too close to the deadline. This year 2021, you have until May 17th to file your individual taxes because of COVID-19.

If you need to file for an extension to make sure your taxes are completed on time, now is the time! Many people feel pressure and anxiety when it comes to taxes and deadlines, so dont let the deadlines sneak up on you.

Filing for yourself has never been easier, but if you are entering the territory of amendments and extensions, you might want to consider seeking professional help.

The more forms you have to file, the more complicated your tax situation gets. Working with a tax professional can help minimize costly errors, and make sure you are getting all of the deductions possible.

Also Check: How To Claim Gas On Taxes

Figure Out What You Owe With Polston Tax

If you need help figuring out what you owe in taxes or need help paying off the taxes you do owe, Polston Tax can help! Our team of tax attorneys and tax accountants can guide you through the tax brackets and let you know how you can save money through tax deductions or credits.

We have a team of more than 100 attorneys, accountants, tax professionals, CPAs, case managers and financial analysts who will fight for you. Founded in 2001, we have been operating with the mission to help our clients escape the challenge of owing back taxes. We are located in five offices across the nation. We offer services to those who owe the IRS or the state back taxes and can help with the following services:

How The Tax System Works With Multiple Income Streams

If you have multiple streams of income, you need to realize, it is taxed altogether, not separately. The IRS looks at how much total income you have received in the tax year and that is how they determine your tax bracket.

So if you earn $75,000 from your salary job, but earn $25,000 a year in pension or other income, then you will move up a tax bracket. You will then earn a total of $100,000 for the year. You can use the same process to figure out how much taxes you will owe total for all your income.

The income tax brackets work as a tiered system, not a flat tax percentage on all your income. So when you hear youve moved up a tax bracket, dont be scared. Moving up a tax bracket doesnt necessarily mean youre going to lose more money it just means the portion of money youve earned over your previous tax bracket will be taxed at a higher rate.

If you are unsure how your multiple streams of income may affect your taxes, reach out to a tax attorney at Polston Tax who can advise you on what you can expect at tax time.

Also Check: How To Get Income Tax Return Copy

Tips To Beat Bracket Creep

The government has said it is looking for ways to combat bracket creep like making smaller brackets or adjusting them for inflation but in the meantime, heres how it affects the average working taxpayer.

Jackie earned $179,000 a year during 2014-15. She sat in the $80,001 to $180,000 tax bracket, so her income in that bracket was taxed at 37%*. Her employer offered her a raise of $11,000 a year. Jackie was thrilled to earn $190,000, but she unknowingly crept into the next tax bracket.

The tax rate for her new bracket is 47%*. As she enters the higher bracket, her additional tax payable, because of the $11,000 pay rise, is $5,070 a year. Were Jackie left within her previous bracket, her pay rise would have attracted $4,070 in extra tax in other words, she is now liable to an additional $1,000 in tax. But there are options for her to lessen this burden.

Option 1 – Salary sacrifice the additional income

Instead of accepting the higher salary as purely taxable income, Jackie decides to sacrifice an extra $10,000 into her super. That way, her taxable income is reduced to keep her in the lower tax bracket, and that $10,000 yearly super injection ends up being taxed at only 15% .

Super isnt the only avenue. Consider speaking to your employer about a novated leasing arrangement. Salary packaging a car is a good way to potentially reduce your taxable income if you need a nice new set of wheels.

Option 2 – Negatively gear properties and/or shares

Taxable Income Less Than $80k Married $40k Single

Lower-income taxpayers should make different choices to maximize tax savings. A few options:

- Perhaps you should not contribute to a deductible retirement account. Instead, fund a Roth IRA, or make Roth contributions to your 401 plan.

- Use low-income years to take IRA withdrawals and pay little to no tax. See details about this tax planning strategy below.

- Consider converting your IRA account, or a portion of it, to a Roth IRA.

Recommended Reading: How Much Do I Get Back In Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Keep Tabs On Your Taxes

Keeping good tax records doesnt have to be a daunting task.

You just need to be prepared and document everything. To make tax deduction claims, keep all receipts using the Etax mobile app.

Putting aside 10 minutes a week to load receipts into the app helps with record keeping for each tax year, making your tax bill much easier to tackle.

Don’t Miss: Can I File Past Years Taxes Online

Tax Bracket Management: A Great Way To Boost After

Regardless of whether your investment objective is growth or capital preservation, maximizing your after-tax return should be a primary goal. One of the best ways to increase after-tax returns is to implement tax bracket management. This is a strategy utilized to reduce taxes in high-income years by possibly realizing additional income in lower income years if you expect to receive higher income in future years.

Currently, there are seven tax brackets . President Trump has indicated he would like to simplify the tax code and reduce the current seven tax brackets to just three. Regardless of whether tax reform occurs, tax bracket management is still a great tool for helping develop a tax-efficient withdrawal strategy to boost your after-tax returns.

With tax bracket management, you usually arent eliminating income, but simply deferring income into another period. So its crucial that you consider when and how the realization of the deferred income will be taxed. If done poorly, short-term decisions may actually result in higher taxes at a later date. Therefore, we believe it is important to work with your CPA or tax advisor to develop a long-term plan that optimizes your cash flow while minimizing your tax liability.

Donate Money To Charity

Generally speaking, donations to charity are tax-deductible. You can write off IRS-qualified charitable contributions and donations to decrease your taxable income, which could lower your tax bracket. You cant, however, deduct donations you make to individuals, so make sure the recipient of your gift qualifies for a deduction.

You May Like: Where To Find Tax Forms

Above The Line Deductions For 2022

Above the line deductions reduce a taxpayer’s adjusted gross income and are allowed regardless of whether you itemize or take the standard deduction. Above the line deductions are important because reducing your AGI may help you qualify for additional deductions or credits on your return. High-income earners may consider the following above the line deductions:

Health savings account contributions. HSAs are triple tax-advantaged accounts: Contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free for qualified medical expenses for those under age 65, and for any purpose if you are age 65 or over. The contribution limits for 2022 are $3,650 for individuals and $7,300 for families. If you are age 55 or over, you can contribute an extra $1,000.

Deductible Traditional IRA contributions. Contributions to Traditional IRAs are deductible with different income thresholds based on if you have access to a group retirement plan or not. If you and your spouse do not have access to a group plan then there is no income limit for taking the deduction. The MAGI limit to deduct contributions for a married couple with just one spouse having access to a group retirement plan is $204,000 – $214,000. If both spouses have access to a group plan then the MAGI limit for the deduction is $109,000 – $129,000. For a single filer who has access to a group retirement plan, the MAGI limit is $68,000 – $78,000.

Make Adjustments In W

Maybe you did not have the tax outcome you were expecting in 2021 due to changes in tax laws or because you experienced life changes like having a baby, getting a pay increase or decrease, losing a job, or getting a new one. If so, this is a good time to adjust your withholding on your W-4 form and refile it with your employer, according to Greene-Lewis.

You May Like: How Do I Find My Old Tax Returns On Turbotax

How Can I Legally Not Pay Taxes Again

If you want to avoid paying taxes, youll need to make your tax deductions equal to or greater than your income. For example, using the case where the IRS interactive tax assistant calculated a standard tax deduction of $24,800 if you and your spouse earned $24,000 that tax year, you will pay nothing in taxes.

How Can I Save My Taxes On Big Time

Enhance your purchase

Don’t Miss: Where Do You Go To File Taxes

Plan To Retire In A Low Tax Bracket With The Right Mix Of Rrsp And Tfsa

Your taxable income can be very different from the cash you receive. You do not really need income you need cash flow. Income is taxable cash flow may or may not be taxable.

You can have a lower taxable income by having the right mix of fully taxable, low tax and tax-free incomes.

You are fully taxed on your pensions, RRIF withdrawals and interest, but only partially on tax-efficient non-registered investments and not at all from TFSA withdrawals.

The ideal goal is to have your taxable income below $46,000, regardless of how much cash you get. This is the lowest tax bracket. Even better, if it is under $25,000 for a single person , you can also receive the tax-free Guaranteed Income Supplement .

For example, you want a taxable income under $46,000. Your government CPP and OAS pensions are $15,000 and you have no work pension. That means you can have up to $30,000 taxable income from your investments.

You could achieve this by having no more than about $750,000 in your RRSP and the rest in a TFSA.

With $1 million in investments, if it is all RRSP, you are required to withdraw at least 4%, or $40,000, of which $30,000 is in the lowest 20-23% tax bracket, while $10,000 is in the middle 30-33% tax bracket.

If you have $750,000 in your RRSP and $250,000 in your TFSA, then you can withdraw $30,000 from your RRSP, all at the lowest tax bracket, plus $10,000 from your TFSA all tax-free.

Tax Brackets Vs Tax Credits

Tax brackets are used to calculate your tax bill. Tax credits are then applied to lower your tax bill. Some tax credits are partially or fully refundable if your tax bill drops to $0 after applying credits, you may get the remaining credit as a tax refund.

Common tax credits include:

- The Earned Income Tax Credit

- The Child Tax Credit

- The Child and Dependent Care Credit

- The Lifetime Learning Credit

- The American Opportunity Tax Credit

- The Recovery Rebate Credit

Read More:How to Reduce Taxable Income: Can the Average American Pay No Taxes?

Recommended Reading: How Much Do You Have To Make To Owe Taxes

Will I Pay The Amt In 2021

To determine whether you pay the AMT, the IRS first calculates your tentative minimum tax, which is based on your income minus the AMT exemption, before any deductions are applied.

In 2021, the AMT exemption for individuals is:

-

$57,300 for people with filing status married filing separately

-

$73,600 for people with filing status single or head of household

-

$114,600 for people with filing status married filing jointly or qualifying widower

In 2022, the AMT exemption for individuals will be:

-

$59,050 for people with filing status married filing separately

-

$75,900 for people with filing status single or head of household

-

$118,100 for people with filing status married filing jointly or qualifying widower

If you owe more using the tentative minimum tax calculation than the regular tax calculation , then you have to pay AMT on the excess.

Use the following table to determine your tax rate according to the AMT. The income ranges represent your income minus the AMT exemption plus a handful of AMT-specific tax deductions.