What Is Utahs Sales Tax

The base sales tax rate in Utah is 4.7% and this applies to the whole state of Utah, however, the rate you pay or have to collect may be different since there are a variety of different sales tax rates depending on the county you are in. So, the way Utahs sales tax is calculated is the base rate of 4.7% Utah sales tax throughout the whole state plus the additional percentage rate each county charges, equals the total Utah sales tax rate you will pay or have to collect from your customers if you are a business.

Any retail, furniture, electronics, auto repair, or restaurant-related business you visit in Utah should charge you the prevailing rate of Utahs sales tax according to the county they are located in, and this may also include accommodations such as hotels and motels and some service-related businesses.

While paying sales tax is mostly applicable to the sale of products, it can also apply to some service-related businesses such as hotels, taxi and limo services, admissions charges to places of amusement, sporting and entertainment events, and pet grooming salons, as an example. If you are unsure whether your business should collect Utah sales tax, you may want to visit the Utah State Tax Commission website.

Lenovo Legion 5 Yellow Screen

The Utah sales tax rate is 5.95% as of 2022, with some cities and counties adding a local sales tax on top of the UT state sales tax. Exemptions to the Utah sales tax will vary by state. Tax-Rates.org The 2021 Tax Resource. Start filing your tax return now : TAX DAY NOW MAY 17th – There are -454 days left until taxes are due. Mar 11, 2021 – m211 m35 planetary axles bobbed deuce and a half trucks for sale, m35 whistler engine manual transmission locker hubs super single xzl tires mutlifuel. 1952 GMC M211 2.5 ton military truckDate of delivery: 12-52 Serial number: 11577This truck is located in Sylva, orth Carolina.The buyer will be required to pay a $200 deposit via PayPal. 1952 GMC. Municipal governments in Utah are also allowed to collect a local-option salestax that ranges from 1.25% to 4.2% across the state, with an average local tax of 2.11% . The maximum local tax rate allowed by Utah law is 3.35%. You can lookup Utah city and county salestax rates here.

- cz scorpion featureless gripCreate an internal knowledge resource

- disney aEquip employees with 24×7 information access

- missile silo for sale 2022 texasCentralize company information

Carvana Load Board Login

2021. 7. 1. ·Utah Sales Tax Rates by City The state sales tax rate in Utah is 4.850%. With local taxes, the total sales tax rate is between 6.100% and 9.050%. Utah has recent rate changes . Select the Utah city from the list of cities starting with ‘O’ below to see its current sales tax rate. Utah‘s sales tax rates for commonly exempted categories are listed below. Some rates might be different in Moab. Groceries: 6.9%: Clothing: 9.85%: Prepared Food: 9.85%: Prescription Drugs: 3.9%: Non-Prescription Drugs: 3.9%: Moab Sales Tax Calculator Purchase Details: $ in zip code Leave the zip code default for purchases made in Moab. .

- ethan allen tavern chairsAccess your wiki anytime, anywhere

- earn money by watching video adsCollaborate to create and maintain wiki

- georgia available hunting leasesBoost team productivity

Also Check: When Are Virginia Taxes Due

Sales Tax Nexus In Utah

You are not obligated to collect and remit sales tax on purchases by customers in Utah unless you have a nexus, or significant business presence, in the state. Utah defines a nexus condition for sales tax purposes as:

- Having or using an office, distribution house, sales house, warehouse, service enterprise, or other place of business in the state

- Maintaining a stock of goods in the state

- Regularly soliciting orders in the state, unless this solicitation is only through advertising or solicitation by direct mail, email, the internet, telephone, or similar means

- Regularly delivering property into Utah through means other than a common carrier

- Regularly engaging in any activity related to the leasing or servicing of property located in Utah

You may also have a nexus if you sell the same or a very similar line of products as a related seller under the same or a very similar business name, or you use the place of business of a related seller to advertise, promote, or assist in making sales, and you:

- Have more than a 10% interest in the related seller, or

- The related seller has more than a 10% interest in your company, or

- Your company is wholly owned by the related seller.

What To Expect During An Audit

The typicalaudit process is shown in this flowchart. Detailed guidance for each stage of the process follows in the sections below.

Utah regularly audits businesses required to charge, collect, and remit various taxes in the state. Many audits begin with a call from a Utah Tax Commission sales tax auditor. Shortly after the call, your business will receive aNotification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Utah sales tax audit.

A Notice of Determination stating the reason for the assessment and the amount will be sent to you by the Tax Commissioner no later than 12 months from the commencement of the audit.

It is good to start with getting a state and local tax professional involvedto prepare for the audit.

Read Also: What Does Payroll Tax Pay For

Uninsured Motorist Identification Fee

Utah Code §41-1a-1218

The fee is $1.00 per year, upon registration of each motor vehicle, except commercial vehicle registered as part of a fleet, vehicles owned or leased by the state or its subdivisions, and vehicles registered with a Purple Heart plate.

This website is provided for general guidance only. It does not contain all motor vehicle laws or rules.

How Much Is The Car Sales Tax In Utah

Finding the sales tax rate for car purchases in Utah can get confusing. Multiple sources state that the tax rate is 6.85%, but we haven’t been able to verify that rate on the Utah DMV site.

We found that the base state sales tax in Utah is 4.85%, but on average, local counties add up to 2.11%. Therefore the average combined sales tax rate is 6.96%.

For our examples in this article, we’ll use the average combined rate of 6.96%. But know that the lowest rate in Utah is 6.1% and the highest is 9.05%.

Recommended Reading: How To File School District Taxes In Ohio

Utah Sales Tax Rates By City

The state sales tax rate in Utah is 4.850%. With local taxes, the total sales tax rate is between 6.100% and 9.050%.

Utah has recent rate changes .

Select the Utah city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Utah was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Protest Rights And Audit Finding Confirmation

If you disagree with an audit’s findings, you mustfile an appeal 30 days from theNotice of Determination/Assessment date. Theappeal must state why the assessment, the tax, interest, or penalties are incorrect.

The appeal results in an informalinitial hearing in front of the Utah Tax Commission. While the hearing is under the Administrative Procedures Act , it is often heard by the Tax Commissioners office, but sometimes by an ALJ. While you may handle the case yourself, it is usually wise to have an experienced sales tax lawyer or professional represent you during these proceedings.

The initial hearing proceedings result in an Initial Hearing decision, which is appealable by requesting a formal hearing within 30 days. While the Initial Hearing is waivable, it is generally not advisable to skip this step in the process.

If you have received a Notice of Deficiency and haven’t talked to someone experienced in Utah State tax, now is the time. Do it before these deadlines are missed.

You May Like: How To File California State Taxes

Is The Utah Sales Tax Destination

Utah is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.

Retail Sales And Personal Property Leases

Utah sales tax law includes retails sales and tangible personal property leases. Personal property that’s considered tangible includes physical items like seating, tables, and garments. It also includes products that are transferred electronically, such as music or movies. Some services can also be taxed, like maintenance and repair labor costs. The costs of laundering garments, attending movies and other entertainment venues, hotel stays, and telecommunications are also taxable.

Also Check: How To File Va State Tax Extension

Utah Sales Tax On Cars: Everything You Need To Know

If you’re moving to Utah or seeking to purchase a vehicle in the state, you must know the Utah sales tax on cars. Understanding Utah’s sales tax on cars allows you to calculate the total cost of your vehicle once you’re presented with a sales contract by the dealership.

If you’re moving to Utah or seeking to purchase a vehicle in the state, you must know the Utah sales tax on cars. Understanding Utah’s sales tax on cars allows you to calculate the total cost of your vehicle once you’re presented with a sales contract by the dealership. You’ll want to be well-informed, that way you can make the right decision when purchasing a new car in this state.

Utah Sales Tax Audit Protest Process Flow Chart

NOTE:If the deadlines are missed, it can be tough to get the case reopened.

After an audit, the auditor will issue aNotice of Determination . It’s essential to review and understand its implications carefully.

The audit report:

- Details of the auditor’s findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you disagree with the proposed changes, you may request an informal conference with the auditor. You must request an informal conferenceand attempt to resolve the case with the auditor.

Read Also: Is Medicare Supplemental Insurance Tax Deductible

After The Audit Understand And Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the Utah sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor’s findings. You’ll want to push back on areas where they have overstepped their bounds or misapplied Utah’s sales tax laws.

It’s best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

|

Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren’t well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We’ll cover the process of challenging a Utah sales tax audit assessment in detail in the following sections.

Incentives And Rebates Offered By Dealerships

Utah car dealerships offer incentives or rebates to car buyers. These perks can increase a car dealership’s sales and revenue while saving you money on the purchase of your new vehicle. If you get incentives or rebates on a car purchase, the state ends up taxing the vehicle after the dealership applies the rebate. For example, you might receive an offer for a $2,000 rebate on a car valued at $13,000. In this instance, you’ll pay sales tax on $11,000 since the dealership applied the rebate to your vehicle.

Recommended Reading: How To Pay My Property Taxes Online

Utah State Rate For 2022

4.7% is the smallest possible tax rate 6.1%, 6.2%, 6.35%, 6.4%, 6.45%, 6.5%, 6.6%, 6.65%, 6.7%, 6.75%, 6.85%, 6.9%, 6.95%, 7%, 7.1%, 7.15%, 7.25%, 7.35%, 7.45%, 7.5%, 7.6%, 7.75%, 7.95%, 8.05%, 8.1%, 8.2%, 8.25%, 8.3%, 8.75% are all the other possible sales tax rates of Utah cities.9.05% is the highest possible tax rate

The average combined rate of every zip code in Utah is 6.819%

About The Utah Sales Tax

The state of Utah has relatively simple sales tax rate, and utilizes a flat state tax rate. The local taxes also have a base rate, although the local authorities have the ability to impose their own tax rates, href=”/utah/rates”> meaning that they will vary significantly depending on which jurisdiction you are in. In addition of state and local sales tax rates, some local taxing authorities have the ability to impose their own sales tax.

Recommended Reading: Are Donations To St Jude Tax Deductible

Utah Sales And Use Tax

If you sell physical products or certain types of services, you may need to collect sales tax and then pay it to the Utah State Tax Commission. Utah’s sales tax is collected at the point of purchase. The listed sales tax rate for the state of Utah is currently at 4.85%, but certain counties, cities, and municipalities may levy an additional sales tax, resulting in a combined sales tax range of 6.10% to 9.05%.

You’ll typically need to collect Utah sales and use tax on:

- Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc.

- Certain services your business might provide

Most states do not levy sales tax on goods that are considered necessities, like food, medications, clothing or gas. Check with the Utah State Tax Commission to confirm whether your business is required to collect Utah sales and use tax.

How To Calculate Utah Sales Tax On A Car

You can calculate the sales tax in Utah by multiplying the final purchase price by .0696%.

For example, lets say that you want to purchase a new car for $30,000, you would use the following formula to calculate the sales tax:

$30,000 x .0696 = $2,088

This means that your sales tax is $2,088 on a $30,000 purchase price.

Don’t Miss: Can You File Previous Years Taxes Online

Utah’s Sales Tax By The Numbers:

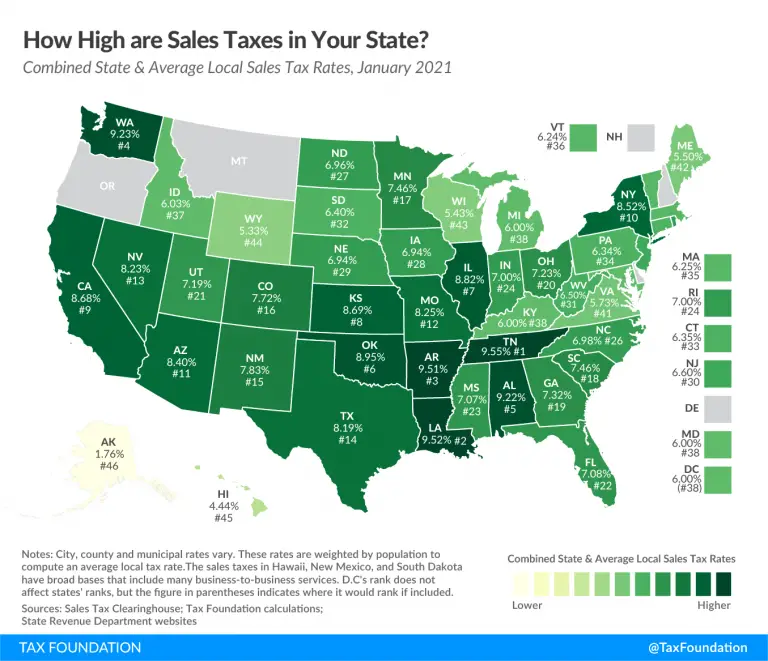

Utah has alower-than-average sales tax, includingwhen local sales taxes from Utah’s 125 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 27th highest by combined state + local sales tax

Ranked 28th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 13th highest by state sales tax rate

Ranked 35th highest by per capita revenue from the statewide sales tax

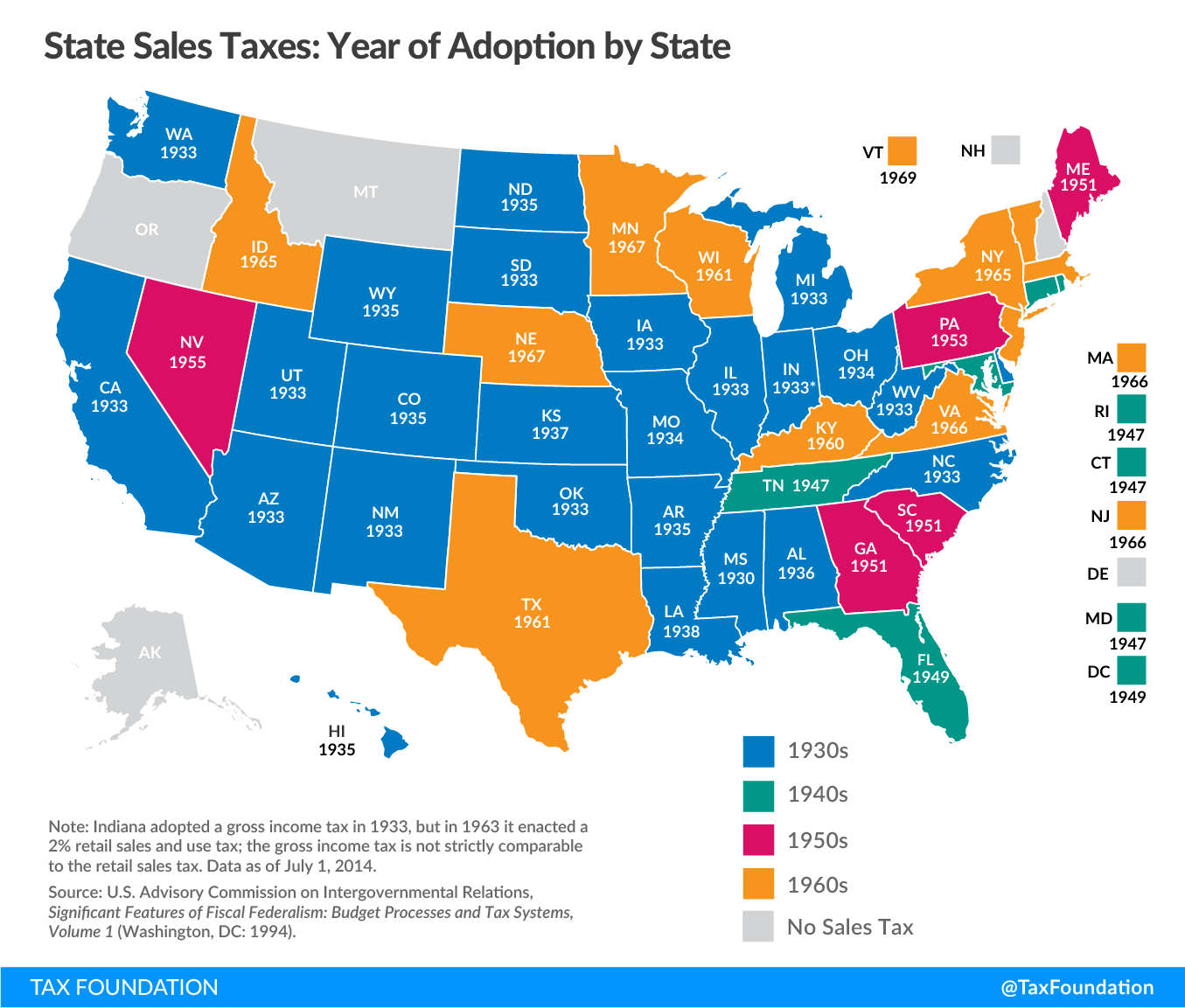

Utah has a statewide sales tax rate of 4.85%, which has been in place since 1933.

Municipal governments in Utah are also allowed to collect a local-option sales tax that ranges from 1.25% to 4.2% across the state, with an average local tax of 2.114% .The maximum local tax rate allowed by Utah law is 3.35%.You can lookup Utah city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Utah. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Utah Sales Tax Handbook’s Table of Contents above.

Using Your Old Vehicle As A Trade

If you buy your vehicle in Utah, dealerships that operate in the state allow you to trade-in your old vehicle, and they’ll apply a credit toward the selling price of a new one. For instance, you can trade-in your old vehicle at the dealership and earn a $5,000 credit to put toward the purchase of a newer vehicle that costs $11,000, making the total selling price equal to $6,000.

For any trade-in, you’ll pay sales tax on $5,000. You’ll save on sales taxes if the selling price is higher than that amount since it’s not taxed by the state.

Read Also: When Is The Irs Sending Out Tax Returns

State Tax Rates And Rules For Income Sales Property Fuel Cigarette And Other Taxes That Impact Utah Residents

Retirees: Mixed Tax Picture

Utah has a flat-rate income tax system . But retirees can get stung by the Beehive State’s income tax, since Utah is one of only a handful of states that taxes Social Security benefits.

Sales taxes in Utah aren’t exactly steep but they’re certainly not what you’d call low, either. The state’s average combined state and local sales tax rate is 7.19%, which is above average.

Residents should like the property tax rates in the state. The median property tax rate in Utah is the 10th-lowest in the nation.

Administrative Hearing With The Utah Tax Commission

If you disagree with the initial hearing decision or you waive the initial hearing, the case proceeds to theFormal Hearing Division.

Like any hearing, it is possible to represent yourself. However, the formal hearing is your last shot to resolve your sales tax matter before going to judicial court, and it is highly advisable to have a sales tax pro in your corner. Even though your case is still being heard within the Tax Commission, the deadlines and rules of evidence are strictly enforced during the formal hearing.

To achieve the most favorable outcome, it is critical to present the evidence and develop the case record. Our team has decades of experience representing businesses in administrative court.

After the hearing, a decision and order is rendered by the administrative law judge or Tax Commissioner, who presided over the case. Either party has 20 days to ask for redetermination is something was not considered. At the completion of the reconsideration process or directly after the formal hearing decision is issued, either party may seek judicial review of the decision. An appeal to Utah District Court, removes the case from the agency and gets you into judicial court.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Don’t Miss: How To Find Out How Much Property Tax I Paid