The Premium Tax Credit

If your income is between 100% and 400% of the federal poverty line, the PTC will reimburse the amount you spent on monthly premiums for health insurance purchased through the Health Insurance Marketplace. These federal poverty line thresholds are actually higher than the minimum amount needed to file a tax return. However, if you received unemployment compensation for any week beginning during 2021, your household income is automatically considered to be 133% of the federal poverty line and therefore qualifies you for the credit.

To claim it, you must file a federal income tax return and attach Form 8962. More information about claiming this credit can be found here.

Do Working Children Pay Taxes

As with any Canadian citizen, your child isnt generally required to file a tax return if they have no tax owing. Usually, the amount earned by a minor child doesnt hit the basic personal credit amount meaning they wont owe tax on their earnings. There are some exceptions.

Regarding tax returns for a child, how much the child earned from what activities will determine if your child needs to file taxes. Dont worry well help you figure out what you and your child need to do.

How Much Can You Earn Without Paying Tax

Answer it$10,400

Beside this, how many qualifying years do I need for new state pension?

needqualifying yearsnew State Pensionnew State Pensionhavequalifying yearshavequalifying years

How much do you have to earn to pay tax?

£11,000£43,000£42,385

What does the national insurance pay for?

National InsurancepaidtheThe National Insurancepay

Also Check: How To Pay Quarterly Taxes Doordash

How To Tell If Someone Is A Qualifying Child

To be a qualifying child for the purpose of claiming them under the Earned Income Tax Credit, your child must:

- Be your own child, adopted child, stepchild, or foster child. You can also claim a sibling, step-sibling, half-sibling, or a descendent of any of them and

- Have lived with you for more than half of 2021.

- Any age and permanently and totally disabled at any time during 2021

The IRS provides detailed information on other, less common factors that may impact whether a child is a qualifying child for the Earned Income Tax Credit.

The Child And Dependent Care Credit

This credit covers some of the costs associated with caring for a child or dependent with disabilities, including after-school programs, babysitters or daycare, if that care enabled you to work.

The American Rescue Plan made this credit fully refundable in 2021 only. The maximum eligible expense for this credit is $8,000 for one qualifying person and $16,000 for two or more.

The exact credit amount you might qualify for depends on a few factors, including income. To find out what you might be owed, use this IRS tool. The claim for this credit is made using Form 2441.

Also Check: Tax Deductions Doordash

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- Repayment of the First-Time Homebuyer Credit.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the Health Coverage Tax Credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments.

- You are required to file Form 965-A for an elected installment payment.

- You are claimed as a dependent, but your income exceeded the filing requirement threshold.

How Will Your Social Security Be Taxed

If a portion of your Social Security benefit is taxable, theres no avoiding the federal income tax. But you wont pay taxes based on your entire Social Security benefit. Instead, you will pay taxes on 50% or 85% of your total Social Security amount.

If youre a single filer with an income between $25,001 and $34,000, youll pay taxes on 50% of your Social Security benefits. But as a single filer who has a total income of more than $34,000, youll pay taxes on 85% of your Social Security benefits.

Exceptions to This Rule

Every rule has an exception. In this case, filers in certain states need to be aware of their states tax requirements.

There are 12 states that tax Social Security benefits. These include Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia. However, almost every one of these states allows for some kind of deduction, credit or income limit to minimize the tax burden at a state level.

New Mexico doesnt provide a way to minimize the burden. Instead, youll pay state taxes on all of the Social Security income taxed at a federal level.

Read Also: Protesting Harris County Property Tax

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Efstatus Taxact 2016

There Are Basic Eligibility Rules That Apply To Most Everyone

Generally, to be eligible for the Earned Income Tax Credit, you must:

- Not have made more than $10,000 from investments in 2021.

The IRS provides helpful eligibility information on their Who Qualifies for the Earned Income Tax Credit webpage.

Getting a Social Security number: If you dont have a Social Security number, you can apply for one by filing Form SS-5 with the Social Security Administration . You can get Form SS-5 online at SSA.gov/forms/ss-5.pdf, from your local SSA office, or by calling the SSA at 800-772-1213.

The Basic Personal Amount: A Tax Credit For Every Canadian

Every Canadian resident is entitled to claim the basic personal amount, a tax credit which reduces the amount of tax you owe. Beginning in 2020, the amount you can claim will depend on your income. However, as long as you earned less than $150,473, youll be able to claim the maximum amount of $13,229. This means if youre reporting less than $13,229 in income, you wont owe federal taxes this year. You can also claim a corresponding provincial basic personal amount the amount youll receive for this tax credit depends on which province or territory you live in.

You May Like: 1040paytax Com Legitimate

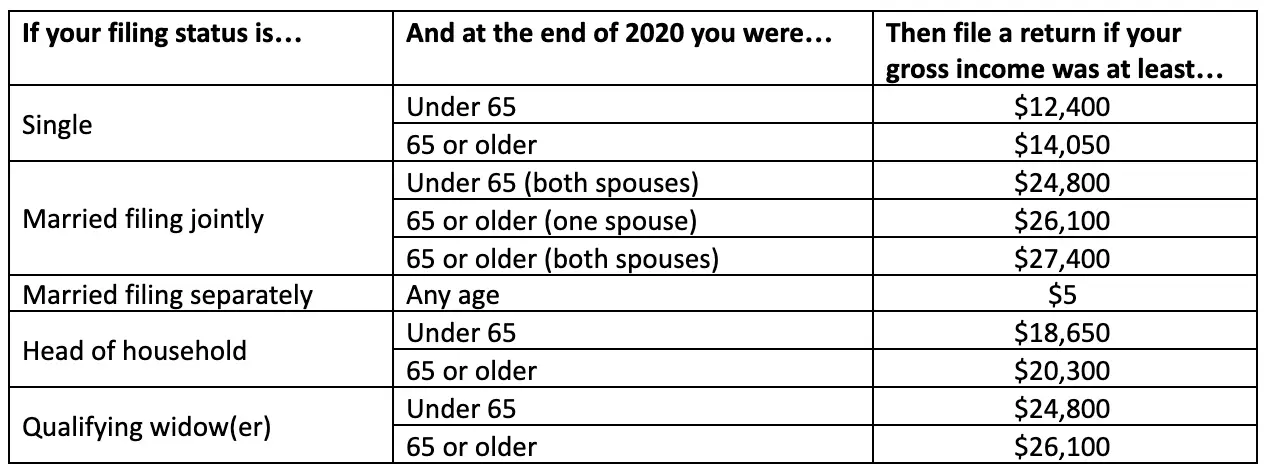

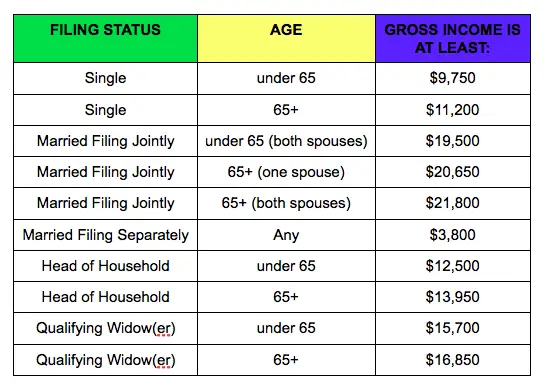

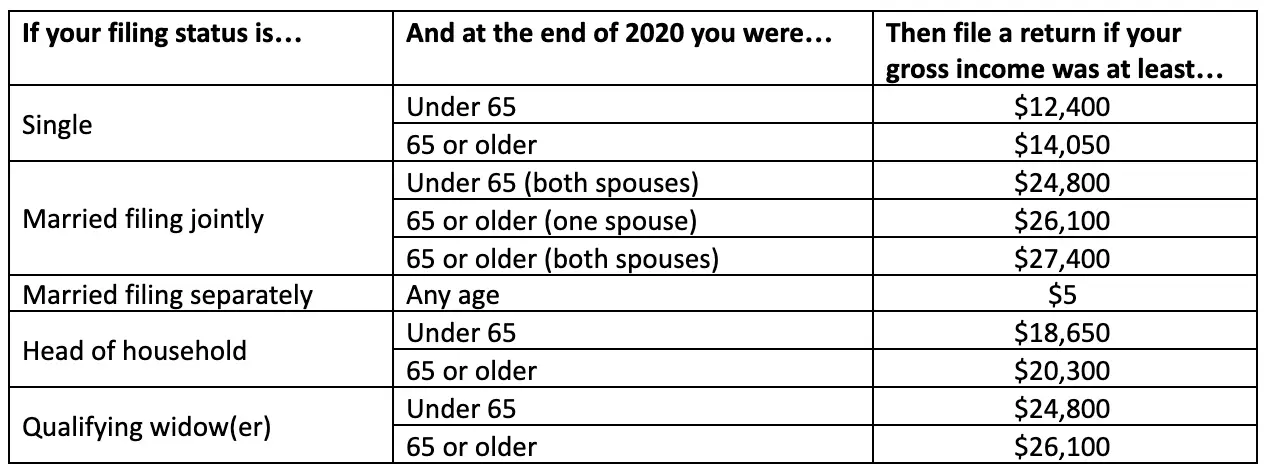

Do I Need To File A Tax Return

Factors such as age, disability, filing status, and income will determine whether or not the U.S. federal government requires you to file a tax return. The charts below will assist you in determining this.

However, just because you are not required to file a tax return does not necessarily mean you shouldn’t. Later in this article, we will discuss the reasons to file a tax return even when it is not required.

Tax On Taxable Income

Certain types of income you earn in Canada must be reported on a Canadian tax return. The most common types of income include:

- income from employment in Canada

- income from a business carried on in Canada

- the taxable part of Canadian scholarships, fellowships, bursaries, and research grants

- taxable capital gains from disposing of taxable Canadian property

You may be entitled to claim certain deductions from income to arrive at the taxable amount. You can also claim a credit for any tax withheld at source or paid on this income.

If there is a tax treaty between Canada and your country or region of residence, the terms of the treaty may reduce or eliminate the tax on certain types of income. To find out if Canada has a tax treaty with your country or region of residence, see Tax Treaties. If it does, contact the CRA to find out if the provisions of the treaty apply.

You May Like: Does Doordash 1099

How To File A Free Return

If you arent sure if you need to file then you probably should. And being able to file for free with TurboTax makes it a no brainer. Youre able to file a return using the Free Edition if you have simple tax situations. According to TurboTax, simple tax situations can include:

- W-2 income

- Limited interest and dividend income

- A standard deduction

- Earned Income Tax Credit

- Child tax credits

Youre not eligible to use the free edition in situations like itemizing your deductions, business, or 1099-MISC income, rental property income or when taking a student loan interest deduction.

Before you start, get all of your paperwork gathered. If you have them, youll need things like your W-2, 1099-INT, 1099-DIV, or social security information. To determine if you need to file a return using TurboTax, begin by answer a few questions.

After that, youll be prompted to create a TurboTax account with Intuit. If you already have an Intuit account for Quickbooks or Mint, you can use the same login to have one account for all of their services.

Once your account is set up, next, youll add more details on your personal information to help personalize questions they ask you to complete your return.

Up next, theyll ask other questions like your marital status, mailing address, and if anyone else can claim you as a dependant. TurboTax asked questions based on your response to previous questions. So the steps you experience will be unique to your current situation.

- Wages and salaries

Many Types Of Eligible Individuals And Families Miss Out On The Earned Income Tax Credit Simply Because They Do Not Claim It

Individuals most at risk of missing out on the Earned Income Tax Credit include people:

- Without children

- Living in non-traditional families, such as a grandparent raising a grandchild

- Whose earnings declined or whose marital or parental status changed

- With limited English language skills

- Who are members of the Armed Forces

- Who live in rural areas

- Who are Native Americans or

- With disabilities or who provide care for a dependent who is disabled.

Also Check: Sales Tax In Philadelphia

How Much Do You Have To Make To File Taxes

Income-based tax requirements will be dependent on how you plan on filing a tax return. Inevitably whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file.

When Are Taxes Due

The IRS Tax Code states that individual taxes are due on the 15th day of the 4th month of the year or April 15th. Now, if the day is on a weekend or holiday, Tax Day will be the following business day. There has been more than a handful of times the deadline to fall on a weekend or holiday. Emancipation Day is a federally observed holiday only in Washington DC that has interfered with the tax deadline.

Currently, in 2020 the United States and World are affected by the COVID 19 virus. The IRS earlier this year, extended the tax filing season from April to July 15th. Many penalties for late filing are being forgiven if you are late, consult a tax professional to see if they may help.

Also Check: Doordash Independent Contractor Taxes

What Is The Maximum Income Before Paying Taxes In Ontario

The state of Ontario is rated 5.0 or higher. This is payable to individuals with taxable income only in the range of $45,142 to $49,153. Over $45,142 in taxable income, the amount increased by $90,287, bringing this rate to 15%. In total, income over $90,287 may be subject to double taxes up to $150,000.

When Can I File Taxes For 2021 Canada

When will you have the opportunity to file electronically is February 21, 2022. At the end of the 2021 tax year, April 30, 2022 will mark the deadline for filing taxes. The day any money due becomes due unless you are able to arrange for another payment with Revenue Canada is that day. In this time, interest begins to accrue.

Read Also: 1040paytax

When Can I Start Filing Taxes For 2021

At midnight on January 24, 2022, the IRS begins its 2022 tax season. From now on, individual 2021 tax returns will be accepted and processed by the IRS. It will be the 28th of January also known as Earned Income Tax Credit Awareness Day when people should be aware of the resources they can take advantage of, such as the ability to qualify for certain tax credits through prior years income.

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

Recommended Reading: Square Dashboard 1099

Penalties For Not Paying Your Taxes

Even if you file an extension to submit your tax return, you must pay any estimated tax you owe by April 15, 2022. If you do not pay your taxes, you will be charged a penalty and owe interest on any unpaid balance.

The penalty for failing to pay your taxes by the due date is 0.5 percent of your unpaid tax for each month or part of a month that your return is late. This penalty is capped at 25 percent of late unpaid taxes. If you file your return on time and request to pay by an installment agreement, the penalty drops to 0.25 percent for each month or part of a month of the installment agreement.

Youre also charged interest on the unpaid balance, which compounds daily. The rate is set each quarter and is based on the federal short-term rate, plus an additional 3 percent.

If you owe taxes and dont file your return on time, youll be charged a penalty for failing to file. This is usually 5 percent of the tax owed for each month or part of a month your return is late. This penalty is also capped at 25 percent.

Electing Under Section 2161

If you are a non-resident actor, a non-resident withholding tax of 23% applies to amounts paid, credited, or provided as a benefit to you for film and video acting services rendered in Canada. Generally, the non-resident withholding tax is considered your final tax obligation to Canada on that income.

However, you can choose to report this income on a Canadian tax return for 2020 by electing under section 216.1 of the Income Tax Act . By doing this, you may receive a refund of some or all of the non-resident tax withheld on this income.

Write “ACTOR’S ELECTION” at the top of page 1 of your return.

Generally, if you choose to file a return under section 216.1, your return for 2020 has to be filed on or before .

If you are self-employed, your return for 2020 has to be filed on or before June 15, 2021. However, if you have a balance owing, you still have to pay it on or before April 30, 2021.

If you send the CRA your return after the due date, your election will not be considered valid. The 23% non-resident withholding tax will be considered the final tax obligation to Canada on that income.

Note

This election does not apply to other persons employed or providing services within the movie industry, such as directors, producers, and other personnel working behind the scenes. It also does not apply to persons in other sectors of the entertainment industry, such as musical performers, ice or air show performers, stage actors or stage performers, or international speakers.

You May Like: How To Report Plasma Donation On Taxes