With Direct Deposit Few Ever Look At Their Pay Stub Heres Why You Should

Anyone who receives a paycheck from an employer should understand the information included on their pay stub and review it regularly. Why? Its important to make sure that you are not only receiving the money you are entitled to but also paying the correct amount in taxes. With the increasing popularity of direct deposit, fewer people are receiving a physical paycheck, which makes checking this information even more necessary. Here are the major terms and figures on your pay stub with which you should be familiar.

What Are Federal Taxes

Federal taxes are the taxes that are withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld, however, FUTA is paid solely by employers.

For employees, there, unfortunately, isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck. The amount withheld depends on several factors. However, working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Read Also: Oregon Tax Preparer License Renewal

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

Here is a look at what the brackets and tax rates were for 2019:

2019 Tax Brackets| Tax rate |

|---|

Overview Of Georgia Taxes

Georgia has a progressive income tax system with six tax brackets that range from 1.00% up to 5.75%. Peach State residents who make more money can expect to pay more in state and federal taxes. There are no local income taxes in Georgia.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: What Does Agi Mean In Taxes

Don’t Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

By Stephen Fishman, J.D.

The United States has a “pay as you go” federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If you’re an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, you’ll be better off if you don’t have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way you’ll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

Whats A Withholding Allowance

A withholding allowance is a number that your employer uses to determine how much Federal and state income tax to withhold from your paycheck. The more allowances you claim on your Form W-4, the less income tax will be withheld from each paycheck.

The number of allowances you should claim varies. It is based on a number of factors, such as marital status, job status, earned wages, filing status, and child or dependent care expenses.

With the help of TaxAct withholding calculator, you can find the amount of your tax withholding allowances.

Recommended Reading: How Can I Make Payments For My Taxes

How To Calculate Income Tax In Fy 2020

Lets start with the basics here. For a salaried employee, the monthly payslip describes the various components of ones salary. Have a look at your payslip. You will find that your total salary is the total of Basic Salary HRA Transport Allowance Special Allowance Any other allowance. Income Tax Act provides various exemptions from salary like house rent allowance, leave travel allowance, etc.

Further, budget 2018 also introduced the concept of standard deduction of INR 40,000, which has been again increased in budget 2019 to Rs 50,000. This tax exemption will not be available in case you are opting for the new tax regime.

Before we move to the calculation part, it is essential to know that if you are opting for the new tax regime, many exemptions are not allowed to be claimed.

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Also Check: How Much Does H& r Block Charge To Do Taxes

Other Payroll Tax Items You May Hear About

-

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

-

SUTA tax: The same general idea as FUTA, but the money funds a state program. Employers pay the tax.

-

Self-employment tax: If you work for yourself, you may also have to pay self-employment taxes, which are essentially the full load of Social Security and Medicare taxes. Thats because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing. A 0.9% additional Medicare tax may also apply if your net earnings from self-employment exceed $200,000 if youre a single filer or $250,000 if youre filing jointly. Because you may not be receiving a traditional paycheck, you may need to file estimated quarterly taxes in lieu of withholdings.

Income And Unemployment: The Other Employment Taxes

Now that you know FICA and self-employment taxes are payroll taxes, lets take a brief look at income and unemployment taxes. Withhold income taxes from employee wages unless your employee is exempt from income taxes. The types of income taxes include:

Most states have state income taxes. If youre in a state with state income tax withholding, collect state W-4 forms from your employees to determine the amount per paycheck. Remember to check with your local government to determine if you need to withhold local taxes from your employees.

Unemployment taxes are the other type of employment taxes you must pay. Unlike income taxes, employers typically pay unemployment taxes. The two types of unemployment taxes are:

- Federal unemployment tax

Like payroll taxes, calculate your unemployment tax contributions based on your employees gross wages.

Keep in mind that income and unemployment taxes are not technically payroll taxes.

Don’t Miss: How Can I Make Payments For My Taxes

How Much In Taxes Is Taken Out Of Your Paycheck

Where does the money go, and what is it used for?

If you’re making money, chances are you’ll have to pay taxes on it. In fact, Uncle Sam takes a decent-sized chunk of your paycheck before it even hits your bank account. Before you sign a lease or nail down your budget, youll need to figure out your “take-home pay,” or the amount of your hard-earned money that will actually end up in your pocket.

In this article, well answer two questions: How much can you expect to pay in taxes, and just what is that tax money used for?

Monthly Tax Payments In Norway

Its relatively straightforward to calculate a rough estimate of your annual tax liability in Norway. However, that doesnt mean your monthly tax liability will be 1/12 of that amount. Norway uses a 10.5 month system of taxation, rather than a 12 month one.

You pay half the normal monthly tax in December and zero tax in June. In fact, most employees don’t receive normal salary in June. That month is when you receive the holiday pay accrued from the year before. That payment is not taxed, so typically you’ll receive a higher monthly payment in June.

Holiday pay is a complex topic and outside the scope of this article. However, I will return to tackle the topic soon, as it’s an area of Norwegian life that quickly confuses newcomers!

Read Also: How Much Does H& r Block Charge To Do Taxes

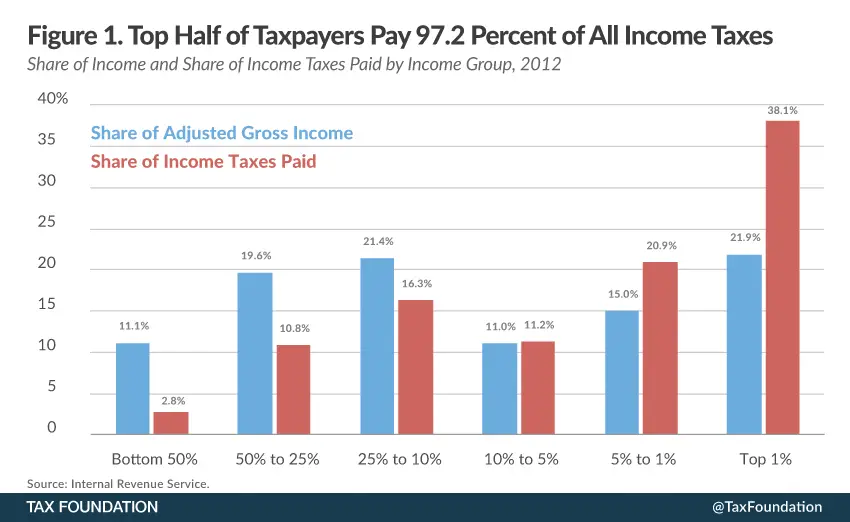

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

Is It Better To Have More Earned Income Withheld Just To Play It Safe

Choosing to have too much tax withheld may feel safer and easier than figuring out how much you should withhold and how to complete the form. However, theres nothing safe about letting the IRS hold your money for a year or more completely interest-free. The small investment of time to make sure your income tax withholding is correct is well worth it.

At the same time, some taxpayers dont want to risk having a tax bill at the end of the year no matter how small. If thats how you feel, adjust accordingly, provide your revised W-4 form to your employer, and plan for a small tax refund.

You can still celebrate when you get your tax refund check. Plus you can be happy knowing you didnt have too much tax withheld.

You May Like: Reverse Ein Lookup Irs

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.

Don’t Miss: Can Home Improvement Be Tax Deductible

What If I’m Paying Too Much Tax

At the beginning of every year, the tax authorities give a tax card’ to your employer to let them know how much to deduct each month. This code is based on your previous year’s income. At the time of publishing this article, 2020 tax cards are available.

If you believe you’re paying too much tax, you have two options. Firstly, you can log on to the Skatteetaten website and request a new tax card. You’re able to see your expected annual income, expected yearly tax liability, plus how much you have paid to date. You’re able to adjust your expected annual income so that your employer receives a correct tax card.

Alternatively, you can just wait! If you have indeed paid too much tax during the course of a year, you’ll receive a rebate through the following year’s tax return process.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Where Is My Federal Tax Refund Ga

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Buy Tax Lien Certificates In California

Is A Withholding Allowance The Same As A Dependency Exemption

No, a tax withholding allowance is not a dependency exemption. However, they are loosely related.

Generally, the more children you have, the more allowances you should claim.

A mistake some people often make is assuming they can only claim as many allowances as the number of children they have. That is not true. In fact, it may be better to claim more allowances than the number of children you have if you have multiple children. However, many other factors aside from children can affect the optimum number of allowances you should claim, including additional income, deductions, or tax credits.

*Note: the dependency exemption was eliminated with the Tax Cuts and Jobs Act of 2017. You can no longer claim a personal exemption for your dependents on your return.