Deduction And Employer Contribution Amounts

The amount of employee deductions and employer contributions will depend on the employees income. To find out how much you have to deduct or contribute you can call Canada Revenue Agency or visit them online to get a copy of the Payroll Deduction Tables. CRA also provides various forms that you and the employee will need to fill out before the employee is paid for the first time.

An employer is required to fill out special forms when reporting employee earnings. To report salaries, wages and taxable benefits, an employer is required to fill out a T4 form and give the employee their copy by the end of February of the following year. To obtain these forms and for more information call CRA.

Most employers are also responsible for paying the Employer Health Tax and Workplace Safety and Insurance premiums, which are calculated as a percentage of the businesss total payroll expense and are administered by provincial government offices. If you are starting a new business or hiring new employees for the first time, you should contact the Employer Health Tax Branch in your area and the Workplace Safety and Insurance Board to register your business and to find out how much tax you will have to pay.

Reporting Pay And Deductions

If you run payroll yourself, youll need to report your employees payments and deductions to HMRC on or before each payday.

Your payroll software will work out how much tax and National Insurance you owe, including an employers National Insurance contribution on each employees earnings above £175 a week.

Youll need to send another report to claim any reduction on what you owe HMRC, for example for statutory pay.

If Your Payment Is Less Than The Instalment Amount But There Is A Credit On Your Account

If the payment amount is less than the Installment Amount and there is a credit on the account as shown in the previous months statement , this credit will be added to the payment and displayed as one total in the Credit/Payment Applied column . The total payment amount will be displayed at the top of the Account Summary/Notice of Assessment .

Example 3

Don’t Miss: What’s The Deadline For Taxes

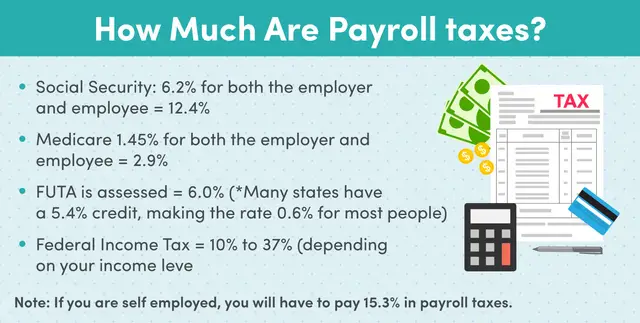

How Much Do Employers Pay In Payroll Taxes

So, how much is payroll tax? The cost of payroll taxes largely depends on the number of employees you have and how much you pay your employees. Why? Because payroll taxes are a percentage of each employees gross taxable wages and not a set dollar amount.

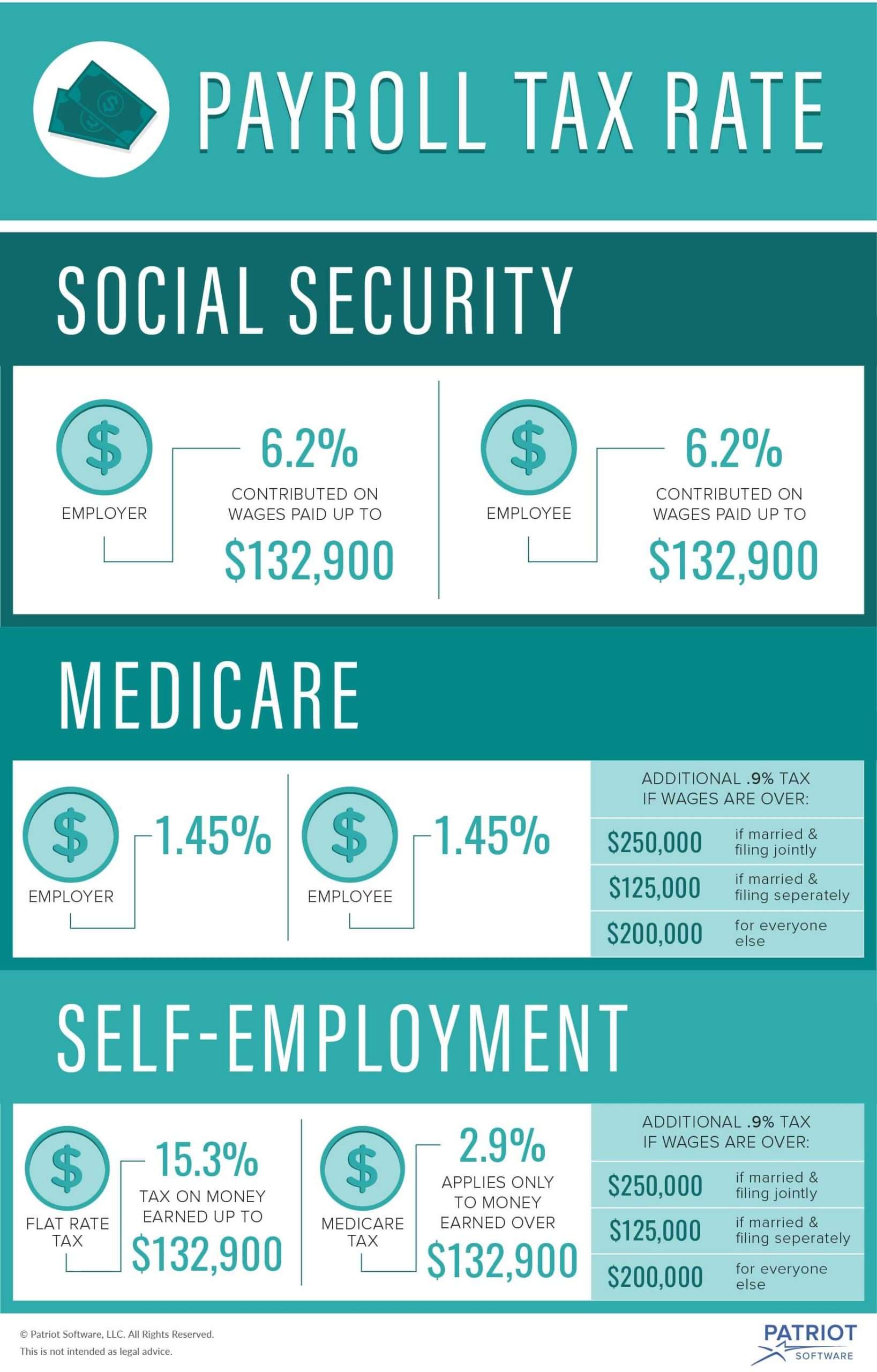

Payroll tax includes two specific taxes: Social Security and Medicare taxes. Both taxes fall under the Federal Insurance Contributions Act , and employers and employees pay these taxes.

Payroll tax percentage is 15.3% of an employees gross taxable wages. In total, Social Security is 12.4%, and Medicare is 2.9%, but the taxes are split evenly between both employee and employer.

So, how much is the employer cost of payroll taxes? Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare.

If you are self-employed, you must pay the entirety of the 15.3% FICA tax, plus the additional Medicare tax, if applicable .

Employees Of A Temporary

You may be the proprietor of a temporary-help service firm. Temporary-help service firms are service contractors who provide their employees to clients for assignments. The assignments may be temporary, depending on the clients needs.

Workers of these firms are usually employees of the firms. As a result, you have to deduct CPP contributions, EI premiums, and income tax from the amounts you pay them. You also have to remit these deductions and report the income and the deductions on a T4 slip.

If you or a person working for you is not sure of the workers employment status, either one of you can request a ruling to determine the status. If you are a business owner, you can use the Request a CPP/EI ruling service in My Business Account. For more information, go to My Business Account.

A worker can ask for a ruling by using the My Account service, at My Account for Individuals and selecting Submit documents and then You may be able to submit documents without a case or reference number.

For more information, see Guide RC4110, Employee or Self-Employed?

Don’t Miss: What Is The Tax Rate On Unemployment

How Do I Handle Independent Contractors Or Self

Independent contractors and self-employed individuals are not employees. However, employers should review the status of the worker to ensure that the individual is properly classified as an independent contractor. Businesses that engage them are not responsible for any employment taxes on payments made to them. These workers pay self-employment tax on their net earnings from self-employment , which is essentially the employee and employer share of FICA. If a self-employed person also has wages from a job, the wages are coordinated with the SE tax so that the wage-base ceiling can be properly applied.

If total payments to such worker in the year are $600 or more, the business must file an annual information returnForm 1099-NECto report the payments to the worker and to the IRS.

Automobile Standby Charge And Operating Cost Benefits

As a temporary COVID-19 response measure, if an employee used an automobile more than 50% of the distance driven for business purposes in the 2019 tax year, they will be considered to have used the automobile more than 50% of the distance driven for business purposes in the 2020 and 2021 tax year. For more information, go to Automobile and motor vehicle benefits.

Read Also: What Does Payroll Tax Mean

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that âemployee-paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees.

State and local payroll taxes are governed at the state and local levels, and payroll tax rates and rules vary by jurisdiction. To find out more about payroll tax in your state and local area, check out the Federation of Tax Administratorsâ list of each stateâs taxing authority.

Accommodation Or Utilities Provided By The Employer

If you provide accommodation or utilities free of charge, it is a taxable benefit to your employee. The method you use to determine the value of the benefit depends on whether or not the place in a prescribed zone has a developed rental market.

Places with developed rental markets

Some cities and towns in prescribed zones have developed rental markets. When that is the case, you base the value of the benefit for any rent or utility you provide on its fair market value.

The cities and towns in prescribed zones that have developed rental markets are:

Cities and towns in prescribed zones that have developed rental markets| Dawson Creek |

| Yellowknife |

Places without developed rental markets

In places in prescribed zones without developed rental markets, you have to use other methods to set a value on the housing benefit. The method you use depends on whether you own the residence or rent it from a third party.

If you provide both rent and utilities and can calculate their cost as separate items, you have to determine their value separately. Add both items to get the value of the housing benefit.

If your employee reimburses you for all or part of their rent or utilities, determine the benefit as explained below. Subtract any amount reimbursed by your employee and include the amount that remains in their income.

Accommodations you own

If you own a residence that you provide rent-free to your employee, report as a benefit whichever of the following amounts is less:

Note

Recommended Reading: Where Is My 2020 Tax Return

Municipal Officer’s Expense Allowance

A municipal corporation or board may pay a non-accountable expense allowance to an elected officer to perform the duties of that office.

For 2019 and later tax years, the full amount of this non-accountable allowance is a taxable benefit. Enter it in box 14, Employment income, and in the Other information area under code 40 at the bottom of the employees T4 slip.

Situations Where You Are Not Considered To Have Collected The Gst/hst

You are not considered to have collected the GST/HST on taxable benefits provided to employees in any of the following situations:

- the property or services that give rise to a taxable benefit are GST/HST-exempt or zero-rated

- a taxable benefit results from an allowance included in the income of the employee under paragraph 6 of the Income Tax Act

- you are restricted from claiming an input tax credit in the situations described in section ITC restrictions for the GST/HST paid or payable on the property and services that give rise to the taxable benefit

- the property or services that give rise to a taxable benefit are supplied outside Canada

Example

You, as an employer who is a GST/HST registrant, would like to reward an employee for outstanding performance, and you have agreed to pay for hotel accommodations and three meals a day, for one week, in London, England. An amount will be included in the income of the employee as a taxable benefit. However, you will not be considered to have collected tax in respect of the benefit provided to the employee, since the supplies were made outside of Canada.

Also, if the taxable benefit is for the standby charge or operating expense benefit of an automobile or an aircraft, you are not considered to have collected the GST/HST on this benefit in the following situations:

Note

Recommended Reading: How To Avoid Capital Gains Tax On Cryptocurrency

Registered Retirement Savings Plans

Contributions you make to your employee’s RRSP and RRSP administration fees that you pay for your employee are considered to be a taxable benefit for the employee. However, this does not include an amount you withheld from the employee’s remuneration and contributed for the employee.

If the GST/HST applies to the administration fees, include it in the value of the benefit.

Payroll deductions

Contributions you make to your employee’s RRSPs are generally paid in cash and are pensionable and insurable. Deduct CPP contributions and EI premiums.

However, your contributions are considered non-cash benefits and are not insurable if your employees cannot withdraw the amounts from a group RRSP before the employees retire or cease to be employed.

Although the benefit is taxable and has to be reported on the T4 slip, you do not have to deduct income tax at source on the contributions you make to your employee’s RRSPs if you have reasonable grounds to believe that the employee can deduct the contribution for the year. For details, see Chapter 5 of Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

Administration fees that you pay directly for an employee are considered taxable and pensionable. Deduct CPP contributions and income tax. These are considered a non-cash benefit, so they are not insurable. Do not deduct EI premiums.

Preparing For Employer Payroll Taxes When Hiring Employees

Before new hires start working, they typically fill out Form W-4 so that their employers can withhold the correct amount of federal income tax from their pay. They may also have to complete a separate withholding certificate for state income tax depending on the state. Some simply use the federal Form W-4 for this purpose and others dont collect income tax at all.

Read Also: How Long Should I Keep Tax Records And Bank Statements

Employee’s Allowable Employment Expenses

Your employee may be able to claim certain employment expenses on their income tax and benefit return if, under the contract of employment, the employee had to pay for the expenses in question. This contract of employment does not have to be in writing but you and your employee have to agree to the terms and understand what is expected.

Examples

- You allow your employee to use his personal motor vehicle for business and pay him a monthly motor vehicle allowance to pay for the operating expenses and you include the allowance in the employee’s employment income as a taxable benefit or

- You have a formal telework arrangement with your employee that allows this employee to work at home. Your employee pays for the expenses of this work space on their own

You have to fill out and sign Form T2200, Declaration of Conditions of Employment, and give it to your employee so they can deduct employment expenses from their income. By signing the form, you are only certifying that the employee met the conditions of employment and had to pay for the expenses under their employment contract.

It is the employee’s responsibility to claim the expenses on their income tax and benefits return and to keep records to support the claim.

For more information on allowable employment expenses, see:

- Automobile and motor vehicle allowances and select Facts about automobile and other vehicle benefits and automobile allowances

Chapter 5 Deducting Income Tax

As an employer or payer, you are responsible for deducting income tax from the remuneration or other income you pay. There is no age limit for deducting income tax and there is no employer contribution required.

We have forms to help you determine how much income tax to deduct:

- Fishers fill out Form TD3F, Fishers Election to Have Tax Deducted at Source.

Don’t Miss: When Did The Child Tax Credit Start

Questions About Calculating Employees Paychecks

If its time to pay your employees, youre in the right place! Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Employers can use it to calculate net pay and figure out how much to withhold, so you can be confident about your employees paychecks.

We also have special calculators for bonuses, final payments, or any other situation that might arise for employers. Try out our payroll calculators above or read on for a great payroll overview.

Well go over the basics employers need to know below, but you can also use our payroll processing guide to find definitions, tax forms, and detailed instructions for calculating payroll on your own.

To run payroll, you need to do seven things:

The calculator above can help you with steps three and four, but its also a good idea to either double-check the calculator by using the payroll tax rates below, or save time and effort by using a reliable payroll service.

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

When using the Wage Bracket Method, there are two possible calculations: one for employees with a Form W-4 from 2019 or earlier, the other for employees with a Form W-4 from 2020 or later.

Employees with a Form W-4 from 2019 or earlier:

In IRS Publication 15-T, find the worksheet marked âWage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier.â

Check Form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Enter the employeeâs total taxable wages for the payroll period on line 1a. This includes any earnings an employee pays taxes on, including salaries and cash tips.

Use the amount on line 1a to look up the Tentative Withholding Amount. Find the table that corresponds to your payroll period and the marital status of the employee

Find the wage amount on the left side of the table. Once youâve identified the row, use the number of allowances the employee has reported on Form W-4 to locate the corresponding column. The cell where these two meet will give you the tentative withholding amount for this employee.

Take the tentative withholding amount from this table and input it on line 1b.

On line 2a, enter any additional amount to be withheld as reported on Form W-4

Add lines 1b and 2a to find the amount to withhold from the employeeâs wages and record it in line 2b.

Employees with a Form W-4 from 2020 or later:

You May Like: Do I Need W2 To File Taxes

When And How To Report The Gst/hst You Are Considered To Have Collected

You are considered to have collected the GST/HST, on a taxable benefit subject to the GST/HST, at the end of February in the year after the year you provided the benefit to the employee. This corresponds with the deadline for issuing T4 slips.

Include the amount of the GST/HST due in your GST/HST return for the reporting period that includes the last day of February 2022.

Example

You are a GST/HST registrant and have a monthly reporting period. Although you calculated the taxable benefits, including any GST/HST and PST, for each applicable pay period provided to your employees during 2021, you are considered to have collected the GST/HST on the taxable benefits at the end of February 2022. In your GST/HST return for the reporting period that includes the last day of February 2022, you have to include the GST/HST for the taxable benefits given to your employees in the prior calendar year on line 104 of your GST/HST return.

Note

If the GST/HST is for a reimbursement made by an employee or an employees relative for a taxable benefit other than a standby charge or the operating expense of an automobile, the amount may be due in a different reporting period. For more information, see Benefits other than automobile operating expense benefits.

Automobile benefits standby charges, operating expense benefit, and reimbursements

Example 1 Remitting the GST/HST on automobile benefits in a non-participating province

Standby charge benefit

$853.47