Request Your Tax Refund Before You Lose It

Its still a good idea to file your taxes after the due date if you expect a refund, but you dont want to wait too long.

The IRS usually allows you three years from the due date of your tax return to request a refund. After this time, youll forfeit your tax refund. For example, your 2021 tax return is due on April 18, 2022. From that date, you have three years to request a refund. In 2025, if you dont file your 2021 return by the tax due date, youll lose your tax refund. The U.S. Treasury now owns your money.

That means if youre one of the estimated 1.5 million taxpayers owed money on their 2018 taxes who have yet to file, youre running out of time.

The IRS said it has $1.5 billion of unclaimed 2018 tax refunds, but these taxpayers must claim it by April 18. Maine and Massachusetts tax filers have until April 19, because the tax deadline falls on Patriot Day, an official holiday observed by both states.

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Child tax credits

- Student Loan Interest deduction

B Hire And Work With A Tax Preparer

While its never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if youre missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professionals guidance.

» Find a local tax preparer for free:See whos available to help with your taxes in your area

If you dont want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

Read Also: Doordash Taces

Read Also: Efstatus Taxact 2016

False Statements And Tax Evasion

If the CRA determines that you have knowingly made false statements on your tax return, you would be charged a penalty of at least $100 or 50 percent of your unpaid tax or falsely claimed credits.

Additionally, the CRA has a number of alternative ways to reassess tax returns. If the agency notices that your lifestyle is grossly inconsistent with the amount of income you report, you may face criminal convictions, fines, and even jail time for unreported income and tax evasion.

How Long Does It Take To Get A Tax Refund

The IRS anticipates most taxpayers will receive refunds, as in past years. Most should receive them within 21 days of when they file electronically if they choose direct deposit . Last year’s average federal refund was more than $2,800.

The IRS says many factors can affect the timing of a refund after the IRS receives a return electronically. A manual review may be necessary when a return has errors, is incomplete or is affected by identity theft or fraud.

TAX APPS:Taxes: How much can you expect to pay to file online this year? What’s a simple return? Get answers.

Also Check: What Tax Form Does Doordash Use

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Interest Relief For 2020 Income Taxes Owing

For income taxes owing for 2020 there could be some relief from interest accruing on those taxes you owe, if you struggled to pay them on time .

The criteria is that your earned income from all sources in 2020 could not exceed $75,000, and you must have been in receipt of one of the COVID-19 emergency or recovery benefits in 2020. The final requirement is that you have filed your 2020 tax return.

If you meet all of those criteria, then you will qualify for interest relief on taxes owed for 2020 only, until April 30, 2022.

If you dont qualify for the above but are struggling to pay outstanding taxes owing, review the options available to you as part of the the Taxpayer relief provisions.

Also Check: Doordash Taxes Percentage

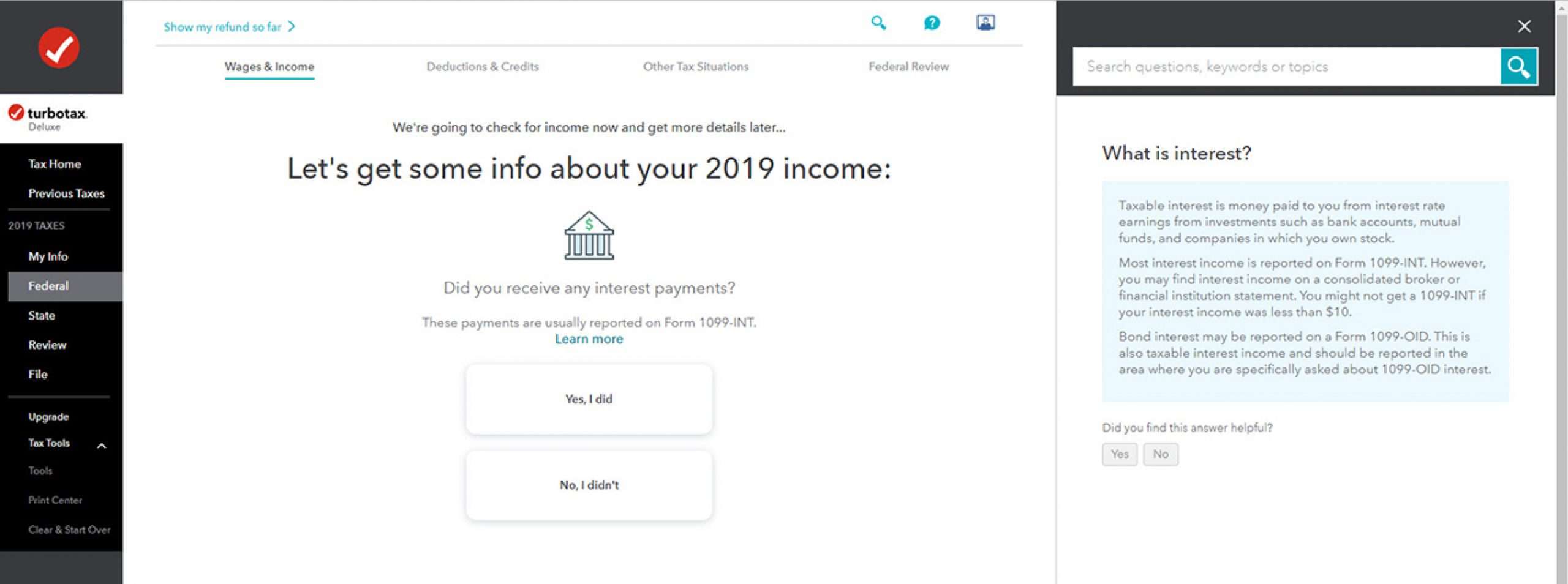

How To File Taxes Online

OVERVIEW

Filing your taxes can seem like a daunting process, but with a little organization and preparation, you can ensure youll file on time and with accuracy from the comfort of your own home. Heres what you should do to be ready for the tax filing deadline.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Whether youre filing your taxes for the first or the fiftieth time, its always a good idea to take a minute to gather your tax information ahead of time so you can file faster.

Starting with a firm grasp of what goes into filing, the documents youll need and the terms that are helpful to know, youll know how to file taxes online and be done in no time. Tax software like TurboTax can simplify everything and guide you through the process all the way from start to finish.

Request Tax Documents From The Irs

Finding documents from previous years may be challenging for some. Thankfully, the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Form 4506-T allows you to request a transcript of your tax return information, even if you haven’t filed a tax return. You can request information from the last 10 tax years.

The IRS will send the information it has on record, including information found on forms such as W-2s, 1099s, and 1098s. It won’t have information about deductions and credits you may qualify for, though, so you’ll still need to do some work on your own.

Read Also: How Much Tax For Doordash

Taxpayers Who Owe And Missed The April 18 Filing Deadline Should File Now To Limit Penalties And Interest Not Too Late To Claim The Child Tax Credit For 2021

IR-2022-91, April 19, 2022

WASHINGTON The Internal Revenue Service encourages taxpayers who missed Monday’s April 18 tax-filing deadline to file as soon as possible. While taxpayers due a refund receive no penalty for filing late, those who owe and missed the deadline without requesting an extension should file quickly to limit penalties and interest.

Families who don’t owe taxes to the IRS can still file their 2021 tax return and claim the Child Tax Credit for the 2021 tax year at any point until April 15, 2025, without any penalty. This year also marks the first time in history that many families with children in Puerto Rico will be eligible to claim the Child Tax Credit, which has been expanded to provide up to $3,600 per child.

Some taxpayers automatically qualify for extra time to file and pay taxes due without penalties and interest, including:

What Is The Penalty For Not Filing Taxes

The penalty for not filing taxes usually is 5% of the tax you owe for each month or part of a month your return is late. The maximum failure to file penalty is 25%. If your return is more than 60 days late, the minimum penalty for not filing taxes is $435 or the tax you owe, whichever is smaller.

Good news: You might not owe the penalty if you have a reasonable explanation for filing late. You can attach a statement to your return explaining your reason for filing late.

The late-filing penalty is not the same as the late-payment penalty. The late-filing penalty affects people who dont turn in their Form 1040 and other important tax documents on time.

The late-payment penalty affects people who pay their taxes late. It is 0.5% of your unpaid taxes for each month your outstanding taxes are unpaid. Add interest on top of that.

» MORE: How to get rid of your back taxes

Also Check: Doordash How Much To Save For Taxes

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up owing even more taxes because you can no longer claim the lucrative tax credits you might have otherwise qualified for.

Did Turbotax Rip You Off

Tweet This

I know, its July, the sun is shining, and the last thing you want to think about for the next eight or nine months is taxes. Well, Intuit, the maker of TurboTax, would love for you to forget too. It most certainly hopes you glossed over the revelations by intrepid reporters from ProPublica who discovered its egregious conduct.

Did TurboTax Rip You Off?

Deposit Photos

TurboTaxs recent machinations are like the digital version of Volkswagens emissions scandal. But instead of manipulating software to hide higher levels of pollutants coming out of a car, TurboTax manipulated software and the metadata on its own site so certain results wouldnt show up in Google searches. The tactic likely prevented millions of Americans from filing their taxes for free. Instead, these individuals were nudged to TurboTaxs premium products and charged for a service they should have gotten without paying.

While ProPublicas article received attention and even led some regulators to open investigations, it deserves amplification as many consumers who may have been short-changed are not aware of what happened, how they were deceived, or what recourse they should take. Furthermore, Turbo Tax has neither shown remorse nor taken real corrective action .

Deposit Photos

Also Check: How To Take Taxes Out Of Doordash

How To File A Tax Extension

If you’re planning to file a tax extension this year, you’ll need to submit Form 4868 to the IRS either by paper or electronically using e-file before the April 18 deadline. Note that you’ll still have to pay all or part of your estimated income tax due using Direct Pay, the Electronic Federal Tax Payment System or using a debit or , and note that you’re filing for an extension.

Some taxpayers are automatically granted more time to file. This includes military personnel who are serving in a combat zone or persons in federally declared disaster areas. US citizens who live outside the country have until June 15 to file.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Read Also: Doordash Tax Filing

How Long Is My Extension Good For

If you filed an extension by April 18, 2022 , it extends your filing deadline to .

- An extension of time to file your return does not mean an extension of time to pay your taxes.

- If you expect to owe money, you’re required to estimate the amount due and pay it with your Form 4868. As long as you do that, the extension will be granted automatically.

The Penalty For Filing Your Income Taxes Late

Filing your taxes late when you have earned a refund or dont owe any further tax will not result in any fees or penalties. However, if you owe money and file late, the CRA charges you a penalty on the taxes owed equal to five percent plus an additional percent for each month late up to 12 months.

Taxes owed to the CRA are due the day your tax return is due for individuals, April 30. If you cannot pay the full amount, the CRA will accept late payments but charges compound daily interest on all amounts due.

If you owe taxes for several different years, all of your payments are credited toward your oldest debts.

For example, if you owe the CRA $10,000 and you file your tax return 5 months late, the CRA assesses a 10 percent penalty. This increases your tax bill to $11,000.

Recommended Reading: If I File Taxes Today Will I Get A Stimulus Check

What’s The Fastest Way To File My Tax Return

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS received your return and has started processing it.

If you’re waiting on a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Will An Extension Delay Any Taxes You Owe To The Irs

No. Extending your filing deadline doesn’t delay when you have to pay taxes that you may owe. According to the IRS, you need to estimate and pay at least 90% of your tax liability by the deadline to avoid late fees. Otherwise, you will have accrued interest on what you owe, which you’ll eventually have to pay — plus possible penalties — on top of your income taxes.

The late-payment penalty is usually 0.5% per month of the outstanding tax not paid by the filing deadline, maxing out at 25%. The IRS can also issue a late-filing penalty of 5% of the amount due for every month or partial month your tax return is late. If your return is filed more than 60 days after the due date, the minimum late-filing penalty is either $435 or 100% of the unpaid tax .

For individual taxpayers, penalties and interest will stop accruing only when your balance is paid in full. For more on penalties or to work out a payment plan with the IRS, check out its web page.

You May Like: How To Pay Taxes For Doordash

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How To File Your Taxes Simply And Easily

We recommend TurboTax as the number one tax preparation platform for the average American. If you want to file your taxes for free and you have relatively simple tax affairs, theres no better alternative.

With a guarantee of accuracy and perfection, you can have peace of mind when you file your taxes this year.

Read Also: Doordash File Taxes