Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

What Can Cause A Delay In My Georgia Refund

A number of things could cause a delay in your Georgia refund, including:

- Paper filed returns.

- If the department needs to verify information reported on your return or request additional information, the process will take longer.

- Math errors in your return or other adjustments.

- You used more than one form type to complete your return.

- Your return was missing information or incomplete.

- Additional steps to protect you from fraud. The GADOR states that it may take up to 90 business days from the date of receipt to process a return and issue a refund.

Georgia Sales Tax Rate

As mentioned previously, the base rate of sales tax in Georgia is 4%, but the average range of Georgia sales tax, including the county sales tax rate, is 6-9%. For your convenience, we have included a table that lists the Georgia sales tax rate for each county within the state. The table combines the base rate of 4% and the local county rate to give you a total tax rate for each county.

Georgia has a lot of different counties, 159 in total, and has the second-largest number of counties in the U.S., with only Texas having more . The Georgia sales tax rate for most counties is 3-4%, which means that most counties, when combined with Georgias sales tax rate, are in the 7-8% range. Currently, the highest rate of sales tax in Georgia is in Fulton County and Dekalb County, but just in the areas that fall within the city of Atlanta. The sales tax rate for these counties in Atlanta is 8.9%.

Recommended Reading: Doordash Self Employment Tax

Georgia State Taxes: Everything You Need To Know

Learn about Georgia sales tax and more. Taxes 101

Almost no one feels peachy about paying taxes, but residents of Georgia have a relatively low burden to shoulder compared to many other American states. The typical Georgian ends up paying over $9,500 a year in taxes, over half of which is going to federal income taxes. Just over $4,000 of that bill is Georgia state tax, including whats effectively a flat tax on income, an average sales tax rate of 7.15 percent and an effective property tax rate just under 1 percent.

Heres a closer look at everything you need to know about state taxes in Georgia.

| Georgia State Taxes | |

| State Sales Tax Rate Range | 6% to 8.9% |

| State Income Tax Rate Range | 1% to 6% |

| N/A |

Live In The House For At Least Two Years

The two years dont need to be consecutive. Meaning, you can live in the house for a year, relocate for a job for a year, and move back for another year, which will total two years living in the property. If you sell a house that you didnt live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

Also Check: How Do I File Taxes With Doordash

Keep The Receipts For Your Home Improvements

The cost basis of your home not only includes what you paid to purchase it but all of the improvements youve made over the years. When your cost basis is higher, your exposure to the capital gains tax is lower. Renovations, new windows, new roofs, landscaping, fences, new driveways, air conditioning installs theyre all examples of things that can cut your capital gains tax.

Georgia Income Tax Rate 2020

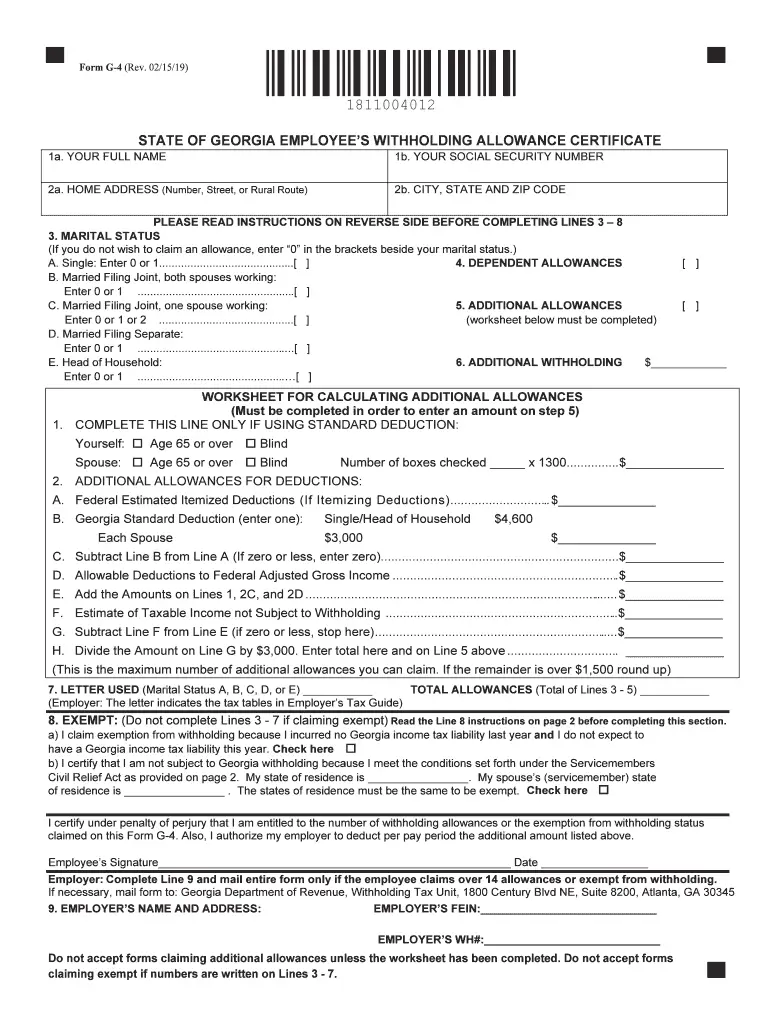

Georgia state income tax rate table for the 2020 – 2021 filing season has six income tax brackets with GAtax rates of 1%, 2%, 3%, 4%, 5% and 5.5% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The top Georgia tax rate has decreased from 5.75% to 5.5% while the tax brackets are unchanged from last year. Georgia income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2020 through December 31, 2020.

Outlook for the 2021 Georgia income tax rate is for the top tax rate to decrease further or change to a 5.375% flat rate. Georgia House Bill 918 passed into law in 2018 notes the reduction of the top rate towards the current 5.5%. House Bill 949 was presented in early 2020 which discussed the move to a flat tax coupled with a larger standard deduction.

Please reference the Georgia tax forms and instructions booklet published by the Georgia Department of Revenue to determine if you owe state income tax or are due a state income tax refund. Georgia income tax forms are generally published at the end of each calendar year, which will include any last minute 2020 – 2021 legislative changes to the GA tax rate or tax brackets. The Georgia income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

Don’t Miss: How Much Is Sales Tax On A Car In Nc

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Often Do I Need To File Georgia Sales Tax

During the first 6 months, you must file your tax returns monthly. After that, you can continue to file monthly, or you may be able to file with a different frequency. Before doing so, you must make a written request and receive written approval. If you do this, your filing frequency depends on the amount of tax youve collected and owe, as follows:

- Quarterly: You may file your returns quarterly if your tax liability over the previous 6 months has averaged $200/month or less.

- Annually: You may file your returns annually if your tax liability over the previous 6 months has averaged $50/month or less.

After six months you may also request a different filing period, known as special period filing.

You May Like: Plasma Donation Income

What Is Georgias Sales Tax

The base sales tax rate in Georgia is 4%, but this does not universally apply to the whole state of Georgia, in fact, there are a variety of different sales tax rates depending on the county you are in. So, the way Georgias sales tax is calculated is the base rate of 4% Georgia sales tax throughout the whole state plus the additional percentage rate each county charges, equals the total Georgia sales tax rate you will pay or have to collect from your customers if you are a business.

Any retail, gas station/convenience store, or restaurant-related business you visit in Georgia should charge you the prevailing rate of Georgias sales tax according to the county they are located in, and this also includes accommodations such as hotels and motels. While paying sales tax is mostly applicable to the sale of products, it does also apply to some service-related businesses such as hotels, taxi and limo services, sale of admissions, and charges for participation in games and amusement activities. If you are unsure whether your business should collect Georgia sales tax, you may want to visit the Georgia Department of Revenue website.

Overview Of Georgia Taxes

Georgia has a progressive state income tax. It is fairly average among states charging income tax. Property and gas tax rates for the state are also both near the national average.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Recommended Reading: Doordash Quarterly Taxes

Does Ga Have Business Personal Property Tax

Filing Business Personal Property Tax Returns In Georgia. In Georgia, property tax is a tax on the value of all real and tangible property unless exempt. All local assessors accept the Georgia Department of Revenues Tangible Personal Property Tax Return: PT-50P. There is a 10% penalty for late filing or non-filing.

Georgia State Tax Tables

The Georgia State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Georgia State Tax Calculator. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The Georgia Department of Revenue is responsible for publishing the latest Georgia State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Georgia. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. This page contains references to specific Georgia tax tables, allowances and thresholds with links to supporting Georgia tax calculators and Georgia Salary calculator tools.

The Georgia State Tax Tables below are a snapshot of the tax rates and thresholds in Georgia, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Georgia Department of Revenue website. The Georgia tax tables here contain the various elements that are used in the Georgia Tax Calculators, Georgia Salary Calculators and Georgia Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. If you would like additional elements added to our tools, please contact us.

Also Check: How Do You File Taxes With Doordash

Tax Policy In Georgia

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Georgia |

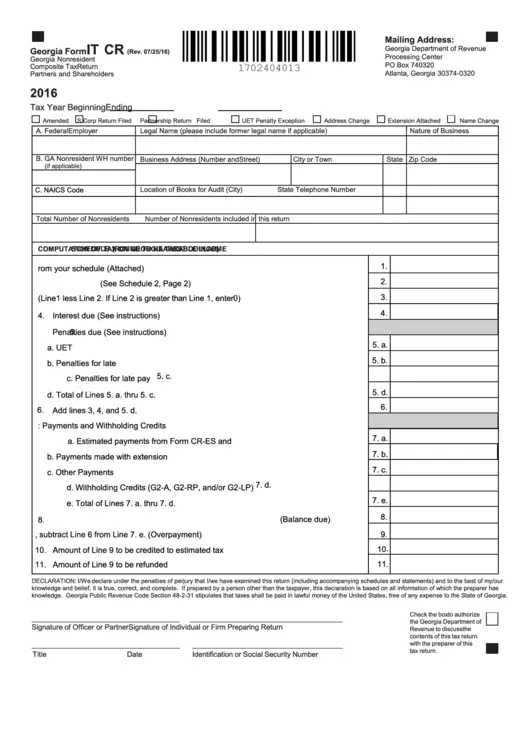

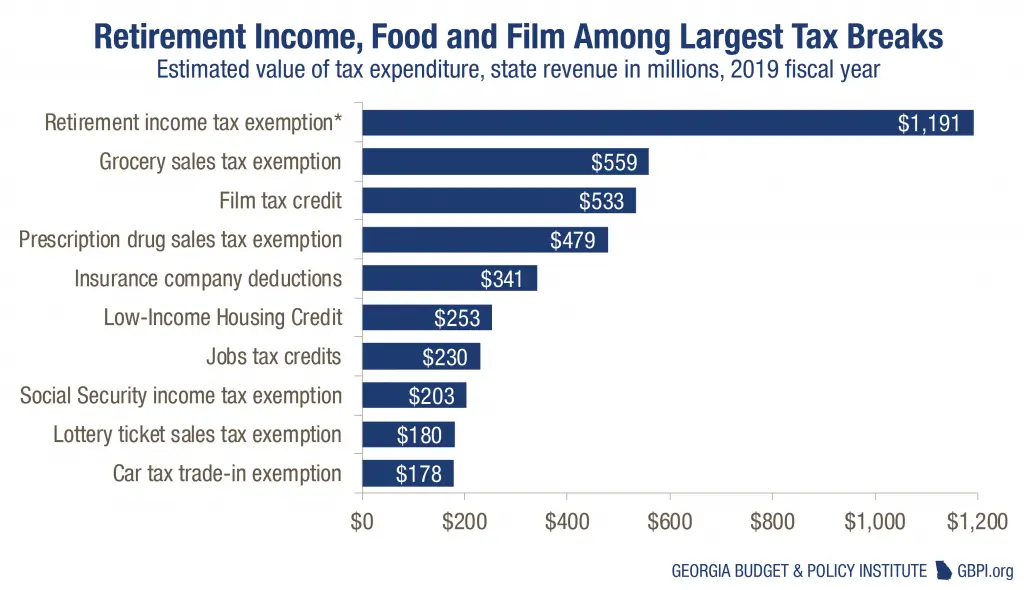

Georgia generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article VII of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Tax Trigger Points For Employment Income

There is a tax exemption for income from employment of a non-resident employee received from a non-resident employer, provided that the employee spends less than 31 days in a calendar year in Georgia and the expenses on salaries are not attributable to the non-resident employerâs permanent establishment in Georgia. Otherwise there is no threshold/minimum number of days that exempts the employee from the requirements to file tax returns and pay tax in Georgia.

To the extent that the individual qualifies for relief in terms of the employment income article of an applicable double tax treaty, there will be no Georgian tax liability.

You May Like: Do You Pay Taxes For Doordash

How To Avoid Capital Gains Taxes In Georgia

By Shawn Breyer

Are you thinking about the tax consequences for selling a Georgia house?

This article is going to walk you through what you need to know about the capital gains that you will be paying when selling your house in Georgia.

Selling real estate often means you will make large profits that you will owe capital gains tax on in Georgia. Unfortunately, that means that HUGE chunks of that cash you make goes to the government. You should consider the capital gains tax implications when selling your home to see if selling is even worth it.

If you want to learn how to sell your house without having to lose all of your profits to capital gains taxes

This blog tackles a few tax tips regarding selling your Georgia property, including the Capital Gains Tax Exemption, reporting issues, and selling cost deductions.

Keep reading.

Georgia Income Tax Refunds: Gov Brian Kemp Signs Bill Amid Budget Surplus

Gov. Brian Kemp signs additional tax refund from budget surplus into law

Single filers will receive up to $250 and joint filers will receive up to $500. The Department of Revenue will automatically credit eligible taxpayers.

ATLANTA – The Department of Revenue confirmed Georgia Gov. Brian Kemp has signed a bill that will deliver additional income tax refunds due to the state’s budget surplus.

Kemp on Wednesday signed the $1.1 billion refund plan into law.

HB 1302 will refund some or all of 2020 income taxes for 2020 and 2021 filers.

Read Also: Efstatus.taxact.com.

Qualified Education Donation Tax Credit

Those who make qualified education donations can claim a credit for them on their Georgia state tax return. The state of Georgia will only allow $5 million in this credit each year and you must request pre-approval electronically before claiming it. This credit is on a first-come, first-serve basiswhich means youll want to take action as soon as possible to claim it.

Resources For Estate Tax Help

- Planning an estate is a lot of work, and it can be overwhelming. If you think you need expert help with this or any other financial planning situation, turning to a financial professional can be a great solution. A financial advisor can help you navigate your financial life and set everything up for you. SmartAsset can help you find the right advisor for you. SmartAdvisor is our free financial advisor matching service. Heres how it works: You start the process by answer a series of questions about yourself and your finances and then our program will match you with up to three advisors in your area. The advisors will get in touch with you to see if you want to work with them. All of the advisors on our platform are free of disclosures and have been fully vetted.

- Its important to know how much money you have saved for retirement so you know what your estate might look like. Use our retirement calculator to see what your savings may look like as you approach retirement.

- No matter what age you are, planning your estate is a vital step. Even if youre years away from thinking about retirement, planning your estate will give you peace of mind in case something unfortunate happens.

Read Also: H& r Block Early Access W2

What Is The Georgia Tax Identification Number

Businesses in Georgia that sell services or products, which involves the collection of state sales tax, need to get registered with the Georgia Department of Revenue Tax Center. You can do it online. After completing the online application, your business will receive a sales and use tax ID number.

Your sales tax ID number is also called an employer identification number or state taxpayer identification number. It is a number specifically assigned to your business by the Georgia government for licensing or tax purposes, according to the Georgia Department of Revenue.

You must register with the IRS to get a federal tax ID number and with the state to get a Georgia tax ID number, then register your business with the GA Secretary of State.

Are Services Taxable In Georgia

Most services in Georgia are not subject to sales tax. So if you perform automotive repair or pet grooming services , then you dont need to worry about sales tax. However, there are a few services that are taxable. These are:

- Accommodations, like hotel stays

- Games and amusement activities

- Shipping and delivery charges

Of particular note to ecommerce stores, among the list of taxable services above, is that shipping charges are taxable. This would apply to any other charge by the retailer that is “necessary to complete the sale of taxable property, ” including handling costs.

You May Like: How To Do Taxes For Door Dash

Getting Your Georgia Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of Georgia, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your Georgia tax refund, you can visit the Georgia Income Tax Refund page.