How Much Can Taxpayers Who Itemize Deduct For Charity

The 2021 tax year offers a special, generous allowance. Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI. Note that non-cash contributions and donations to charities that do not qualify for the special rule will reduce the ceiling amount for qualifying cash donations.

Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income for C corporations.

This special deduction will not be available in 2022 unless the present law is extended. And as of Jan. 13, 2022, it has not been extended by Congress.

What Kinds Of Donations Are Deductible

If you do itemize, you can generally deduct contributions of cash or property to charitable organizations. If property is donated, your deduction is generally equal to the property’s fair market value. If you give property that has increased in value, you may have to reduce the fair market value by the amount of appreciation when calculating the deduction. If the property has decreased in value, your deduction is limited to the current fair market value. For tips on determining the fair market value of donated property, see IRS Publication 561 .

In addition, itemizers can deduct out-of-pocket expenses paid to do volunteer work for a charitable organization. For example, if you drove to and from volunteer work, you can deduct the actual cost of gas and oil or 14¢ per mile, plus parking and tolls. You can’t deduct any amounts that are reimbursed, though.

Note: Unlike other mileage rates, the 14¢-per-mile rate for charitable travel doesn’t change from year to year. It was also immune from the mileage rate adjustments in 2022 for high gas prices.

Whats The Tax Benefit Of Donating Stock To Charity

Instead of selling off well-performing stocks and using the proceeds to donate to charity, you may find even greater tax benefits by directly donating the stock through a donor-advised fund. When you sell your stocks, youll automatically trigger a capital gains tax even if you end up donating the profits.

Depending on your income level, you could end up paying as much as 20% of the profit on your stock in long-term capital gains tax, plus an additional 3.8% in net investment income tax . NIIT applies to taxpayers with the following modified adjusted gross income levels:

- $250,000 for married taxpayers filing jointly

- $200,000 for individual taxpayers

And if you held the stock for less than a year, youll end up paying your regular income tax rate . State taxes also apply on top of the federal tax rates. In California, that can add up to an extra 13.3% tax rate on your capital gains.

Not only do you avoid a large tax bill you also increase the amount you can deduct from your taxes. Thats because youll deduct the fair market value of the stock on the day you made the donation. If you cashed out first, youd have to subtract your cost basis .

Don’t Miss: How To Claim Inheritance Money On Taxes

Connecting With Your Community

Lets start with the basics. There are a few reasons why your business should consider donating. Charitable giving is good PR, and it makes sense for business, especially for small businesses that depend on their communities to keep them afloat.

What distinguishes small business from large-scale corporations is the connection with the community, said Kristen Fusaro-Pizzo, owner of Bath, Body, Candle Moments. People want to shop at a small business because a small business cares about them as individuals and the causes they care about.

Charitable giving demonstrates that you give back to the community and are in business for more than profit. As a small business, while you dont get as large a tax deduction as big corporations and enterprises do, dont overlook the other benefits of philanthropy.

As a single-store retailer, it is important for us to give back to the community, said Brad Schweig, vice president of operations for Sunnyland Furniture. There isnt really any tax benefit for us, so it comes back to being a part of our community. We do think it helps us from a marketing standpoint, as we want people to know that we are local, our team is local, and we support making our local community a better place.

Should You Keep Records Of Your Donations

Always make sure to keep records of your donations if you plan to take advantage of the charity tax deduction. If you are audited, youll have to prove to the IRS or other tax-collecting organization that you gave the donation. The IRS accepts the following forms of proof for a charitable donation:

- Cancelled check

If your donation is for more than $250, you may also need to prove to the IRS that you did not receive anything in return for the donation. This can be done with a statement from the charitable organization.

Also Check: How To File Taxes With No Income For Stimulus Check

Figuring Out The Value Of Noncash Gifts

The fair market value of something can be hard to pinpoint â especially if you’re dealing with secondhand goods. Here’s what you might use to make a reasonable estimate:

- The cost or selling price of the item

- Sales of comparable goods

- The cost of replacing it

Pro tip: Look for a valuation guide. Local organizations will sometimes provide one on their website, with estimated values for the goods they get most often.

As for the bigger charities, Goodwill has their own valuation guide. So does the Salvation Army. Both give you a ballpark figure for commonly donated items in good condition.

For Donations Over $250

For donations worth over $250 you’ll need a “contemporaneous written acknowledgement” from the charity you contributed to.

Basically, this is written proof from the charity. Their statement will need to include:

- The amount of money you donated

- A description if your donation

- An explanation of whether the charity gave you something in return

How to handle quid pro quo contributions

Sometimes, you might get a gift in exchange for your gift â say, concert tickets or a bottle of wine. In that case, the organization will have to describe what they gave you and estimate how much it’s worth.

These are called quid pro quo contributions: âthis for that,â meaning the donor gets something in return. For these, the IRS requires you to subtract the value of that thank-you gift from the donation you made when you claim your deduction.

Also Check: How To Fill Out Small Business Tax Forms

How Do You Claim A Charitable Tax Deduction

Normally, charitable contributions are a personal itemized deduction. Like medical expenses, mortgage interest, and property taxes, these are personal expenses you can deduct if you skip the standard deduction.

For 2021, though, the IRS has allowed for a special tax deduction for donations on top of the standard deduction.

Let’s talk about how this works first. Then weâll get into how things normally go.

Charities Accepting Tax Deductible Donations

Even though your donation may be used for a good cause, that doesn’t necessarily mean that you can deduct it. Only contributions to certain charitable organizations are deductible. For example, you probably can’t deduct a donation given through a GoFundMe page to help a local business that’s struggling or a neighbor whose house burned down.

Fortunately, there’s an easy way to determine if donations you make to an organization are tax-deductible charitable contributions. The IRS’s online “Tax Exempt Organization Search ” tool will tell you if an organization is tax-exempt and eligible to receive tax-deductible charitable contributions.

Don’t Miss: Do You Pay Taxes On Social Security Disability

Charitable Contributions And Volunteer Work Can Reduce Your Taxes And Enrich Your Retirement

After retirement , many people are looking for meaningful ways to spend some of their newly free time and to make a difference in the world. Volunteer work is often the solution. Whether you use expertise developed during your paid career or throw yourself into something new, volunteer work allows you to help worthy causes, pursue your interests, and meet new people. And the IRS is willing to give you a little help, in the form of tax deductions for some of your volunteer expenses.

Of course, volunteer work isn’t the only way to help others. If you are fortunate enough to have cash or property to donate, your charitable giving can fund worthwhile endeavors — and the attendant tax breaks are nothing to sneeze at, either. Whether you give money, property, or your time, this article explains some basic rules about claiming tax deductions for your good work.

How Much Can You Claim In Charitable Donations Without Receipts

It depends on what type of contributions you give and how much.

- Cash contributions: Any cash contributions under $250 dont require a receipt from the organization. Any contribution of $250 and over does require some type of written communication from the organization confirming your donation.

- Non-cash contributions: For non-cash contributions, the limit to make a deduction without a receipt is $500. Additionally, non-cash contributions also require an appraisal to determine the fair market value of the item you donated. If the value is $5,000 or less, you just need to hang onto the appraisal with your tax documents in case of an audit. But if the appraised value is more than $500,000, you must submit the qualified appraisal to the IRS with the rest of your tax return.

Also Check: Can You File Taxes Married But Separate

What Are The Limits For Deducting Charitable Donations

The IRS sets a limit on how much youre allowed to claim as a charitable deduction. In 2021, the limit was increased to 100% of an individuals annual gross income in order to incentivize charitable giving during the COVID-19 pandemic.

But the 2022 charitable contribution rules have reverted back to no more than 50% of your AGI for cash contributions. The limit is 30% of AGI for non-cash contributions . Its still one of the most generous deductions available – a couple with an AGI of $200,000 can deduct up to $100,000 of cash donations to charity in a given year. But any charitable donations above those amounts are not eligible for a tax deduction.

Giving Through Specialized Charitable Vehicles

While gifts of cash or appreciated investments can be given directly to a charity, it often makes sense to consider specialized charitable vehicles to make giving easier and to manage the tax benefits. If you give regularly, certain giving vehicles such as donor-advised funds or private foundations can make sense.

Donor-advised funds, for example, allow you to make a donation of appreciated stock held long-term and receive a current-year tax deduction. You can then grant those assets out over time and have the remaining assets invested so they can grow for future grants to worthwhile charities.

If you prefer to leave assets to charity but also earn income for a period of time, a charitable remainder trust or pooled income fund is worth exploring.

Another donation option to consider if your over age 70 1/2 years is a qualified charitable distribution from your tax-deferred retirement account, such as a traditional IRA. A QCD is a tax-free distribution from a retirement account that can be donated directly to a qualified charity and does not have to be taken into your income for tax purposes. In addition, a QCD can also be used to meet up to $100,000 of the required minimum distribution for your IRA. It should be noted that there is no tax deduction for a QCD however, you don’t have to include that distribution into your taxable income.

Read Also: Which States Have The Lowest Property Taxes

Additional Forms You’ll Need

Complete Form 8283 if your car donation deduction is more than $500.

- If your deduction is between $501 and $5,000, you need to complete Section A.

- If your deduction is greater than $5,000, you’ll complete Section B.

- If you complete Section B, you’ll also need a written appraisal as documentation.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

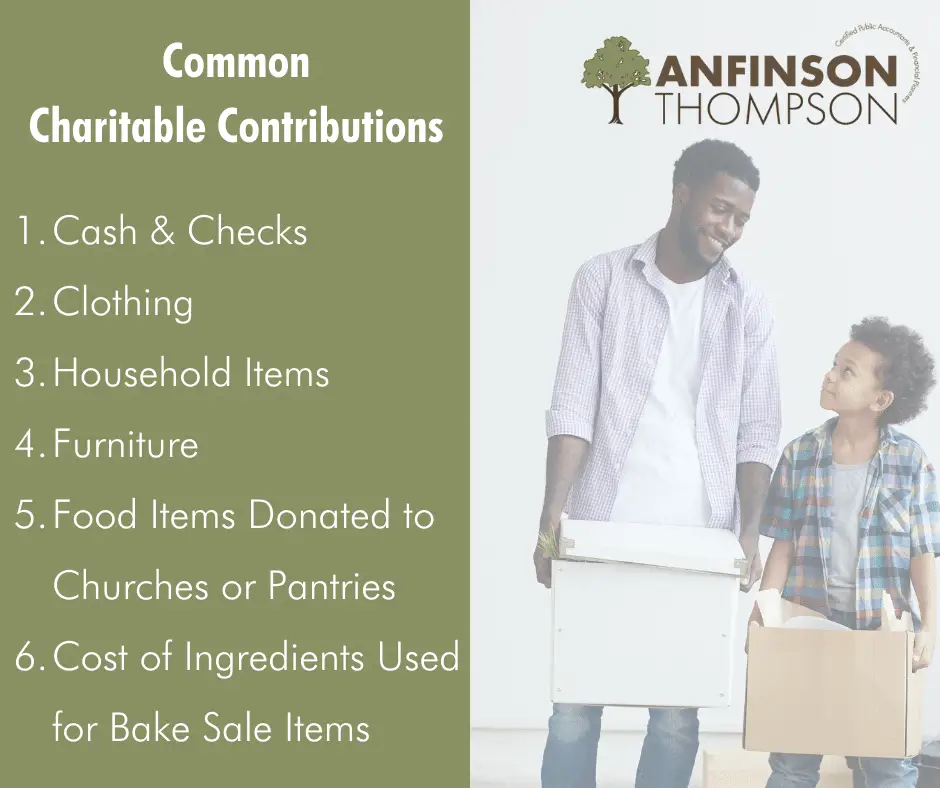

Types Of Charitable Contributions That Are Deductible

- Donations to religious organizations

- Donations to for-profit schools or hospitals

- Donations to social and sports clubs

- Donations to labor unions

- Donations to homeowners associations

Different types of charitable donations have their own set of tax rules. Luckily, the IRS provides a comprehensive guide on charitable contributionsto help you navigate any uncharted tax territory.

Also Check: Where Can I Get My Taxes Done By Aarp

How To Deduct Your Donations On Your Tax Return

You can claim your deduction for making charitable donations when you file your annual tax returns. Youll need to itemize your tax deductions by filling out Schedule A and sending it with your return. You wont get access to the tax benefits of donating to a nonprofit if you take the standard deduction unless the IRS makes an exception for a specific tax year. For example, filers in 2020 could deduct up to $300 of cash donations without itemizing.

While giving money is the most common method of donating to a charitable organization, you can also deduct the value of items you contribute, such as furniture, food, automobiles, computer equipment or office supplies.

If you choose to donate items, you can only deduct the amount you paid for them, not their fair market value or FMV. The FMV is the price the item would reasonably sell for in the current market.

Give Back To An Online Charity Fundraiser Right Now

Thousands of people have used GoFundMe to give back to causes they care about. Through our platform, individuals can quickly donate to certified charities and become part of an online community of people who share similar passions.

Discover charity fundraisers on GoFundMe, then make a tax-deductible contribution to your favorite 501. If youd like to make an even bigger impact, give back with charity fundraising by starting your very own crowdfunding fundraiser. now and start making a difference for those in need.

You May Like: How Do Small Businesses Pay Taxes

Ways To Donate To Charity

There are various ways that a business can donate to charity. Although monetary donations are commonplace, there are other options. The following are a few top ways companies are supporting charitable organizations:

- Volunteer: Instead of a monetary donation, companies can donate their time to a great cause. Volunteer as a company at a soup kitchen, charity run or homeless shelter.

- Sponsor a sports team: Youth organizations are always looking for businesses to sponsor their teams. Donate funds towards field upkeep and uniforms. Companies that sponsor teams can have their names displayed on unforms or field signs.

- Launch a charity drive: Start a collection for a particular cause. Your company can collect non-perishable food items for distribution at food banks. Toy drives are popular around the holidays.

- Donate online: Set up automatic donations through virtual giving platforms. You could even leave out a collection jar at your place of business and cash in the collected amount to send through an online portal.

Know The Deduction Limits

There aren’t too many people who donate very large chunks of their income to charity every year, but if you do, there are limits on what you can deduct. Most public charities are also known as 50 percent organizations, which means that your deductions from donations to those charities are limited to 50 percent of your adjusted gross income for that year. In other words, if you make $100,000 in a certain year and donate $60,000 of it to a qualified public charity, you’ll only be able to deduct $50,000 of that. Other organizations — usually private charities, veterans groups, fraternal organizations and private family foundations — have 30 percent limits. To further complicate matters, if a 30 percent organization happens to show capital gains, then you can deduct only 20 percent of your income.

There are additional limits â too involved to fully explain here â that depend on what type of donation you’re making. If you happen to donate long-term capital gains to a charity, your deduction is limited to 30 percent of your income, even if you’ve given to a 50 percent organization. That percentage goes down to 20 if the long-term gains are donated to a 30 percent organization.

If you’d like to delve deeper into the world of charitable tax deductions, check out the links on the next page.

Also Check: How To File Quarterly Taxes Online

How Charitable Tax Deductions Work

Charitable tax deductions are the IRS’s way of rewarding you for making donations to organizations that help people in need. For every contribution you make to a qualified charity, you can shave a little off your adjusted gross income and reduce your own tax burden.

Charitable contributions can take many forms. Cash, check and credit card donations are the most straightforward type of donation — they’re easy write-offs. But you can also donate property, goods, real estate, your time and services, stock options, intellectual property and just about anything else you can think of. This is where things take a turn into more complicated territory. Some of it will be fully deductible, some partially, some not deductible at all. The answers are all to be found in the IRS publications on charitable deductions, but you might need some time to find them.

Whatever you do, if you’ve made charitable contributions over the year, you must take the itemized deduction option and fill out Schedule A on your federal Form 1040. If you take the standard deduction you won’t get the full benefit of your donations.