Will My Tax Refund Be Delayed

Some tax returns take longer to process than others, not only because of the two tax credits we just discussed. Here are a few more reasons the IRS says may cause a delay in your tax refund:4

- Your return had errors, or was incomplete.

- You are a victim of tax fraud or identity theft.

- Your return includes Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process. Form 8379 does not have to do with physical injuries, but refers to a situation in which a joint refund is seized because one spouse owes a debt like taxes or child support, even if the other spouse was expected to get a refund. The injured or negatively affected spouse can file Form 8379 to receive their portion of their joint tax refund.5

- Your return needs further review in general, such as if youre being audited.6

The IRS will contact you if they need any more information to process your tax return.

What If Ecsi Says There Is No Form For Me

- If your most recent term of enrollment was spring of last year and you registered and settled prior to December 31 the previous year, the qualified charges for spring would have been reported on your prior years 1098-T. You should use that years form along with your own records of payments made to determine your eligibility for a tax credit.

- Employee tuition assistance benefits and graduate assistant tuition remission are treated as reductions to qualified charges. No form is issued if you have no net qualified charges.

- Forms are not required for students whose scholarships, grants or third-party payments meet or exceed qualified charges.

How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund . There’s also a mobile app, IRS2Go.

You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, your filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

You May Like: How Much Taxes Does Doordash Take Out

So Far In The 2022 Tax Season The Average Tax Refund Is More Than $3300

For some Americans, this years tax season was easy. They filed electronically, elected to have their money sent by direct deposit to their bank account and, in three weeks or less, got their refund.

The IRS said that, as of March 18, almost 52 million refunds have been issued worth more than $171 billion, with the average payment totaling $3,305.

But for others, a massive return backlog has delayed refunds or held up the processing of returns that were refiled by taxpayers because a correction or change needed to be made.

With about three weeks left in the 2022 filing season, which began Jan. 24, heres what you need to know about why your return may have been delayed:

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

You May Like: Appeal Property Tax Cook County

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

What Does A Math Error Notice From The Irs Mean

Millions of Americans have received confusing math-error notices from the IRS this year letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agencys collection unit.

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, Many math error notices are vague and do not adequately explain the urgency the situation demands. Additionally, sometimes the notices dont even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

You May Like: How To Pay Federal And State Taxes Quarterly

Recommended Reading: Is Selling Plasma Taxable

Families First Coronavirus Response Act: Payroll Tax Credits For Employee Leave

On March 18, 2020, President Trump signed the Families First Coronavirus Response Act . The FFCRA requires certain employers to provide paid leave to employees who are unable to work due to circumstances related to COVID-19.

The FFCRA also includes provisions to help companies with fewer than 500 employees fund paid leave for workers during the crisis. If you are an expat who runs a small business with employees in the US, these provisions may apply to you.

Read Also: How To Subtract Taxes From Paycheck

Got More Tax Refund Questions We Have Answers

One way is to qualify for more tax deductions and tax credits. They can be huge money-savers if you know what they are, how they work and how to pursue them. Here’s a list of 20 popular ones to get you started.

But beware of big tax refunds. They’re a direct result of overpaying your taxes all year, and that often happens because you’re having too much tax withheld from your paychecks. Get that money in your hands now by adjusting your Form W-4 at work. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it.

Yes. Simply provide your direct deposit account information on your Form 1040 or 1040-SR when you file. If you file IRS Form 8888 with your tax return, you can even tell the IRS to split the money up and deposit it into as many as three different investment accounts. Here’s how to do it. Note that you’ll need to have an IRA account first. Here’s how to do that, too.

If you’re behind on your taxes, the IRS will withhold what you owe from your federal tax refund. You’ll get a letter from the IRS explaining what it adjusted.

You can fix it by filing an amended tax return using IRS Form 1040X. Here’s how to do it.

Read Also: Efilemytaxes

How Long Will It Take To Get Your Tax Refund Here’s How To Track Your Money

If you got your taxes submitted by the tax deadline day, you can start checking the status to see when your refund will arrive.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The IRS has already issued tens of millions of tax refunds.

Tax Day has come and gone, and if you beat the deadline and filed your 2021 tax return on time, the next thing on your list is waiting for your refund money to arrive. For those expecting refund money this year, it should arrive within 21 days of filing — assuming the return has been filed electronically with direct deposit set up.

To keep tabs on your refund, you can start tracking it to your bank account after the IRS begins processing your tax return. Tracking your refund will also assure you that your tax return has been accepted by the IRS and hasn’t been rejected because of errors.

If you’ve requested a paper check for your tax refund, it’ll take longer — about six to eight weeks — but you can also track that check to your mailbox using a free Postal Service tool. Also, if you’re filing late, expect your refund to arrive late.

How To Use The Where’s My Refund Tool On The Irs Site

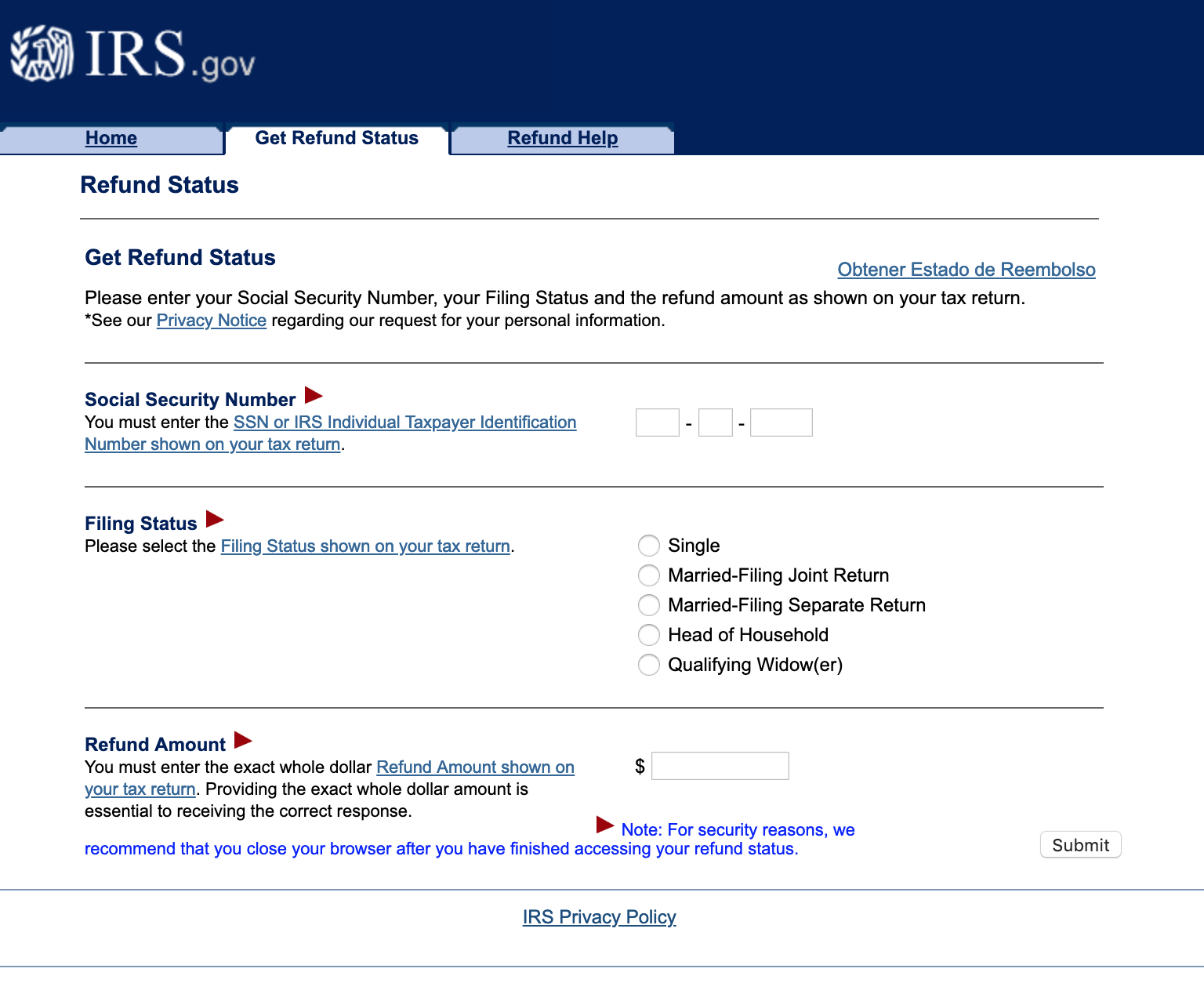

To check the status of your 2021 income tax refund using the IRS tracker tools, you’ll need to provide some personal information: your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund.

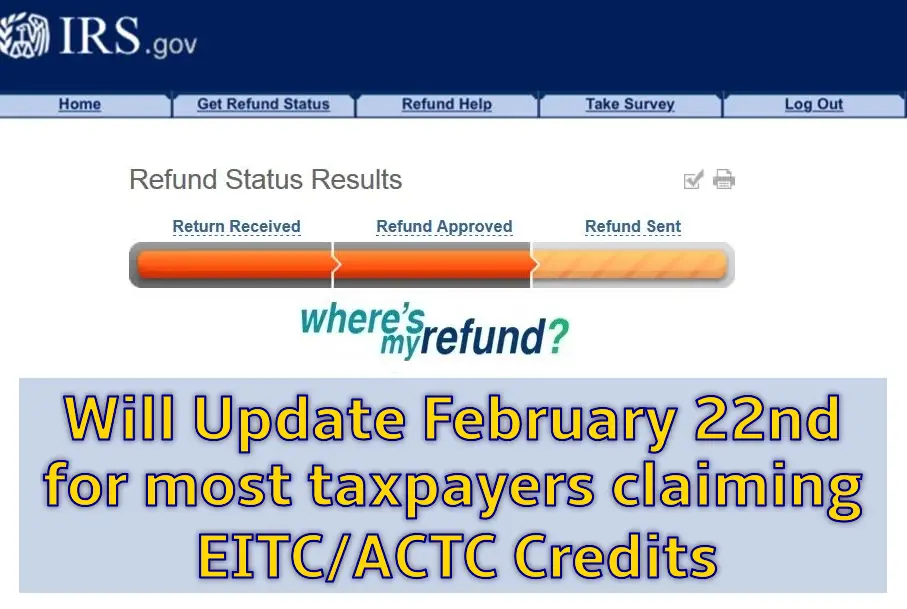

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your personal data, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Where’s My Refund has information on the most recent tax refund that the IRS has on file within the past two years, so if you’re looking for return information from previous years you’ll need to check your IRS online account for more information. Through your own personalized account, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Recommended Reading: How To Write Off Miles For Doordash

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Don’t Miss: Where Can I Find My Tax Return From Last Year

How Long Does It Take For The Irs To Send Tax Refunds

The IRS usually issues tax refunds within three weeks, but some taxpayers could have to wait a while longer to receive their payments. If there are any errors in your tax return, the wait could be lengthy.

When an issue delays your return, its resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you receive your tax refund also depends on the method you used to file your return.

If your tax refund goes into your bank account via direct deposit, it could take an additional five days for your bank to put the money in your account. This means if it takes the IRS the full 21 days to issue your check and your bank five days to deposit it, you could be waiting a total of 26 days to get your tax refund. Online services like Venmo and Cash App can deliver your tax refund a few days sooner since there’s no waiting period for the direct deposit.

If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

What Happens If I Miss The Deadline

According to H& R Block, there is no federal penalty if you don’t owe any tax. However, you won’t receive a refund until after you file your return.

If you owe money, expect to be charged 5 percent of your unpaid tax called the “Failure to File Penalty” each month that your federal tax return is late. The most you can be charged is 25 percent of your unpaid taxes.

Ohio taxpayers are subject to a 3 percent interest rate on unpaid state tax this year. The late filing penalty is either 5 percent of the tax due or $50, whichever is greater, for each month that the return is late. The maximum penalty is 50 percent of the tax due or $500, the latter of which you’ll have to pay even if you’re entitled to a refund.

Also Check: Best Taxes Company

What Money Will Be Included In My Tax Refund This Year

There are several things that could be tacked on to your tax refund this year. As usual, if you overpaid your taxes in 2021, you’ll receive that money back. However, if you’re a parent, you could also expect to receive the rest of your child tax credit money, as well as a reimbursement for money you spent on child care related expenses last year.

Also, if you’re still missing your third stimulus payment, you might receive that when you get your tax refund.

New Tax Rules For The Foreign Earned Income Exclusion During The Covid

As Coronavirus safety concerns and travel bans increased, some Americans living abroad decided to return to the US. Many had intended to stay abroad but cut their plans short because of the pandemic. Taking into account these unique circumstances, the IRS decided to adjust the requirements to qualify for the Foreign Earned Income Exclusion.

Under the revised rules, if you reasonably expected to meet the eligibility requirements of the FEIE during 2019 or 2020 but failed to do so because of the Coronavirus pandemic, you can still claim the tax exclusion. However, you must have left your country of residence within a specified date range. The date range is determined by when the period of adverse conditions began in different regions.

Therefore, you can still qualify for the FEIE if you left these regions after the dates below:

The period for this exception will end on July 15, 2020, unless the Treasury Department and IRS choose to extend it. This means that, if you left China between December 1, 2019 and July 15, 2020, you could still qualify as physically present or a bona fide residentso long as you expected to meet the requirements if not for the COVID-19 Emergency.

To determine the maximum available exclusion you can claim, youll need to prorate the FEIE amount based on the percentage of the year that you lived outside the US.

Heres how you would calculate the maximum FEIE exclusion for 2020 based on our example above:

Recommended Reading: Do You Have To Pay Taxes Working For Doordash

Check Your Refund Status Online In English Or Spanish

Where’s My Refund? – One of IRS’s most popular online features-gives you information about your federal income tax refund. The tool tracks your refund’s progress through 3 stages:

You get personalized refund information based on the processing of your tax return. The tool provides the refund date as soon as the IRS processes your tax return and approves your refund.

It’s Fast! – You can start checking on the status of your return sooner – within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return.

It’s Up-to Date! – It’s updated every 24 hours – usually overnight — so you only need to check once a day. There’s no need to call IRS unless Where’s My Refund? tells you to do so.

It’s Easy! – Have your tax return handy so you can provide your social security number, filing status and the exact whole dollar amount of your refund.

It’s Available! – It’s available 24 hours a day, 7 days a week.

Find it! – Download the IRS2Go App by visiting the iTunes app store or visit Google Play or

Página Principal – ¿Dónde está mi reembolso? at IRS.gov

If you do not have internet access, call IRS’s Refund Hotline at 1-800-829-1954.

Caution: Don’t count on getting your refund by a certain date to make major purchases or pay other financial obligations. Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days, it’s possible your tax return may require more review and take longer.