What Is The Minimum Sales Tax In Monterey County

9.25%The minimum combined 2021 sales tax rate for Monterey, California is 9.25%. This is the total of state, county and city sales tax rates. The California sales tax rate is currently 6%. The County sales tax rate is 0.25%.

What is the sales tax in Monterey?

Monterey, California sales tax rate details The California sales tax rate is currently 6%. The County sales tax rate is 0.25%. The Monterey sales tax rate is 1.5%.

How States Plan To Spend ‘millionaire Tax’ Revenue

While the proposed taxes sound similar, there are differences in how each state plans to use the revenue.

In Massachusetts, assuming voters pass the measure, the tax is expected to generate about $1.3 billion of revenue in 2023, according to a Tufts University analysis. The state aims to use the revenue to fund public education, roads, bridges and public transportation.

California’s tax is projected to bring in $3.5 billion to $5 billion annually should it pass, and the state plans to use the revenue to pay for zero-emissions vehicle programs and wildfire response and prevention.

Whether voters support higher income taxes or not, revenue plans often affect the results on Election Day, experts say.

“We’ve seen voters reject income tax increases on high earners, even when it applies to relatively few people,” said Jared Walczak, vice president of state projects at the Tax Foundation. “And we’ve seen them embrace income tax changes that would affect many.”

We’ve seen voters reject income tax increases on high earners, even when it applies to relatively few people.Jared WalczakVice president of state projects at the Tax Foundation

Overall, there’s one clear trend with state tax ballots: Voters care about the plans for the money, he said.

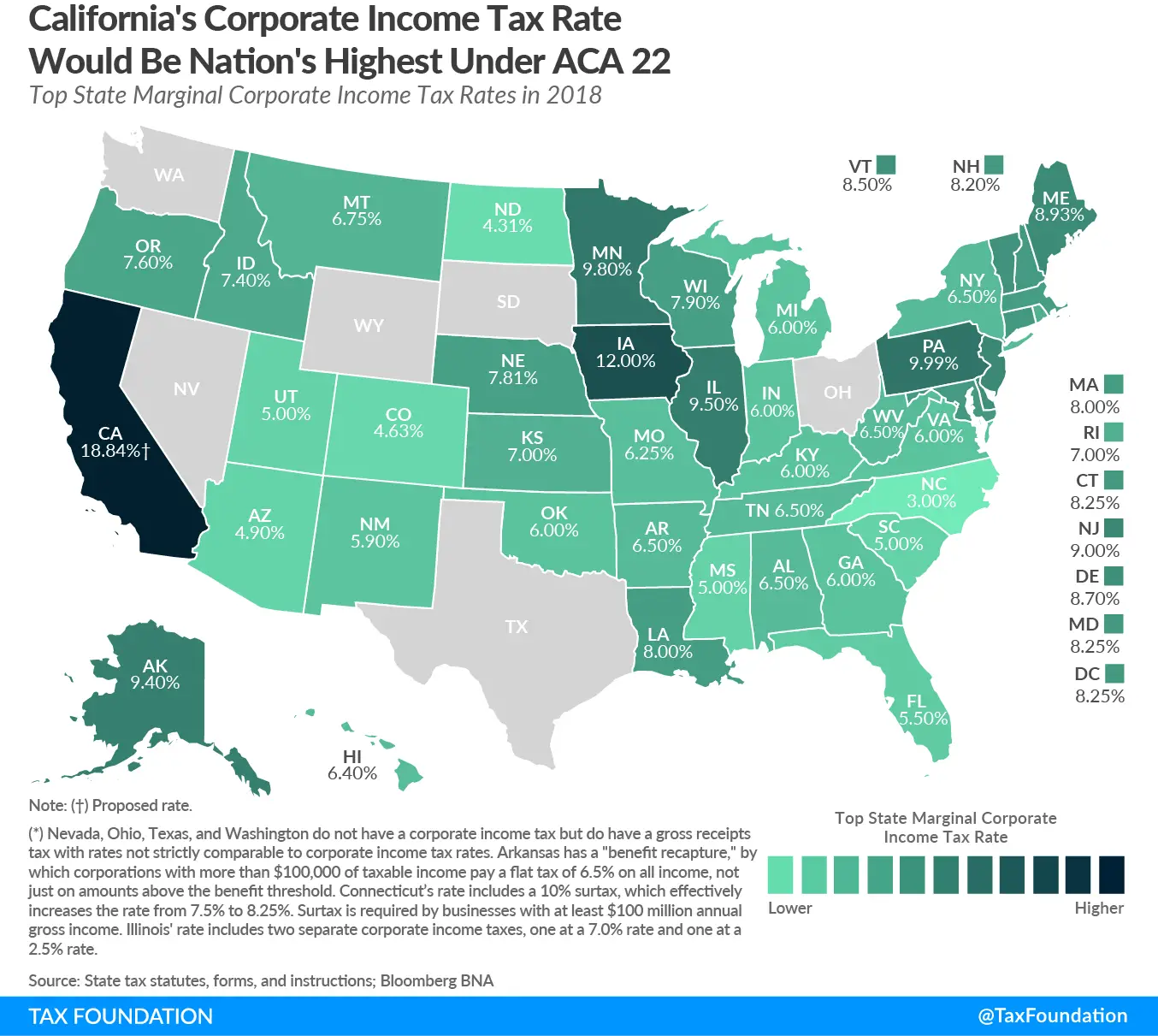

Californias State And Local Tax System Could Be More Progressive

The overall impact of the state and local tax system on Californians is determined by the combination of the progressive personal income tax and regressive sales and excise taxes, as well as other taxes levied by the state and localities most notably local property taxes and corporate income taxes. The combined impact is a state and local tax system that is regressive for people with lower incomes and progressive for people with very high incomes. The richest 1% of California tax filers pay the largest share of their income in state and local taxes , but the 20% of filers with the lowest incomes pay the next highest share . While the richest Californians pay a smaller portion of their income in sales, excise, and property taxes than any other group, it is made up for by the larger share of their income that goes to income taxes. Conversely, while the bottom 20% of Californians on average get money back from the personal income tax system via refundable tax credits, this is not enough to make up for paying larger shares of their income in sales, excise, and property taxes.

Recommended Reading: Are Mortgage Interest Tax Deductible

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Supplementary Local Sales Taxes

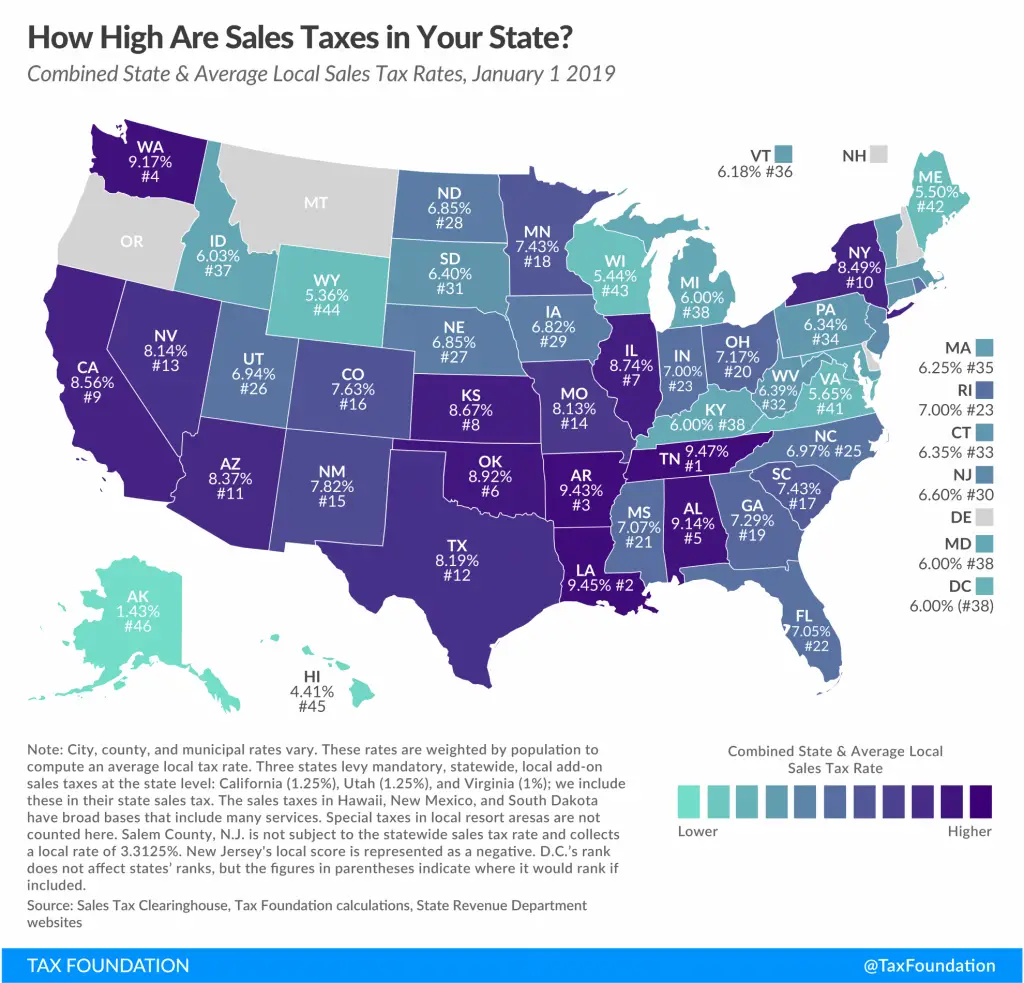

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2022, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2022, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

You May Like: How Much Per Mile For Taxes

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

How Bench Can Help

Wondering what deductions you can claim? Could you save on taxes by switching to an S corporation status? Bench provides small businesses with year round tax advice from a team of experts inside our easy-to-use platform.

With Bench, you receive a dedicated bookkeeper to do your monthly bookkeeping and ensure your financials are organized and up-to date for tax filing. Youâll have an on-going, accurate view of the health of your business and the most stress-free tax season yet.

You May Like: How To Report 1099 K Income On Tax Return

How Does The Tax Rate For Salinas Compare To Other Cities In Monterey County

Higher maximum sales tax than 91% of counties nationwide.Tax Rates By City in Monterey County, California.

| City |

|---|

How are property taxes calculated in Monterey County?

Monterey County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Monterey County Property Tax Assessor. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value.

Is Your State Sending Out A Tax Rebate Check In November

South Carolina taxpayers will soon get income tax refund checks for up to $800.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

On Nov. 1, Massachusetts started issuing refund checks and direct deposits from a $3 billion tax surplus, thanks to a law that links the state’s tax revenue to wages and salaries. The refunds are for approximately 14% of an individual’s 2021 state income tax liability.

In South Carolina, taxpayers are expected to receive refunds of up to $800 by the end of the year.These are just two of the many states issuing tax refunds and stimulus checks to help residents grapple with ongoing inflation.Is your state one of them? Do you qualify and how much money could you get? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Recommended Reading: Where Is The Cheapest Place To Get Taxes Done

When Is This Bill Effective

Senate Bill 113 is effective for the tax year beginning on or after Jan 1, 2022. This allows other state tax credits to be used before the pass through entity tax credit. This bill also ends the temporary suspension of net operating losses, and it also takes away the five million dollar business credit limit enacted under Bill 85.

For taxable years after Jan 1, 2019, Senate Bill 113 excludes gross income any amount received from federal restaurant revitalization adopts and grants. Businesses that consider making a pass through tax entity election could see significant tax benefits.

It is very important to note that making the decision to elect pass through entity requires modeling and analysis of your business. In order to do that, you may want to reach out to a reputable tax advisor to help you sort through this new bill to see if it will benefit you and your business.

Write Off Business Trips

When filing your California self-employed taxes, business trips are tax-deductible. So if you go somewhere on business, then you may deduct the expenses that served that purpose. This includes transportation, lodging, or food that was consumed with a potential client at a restaurant.

You may also combine a vacation with a business trip in order to reduce the costs. Simply deduct the travel expenses associated with the business part, such as a plane ticket or hotel bill. You’ll only be able to deduct the percentage that you spent doing business.

Also Check: Do You Pay Taxes On Unemployment

What To Do Living In California

Since Wisconsin first started to levy state taxes in 1911, state tax system has to become increasingly complex. They tend to mirror federal tax system but has diverged significantly.

California not only has one of the most progress tax rates for individual, but it’s also non-conformity to federal tax law adds to the complexity. For example, capital gains are taxed as the ordinary income instead of lower long-term capital gain tax treatment for federal income tax purpose. California is notoriously aggressive in their tax compliance and tax collection. FTB also audits returns that IRS never even bothered. (Read my article “Odds of being audited” and also “Should I ignore IRS/FTB notices?”

Taxpayers have to continually deal with any differences between state and federal tax provisions. Same complexity problems lie with corporate taxes, property taxes, and sales/use taxes as well. Most taxpayers do not understand the imposition of the tax. The three most important resources for Californian Taxpayers are Franchise Tax Board, Employment Development Department and Board of Equalization and of course, your California Virtual Accountant-Virtual CPA For You.

Why Do I Owe So Much California State Taxes

There are various reasons why you may be paying more tax in California. The first reason is that you didn’t get enough deductions or withholding. This means that you will be taxed more on income and get less in tax returns. If you went through a period of unemployment, you would also have more California taxes.

Bear in mind that the fact that you owe so much tax may also be because you did not get your due tax deduction. As a business owner, you need to file for them. You also need to take advantage of the tax benefits provided to you, as there are many things that you may do in order to get the most out of your taxes.

Recommended Reading: Where To Do My Taxes

Taxes Can Be Progressive Proportional Or Regressive Depending On How They Impact People Across Income Levels

A key aspect to tax equity is how a tax or a tax system as a whole impacts households across income levels. One way to measure this is by comparing effective tax rates meaning the share of ones income paid in a tax of people in different income groups. A tax is considered progressive when households with higher incomes have higher effective tax rates than those with lower incomes. The opposite of a progressive tax is a regressive tax. With regressive taxes, people with lower incomes have higher effective tax rates than people with higher incomes. Finally, a tax is considered proportional when people at all income levels have the same effective rates. Progressive taxes are the most equitable taxes, since they ask the most from people who have the most ability to pay.

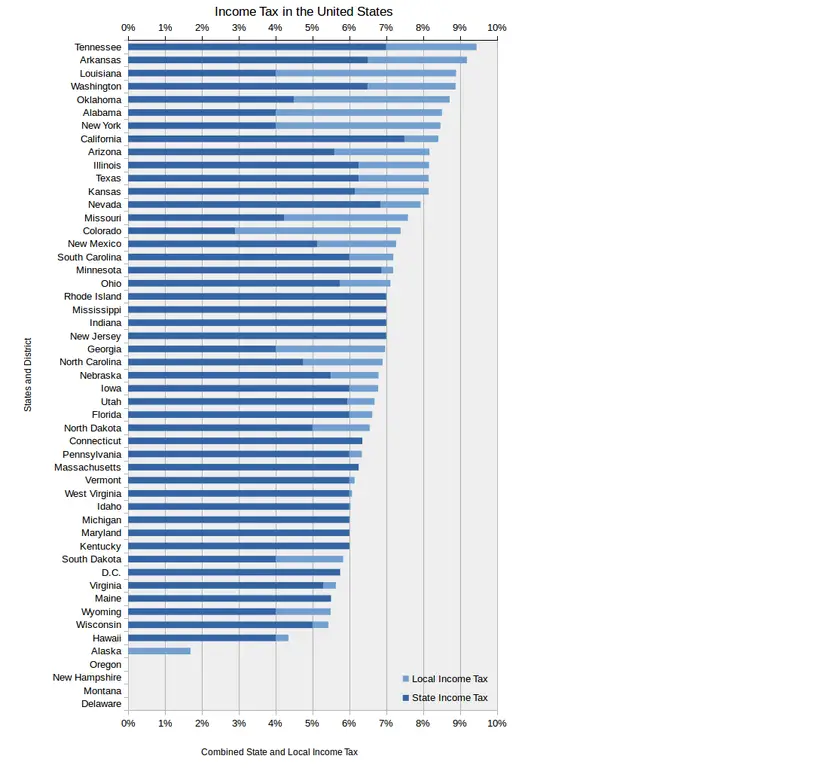

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Read Also: How Do I Find My Business Tax Id Number

Claim Military Members Deductions

Perhaps you are working in the military reserve – for instance, the National Guard. In this situation, you may frequently have to go more than 100 miles away from your home, staying overnight in most circumstances.

When this happens, you should know that you can easily deduct those taxes. If there were any other unreimbursed travel expenses , then you may claim those costs at the end of the tax year.

Likewise, if you are an active member of the service, you may have to deal with tax liability. In that regard, you may deduct tax costs related to your movement from one station to another.

How Much Is Monterey County Tax

Monterey County, California sales tax rate details The minimum combined 2021 sales tax rate for Monterey County, California is 7.75%. This is the total of state and county sales tax rates. The California state sales tax rate is currently 6%. The Monterey County sales tax rate is 0.25%.

How much is property tax on a $300000 house in California?

If a property has an assessed home value of $300,000, the annual property tax for it would be $3,440 based on the national average. But in California, it would be only $2,310. To calculate the rounded estimate of the property tax bill, you can multiply your propertys purchase price by 1.25%.

Also Check: Where To File 2017 Taxes

Local Sales Tax Reduction Or Repeal Using Proposition 218

Proposition 218 was a 1996 initiative constitutional amendment approved by California voters. Proposition 218 includes a provision constitutionally reserving to local voters the right to use the initiative power to reduce or repeal any local tax, assessment, fee or charge, including provision for a significantly reduced petition signature requirement to qualify a measure on the ballot. A local sales tax, including a sales tax previously approved by local voters, is generally subject to reduction or repeal using the local initiative power under Proposition 218.

Examples where the reduction or repeal of a local sales tax may be appropriate include where there has been significant waste or mismanagement of sales tax proceeds by a local government, when there has been controversial or questionable spending of sales tax proceeds by a local government , when the quality of the programs and services being financed from sales tax proceeds is not at a high level expected by voters, when the local sales tax rate is excessive or unreasonably high , or when promises previously made by local politicians about the spending of local sales tax proceeds are broken after voter approval of the sales tax #General_Tax_Abuses_By_Local_Governments” rel=”nofollow”> legally nonbinding promises concerning the spending of general sales tax proceeds that are not legally restricted for specific purposes).

Californias Income Tax Brackets For 2019

Californias individual tax brackets apply to single taxpayers as well as married taxpayers and registered domestic partners who are filing separately. For spouses and registered domestic partners who file jointly, the income levels are simply doubled . As published on Bankrate.com, Californias income tax brackets for 2019 are:

- 1% for taxable income up to $8,544

- 2% for taxable income between $8,545 and $20,255

- 4% for taxable income between $20,256 and $31,969

- 6% for taxable income between $31,970 and $44,377

- 8% for taxable income between $44,378 and $56,085

- 9.3% for taxable income between $56,086 and $286,492

- 10.3% for taxable income between $286,493 and $343,788

- 11.3% for taxable income between $343,789 and $572,980

- 12.3% for taxable income between $572,981 and $999,999

- 13.3% for taxable income of $1,000,000 or more

You May Like: How Much Do You Get Back From Tax Write Offs

Start A Health Savings Account

People with a high-deductible medical plan may contribute to a health savings account in order to reduce their taxes. These accounts provide an immediate tax deduction and are deferred from tax.

These savings may be withdrawn tax-free, as long as they are for qualified medical expenses. If there is any balance left at the end of the year, then it can roll over in the same way as a retirement account.

How Much Are Property Taxes In Carmel Ca

Monterey County has one of the higher property tax rates in the state, at around 1.095%. 30 out of 58 counties have lower property tax rates. 26 counties have higher tax rates. Note that 1.095% is an effective tax rate estimate.

| Sales Tax |

|---|

| 1% to 13.30% |

How does property tax work in California?

Property taxes are calculated by multiplying the propertys tax assessed value by the tax rate. The standard tax rate in the state is set at 1 percent, per the proposition. Therefore, residents pay 1 percent of their propertys value for real property taxes.

Also Check: Can I Get My Past Tax Returns Online