File A Digital Return With Free Tax Help

If you earn $73,000 or less, youre eligible for free tax help from companies that have partnered with the IRS.

A tax prep service walks you through the filing process and makes sure you have the right information and documents. But it also performs important calculations on your return. Some services even include a free state tax return.

Important RemindersYou must access the services through the IRS website. If you go to the providers directly, any account you create there will not work on the Free File system.

The tax prep service is a public/private partnership between the IRS and third-party providers. This years partners are: 1040Now.NET, ezTaxReturn.com, FreeTaxReturn.com INC, FileYourTaxes.com, On-Line Taxes at OLT.com, TaxAct, FreeTaxUSA, and TaxSlayer.

Two of the third-party services offer their tool in Spanish: ezTaxReturn.com and TaxSlayer. None of the remaining services offer any language other than English.

How to Find ItGo to the Free File webpage on the irs.gov website and click the Choose an IRS Free File Offer button. > > From this page you can choose to browse the offerings or to use the finder tool which pinpoints the service best suited for you.

For the browse tool, click the Browse All button. > > Here youll see each of the services, along with important information to help you decide which is the right one for you.

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How Much Is Sales Tax On A Car In Nc

Free Federal And State Tax Filing Sources

There are many free filing options available, even for taxpayers with higher incomes. Choose any of these for more information:

- TAP Taxpayer Access Point at tap.utah.gov: The Utah State Tax Commissions free online filing and payment system.

- Earn it. Keep it. Save it at utahtaxhelp.org: Provides free tax help.

- My Free Taxes at myfreetaxes.com: Sponsored by H& R Block and The United Way.

- The FreeFile Alliance at freefilealliance.org: Partnered with the IRS to help taxpayers e-file.

- : A service of the IRS.

Electronically File Your Arizona 2020 Income Tax Returns For Free

Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services. Free File is the fast, safe and free way to do your tax return online.

Individuals who meet certain criteria can get assistance with income tax filing. Taxpayers can file for free if they meet the following criteria:

You May Like: Irs Forgot Ein

Benefits Of Filing Taxes Online

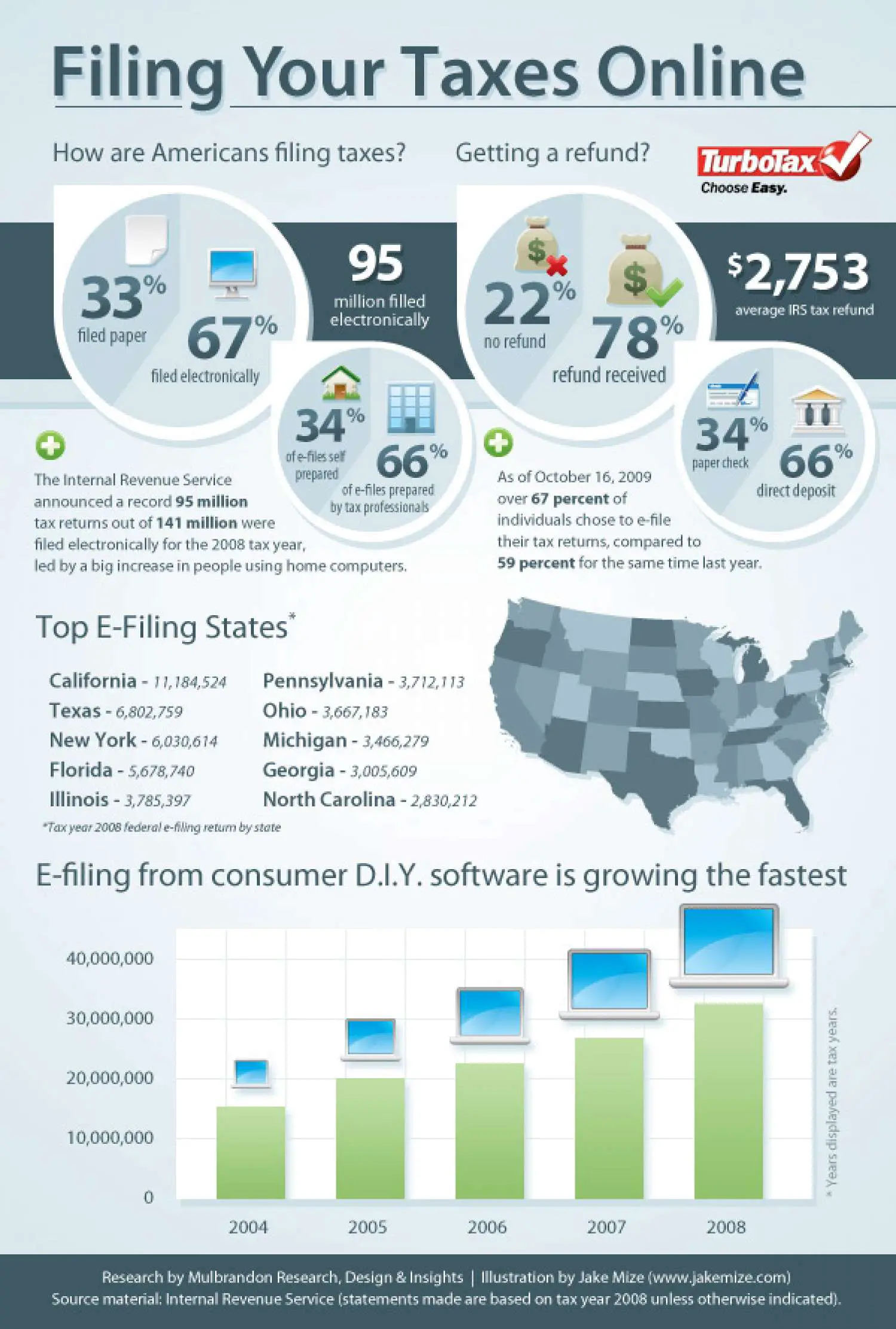

The IRS expects the number of individuals filing taxes electronically will grow to record numbers this year. E-filing offers:

- Faster refund Electronic filing is faster to process, which means a faster refund.

- Accuracy Although it may not prevent all mistakes, e-filing is software-based, so it’s able to check quickly for errors and scan for missing information. In fact, the IRS has reported that e-file returns are more accurate than paper ones.

- Early filing Taxpayers may e-file early, just as they can with paper returns. The sooner you e-file, the sooner the IRS will send you any refund you are owed. The difference, however, is that with early e-filing, it is not necessary to pay the balance of any taxes you owe until the filing deadline.

- Federal and state filing In most states you can e-file both federal and state tax returns with the IRS at the same time.

- Proof of filing The IRS will send you an acknowledgement when they have received and accepted your return.

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

You May Like: Pastyeartax Com Review

When You Should Hire A Cpa Or Tax Pro

When should you hire a CPA or tax preparer, and when can you do your taxes yourself? A look at the costs, advantages, and disadvantages of hiring a tax pro.

As with auto repair, home improvement, and first aid, there are situations in which it makes sense to DIY and then there are situations that are better left to the pros. If you freelance or own a business, if you manage rental property, or if you have investments more complex than interest or dividend payouts, you can save yourself time and stress by finding a good tax professional.

Though a tax preparers services will likely cost you more than even the most expensive tier of DIY tax softwareCPA fees vary depending on where you live and the complexity of your returnyou get a lot of value from that higher price tag. Once you turn over your forms and documents, the pro enters your data for you, which not only saves you time but also prevents DIY errors. Plus, their pricing is often more up front than that of most online software, which usually tries to upsell you midway through the filing process. Building a relationship with a pro that you can count on for years to come is also invaluable.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Read Also: Can Home Improvement Be Tax Deductible

File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

How To File Taxes Online In 2022

CBS Essentials is created independently from the CBS News staff. We may receive commissions from some links to products on this page. Promotions are subject to availability and retailer terms.

Tax season is on. The IRS began accepting and processing federal income returns for the latest tax year on Jan 24. Between now and April 18, which is the filing deadline for most Americans, nearly all taxpayers will submit their taxes electronically.

When it comes to e-filing, also known as online filing, there seem to be as many options to get the job done as there are forms to fill out. Which online filing option is right for you may depend on your income, your budget, the complexity of your return — and perhaps your patience for filling out forms. Here’s a look at options, including IRS Free File and TurboTax, that should work for just about every and any kind of taxpayer.

Read Also: 1099 For Doordash

What Happens If You File Your Taxes Late

If youve somehow forgotten to file your prior years taxes, youre not alone. It happens. Youll be wading into more dangerous waters if youve made a habit of not filing taxes at all for many, many years. A word of advice: dont drag your feet any longer since the longer you wait, the worse it will get for you. As the CRA site sets out in rather vague terms, you may have to pay a federal and provincial or territorial repeated failure to report income penalty. Youll obviously be in better stead had you not owed anything to the government, but either way, you could be in some major trouble. Should you not file taxes, the government may simply send you a bill based on whats known as a notional or involuntary assessment, which means that theyll take all the information available through income thats been reported to them and assess taxes and penalties These rarely turn out well for taxpayers.

List Of Commercial Websites And Software Providers

We have authorized the following companies to provide software or websites for preparing and filing taxes. These companies have completed the authorization process. Testing occurs in November and December of each year. The Tax Commission does not endorse any specific product or website.

In the list below, No means the vendor does not support this form.

| Company Name |

|---|

Recommended Reading: Appeal Property Tax Cook County

When Should I Consider Hiring A Tax Professional

As a CPA and former IRS agent, there are certain filing situations that I believe should be left to the professionals. I have seen many do it yourself tax returns that landed in the hands of an IRS auditor. Here are some scenarios where you should consider hiring a tax pro:

- You just started a business in the 2020 tax year or have a complex business structure, such as an S-corporation, partnership or corporation

- You have employees or youre self-employed

- You experienced a recent change in your tax situation

- You sold a property in the 2020 tax year

- You worked in multiple states

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But it’s still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Don’t Miss: Door Dash 1099

File Early And Sign Up For Direct Deposit

If you think you may be getting a tax refund for 2021, theres more of an incentive to prepare your taxes and e-file early. The sooner you file, the sooner youll get your refund, and you know what this means more money in the bank. If you want your cash as fast as possible,make sure you choose direct deposit. Its the safest and easiest way to get your funds.

The IRS states that choosing to receive your tax refund through direct deposit gets you your refund in 21 days or less, while a check can take up to 2 months to arrive at your door. TheIRS pays out refundsbased on a schedule that actually prioritizes e-filed returns and direct deposit refunds. To be a part of that group, sign up with the IRS for a direct deposit payment straight into your bank account. You can do this when you file your tax return electronically.

Filing your taxes online is instant, unlike mailing in a paper tax return, which takes time to reach the IRS. After you file your taxes online, youll get a notification from the IRS saying that it was successfully received or that an error occurred. Again, if youre owed a tax refund, you will receive your money through direct deposit or a paper check. Remember, direct deposit is quicker and eliminates the risk of your money getting lost in the mail.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

You May Like: Www.michigan.gov/collectionseservice

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Free Canadian Tax Software

TurboTax Free costs $0. File your simple Canadian tax return for free with no hidden fees.

Follow a simple step-by-step process to fill out your return and our software does the math for you and stores your information to use on next year’s return.

Save time by importing your tax slips into your return from the CRA with Auto-fill my return.

TurboTax Free protects all your personal tax info so you can file your taxes confidently.

Browse our TurboTax Community forum 24/7 or post a tax question for our users and experts.

TurboTax Free is ideal for simple tax situations:

Employment and unemployment income

Why customers love TurboTax Free

Also Check: Pin Number To File Taxes

Who Should Use A Tax Preparation Service

Tax preparation services are best for anyone who doesnt want to do their own taxes for any reason. Whether youre looking to save time, dont know how to handle a complex tax situation, or just dont like doing math or using computers for your finances, a tax preparation service becomes a good choice for you.

Its important to note that you can likely save money doing your own taxes manually or with tax preparation software. Depending on your income and tax complexity, you may even have an option to do your taxes online for free. It is entirely up to taxpayers to use what gives them the most confidence in sending off IRS-related forms.