S To Check Outstanding Property Tax

How to check your outstanding property tax:

- Ask Jamie, your virtual assistant.

- Use the ‘Check Property Tax Balance’ digital service without having to log in to mytax.iras.gov.sg.

- Search using your property address and your tax reference number or your property tax reference number.

- Type in the verification code shown in the image.

- Select ‘Search for property’.

Use the property tax reference number to pay your outstanding tax via the various payment options available.

Alternatively, if you wish to check the details of your past payment transactions, you will need to:

31 Jan1 month from the date of notice

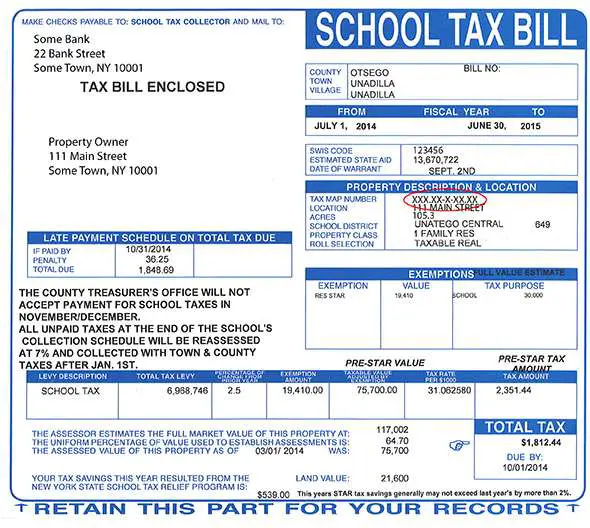

Assessment Vs Fee Numbers

Your tax bill shows both an assessment number and a fee number. Use of the ASMT number displays that specific tax bill only. The fee number will display all tax bills associated with this property, including supplemental tax bills and defaulted tax years. We recommend using the fee number for online payments.

To access your property tax information, only enter one “Search Criteria” in the corresponding row of the chosen field: assessment number, fee parcel number or property address. For questions about your property taxes, please contact the Tax Collector’s office at 707-253-4312.

If you do not receive a confirmation number at the end of your transaction, your transaction was not successful.

Treasury Services Are Currently Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Real Property Email:

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Personal Property Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson St.

I know my parcel/account number

Need additional information? Check our Frequently Asked Questions .

You May Like: What Is The 3600 Child Tax Credit

All Unpaid 2022 Property Tax Payments Are Now Past Due Pay Now To Avoid Further Charges

To review current amounts due please use the safe and secure online eCommerce System

What are Real Property and Personal Property Taxes?

- Real Property is residential or commercial land and structures

- Personal property is assets used in conducting a business

- Mobile homes and floating homes are taxed as personal property if not associated with a real property account

Many changes have been made to the property tax exemption and deferral programs for seniors, people with disabilities, and military veterans with a service-connected disability.

Be aware that the accuracy of the information you are accessing may be affected by pending payments or other changes. Therefore, King County Treasury Operations cannot warrant the accuracy, reliability, or timeliness of this information, and shall not be held liable for losses caused by using this information. Any person or entity that relies on any information obtained from this system does so at their own risk.

How Does Funding Schools Impact My Property Taxes

About one third of your property tax goes to funding education. The Legislature passed Engrossed House Bill 2242 in 2017, in response to a Supreme Court order to fund education. This bill makes changes to:

- property taxes imposed by the state.

- voter-approved property taxes imposed by school districts.

- state funding for certain school districts.

In 2018, the Legislature made additional changes to lower the levy rate for taxes in 2019.

Read Also: When Can You File Your 2021 Taxes

Important Electronic Payment Information

All credit card and eCheck payments will take 3 to 5 business days to process and post to your account. However, your payment will be posted as of the date of the online transaction. Before you begin the credit card or eCheck payment process, it is important to make the necessary modifications to your spam blocker to allow the confirmation e-mail to be sent to you. Once you receive the e-mail confirmation, you can go back and enable your spam blocker. You may also include the to your authorized list of senders.

If you should have any questions or concerns, please feel free to contact the Office of the Tax Assessor-Collector during our regular business hours at 210-335-2251.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: How Much Is To Do Taxes

My Husband And I Are Co

Property tax is a tax levied on property ownership. The payment arrangement on the property tax payable is a private matter to be settled among the property owners. If one of the owners has made payment, the co-owner is not required to make another payment for the same property.Both owners will be able to view the same amount in myTax Portal as it is tied to the same property.

How Do I Get My Missouri Personal Property Tax Receipt Online

Please visit http://revenue.stlouisco.com/Collection/ppInfo/ to print an official personal property tax receipt. Search by account number, address or name, and then click on your account to bring up the information. Once your account is displayed, you can select the year you are interested in.

Don’t Miss: Is Memory Care Tax Deductible

What Is Personal Property Tax In Missouri

Missouri law sets the assessment ratio for personal property at one-third of true value throughout the state. Real properties classified as commercial and industrial, are assessed at 32 percent residential, 19 percent and agricultural, 12 percent of true or fair market value.

Property Id Number Availability Exceptions

If you hit a snag when searching for a new property tax ID number, you may be unable to find it because your assessors office has not yet assigned it. Processing times vary, and some government offices may set aside the task of assigning new numbers for a month or two during tax preparation season or other high-volume workload times. Another reason for a delay in obtaining a new property tax ID number occurs when the owner of two or more contiguous parcels requests a single parcel number instead of multiple numbers for each property.

Existing property tax ID numbers may be changed from time to time because of lot line adjustments, property map page layouts and land divisions . Even if you call your tax assessors office for the latest property ID number for a particular parcel of land, the staff may not have this information yet.

Read Also: What To Take To Get Taxes Done

Look Up Your Property Tax Bill

Use multcoproptax.com to look up your property tax bill/statement. You can view copies of your bill back through 2018. You can see property value and tax information back through 2008. To get a copy of your bill before 2018, contact Customer Service via phone, email, or chat.

Local Property Appraisal And Tax Information

The Comptroller’s office does not have access to your local property appraisal or tax information. Most questions about property appraisal or property tax should be addressed to your county’s appraisal district or tax assessor-collector.

Appraisal districts can answer questions about:

- agricultural and special appraisal

County tax assessor-collector offices can answer questions for the taxing units they serve about:

- payment options

- other information related to paying property taxes

Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit.

This directory contains contact information for appraisal districts and county tax offices and includes a listing of the taxing units each serves. Taxing units are identified by a numerical coding system that includes taxing unit classification codes.

This directory is periodically updated with information as reported by appraisal districts and tax offices.

Also Check: How To Avoid Capital Gains Tax On Cryptocurrency

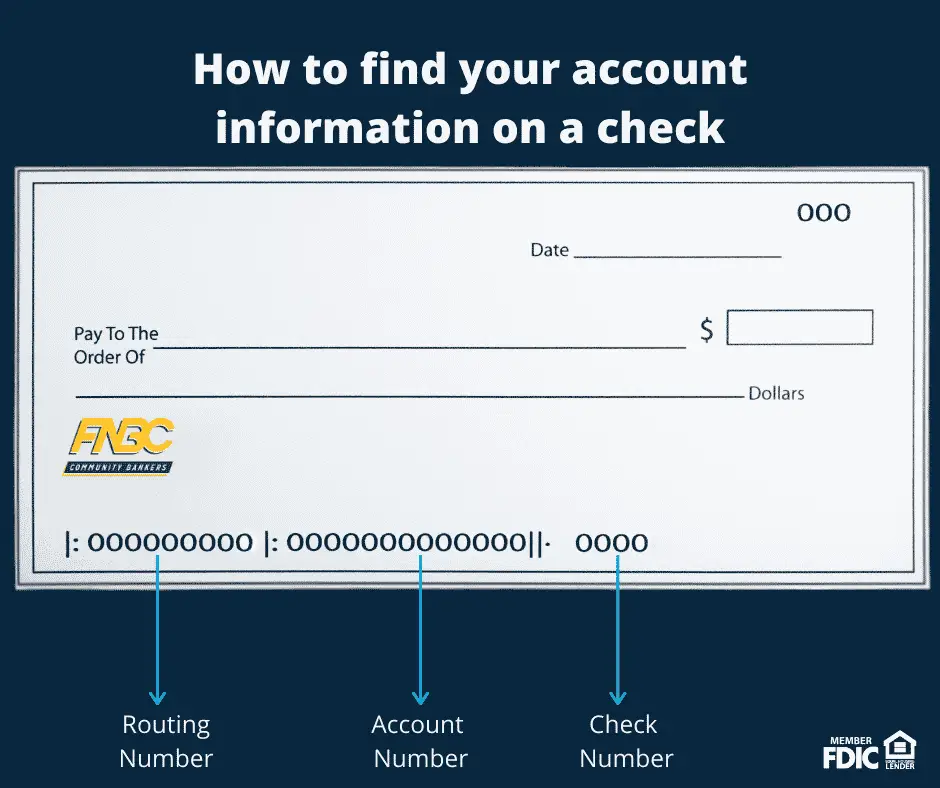

Bank Or Financial Institution

You can pay your property taxes through the bank, credit union or other financial institution you have an account with. When you use your bank or financial institution, we recommend that you always confirm when your payment will be processed by your bank to avoid late payment penalties. For example, banks will often process payments received in the afternoon with the date of the next business day.

There are three ways you can pay your property taxes through your bank or financial institution:

Note: You can no longer make a payment at a financial institution you dont have an account with.

Bill payment service

Most banks and financial institutions offer bill payment services for their clients. Bill payment services can generally be accessed through your online banking account, an automated teller machine , telephone banking or in person with a teller at the financial institution that you bank with.

Note: When you pay in person, you need to set up a bill payment service for Rural Property Taxation before you pay with a teller.

To pay your property taxes using a bill payment service you’ll need to add a payee for Rural Property Taxation to your bank account. To add a new payee to your bank account you need to know our payee name and your folio number.

- Our payee name is PROV BC – RURAL PROPERTY TAX

- Your folio number is listed on your Rural Property Tax Notice. It must be entered without spaces or decimals. For example, 012 34567.890 must be entered as 01234567890

Wire transfer

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: Can You Still File Taxes After Deadline

Online Credit Card Payments

Credit card payments may be paid through JetPay, the authorized agent of the Bexar County Tax Assessor-Collector. There is a convenience charge of 2.10% added by JetPay to cover the processing cost. To pay with a major credit card, you must have your 12 digit tax account number and your credit card number. Payments may be made by calling 1-888-852-3572 or online.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Also Check: How Much Property Tax Can I Deduct

About The Personal Property Tax

The Personal Property Department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. The value of your personal property is assessed by the Assessor’s Office. These tax bills are mailed to citizens in November and taxes are due by December 31st of each year.

The Personal Property Tax Department can print personal property tax bills, tax receipts, and assist taxpayers with their inquiries pertaining to personal property tax payments. Only the Assessor’s Office can change the vehicles or addresses on a personal property tax bill.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Don’t Miss: How Are Tips Taxed On Paycheck

Finding Property Tax Id Numbers

If the ID number you need to find is for a property you own, you may already have the number in your files. Look on your last tax bill, the deed to your property, a title report or perhaps even on the appraisal report of your property to locate the property ID number. If you cant readily put your hands on any of this paperwork, or if the ID number you need to find is for a property you do not own, you have other search options.

Visit your local tax assessors website and search for the property by its address or, in some cases, the owners name. For some municipalities, you may also find this information on record at your courthouse. If youre unable to find the property ID number with these searches, call the tax assessors office for this information.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

You May Like: How To Pay Your Federal Taxes Online

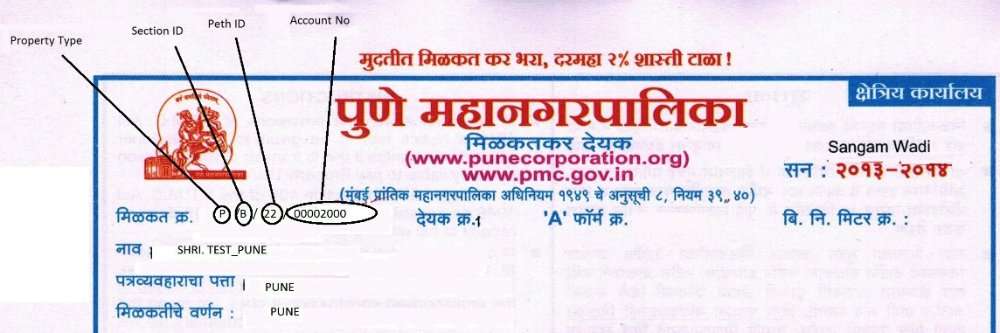

How Do I Find My Personal Property Tax Account Number

- Your property account identification number is located above your name and address on your assessment notice. Look for the information in the following format: In the example above, the property account indentification number consists of the county code 01, the assessment district 02 and account number 123456.

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Don’t Miss: How To Get Entirely Tax Free Retirement Income