What Are The Car Mileage Allowance Rates For 2018 In The Uk

Employees that use their own car for business journeys can claim tax relief on the approved mileage rate. They cant claim separately for owning and running costs like fuel and MOTs, as the business mileage rate covers these expenditures. If they instead use a company car for business travel, they can claim on what theyve spent on fuel and electricity, providing accurate records are kept.

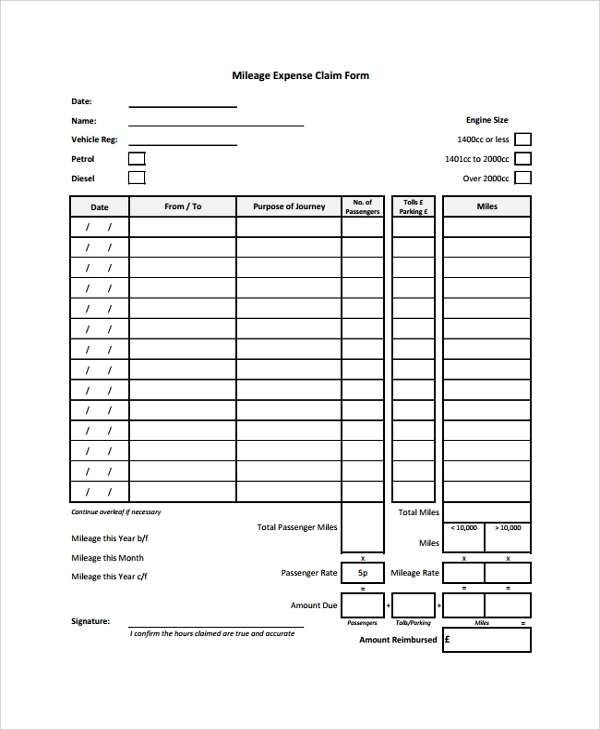

45p per mile is the tax-free approved mileage allowance for the first 10,000 miles in the financial year its 25p per mile thereafter. If a business chooses to pay employees an amount towards the mileage costs, these reimbursements are called Mileage Allowance Payments . If not, employees can claim tax relief through their Self Assessment tax return.

For an employee who travels with any fellow team members from the same business, the driver can claim tax relief. They can claim an additional 5p per mile passenger rate for each qualifying passenger. So, if five members of staff travelled together for business purposes, 65p per mile could be claimed .

Mileage Reimbursement Versus Mileage Deduction

It’s important to note the difference between mileage reimbursement and mileage deduction. A reimbursement is when an employer or client pays you a specific rate for the miles you drive. Mileage deduction is when you take a write-off for the miles driven on your annual tax return.

The IRS doesn’t require employers or clients to reimburse you for mileage. Many offer it as part of their benefits to maintain and attract workers, but there’s no mandated state or federal mileage rate for non-governmental employees.

Do You Drive For Work And Want To Know If You Can Claim Mileage On Your Taxes Business Mileage Driven For Work And Other Car Expenses Are Write

Driving your personal car for work is expensive. You have likely realized the expenses as a result of using your personal car for work just keep growing. Particularly the more you drive.And you likely ask yourself, can I claim mileage on my taxes?

The good news is you can write off mileage on taxes. The IRS provides a few methods for deducting mileage expenses.

In this article, we explain what business mileage is tax-deductible, and the different methods the IRS provides for business use car write-offs. Read to learn.

Don’t Miss: Pastyeartax Reviews

Motor Vehicle Expenses You Can Claim Related To Use Of A Motor Vehicle

When you use a motor vehicle to earn business income, you can then claim:

- license and registration fees

- money borrowed to buy a motor vehicle

- maintenance and repairs and

- leasing costs.

But , there is a catch. If you also use that same vehicle for personal use, you can only deduct the portion of the expenses above that are directly related to using your vehicle for earning income.

This means that to claim motor vehicle expenses, you need to know how many kilometers you have driven for business reasons and how many kilometers you have driven for personal use.

The cost of parking and supplementary business insurance for your vehicle are the exceptions to the you-can-only-claim-a-portion rule you can claim 100% of those expenses.

Hold On To Your Records

After you file your return, you may be required to submit documentation to the IRS to verify your mileage. Because of this, you should hold on to your records for a minimum of three years. Make sure to separate your records, receipts, and other documentation for each tax year to stay organized.

If you find that your records are taking up too much space, you might want to consider scanning your documents, using accounting software with built-in mileage tracking, or using another computer-based form of storage for future tax years.

Don’t Miss: How Do I Get My Doordash 1099

Choosing Standard Mileage Rate Or The Actual Expense Method

Whether you opt to deduct the standard mileage rate or use the actual expense method depends one which approach saves you more money. Your best bet is to spend one month tracking your vehicle expenses, as well as business mileage on your vehicle. Then do the calculations to find out what you can deduct using each method.

Do I Qualify For The Mileage Tax Deduction

In years past, many employees could take advantage of the mileage tax deduction to lower their tax liability. However, the passage of the Tax Cuts and Job Acts of 2017 changed this for many people, making it so that only the self-employed and employees in specific industries could take advantage of this deduction.

You can claim the mileage tax deduction on your income tax return if one of the following conditions apply:

- You own a small business

- Youre self-employed and file a Schedule C or Schedule F

- Youre an independent contractor

- You drive for a rideshare service

- Youre traveling for volunteer work

- Youre traveling for medical appointments

- Youre a qualified performing artist

- You work as a fee-based government official

- Youre a reservist in the armed forces

- Youre an active-duty military member that has moving expenses associated with a permanent change of station

Additionally, you will also need to determine what counts as business mileage. The following mileageis deductible:

- Travel from store, office, or another type of business location to other business-related locations

- Travel from your home to another business location if you work from a home office

- For rideshare drivers, trips driven between your first business stop through the last stop

The following mileage is not deductible:

- Travel from your home to your store, office, or other business location

- For rideshare drivers, the trip from your home to your first stop and the trip from your last business stop to home

Also Check: What Type Of Business Is Doordash For Taxes

Actual Expenses Vs Standard Mile Deduction

| Standard Mileage Deduction | |

|---|---|

| Calculated using the current standard mileage rate set by the IRS | Calculated using the costs to operate the car for business use |

| Cant write off vehicle expenses must use standard rate per mile driven for business use | Can write off expenses including gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation |

| Tracked using a mileage log | Expenses tracked using receipts and other documentation |

| Must be used the first year the car is placed into service | If chosen for the first year car is placed into service, it must be used every year following that the vehicle is in service |

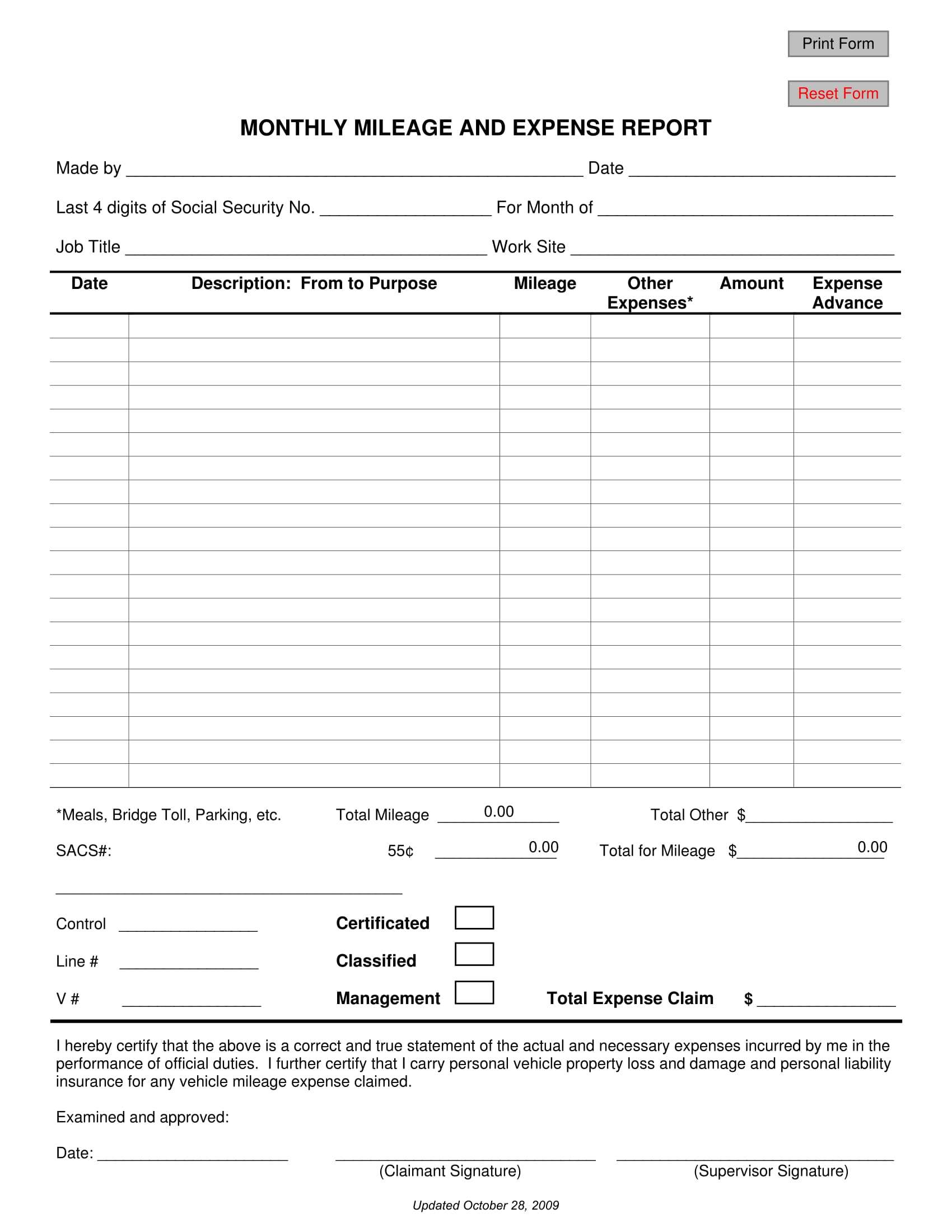

With the standard mileage deduction, you can deduct a set rate per mile when a vehicle is used for business purposes. This rate changes each year and is posted on the IRS website. You must own or lease the vehicle for which you are claiming the standard deduction. Mileage should be tracked using a mileage log.

The standard mile deduction is easy to calculate, which is why many taxpayers choose to use this option. However, in some cases, you may not be able to use the standard mile deduction. Per the IRS, you will be unable to use this option if any of the following apply:

To use the standard method, you must use it the first year that your car is put into service for your business. In subsequent years, you can continue to use the standard mileage deduction, or you can switch to the actual expenses method.

- Gas

- Registration fees

- Vehicle depreciation

Business Mileage For Self

Self-employed workers can deduct miles they drive in their personal cars for business. You cannot deduct the cost of driving into a regular office, but otherwise it doesnât matter if your going to meet a client or buy work supplies. You will need to claim your business miles as expenses in Part II of Schedule C.

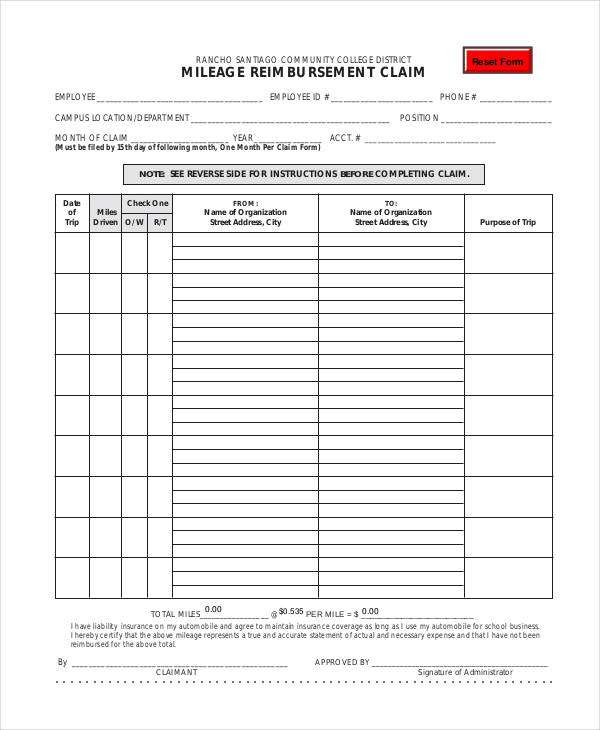

If you plan to get reimbursed for business miles, you need to keep a detailed mileage log. Without records, the IRS may not accept your mileage. Your log should include the dates, miles traveled, and reasons for all of your mileage. Ideally you can include odometer readings as further proof. This is a lot of work, but there are apps and services that make it easier.

Learn more about our best tax filing services for 2022.

Read Also: How Do You File Doordash On Your Taxes

Driving Down Taxes: Auto

OVERVIEW

Your car might save you a bundle come tax day, especially if you drive as part of your work. Knowing all of the auto-related deductions can ensure that your automobile is working as hard for you as you are for your paycheck.

You can make car expenses work for you. For many Americans, work and personal time have become increasingly intertwined over the years. While this certainly has its drawbacks, it can be a boon come tax time for those who must drive as part of their work. Knowing all of the auto-related deductions youre entitled to can ensure that your automobile is working as hard for you as you are for your paycheck.

The first thing an auto-using taxpayer needs to do is determine which of the two types of write-offs to use, said Julian Block, a Larchmont, New Yorkbased tax attorney who is the author of “Tax Deductible Travel and Moving Expenses: How to Take Advantage of Every Tax Break the Law Allows.” One type entails personal use of your vehicleusing travel deductionsand the other includes business use. People often do a little of both. “If you use your car exclusively in your business, you can deduct car expenses,” said IRS representative Sara Eguren. If you use your car for both business and personal purposes, you must divide your expenses based on actual mileage.”

Is There A Limit To The Number Of Miles You Can Claim

The IRS has no maximum amount of mileage you can claim as long as you can substantiate them.

However, there are a few red flags that will put you in trouble with the IRS including

- filing a round number such as 10,000 miles

- claiming 100% of all your mileage for business

- claiming an unusually high number of business miles

Also Check: Tax Preparer License Requirements

Medical Mileage Deduction: Everything You Need To Know

Ted He

What is a mileage deduction? This term essentially relates to mileage reimbursement the money you are legally entitled to scratch off from your total mileage.

Now, there are three main categories of mileage deductions: business, medical and moving, and charitable. In this article, were going to cover everything you need to know about IRS medical mileage deductions.

Related:Home Care Mileage Reimbursement Why Companies Should Care

Why Do You Need To Keep A Mileage Log

Without a mileage log, you have no way to prove how much driving was for business or personal purposes. This also means you cant claim this deduction.

There are several ways to keep track of your vehicle mileage, such as a notebook dedicated to just vehicle mileage or a spreadsheet. However, a mileage tracking app allows you to easily track this information in a streamlined manner. However you choose to maintain records, remember you must hold on to all of your business records, including logbooks, for no less than six years. To simplify this process, you can also take advantage of the CRAs simplified system for mileage deductions.

You May Like: Doordash Take Out Taxes

How To Log Mileage For Taxes In 8 Easy Steps

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you must drive as part of your job, you may be qualified to deduct the costs on your federal income tax return. If you qualify, get ready to document your travels as supporting evidence in the event your taxes are audited.

Mileage Allowance Relief Guide

Use your car as part of your job? You could be eligible to claim for mileage allowance relief.

Many people dont know they can claim mileage tax relief for some, or even all, of their work related journeys. It doesnt matter what your job is if you travel to different places of work, you could eligible to claim tax back on your mileage.

Use our free mileage allowance relief guide to find out if you can claim a mileage tax rebate and how to claim it back.

You May Like: How To Calculate Doordash Taxes

The Two Types Of Motor Vehicle Expense Claims

First, before you claim vehicle expenses, you need to understand that there are two types of motor vehicle expenses, broadly speaking, when it comes to income tax in Canada:

This article covers motor vehicle expenses relating to using a motor vehicle for business purposes.

in Part 6 on page 2 of Form T2125.)

Medical Mileage Deduction 101

Medical mileage deductions are most often related to your trips to the doctor, medical or dental. Since this category is very broad, the IRS made sure to make a list of deductible medical mileage .

Beginning on Jan. 1, 2022, the standard mileage rates for cars are as follows:

- 58.5 cents per mile driven for business use.

- 18 cents per mile driven for medical or moving purposes, up 2 cents from 2021.

- 14 cents per mile driven in service of charitable organizations.

Deductible medical expenses revolve around health insurance that is usually not covered by the employer, including both uncovered premiums and unreimbursed premiums. These costs include diagnosis, treatments, prevention, cure, or mitigation according to IRS standards.

Taking all this into account, the amount you would be able to save from medical mileage deduction is still pretty vast. That is the reason why the IRS subjected this category to adjusted gross income limitation .

Recommended Reading: Do You Have To Pay Taxes Working For Doordash

What Evidence Do I Need For A Mileage Claim

The type of evidence you need depends on a few factors which we will cover below.

The type of information needed varies from person to person a joiner travelling to different sites will need different records from a sales person who travels to clients and is paid a mileage allowance by their employer.

How Many Miles Can You Claim On Your Taxes

There is no limit to the miles you can claim when you file your taxes you can claim as many miles as you can substantiate. With that said, some claims raise a red flag with the IRS, including:

- Having a round number like 25,000 miles

- Claiming 100 percent of your miles for business

- Claiming an unusually high number of miles

Also Check: Is Selling Plasma Taxable

How Do I Submit A Mileage Claim

There are 2 different ways to submit a claim:

If you’re an employee and claiming less than £2,500: fill in a P87

Self-employed taxpayers, or employees claiming over £2,500: use the self-assessment system, this means submitting a self-assessment tax return

FreshBooks makes self-assessment easy for you in terms of record keeping and submission, whether you’re self employed or an employee.

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

You May Like: Look Up Employer Ein Number

Who Can Deduct Mileage From Their Taxes

You may deduct mileage from your taxes under two conditions. First, you need to itemize your deductions. You have two options when it comes to deducting business expenses: you may itemize your deductions and deduct each individual business expense, or you may take the standard deduction. The standard deduction for 2018 is $12,000 for single filers or $24,000 for married couples filing a joint return. If you choose the standard deduction, you may not also deduct your mileage.In addition to forgoing the standard deduction, you must also drive for a business purpose. You may deduct mileage if you fit into one of the following categories: