Pay Stub Deduction Codes What Do They Mean

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employers contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code |

|---|

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Don’t Miss: How To Get A License To Do Taxes

Calculating Your Total Withholding For The Year

Take your new withholding amount per pay period, and multiply it by the number of pay periods remaining in the year. Next, add in how much federal income tax has already been withheld year-to-date. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Ask yourself whether you can easily write a check to the government plus a little interest if your calculations show that you’re going to owe the IRS $500 in April. Now is the time to adjust if you can’t.

You can now compare your total withholding to your tax liability projection. If your withholding amount is larger than your tax liability, that’s how much of a federal tax refund you can expect to receive. If your withholding is less than your tax liability, that’s how much federal tax you might have to pay when you file your tax return.

Remember, these amountsyour withholding and your tax liabilityare approximate. You’re close to where you need to be if they’re not too far apart. You’re free to change your withholding at any time during the tax year if a change in your circumstances would result in a tax increase or decrease.

Payroll Hourly Paycheck Calculator

This calculator uses the withholding schedules, rules and rates from IRS Publication 15.

APL Federal Credit Union

© 2018 APL Federal Credit Union. .All rights reserved. 800.367.5796 · 11050 Johns Hopkins Rd. · Laurel, MD 20723

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Read Also: Www.1040paytax.com Review

Overview Of Ohio Taxes

Ohio has a progressive income tax system with six tax brackets. Rates range from 0% to 3.99%. For all filers, the lowest bracket applies to income up to $25,000 and the highest bracket only applies to income above $110,650. There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

What Is A Federal Income Tax Withholding

Federal income tax is imposed by the United States Internal Revenue Services on all earnings of U.S. individuals and businesses. It is a standard tax withheld on all forms of income when you operate a business or work for a company in all fifty states of the U.S. The income taxes withheld are the source for all development programs of the government.

Don’t Miss: Doordash 1099 Form

What Is The Average Amount Of Taxes Taken Out Of A Paycheck

The average tax wedge in the U.S. was about 28.29% in 2020. The tax wedge isn’t necessarily the average percentage taken out of someone’s paycheck. Someone would need to pay just the right amount of taxes so that they wouldn’t owe or get a refund when they file their tax returnin that case, the average rate of 28.29% would apply.

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

Don’t Miss: Payable Com Doordash

Caution For Employers Using Software Programs In

For Canada Pension Plan purposes, contributions are not calculated from the first dollar of pensionable earnings. Instead, they are calculated using the amount of pensionable earnings minus a basic exemption amount that is based on the period of employment.

As of 2019, the Canada Pension Plan is being enhanced over a 7 year phase-in. For more information, go to Canada Pension Plan Enhancement.

If used improperly, some payroll software programs, in-house payroll programs, and bookkeeping methods can calculate unwarranted or incorrect refunds of CPP contributions for both employees and employers. The improper calculations treat all employment as if it were full-year employment, which incorrectly reduces both the employee’s and employer’s contributions.

For example, when a part-year employee does not qualify for the full annual exemption, a program may indicate that the employer should report a CPP overdeduction in box 22 Income tax deducted of the T4 slip. This may result in an unwarranted refund of tax to the employee when the employee files his or her income tax and benefit return.

When employees receive refunds for CPP overdeductions, their pensionable service is adversely affected. This could affect their CPP income when they retire. In addition, employers who report such overdeductions receive a credit they are not entitled to because the employee worked for them for less than 12 months.

Lowering Your Tax Bill

If you have income from a rental unit or have a side business, the tax your employer deducts from your pay is especially important. By accurately completing the Form TD1, you can avoid a hefty bill at tax time by increasing the tax deducted weekly.

If you have more than one employer, be sure to include this info on your TD1. The payroll chart provided by CRA includes the basic deduction all taxpayers are entitled to. If each of your employers bases your tax deducted on the same formula, youre likely going to come up short at tax time. Form TD1 has a spot to include income from other sources. Make sure that you fill this out as accurately as possible.

Recommended Reading: How Do I Pay Taxes For Doordash

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

You May Like: Pastyeartax Com Reviews

Conquer Your Payroll Tax Fear

Trust me, we know it can be incredibly daunting when youâre facing filing forms and impending deadlines as you are first navigating how to pay payroll taxes.

But once you get the steps down, those seemingly endless moments of âhow do I pay my payroll taxes?â or âhow do I pay my employees payroll taxes?â will become less frequent.

It takes patience, going through a payroll tax calculation example or two, and just a few cycles to get the hang of things.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees. As with federal payroll tax, part of this tax is employer paid and part is employee paid. Keep in mind that âemployee paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees. Have all your SUTA questions answered in just a 3 minute read.

State and local payroll taxes are governed at the state and local level, and every stateâs payroll tax rules are different. The Federation of Tax Administrators published a list of each stateâs taxing authority. You can find out more about payroll tax in your state and local area there.

Also Check: Do You Get Taxed On Doordash

Calculating Withholding More Accurately

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute the current tax rates and income brackets. Calculate your income and deductions based on what you expect for this year, and use the current tax rates to determine your projected tax.

Then, use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. The number of dependents you support is an important component of your analysis, as is the number of streams of income.

What Is Federal Income Tax Withholding

Every time you get a paycheck, your employer withholds, or sets aside, taxes based on the information you provided on your Form W-4 when you first started your job.

Your Form W-4, also known as your Employees Withholding Certificate, provides financial details that allow your employer to deduct the correct amount of federal income tax from your pay.

If not enough federal tax is withheld, youll owe the IRS money and may have to pay a penalty, depending on the size of the shortfall. If too much is deducted, youll be owed a tax refund.

When any big changes happen in your life you get married, have a child, or get a big raise, for example you will need to update and resubmit your W-4 to your employer so your paychecks can be adjusted accordingly.

In recent years, the IRS redesigned Form W-4, and the changes have meant disappointing refunds for some taxpayers. Even if your financial situation stayed the same in 2021, H& R Block recommends that you review your W-4 on a regular basis.

Some of the changes to Form W-4 included the elimination of withholding allowances, one new blank for income that doesnt come from jobs, and another that allows you to factor in likely deductions.

You May Like: How To Appeal Cook County Property Taxes

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

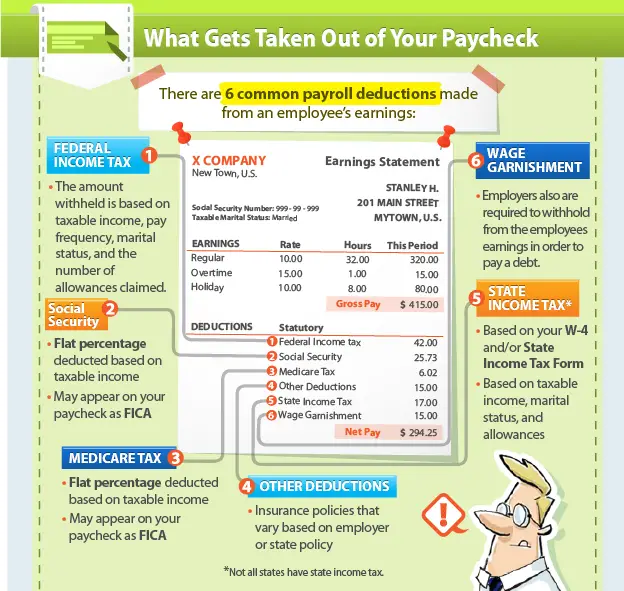

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

You May Like: Form Acd-31015

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

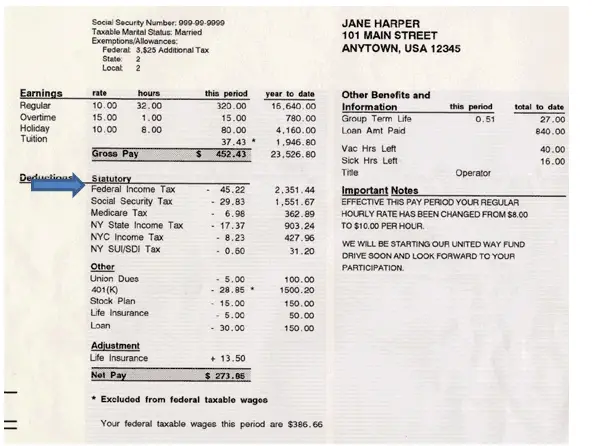

How To Read A Pay Stub An Example Pay Stub

Don’t Miss: How Do I Protest My Property Taxes In Harris County