Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Tax Time Guide: Payment Options Available For Those Who Owe

IR-2020-48, March 5, 2020

WASHINGTON The Internal Revenue Service today reminded taxpayers that if they need to make a tax payment or owe and can’t pay, the IRS offers several options.

This news release is part of a series of IRS tips called the Tax Time Guide, designed to help taxpayers file an accurate tax return.

This year’s tax-filing deadline is April 15. Taxpayers should know before they owe. The IRS encourages all taxpayers to check their withholding with the IRS Tax Withholding Estimator.

Taxpayers who do end up owing taxes this year can choose among the following quick electronic payment options:

Taxpayers must file their 2019 tax returns by April 15, 2020, or request a six-month extension however, any taxes owed are still due on April 15. If they can’t pay, taxpayers should still file an extension to avoid the higher penalties for not filing at all.

Extensions can be requested using Free File, by filing Form 4868 or by paying all or part of the income tax due and indicating that the payment is for an extension or Form 4868 using Direct Pay, the Electronic Federal Tax Payment System or a . Taxpayers paying electronically do not have to file a separate extension form and they receive a confirmation number for their records.

Most individual taxpayers and many business taxpayers may qualify to use Online Payment Agreement to set up a payment plan.

Do I Have To Claim The Credits

No, you never have to take advantage of tax breaks, but why wouldnt you? Yes, filing taxes can be an intimidating hassle. But it can be well worth it. And taking advantage of any available tax breaks while minimizing your tax bill is a smart way to give yourself a financial boost.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.

Stacy Rapacon is a freelance writer and editor, who has specialized in personal finance topics including investing, saving for retirement, credit, family finances and financial educationsince 2007.

Don’t Miss: How To Pay Colorado State Taxes

What Is The 20 Deduction For Self

The qualified business income deduction is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income on their taxes. In general, total taxable income in 2021 must be under $164,900 for single filers or $329,800 for joint filers to qualify.

The Bottom Line: As Your Income Grows You May Face A Higher Marginal Tax Rate

How much you pay in federal income taxes each year is based on your taxable income, tax bracket and the marginal tax rate attached to your bracket. You can exert some control over how much you pay in taxes each year by taking advantage of tax credits and deductions. And owning a home is one source of deductions, including mortgage interest and property taxes.

If you are interested in reducing your yearly tax bill, learn more about tax deductions for first-time homeowners.

You May Like: How To Find Out Why I Owe Taxes

Why Am I Getting Back Less Taxes This Year 2021

So, if your tax refund is less than expected in 2021, it could be due to a few reasons: You didn’t withhold your unemployment income: The unemployment rate skyrocketed in the U.S. with millions of Americans filing for unemployment benefits. … This could affect your refund between tax years, even if you work the same job.

Home Office Or Office Space Rental

Self-employed people often work remotely at home or rent out an office space for themselves. If you rent space, you can deduct your monthly rent payment and any equipment you rent.

If you work out of a home office, you can potentially write it off. However, this is a bit more complicated and involves a few requirements. But it can be done.

The standard method and the simplified method both require exclusive business use. In the standard method, youâll need to determine your home office expenses, making sure to track everything in great detail.

With the simplified method, office space shouldnt exceed 300 square feet. Youâll need to multiply the square footage of your home office space by the IRS rate. The IRS uses $5 per square foot to calculate your deduction.

Don’t Miss: When Do We Get Our Taxes

How Much Tax Do I Pay On 50k Self

For example, if your net self-employment income is $50,000 multiply $50,000 by 0.9235 to get $46,175. Then, because $46,175 is less than the 2021 contribution and benefit of $142,800, multiply $46,175 by 0.153 to find you owe $7,064.78 in self-employment taxes for the year, which would leave you with $42,935.22.

Penalties And Interest Rates

Q. What are the applicable interest and penalty rates for underpayments of Delaware Income Tax?

A. The interest and penalty rates for underpayment of Delaware Income Tax are as follows:

You May Like: Do I Pay Taxes On Unemployment

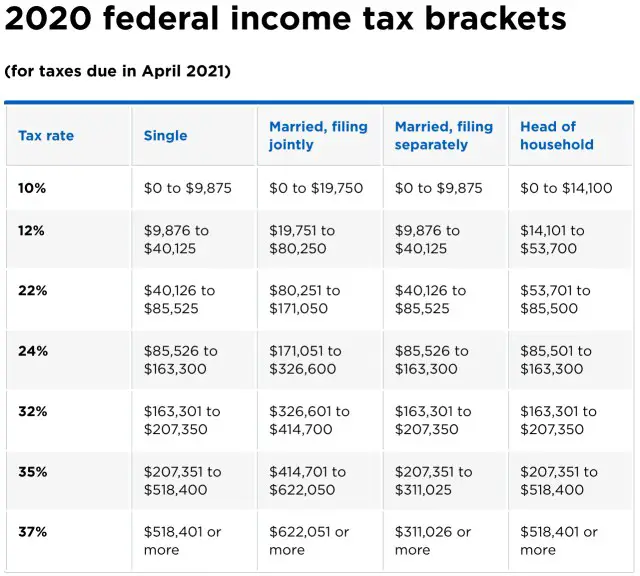

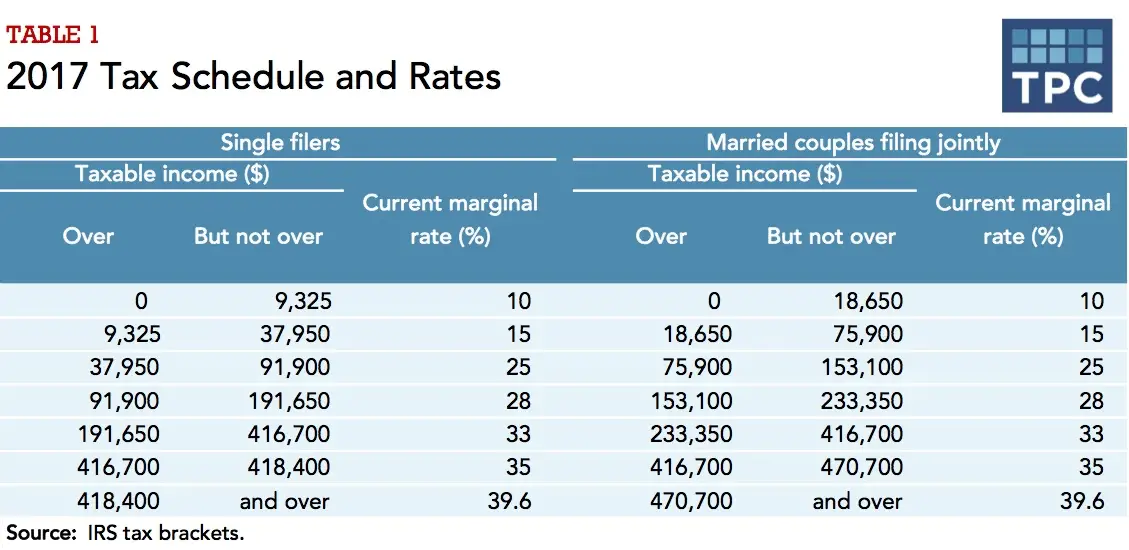

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Also Check: Do Churches Pay Payroll Taxes

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

States That Tax Social Security Benefits

The above calculations are for federal taxes on your Social Security benefits, but the following 13 states also tax benefits:

All of these states have their own formulas for taxing benefits. Check with your state Department of Revenue to figure out how much of your Social Security benefits you might owe state taxes on. Fortunately for residents of West Virginia, its government is beginning to phase out Social Security benefit taxes, and by 2022 it won’t tax Social Security benefits at all anymore.

Recommended Reading: Can I Use Turbotax Business For Personal Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I Calculate My Federal Estate Tax Liability

Your taxable estate is then multiplied by the 40% tax rate to arrive at your federal estate tax liability, which in this example equals $804,000. Now lets use the same numbers in the first example but assume that you made $4 million in taxable gifts during your lifetime over and above the annual exemptions that were available to you at the time.

What percentage of taxes do you pay on 1 million dollars?

Finding Taxes on 1 Million Dollars of Earned Income. For the 2018 tax year, there are seven tax brackets ranging from 10 percent to 37 percent. With an earned income of 1 million dollars you will find yourself squarely in the 37 percent bracket for the majority of your income.

Don’t Miss: How Much Does Tax Take

How Do Deductions Affect Your Tax Bracket

Tax deductions reduce your taxable income, lowering the amount of income subject to taxes. Generally, deductions lower your tax by your marginal tax rate multiplied by the value of the deduction. For example, if you had a $1,000 tax deduction and are in the 22% marginal tax bracket, youd pay $220 less on your taxes. If you are on the lower edge of a tax bracket, claiming a deduction may get you into a lower one.

Dont Miss: When Is The Last Day To Turn In Taxes

Request For Copies Of Returns

Q. How do I request a copy of a tax return I have filed?

A. In order to give you this information, please provide your social security number, name, your filing status for that year, the amount of refund or balance due, and your address on the return at that time. You may email your request by clicking the personal income tax email address in the contact file, or contact our Public Service Bureau at 577-8200.

Read Also: How Is Property Tax Paid

Don’t Miss: What Is The Cut Off For Filing Taxes

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

When Can I Start Filing Taxes For 2022

Let’s call it the new normal. Start with the scheduled tax-filing deadline of , for individuals to file tax returns for the 2021 tax year. During the 2020 tax season, the IRS pushed back the tax return filing due date until July because of the COVID pandemic. In 2021 the deadline was pushed back to May.

Recommended Reading: How To Send Taxes By Mail

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2022 tax year, due April 15, 2023

- Single filers: $12,950

- Heads of households: $19,400

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

How To Pay Your 1099 Taxes

If you think you might owe more than $1,000 in federal income taxes, you should be making payments throughout the year â not just when you file your return. These additional payments are referred to as âquarterlyâ or âestimatedâ tax payments. You pay your quarterly taxes on the 15th day following the end of the quarter. For example, letâs say you expect to owe $2,000 in taxes. You would divide that amount by four and make your quarterly tax payments on the following schedule:

| Quarter |

|---|

| $500 |

We havenât gotten into all the nitty-gritty here â like the forms that are involved in the filing process. If youâre interested in more details, check out our blog post on how to pay self-employment taxes step by step.

Read Also: Can I File My Taxes Without My Social Security Card