Causes For The Differences

Property taxes are based on two separate components: a home’s assessed value and the county’s tax rate. When a county includes a lot of high-priced real estate, it can affect median calculations, because a median figure is one that falls right in the middle. Additionally, tax rates are percentages of value. A county might have a 0.25% property tax rate, but 0.25% of $1 million works out to a lot more than 0.25% of $100,000.

Areas with steep real estate values naturally rank higher in annual property tax bills than those where moderately priced real estate is more the norm, and those counties need revenue to keep themselves up and running.

Revenues raised from property taxes typically pay for things like schools, parks, libraries, transportation infrastructures, police departments, and fire departments.

Although some states have very low property taxes, they tend to make up for this lack of revenue in different ways, such as higher personal income tax or sales tax. So, you can blame the economy in your area, at least in part, if your county or state made the list of the most expensive.

States Without Property Taxes

Owning property in any of the states plus the District of Columbia always comes with a tax burden. Those who were hoping to find states without any property taxes will be disappointed. Property tax isnt like corporate tax, as we know that six states have no corporate income tax whatsoever. There are, however, several states with no property tax for seniors.

Some states offer exemptions and breaks for disabled people and/or disabled veterans. These regulations vary, so its best to check official state websites for more information on them.

States With The Lowest Average Effective Property Tax Rates In 2022

Property taxes are determined at a local level, not the state level, so different communities in a state can have different property tax costs. To get the bigger, statewide picture of each states property tax costs, we looked at its average effective property tax rate which is based on the average cost of owner-occupied residential property taxes paid across all communities.

Credit Karma found this data in the U.S. Census Bureaus 2020 American Community Survey.

Note that theres a tie for third and fifth place for states with the lowest average effective property tax rates.

| Rank | |

|---|---|

| South Carolina | 0.566% |

Hawaii is the real surprise on this list because it typically ranks as a pretty expensive state, especially in terms of the cost of property. In our study on the cheapest states to live in, Hawaii came in as the most expensive state for average Zillow home value, average rent and cost of living.

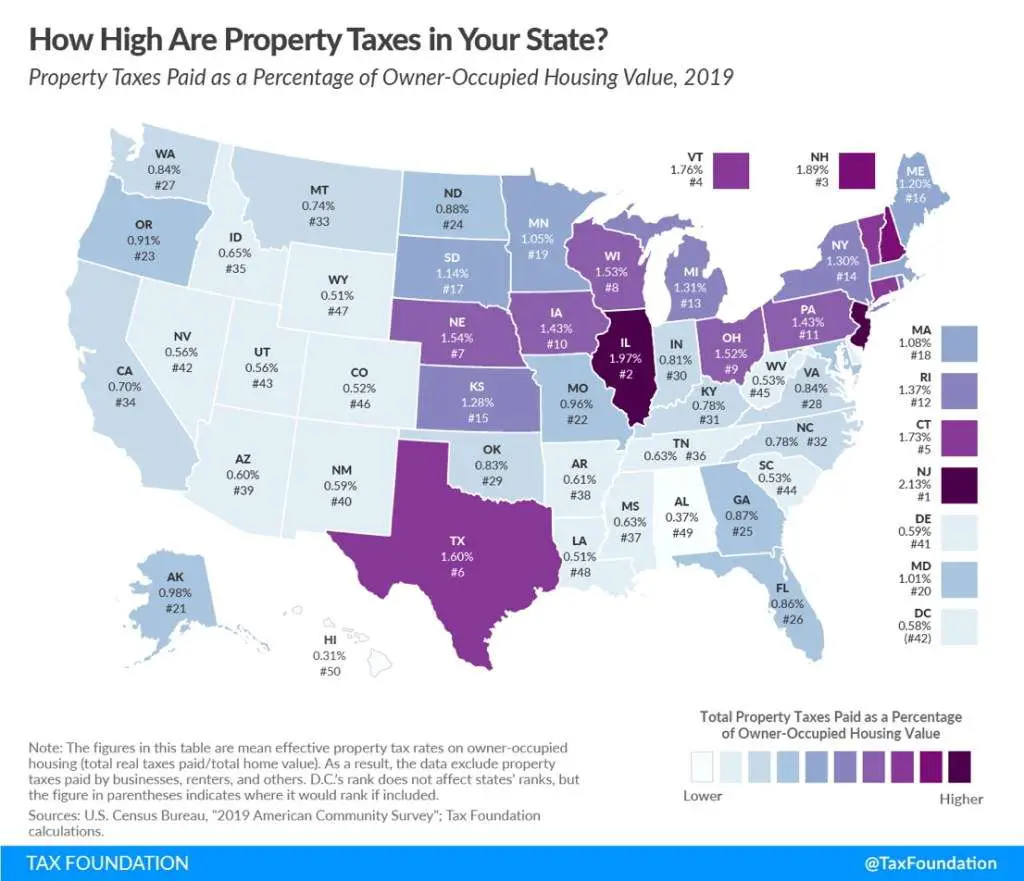

The state with the highest average effective property rate is New Jersey at 2.47%, followed by Illinois at 2.24% and Connecticut at 2.13%.

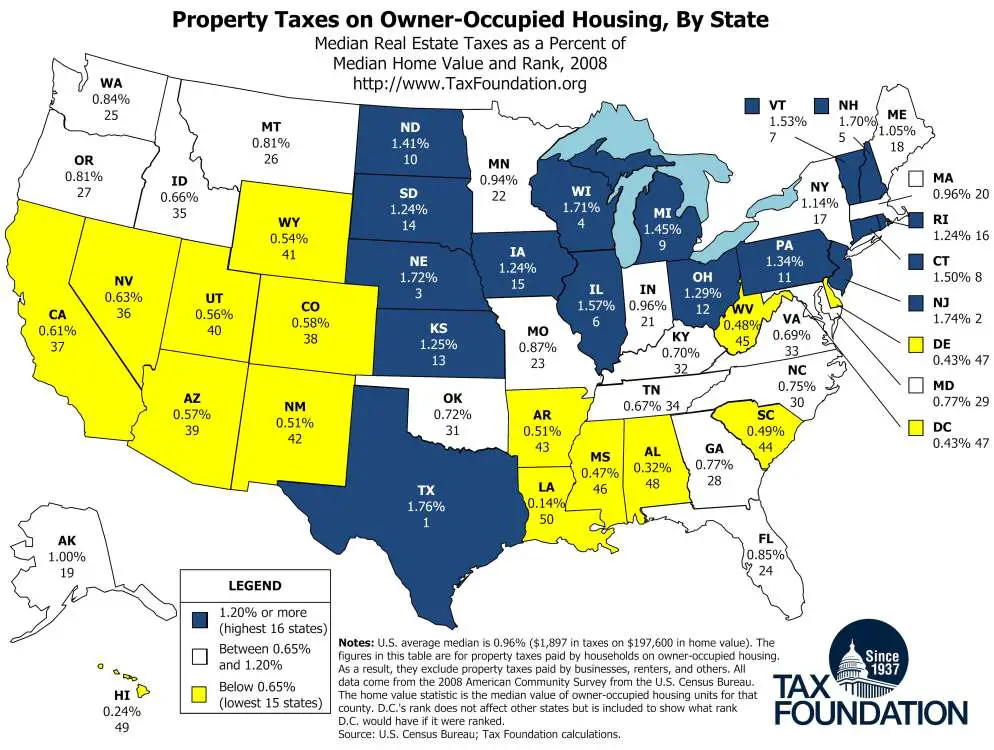

The map that follows shows the average effective property tax rate for each state, along with its rank. Theres a little cluster of higher average effective property tax rates in New England. Texas and Nebraska also make the list of top 10 most expensive states in terms of average property tax rates.

You May Like: Am I Eligible For Child Care Tax Credit

Per Capita Property Tax

D.C. leads the way in the property tax per capita by state category with $3,500. New Hampshire and New Jersey, naturally, follow with per capita property taxes of $3,310 and $3,277. Connecticut is the only other state whose per capita property tax by state is over $3,000 . Alabama, Oklahoma, and Arkansas have the lowest property tax per capita. In Alabama, the per capita amount paid is only $582, while in Oklahoma and Arkansas, its $731 and $741, respectively.

Highest Property Tax #: Vermont

Can maple syrup and Ben & Jerrys ice cream sweeten the sting of Vermonts high property tax rate? Vermonters pay 1.90 percent in property taxes, and the average home costs $227,700 which comes out to annual property taxes of $4,329. Still, the state ranks fairly high in quality of life, somewhere between eleventh and fifth in the nation, depending on which survey you consult. Low crime and unemployment rates, a healthy, educated population and inclusive laws are among the factors that offset its relatively high cost of living.

Read Also: When Can You File Your Taxes

States With The Lowest Property Taxes

The 10 states with the lowest property taxes are an interesting mix geographically-speaking. Five out of the 10 states are located in the U.S. South region, as designated by the Census Bureau. Four out of the 10 states with the lowest property taxes are located in the U.S. Mountain division. And one state is located in the Pacific division. Below is a breakdown of the 10 states with the lowest property taxes:

Median real estate taxes paid: $1,788

Owner-occupied median home value: $636,400

Effective property tax rate: 0.281%

Lowest Property Taxes In The Us

Perhaps surprisingly, Hawaii charges the cheapest property taxes in the US, at least by tax rate. Of course, they also feature some of the highest property values in the country, so a low tax rate still yields a hefty total sum. The ten states with the lowest property taxes in the US are:

If you want to include Washington DC, it would have landed in the #8 slot with property taxes charged at 0.58% of property value.

But the list looks different when you order it by the lowest total property taxes collected for the median property owner:

Many of these states with the lowest property taxes overlap. Alabama, West Virginia, Louisiana, Arkansas, South Carolina, Wyoming, and Mississippi all rank among the states with the lowest property taxes regardless of whether you rank by tax rate or total property taxes collected for the average property.

But some states fall at the opposite end of the spectrum when you look at the total average property taxes collected.

Don’t Miss: How To Buy Tax Forfeited Land

What States Have No Property Taxes 2022

States with no property taxes may sound like a dreambut thats because, unfortunately, it is one. There is no state in the U.S. that has no property taxes, largely because states actually need taxes to fund critical initiatives.

Property taxes help fund schools, fire and police departments, water districts, and libraries, all of which makes states and their citizens need for public health and safety.

How Property Taxes Are Calculated

When it comes to calculating property taxes for a certain area, this process starts with an assessor evaluating all the properties within the municipality. Next, the local government establishes the amount of money that is to be raised by the property taxes. Then, the property tax rate is calculated and finally, each property owner receives a bill.

How property taxes are calculated can vary depending on state or local government. Some governments choose to tax property by imposing a rate or millage on the fair market value of the property. Others impose property tax by a percentage of the market value of a home.

Read Also: Do I Need Previous Year’s Tax Return To File

Raise Concerns With The Tax Assessor

A tax assessor is the person in charge of appraising properties and gathering information to establish the property taxes. The assessment relies on the property age, lot size, location, and features of the house. Homeowners interested in learning more about their property assessment can request further information from the county clerk. They should be able to provide assessment material from years prior as well. If you notice any inconsistencies, be sure to alert the county assessor. In most cases they will be able to conduct a new assessment and fix any areas if there are any. When successful, this can result in a lower property tax bill.

South Carolina And Delaware

Tied for the next slot on states with the lowest property tax rates are South Carolina and Delaware. Both of them have an effective state property tax rate of 0.56%. Delaware also has no sales tax and a higher income rate than South Carolina. However, South Carolina has cheaper homesby as much as $80,000 less on average!

You May Like: Where Is My California State Tax Refund

Lowest Property Tax Rate #: Colorado

Coloradans pay just 0.51 percent in property taxes, but the median housing price is high, at $343,300, which translates to $1,756 in annual property taxes. The Mile High State also rakes in revenue from taxes on legalized marijuana, which brought in $387 million in 2020. Colorado ranked #16 in U.S. News & World Reports 2021 list of best states to live in, earning high marks for education and economy, but scoring lower for opportunity and fiscal stability.

Aggregate & Local Property Tax Stats

- 2020: In 2020 the average single-family home in the United States had $3,719 in property taxes, for an effective rate of 1.1%. This raised $323 billion in property taxes across the nation.

- 2019: In 2019 homeowners paid an average of $3,561, raising $306.4 billion.

- Local Data: ATTOM Data Solutions provides a county-level heat map.

Read Also: When The Last Day To File Taxes 2021

Check Eligibility For Property Tax Exemption

There are certain property tax exemptions available at the state and local level, depending on where you live. Thy are typically reserved for seniors, veterans, active-duty service members, and individuals with disabilities. If any of these apply to you, you can apply for an exemption with your county. Note that for some of these categories, there may be additional income requirements as well. In some situations, homeowners may be eligible for a complete exemption from property taxes.

States With The Highest Property Taxes

Next, well reveal the 10 states with the highest property tax rates in our country. Do you own property in one of the following states? If you have felt like your property taxes were high, this will validate your feelings. If your state didnt make it into this top 10 list, now you know that there are property owners out there paying much higher taxes than you are.

New Jersey: 2.49%

Pennsylvania: 1.58%

Take Note

Just as we covered by looking at the states with the lowest property taxes, the states listed above might be attractive to real estate investors for other reasons, such as a lack of income tax or low effective home values. Depending on the propertys location, homeowners might also qualify for property tax exemptions offered by local jurisdictions.

For example, homestead exemptions are tax breaks for certain portions of a homes value and are typically offered to those who meet age or income requirements following the death of a spouse or declared bankruptcy. Other exemptions exist as well, such as lower taxes for senior, disabled, or veteran homeowners. While these exemptions should be leveraged when possible, homeowners need to seek assistance if interested because they will not be automatically dedicated from their property taxes.

You May Like: Can You File Your Taxes For Free With Turbotax

Property Taxes By State

Depending on where you live, property taxes can be a small inconvenience or a major burden. The average American household spends $2,471 on property taxes for their homes each year, according to the U.S. Census Bureau, and residents of the 27 states with vehicle property taxes shell out another $445. Considering these figures and the massive amount of debt in America, it should come as no surprise that more than $14 billion in property taxes go unpaid each year, according to the National Tax Lien Association.

And though property taxes might appear to be a non-issue for the 36% of renter households, that couldnt be further from the truth. We all pay property taxes, whether directly or indirectly, as they impact the rent we pay as well as the finances of state and local governments.

But which states have the largest property tax load, and what should residents keep in mind when it comes to meeting and minimizing their tax obligations? In search of answers, we analyzed the 50 states and the District of Columbia in terms of real-estate and vehicle property taxes. We also asked a panel of property-tax experts for practical and political insight.

| $335,600 | $8,362 |

*$217,500 is the median home value in the U.S. as of 2019, the year of the most recent available data.

Highest Property Taxes In The Us

Which states charge the highest property taxes in the country?

The ten states with the highest property taxes in the US are:

Of the five states that charge the highest average property tax rates, two of them charge no income tax: New Hampshire and Texas. More on how property taxes fit in the larger state tax burden momentarily.

Again, percentage and dollar amount vary with the actual real estate prices in each market. By dollar amount, the ten highest property tax states read as follows:

The state with the highest property tax, New Jersey, charges more than double the average property taxes collected by the tenth most expensive state for property taxes, Maryland. Its probably not the only reason residents are moving out of New Jersey, but it certainly doesnt encourage them to stay.

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

You May Like: How To Fill Out Tax Form 8962

Highest Property Taxes #: Connecticut

The average cost of a home in Connecticut is $275,400, placing it above pre-pandemic housing cost averages across the U.S. Factor in the states hefty tax rate of 2.14 percent, and Connecticut homeowners pay an average of nearly $6,000 a year in property taxes. In exchange, they get high-quality health care and education the state ranks third nationwide in these indexes. But its high cost of living and a lack of affordable housing pull it down to the middle of the pack in terms of overall quality of life.

What Are Property Taxes

Property taxes, or real estate taxes, are paid by a real estate owner to county or local tax authorities. The amount is based on the assessed value of your home and vary depending on your states property tax rate. Most U.S. homeowners have to pay these fees, usually on a monthly basis, in combination with their mortgage payments. If you pay off your loan, you receive a bill for the tax from local government occasionally during the year.

The money used for the property tax goes toward the community. It supports infrastructure improvements, public services and local public schooling.

Also Check: Are Refinance Points Tax Deductible

Common Methods Look At Cost And Sales Comparison

Assessors that use the cost method, will look at how much the expense would be to the owner to replace a property in the event it were rebuilt from scratch. The structures depreciation in value and value of the land it is on are taken into account.

In a sales comparison, the assessor will judge your propertys value by comparing it to similar properties that have recently sold in the same area. Variables that could affect the value making the house more of less valuable than another will be used to adjust the assessment.

For commercial and business properties the tax assessor may use the income method. This estimate is based on how much income the property would bring the owner were it rented. Current market rental rates and operating expenses among other things are factored in.

Tax Rates.org provides an online property tax calculator that can give a ballpark idea of the tax bill that you can expect to hit with.

Ranking The Lowest Property Tax States

How much are you paying in property taxes? Depending on where you live, your property taxes may be modest, or they may actually be higher than your mortgage payment. If you’re feeling the property tax pinch, maybe it’s time to seek a little tax relief by moving to a less costly region. This list of the 15 states with the lowest effective property tax rates may inspire you to pack your bags and head southor to the islands.

Also Check: Can We File Taxes Now

Why Are My Property Taxes So Highor Low

While property taxes may be high in some states, lower home prices may offset this tax burden. For example, Illinoiswhich has the second-highest tax rate, at 2.27%has a low median home price of only $194,500, resulting in annual property taxes hovering around $4,419. Thats less than youd pay in other states with lower tax rates .

So what can you do if you live in a state with high tax rates and high home prices?

Unfortunately, living in the Northeast has become a very expensive proposition if you want to own properties, says Ralph DiBugnara, president of Home Qualified and senior vice president at Cardinal Financial. But homeowners should be aware of what they can write off when it comes to homeownership, especially in these high-tax areas.

In other words, in high-tax-rate states with pricy properties, the good news is that you are allowed to write off up to $10,000 of your property taxes. Just remember that this may not cover all of your property taxes it depends on how much your home is worth.

If your home is worth $500,000 or below, you should be able to write off all of your property taxes, says DiBugnara. But if your home value is above $500,000 and in a state with tax rates around 2%, most of the time this is not enough of a write-off to cover all of your property taxes.

This problem is typical in Northeast states. Still, any write-off is better than none, right?

Also weigh what your property taxes go toward when deciding where you want to live.