What Do I Do With My Pay Stubs

Keep your pay stubs for a year. Your employer will send you a W-2 form each year. A W-2 form says how much money you earned during the year. Your W-2 also says how much money your employer took out for taxes. When you see that your W-2 is right, you can get rid of your pay stubs for that year.

Shred your pay stubs before you throw them away. Your pay stubs might have your Social Security number on them. Someone could use that to steal your identity.

How Much Does Canada Take From Your Paycheck

On average, Canadian single workers had a tax rate of 23 in 2015. Compared to the OECD average of 24 for 2020, the US economy will grow by 2%. Consequently, the mean per capita income for an ordinary single worker in Canada after taxes and benefits is $76 per month. Compared with OECD average incomes of 75, their gross wage is 8%.

Canada Pension Plan Contributions

If you are 18 years old or older, but younger than 65, you are employed in pensionable employment, and you do not receive a CPP retirement or disability pension, your employer will deduct CPP contributions from your pay.

If you are at least 65 years of age but under 70 and you work while receiving a CPP or QPP retirement pension, your employer will continue to deduct CPP contributions from your pay, unless you elect to stop paying CPP contributions. You cannot elect to stop contributing to the CPP until you are at least 65 years of age. For more information, see Canada Pension Plan contributions for CPP working beneficiaries.

The CPP provides basic benefits when you, a contributor to the plan, become disabled or retires. In the event of your death, the plan provides benefits to your survivors.

Your employer will calculate how much CPP to deduct with approved calculation tools, using the annual CPP contribution rates and maximums.

Your employer remits these deductions to us, along with his or her share of contributions, through payroll remittances.

To get information on the CPP, go to Canada Pension Plan Overview.

Read Also: Www Aztaxes Net

The Tax Is Also Subject To An Income Cap

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

The Old-Age, Survivors and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

For both 2021 and 2022, the Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

How Your Federal Income Taxes Are Calculated

The actual amount of federal income tax thats deducted from your paycheck is based on your income and information from your W-4, such as whether you file as a single person or with your spouse, and whether youre claiming any dependents.

The calculation also takes into account the tax brackets your income falls into. Under Americas progressive tax system, chunks of your income are taxed at different rates.

These are the federal tax brackets for the taxes youll file in 2022, on the money you made in 2021:

- Income amounts up to $9,950 / $19,900 : 10%.

- Income amounts over $9,950 / $19,900: 12%.

- Income amounts over $40,525 / $81,050: 22%.

- Income amounts over $86,375 / $172,750: 24%.

- Income amounts over $164,925 / $329,850: 32%.

- Income amounts over $209,425 / $418,850: 35%.

- Income amounts over $523,600 / $628,300: 37%.

You May Like: Door Dash And Taxes

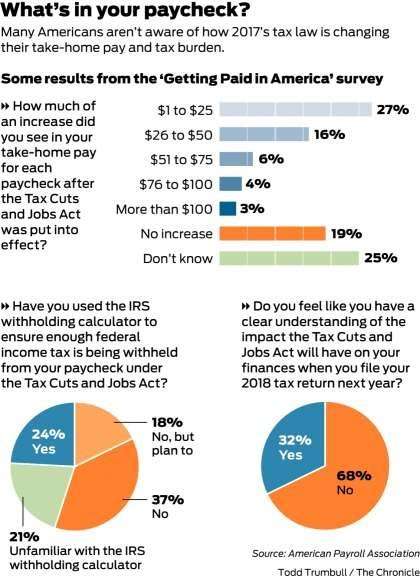

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

Summary Of Payroll Taxes

There are two types of payroll taxes: ones that come out of your own pocket, and ones that you just collect from employee paychecks and remit to the government.

Payroll taxes that come out of your pocket:

-

FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees. Review a CPAâs summary in just a 4 minute read.

-

FUTA tax: covers unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%. Get everything you need to know in a 9 minute read.

Payroll taxes that you just collect and remit:

-

Federal income taxes

-

State and local taxes

Weâll cover each of these in detail, beginning with federal income tax withholding, since itâs the most commonly asked about.

Read Also: Efstatus.taxactcom

Paycheck Deductions For $1000 Paycheck

Looking at a simple example can help clarify exactly how federal tax withholding works. For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62. In each paycheck, $62 will be withheld for Social Security taxes and $14.50 for Medicare . Depending on the state where the employee resides, an additional amount may be withheld for state income tax.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Also Check: Doordash Self Employment Tax

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

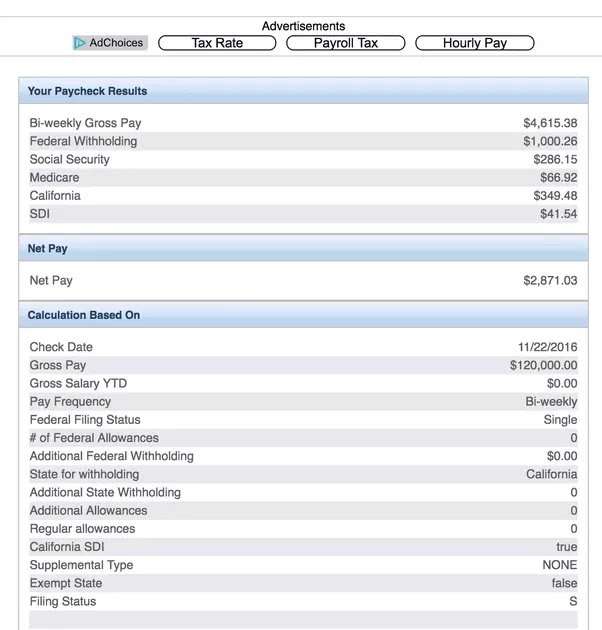

What Is A Paycheck Calculator

A paycheck calculator lets you know what amount of money will be reserved for taxes, and what amount you will actually receive. Generally, paycheck calculators will show the take-home salary for salaried and hourly workers they can also help calculate the amount of overtime pay will be paid out directly in your check.

To get the most accurate estimate, look at your pay stub, paying attention to withholdings for federal, state, and local taxes, FICA deductions for Social Security and Medicare, and any other deductions for health insurance, retirement, and flex spending accounts.

You May Like: Is Doordash Money Taxed

What Are Gross Earnings On A Paycheck

A pay stub also lists gross and net income to-date. This means you know exactly how much money you are taking home. This allows you to accurately and confidently plan your monthly and yearly budgets.

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form, which details your wages and taxes paid for the year.

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Recommended Reading: How To Get Your 1099 From Doordash

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

How Much Tax Is Taken Out Of $15 An Hour

What is $15 an hour annually after taxes? With the average single American contributing 29.8% of their earnings to income taxes, Medicare and Social Security, your average take home salary annually on $15 an hour after taxes will be $21,902.40. The exact figure will, however, vary depending on which state you live in.

Recommended Reading: Ein Reverse Lookup Free

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

How Do I Work Out My Tax

Remember that the tax year runs from 6 April one year to 5 April the next, for example, the tax year 2022/23 runs from 6 April 2022 to 5 April 2023.

Working out your tax position is basically a four stage process, which we set out in the tax basics section. In stages one and two, you have to work out your taxable income and any allowances or deductions you are entitled to.

In this employed section of our website, we provide further information on:

- stage two: reliefs and allowances

that relate specifically to employees.

For most people in employment, their only earnings income will be their taxable employment income, including non-cash benefits-in-kind. For most people in employment, their only allowances will be the personal allowance.

To work out your tax , you also need to understand at what rate your income is taxed and how much tax you pay through PAYE, so you need to be able to check your coding notice and understand your payslip.

You can read about tax rates on our page What tax rates apply to me?

You can read about how tax is collected through PAYE on the How is my tax collected? page.

You have to pay tax on any other taxable income that you have in the tax year too. So, if you have any other taxable income, you need to include this in your calculations.

Read Also: Doordash Tax Tips

How To Change Your Take

If you’re wondering what percentage of your paycheck is withheld for federal income tax and how you can adjust it it all comes down to Form W-4. To calculate how much you should take out of each paycheck, use aW-4 Withholding Calculator and try a few different tax scenarios to find what works best for you.

Thenew format for the W-4 form introduced in 2020 allows you to indicate how much money you earn from additional jobs or how much your spouse makes to set accurate withholding levels.

- Additionally, you can adjust forchild tax credits, credits for other dependents, and any other relevant tax deductions you plan to take in excess of the standard deduction.

You may be able to simply ask for an additional specific dollar amount to be withheld. The W-4 comes with a worksheet to help you calculate the amount you want to have taken out.

- If you enjoy the thrill ofa large refund, don’t claim any extra deductions or make adjustments for other credits.

- Conversely, the more credits and deductions that you specify, the larger your regular paycheck will be and the lower your refund will be.

Most tax experts advise you not to go for a large refund because that, in effect, means you’re giving the government an interest-free loan. Financial advisors typically recommend that you should maximize your paychecks andinvest the extra money throughout the year.

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Read Also: How Much Taxes Does Doordash Take Out

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

Don’t Miss: Doordash Tax Rate

Determining Federal Income Tax Withholding

The Internal Revenue Service expects taxpayers to pay taxes on wages at the time theyre earned. This is done through federal income tax withholding. The amount of federal income tax withheld varies by individual, based on the data in Form W-4, which all employees are required to submit to their employer.

The form includes information about whether a worker will file a tax return as married or single, the number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation. The IRS also provides a free online paycheck calculator to help determine the correct number of withholding allowances.