Can I Use Free Tax Filing Software For Self

Self-employment earnings may be one of the more common reasons tax preparation gets complex, since there is only the self-employed taxpayers receipts, and annual information may be built from scratch at tax time.

However, because self-employment income is so common, it is covered in a T1 federal tax return, which Canada Revenue Agency-approved software covers, so it may be possible to declare self-employment income with some free packages including TurboTax Free.

Earn It Keep It Save It

This coalition of statewide partners offers free tax preparation and free online DIY tax prep to certain low-income taxpayers. See UtahTaxHelp.org.

This website is provided for general guidance only. It does not contain all tax laws or rules.

For security reasons, TAP and other e-services are not available in most countries outside the United States.Please contact us at 801-297-2200 or for more information.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Read Also: Restaurant Tax In Philadelphia

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Choose Software That Allows For Refund Optimization

Unlike our neighbours to the south, here in Canada theres no such thing as filing jointly with a spouse or domestic partner. However, using whats known as refund optimization, you can reduce your overall tax bill by playing with certain credits and deductions in a way that will benefit you as a couple. Contributed $200 to a Save The Pigeons charity? Either one of you will be able to claim the deduction but it will likely save you more if its reported in one spouses return. The software you choose should be able to link your return with your spouse/domestic partners and tell you where it makes most sense to include deductions like these.

Don’t Miss: Do You Pay Taxes On Plasma Donations

Free Tax Software In Canada

Here are some of the tax software certified by the CRA for NETFILE tax return submissions. They all offer free options to file your taxes and some have paid versions as well.

Typically, the free version can handle most tax situations. However, the software provider may have restrictions based on your income level and there may be limited to no phone or email support available.

My general advice is that if you are in doubt, start with the free version and only upgrade if required.

Make Sure It Has An Auto

Unless youre the kind that simply cant live without hours of manual data entry, look for a provider with an auto-fill option. Most will offer the auto-fill ability, which, once youre signed in, will automatically fill in the parts of your return that the CRA has access to, like your T4 reported income for instance. This greatly simplifies the process, so make sure the software you choose offers it.

Read Also: How To File Income Tax

Benefits Of Filing Your Taxes Online Using A Tax Software

The benefits of filing your taxes online as opposed to completing the paper forms and mailing to CRA are:

A. Faster Refunds: Electronic submissions result in faster refundsoften in as few as 8 business days.

B. User-friendly: Online tax software are generally user-friendly and they guide you through the process so you dont need to be a tax expert to file your own return. They also keep your previous tax returns on file for several years, making it easy to retrieve them if needed.

C. Cheaper: Compared to the cost of an accountant helping you out, online tax software can be free or much cheaper.

D. Improved Accuracy: NETFILE-certified tax software can use the Auto-fill My Return service which automatically fills part of your tax return. Combine this with the accuracy guarantee and automatic calculations provided by the software, and your chances of submitting an accurate return increase.

If you plan to file your taxes electronically, ensure that the tax software is:

- Certified by the CRA

- Has adequate security in place to protect your personal information

- Easy to use and compatible with your devices

- Affordable or free

For the 2021 tax-filing season , we recommend going with TurboTax. For a pay-what-you-want option, you can also try Wealthsimple Tax or H& R Block.

Free Federal And Select State Tax Returns For Individuals On A Strict Budget

TaxACT offers free federal tax filing for a wide range of individuals such as filers claiming dependents, unemployment income, college expenses, or retirement income. It’s one of the services approved for free tax filing by the IRS. To qualify for the service, you’ll need to be 56 years old or younger with an adjusted gross income of less than $65,000, or military personnel with an income under $73,000.

In addition to complementary federal filing, TaxACT provides free state tax returns for: AR, AZ, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NH, NY, OR, RI, SC, VA, VT, and WV.

Using TaxACT is fairly simple. You can manually import your information or import PDF files from other services such as H& R Block or TurboTax. There’s a glossary with over 300 terms in addition to TaxAct Alerts that ensure accuracy to help you avoid an audit. TaxACT guarantees your return is correct for up to $100,000. And although it’s free, you can access your returns for up to seven years.

TaxACT Free Edition Advantages

-

Free state and federal tax returns: Besides the federal income tax filing, you can file state taxes for free for 23 states.

-

Guided filing: Follow the platform’s step-by-step process to ensure accuracy and make sure you didn’t miss a deduction.

-

Free mobile filing: You can also file for free using the TaxACT Express mobile app for your Android or iOS smartphone or tablet.

Also Check: Doordash 1099 Example

I Traded Stocks And Crypto Last Year Can Wealthsimple Tax Handle Calculations Like Capital Gains Or Losses

You bet Wealthsimple Tax can be an easy and seamless solution for investors. Link your Wealthsimple accounts to have your trades on stocks and crypto sorted automatically even if you hold crypto in other places. Check out our Help Centre for more details and the full list of supported exchanges.

Is It Safe To File My Taxes Online

Maybe youre nervous about filing your taxes online. Rest assured that at TurboTax, security is built into everything we do. We use multi-factor authentication, data encryption, and data safeguards to make filing your taxes online safe. Learn more about security at TurboTax.

As well as ensuring that weve taken every security precaution in our products, TurboTax Free connects securely with the government through CRAs Auto-fill my return to import your data into your return and submits your electronic return if you file online through the CRAs NETFILE service. For an additional layer of security when you file online, learn about using the CRAs new NETFILE Access Code to authenticate your identity when you submit your taxes this year.

You May Like: License To Do Taxes

Investigate The Type And The Quality Of The Support You Can Expect

Support might be more important to some taxpayers. Freelancers or those with more complicated tax situation, like those with multiple sources or income like rental or investment income, may feel that they require a bit more hand holding. Some free tax filing services offer phone support for an additional fee. While most free or pay what you like services do not offer human telephone support, they may offer email or chat support. There will likely be striking differences between the quality of both telephone and email support of the various companies. Before choosing, find a software that hires staff thats well versed on Canadian taxes and able to communicate with you in your native tongue, whether its English, French, or Chinese during tax season, some tax preparation software companies staff up with seasonal helpers thousands of miles from Canada, who, no fault of theirs, arent exactly the ideal correspondents when youre white knuckling through your return. So check their website or reach out to any prospective service and get the lowdown on their support. Keep in mind some totally free tiers will offer limited support and you may have to pay additional fees for additional support.

While wait times may be long , the CRA provides a toll free number for individual tax enquiries: .

Its Goal Is Accuracy And Max Refund For Tax Filers

It may seem odd at first to list Credit Karma as one of the best free tax software since most folks associate them with free credit scores. But it is true: Credit Karma offers a free, online tax preparation program now called Cash App Taxes. To start, you must .

Unlike other free tax filing software that may charge for state returns or certain deductions, Cash App claims there are no restrictions. You can file state or federal taxes for free regardless of the deductions or credits you choose.

-

High customer ratings: Nearly four million returns have been filed with an overall rating of 4.8 out of 5 stars.

-

Totally free: There are no hidden fees or restrictions, regardless of state or federal filing or the deductions and credits you choose.

-

Tax calculator: You can estimate your tax refund before downloading the app to file.

-

Faster refunds: Choose to receive your refund into Cash App to get it up to two days earlier.

-

Accurate: Cash App guarantees your tax filing is accurate and double-checks your return before submitting it.

- Maximum Refund Guarantee: You’ll receive the maximum refund you’re entitled to. Cash App will reimburse you up to $100 if you amended your tax refund with another service and received an additional refund.

Also Check: Do I Have To Pay Taxes On Plasma Donation

What To Do If You Made More Than $73000

If your gross annual income was more than $73,000 in 2021, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Read Also: Deductions For Doordash

How Do I Choose The Right Tax Preparation Method

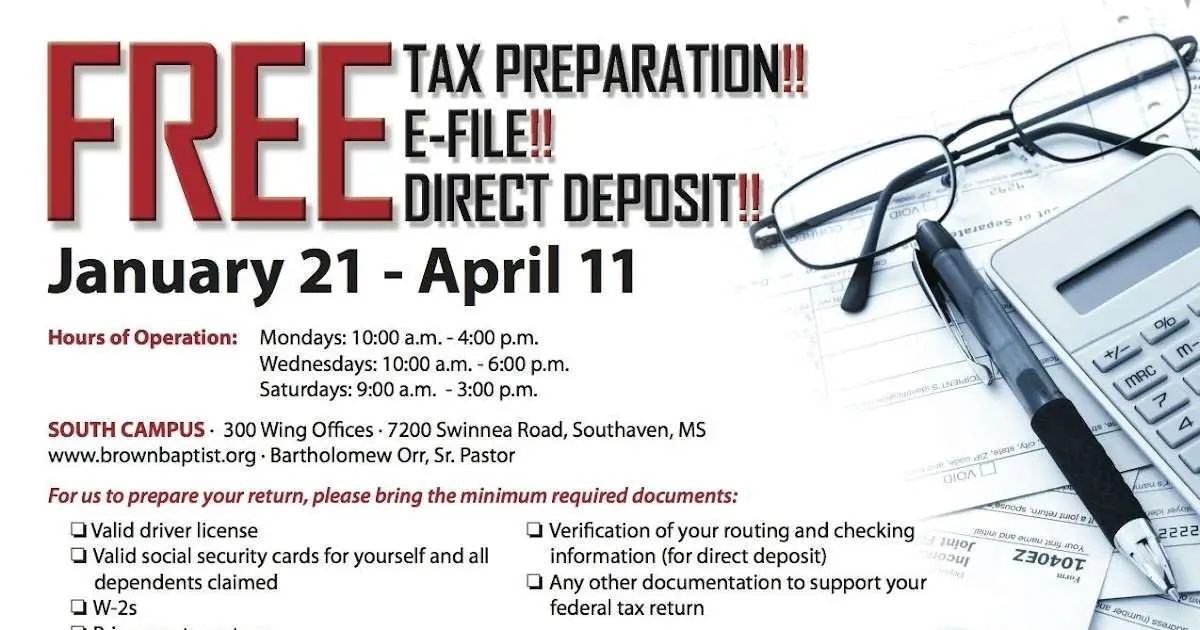

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Free Software Support For Self

Business income from self-employment is supported by most T1 return tax preparation products approved by the CRA for use with its Netfile electronic filing program. The CRAs approval process is a three-phase program and tests proposed software with an extensive array of tax scenarios. Software packages do not need to support every aspect of tax filing, and the CRA allows some omissions, though self-employment earnings are common, and many tax software products, including some free offerings, include form T2125 support. Self-employment income is omitted from some simple-tax-form free offers, so check the products you consider closely to be sure self-employment business income is supported.

Don’t Miss: Doordash Stripe 1099

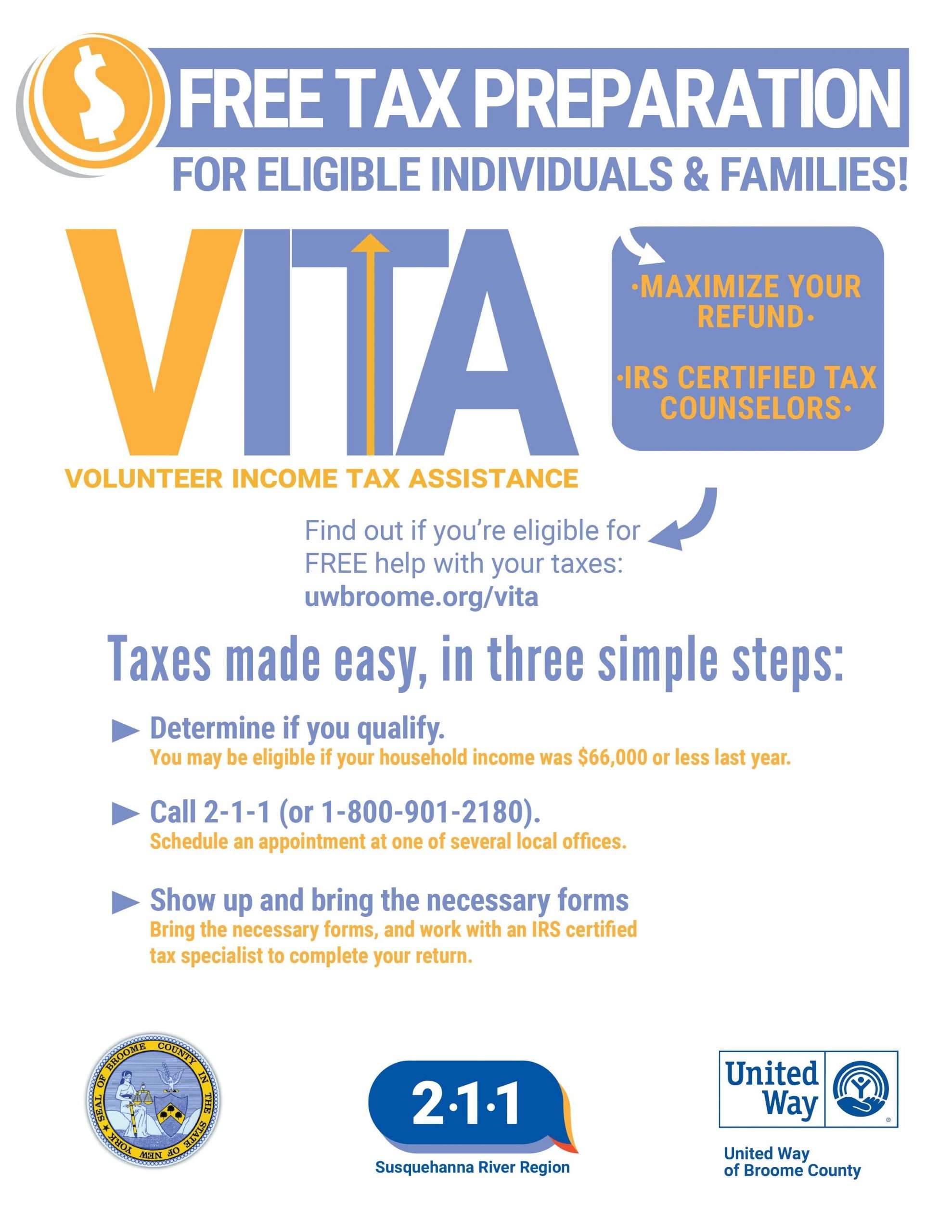

Free Tax Return Preparation For Qualifying Taxpayers

The IRS’s Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $58,000 or less

- Persons with disabilities and

- Limited English-speaking taxpayers

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are operated by IRS partners and staffed by volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

Choosing A Tax Professional

If you need to pay someone to prepare your taxes, make sure they have the appropriate level of skill, education, and expertise to accurately prepare your return. The IRS website has great resources to help you:

Determine what kind of tax preparer you need Check a preparers credentials File a complaint about a tax preparer

You May Like: Doordash File Taxes

When You Should Hire A Cpa Or Tax Pro

When should you hire a CPA or tax preparer, and when can you do your taxes yourself? A look at the costs, advantages, and disadvantages of hiring a tax pro.

As with auto repair, home improvement, and first aid, there are situations in which it makes sense to DIY and then there are situations that are better left to the pros. If you freelance or own a business, if you manage rental property, or if you have investments more complex than interest or dividend payouts, you can save yourself time and stress by finding a good tax professional.

Though a tax preparers services will likely cost you more than even the most expensive tier of DIY tax softwareCPA fees vary depending on where you live and the complexity of your returnyou get a lot of value from that higher price tag. Once you turn over your forms and documents, the pro enters your data for you, which not only saves you time but also prevents DIY errors. Plus, their pricing is often more up front than that of most online software, which usually tries to upsell you midway through the filing process. Building a relationship with a pro that you can count on for years to come is also invaluable.

Is Free Tax Software Really Free

Most tax services offer a limited free version for simple tax filings without too many credits or deductions. In many cases, the service only offers free federal taxes and state taxes have an additional fee. Freelancers or individuals with significant investments may also need to pay a fee for more complex tax filing.

Recommended Reading: How To Find Your Employer’s Ein

Best Free Tax Software 202: Free Online Tax Filing

Professional tax preparation services are great programs for those with complex tax filings. But many online programs offer free tax software for those with simple returns.

Tax filings and payments are due by Monday, April 18, 2022. That day is quickly approaching, and tax preparation takes time and careful attention. Understanding the tools available to you is important, too.

Using a tax preparation service or a professional tax preparer is great if you can afford it. But many people are unaware that there are free tax software options available online.

No matter how you file taxes, there is free tax software on the market that can help you get it done quickly and efficiently. Here is a look at some of the free tax software options that could help you during tax season.