Federal Taxes For Career Streamers

A career streamer would be responsible to pay Self-employment tax and income tax. Self-employment tax is a set 15.3%. The way the IRS sees it, the money gets sent to the business that the streamer essentially works for .

When the business pays the streamer they have to pay both the employer and employee Social security and Medicare taxes. Social security is 6.2% each, and medicare is 1.45% each. Totaled it is 12.4% for social security and 2.9% for Medicare tax. Selfemployment tax is on net earnings

Income tax would be based on any money that the streamer made during the year, less any applicable deductions and expenses.

Income tax is not based on a set percentage of income like self-employment tax is. Instead, income tax is based on the amount of income that a person makes. This is done off of a table.

Note If You Are Exempt From Withholding Taxes

Being exempt means your employer wont withhold federal income tax from your pay. Generally, the only way you can be exempt from withholding is if two things are true:

You got a refund of all your federal income tax withheld last year because you had no tax liability, and

You expect the same thing to happen this year.

If you are exempt from withholding, write exempt in the space below step 4. You still need to complete steps 1 and 5. Also, youll need to submit a new W-4 every year if you plan to keep claiming exemption from withholding.

» MORE:See more about what it means to be tax exempt and how to qualify

Make A Retirement Contribution

One of the most effective ways to reduce taxes on a bonus is to reduce your gross income with a contribution to a tax-deferred retirement account. This could be either a 401 or an individual retirement account . The amount you donate to the retirement account, subject to limitations, reduces your taxable income so youll owe less.

The limitations are different for different types of retirement accounts. They also change from year to year. For 2021, the limits are

- IRA: $6,000, or $7,000 for taxpayers age 50 or older.

You cant get a deduction for a contribution to a Roth IRA.

Also Check: Is Donating Plasma Taxable Income

Estimate What Youll Owe

If you are a salaried employee with a steady job, its relatively easy to calculate your tax liability for the year. You can predict what your total income will be.

Millions of Americans dont fall into the above category. They work freelance, have multiple jobs, work for an hourly rate, or depend on commissions, bonuses, or tips. If youre one of them, then youll need to make an educated guess based on your earnings history and how your year has gone so far.

From there, there are several ways to get a good estimate of your tax liability.

Why Would A Refund Be A Bad Thing

Receiving a tax refund actually means you gave the IRS more from your paycheck than you had tomoney that you could otherwise have spent on bills, pleasure, retirement savings, or investments. The IRS held onto that extra money for you all year and is now returning it to you when you get a tax refundwithout interest. It would have served you better in a simple savings account.

Also Check: How Do Taxes Work For Doordash

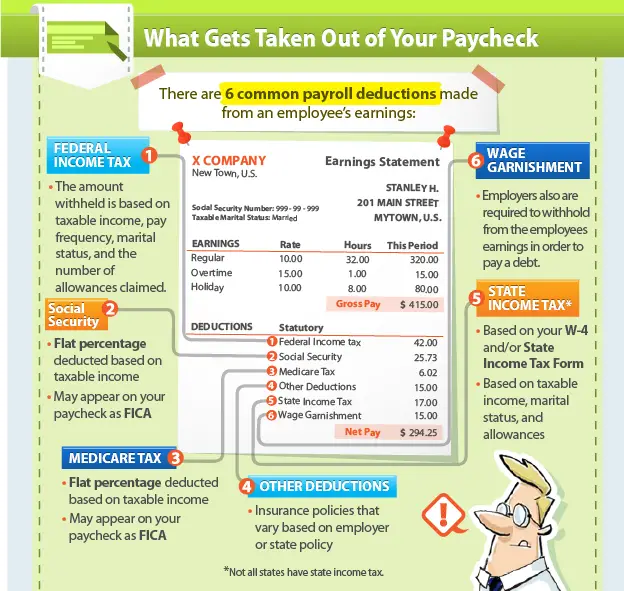

What Are Federal Taxes

Federal taxes are the taxes that are withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld, however, FUTA is paid solely by employers.

For employees, there, unfortunately, isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck. The amount withheld depends on several factors. However, working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

Also Check: Doordash Tax 1099

Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.

What You Should Know About Tax Withholding

To understand how allowances worked, it helps first to understand how tax withholding works. Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck. This withholding covers your taxes, so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. Employers in every state must withhold money for federal income taxes. Some states, cities and other municipal governments also require tax withholding.

Withholding is also necessary for pensioners and individuals with other earnings, such as from gambling, bonuses or commissions. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. You can do this by paying estimated taxes.

Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. You can also list other adjustments, such as deductions and other withholdings.

When you fill out your W-4, you are telling your employer how much to withhold from your pay. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child.

Read Also: Does Doordash Give You A 1099

If Not Enough Is Being Withheld

The W-4 form has a place to indicate the amount of additional tax that you would like to have withheld each pay period.

If youve underpaid so far, subtract the amount that youre on track to pay by the end of the year, at your current level of withholding, from the amount that you will owe in total. Then divide the result by the number of pay periods that remain in the year.

That will tell you how much extra you want to have withheld from each paycheck.

You could also decrease the number of withholding allowances that you claim, but the results wont be as accurate.

Calculating Withholding More Accurately

One way to adjust your withholding is to prepare a projected tax return for the year. Use the same tax forms you used the previous year, but substitute the current tax rates and income brackets. Calculate your income and deductions based on what you expect for this year, and use the current tax rates to determine your projected tax.

Then, use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. The number of dependents you support is an important component of your analysis, as is the number of streams of income.

Also Check: Doordash Tax Rate

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Don’t Miss: Plasma Donation Taxable

Filing Requirements And Filing Deadlines

| Filing Frequency |

|---|

| Notice of Change or Discontinuance | This form can be electronically submitted through MTO. |

Do I have to file a return? What if I do not owe any tax?

If you are registered to pay a tax, you must file a return within your established filing frequency, even if no tax is due.

What is the definition of a tax year?

A tax year for Sales, Use and Withholding tax is defined as a calendar year: January 1st December 31st.

How often do I need to file a tax return for Sales, Use and Withholding taxes?

Initially, Treasury determines your filing frequency based on your estimated monthly payment for each tax that you registered on your registration application.

Because Sales, Use and Withholding Taxes are reported together they will have the same filing frequency.

Subsequently, your filing frequency is reviewed by Treasury annually for update. If your filing frequency is changed you will be notified in writing. Because Sales, Use and Withholding Taxes are reported together they will have the same filing frequency.

For more information, See Table 1: Filing Frequencies & Due Dates.For more information, See Table 2: Tax Return Form Number by Tax Year.

I did not file my monthly/quarterly returns. Can I just file the annual return?

No, the purpose of the annual return is to reconcile, balance, and close the tax year it does not replace monthly/quarterly returns.

I need to amend my Sales, Use and Withholding tax return. What is the process?

Monthly/Quarterly Return

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

You May Like: Efstatus.taxactcom

How To File Taxes As A Doordash Driver

Even though you will not be getting a W-2, your income tax filing process will not be much different than those who have traditional employment. You will get a 1099 from DoorDash, which will list how much pay you received through deliveries.

Most Dashers operate as a sole proprietor, meaning there is no legal structure to their work like there is with an LLC or S-corp. As such, they will still file a personal tax return. There is a section on the personal tax return called the Schedule C on Form 1040 where Dashers can write off their business expenses.

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

Don’t Miss: How Much Taxes Do You Pay For Doordash

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, your first year of retirement you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

- You or a spouse take on part-time work.

- You pay off a mortgage or take on a mortgage.

- You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock.

- You take withdrawals from an IRA or 401 account.

- You and/or a spouse start Social Security benefits.

- You reach age 72 , and required IRA distributions begin.

How To Withhold Your Own Taxes

OVERVIEW

If you have no employer to withhold federal taxes, then you’re responsible for withholding your own.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Whether you work for an employer or are self-employed, you must make estimated tax payments during the year when your income exceeds certain levels. As an employee, you pay these estimated payments by having your employer withhold amounts from your paycheck. In that case, your employer send your money to the IRS for you. However, if you have no employer to withhold federal taxes, then you will need to do this by making estimated tax payments.

Don’t Miss: Look Ein Number

How To Estimate Your Federal Withholding

If you want to change your withholding amount in order to ensure a refund, the first thing you have to understand is how withholding is calculated. Although the calculation can be complicated, it is easier since the IRS introduced a new Form W-4 in 2020.

For instance, withholding allowances are no more, which leaves less room for unexpected results after you submit your W-4. In fact, you are only required to fill out steps 1 and 5, where you provide personal information such as your name and address, and then sign the form.

In order to calculate your withholding, take a look at your most recent pay stub. From your pay stub, youll need the following information:

-

Wages or salary per pay period

-

Wages or salary year-to-date

-

Federal tax withheld per pay period

-

Federal tax withheld year-to-date

POLL: Do You Think States Should Suspend Their Gas Taxes?

Plug this information into the IRSs Tax Withholding Estimator. For an accurate calculation, you may have to provide other numbers, such as contributions to a 401, HSA, FSA, and any bonuses you may have received. The estimator also includes various adjustments and tax credits enter anything here that may apply to you. The steps after income and withholding are optional, but be sure to select the standard deduction in that step, unless you itemize.

Taylor The Hobby Streamer

Taylor is a college student who plays CS:GO on the weekends. His friends have complimented his skill often and suggested he stream. He agreed. While he only started streaming for fun, a few fans have donated to his stream or have given him bits. In 2019, he made $1,235.

Twitch sent him a 1099 for the $630 he made through bits and subscriptions. Streamlabs sent his a 1099 for the donations made through them. Taylor is required to claim the taxes as part of his income and will do so on Form 1040.

Recommended Reading: Ntla Tax Lien

How You Can Affect Your Indiana Paycheck

If you received a large tax refund or were hit with a massive tax bill when you last filed your income taxes, consider changing your withholdings on your W-4. You can fill out a new W-4 , or you can have a dollar amount withheld from every paycheck by entering that amount on the correct line on your W-4. This allows you to get closer to what you need to pay on your income taxes.

While there is nothing wrong with getting a big refund, its nice to have access to that money throughout the year. That way you have the choice to invest that money or at least earn interest from a high-interest savings account. Consistently over-paying your taxes is like giving Uncle Sam a tax-free loan each year.

Pre-tax contributions are another factor that affect your take-home pay. You can actually lower your taxable income by taking advantage of certain benefits that your employer may offer. For example, if you put money into a 401 or 403 retirement account, or a health savings account or flexible spending account, that money will come out of your paycheck before income and FICA taxes are applied. This lowers how much of your income is actually subject to taxation.