Is A 1099 Considered Self

If you received a 1099 form instead of a W-2 , then the payer of your income did not consider you an employee and did not withhold federal income tax or Social Security and Medicare tax. A 1099-MISC or NEC means that you are classified as an independent contractor and independent contractors are self-employed.

Airbnb Income And State And Local Taxes

Additionally, you may also be liable for state and local taxes related to your rental income. If your jurisdiction requires that you pay Transient Occupancy Taxes , Airbnb will automatically deduct and remit the payment of TOT on your behalf. While you do not have to put aside more of your earnings to cover these taxes, you should just be aware that this money will be taken from your earnings upfront.

What Is A 1099

All self-employed individuals or 1099-MISC income earners are required to pay tax every quarter to the IRS. Each January, you should receive a 1099 MISC form in the mail from each company you did work for in the previous year. If you worked for more than one organization in a year, you can expect multiple 1099 MISC forms.Each form will reflect an amount in Box 7. This should be the total amount you were remunerated by an employer, meaning you need to pay tax on this amount. Remember, it is your responsibility to stay on top of your credit responsibilities if you fall in the 1099-MISC income bracket. If you earned more than $3,000 in a year, you will need to pay tax on this amount.

Recommended Reading: When Do We Need To File Taxes

Tax Deductions For Self

You can deduct half of your self-employment tax on your income taxes. So, for example, if your Schedule SE says you owe $2,000 in self-employment tax for the year, you’ll need to pay that money when it’s due during the year, but at tax time $1,000 would be deductible on your 1040.

Self-employment can score you a bunch of sweet tax deductions, too. One is the qualified business income deduction, which lets you take an income tax deduction for as much as 20% of your self-employment net income. Plus, there are other deductions available for your home office, health insurance and more. Heres a primer.

» MORE:Compare online loan options for funding and eventually growing your small business.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

First Of All What Is A 1099

A 1099 is an IRS information return tax form used to record non-employee income. Businesses who employ independent contractors use 1099 forms to report payments made to contractors in exchange for services the contractors provide.

As of 2020, the IRS requires businesses who use independent contractors to file form 1099-NECs. While the 1099-MISC is still used to report general non-employee income the 1099-NEC, however, is specifically for independent contractors. Independent contractors use 1099s to calculate and pay their taxes.

Federal law mandates businesses must file 1099s for each independent contractor to which theyve paid $600 or more for services over the course of the year. Businesses who do not file may be assessed penalties by the IRS. Compliance in this area is crucial.

You May Like: How Much Am I Going To Get Back In Taxes

Estimate How Much You Owe

Now you just have to figure out how much to pay. If this is your first year going solo, be prepared for a much higher tax bill than normal thanks to that 15.3% self-employment tax.

Unfortunately, paying self-employment tax isnât the only thing that makes tax season harder on freelancers. One of the silver linings of W-2 work is fewer surprises when itâs time to pay.

Income and FICA taxes are automatically withheld by the employer and remitted to the IRS at the time theyâre accrued. Self-employed folks, on the other hand, have a harder time automating their tax bill.

Let Tax Software Do The Work

If you usually use tax software or an online tax service such as those offered by TurboTax or H& R Block, estimation should be easy. Tax software will estimate your freelancer quarterly taxes for you based on the previous year and any new information you input. You can then complete Form 1040-ES within the software as you do with your other tax forms.

Also Check: Should I Efile My Taxes

What Is The Minimum Amount To Generate A 1099

What Is The Minimum Amount For 1099 Reporting? The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least $600 in rents, services , prizes and awards, or other income payments. You dont need to issue 1099s for payment made for personal purposes.

Send The 1099 To The Independent Contractor

After filling out a 1099 for each independent contractor, you must mail them to their provided address by January 31st. The 1099 should provide the contractor with an accurate total of what theyve been paid by your company for their services that year.

Make sure youve got at least two copies of the 1099: one for the independent contractor, and one for your companys taxes.

You May Like: Where Is My Agi On My Tax Return

Why You Cant Set Your S Corp Salary Too Low

Before you get too excited, letâs make one thing clear: You canât set your personal salary at $1 to avoid paying FICA taxes on the rest of your business income.

Sadly, the IRS saw through that potential loophole immediately. They keep a pretty close eye on S corporations and require that all salaries be âreasonable compensationâ for the work done.

Itâs up to each business to determine what counts as âreasonable,â depending on the nature of your work. But a few factors will include:

- 𤵠How important the person is to business operations

- â³ How much time is being spent at their job

- ð¨âð« How much education and experience they bring to the table

In Rasheedaâs case, sheâs the only employee. And without her artistic talents, Purrfect Pet Portraits would have to close up shop. It only makes sense for most of the business profits to go into her pockets.

Who Is Exempt From Filing A 1099

Many companies don’t refer to their independent contractors as “1099 exempt” because businesses generally know that if an independent contractor isn’t paid in similar fashion to an employee, the payee is exempt from income tax withholding as well as payroll taxes the company pays on behalf of an employee.

You May Like: Can I File Taxes If I Receive Ssi

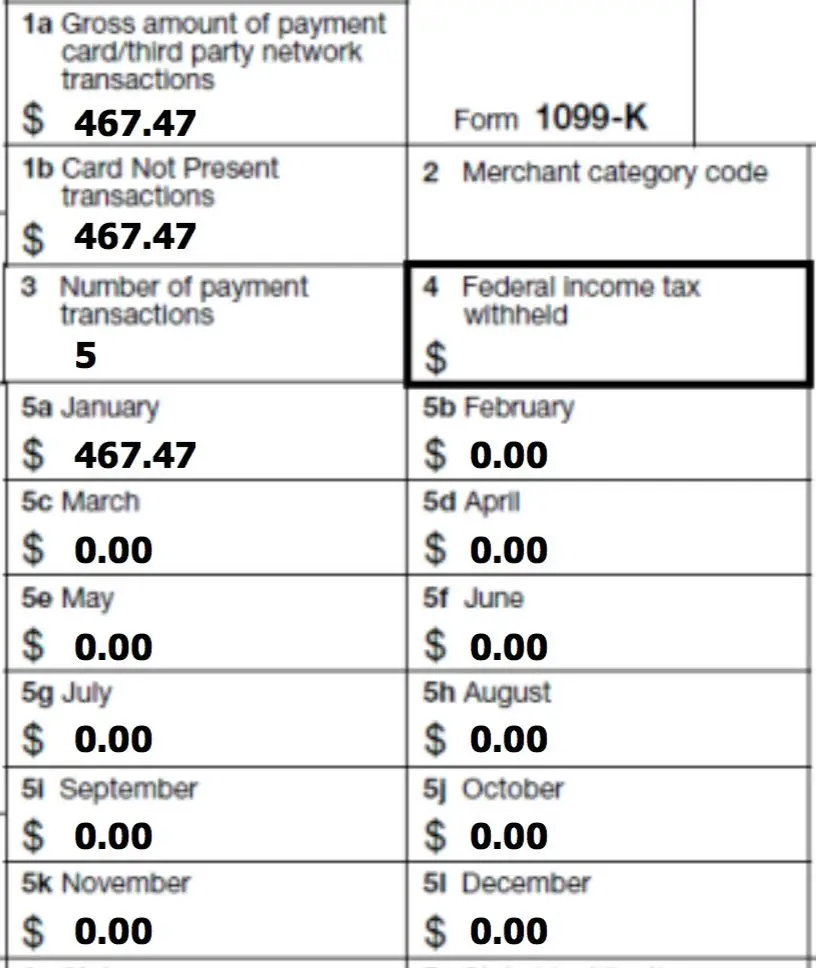

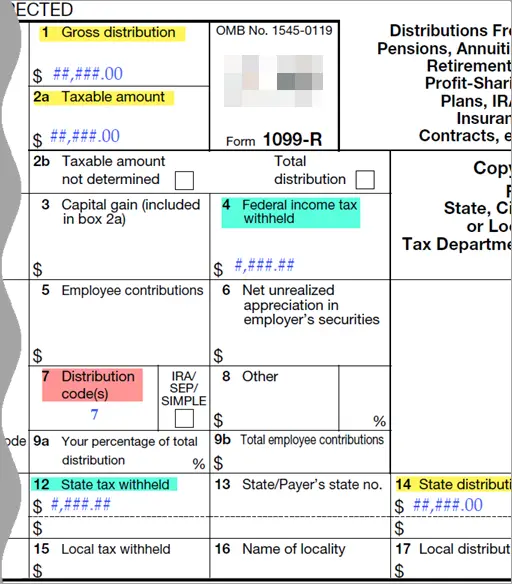

Know The Components Of The Form 1099

Once youve determined which of your team members need 1099 forms and which do not, youll need to know the basics of filling out the form. The form requires the following information:

- The name and address of your company

- Your companys Taxpayer Identification Number, abbreviated as TIN

- The TIN of the independent contractor. Note: its important to get the right TIN from independent contractors, so you will not be responsible for paying their backup withholdings.

Tax Deductions Available For Self

Despite the additional complications associated with paying self-employment tax, there is some good news. According to NerdWallet, certain tax deductions are available to help self-employed individuals save money. For instance, the home office deduction allows independent contractors who work from home to deduct a portion of their mortgage or rent, property taxes, utilities, and repairs and maintenance. Self-employed individuals can deduct office expenses, wear and tear on their car, phone and internet costs, business travel and meals, and more.3

What’s interesting is that the self-employment tax is itself a self-employment tax deduction. In other words, you can deduct half of your self-employment tax on your income taxes. Although you will need to pay the tax when it’s due during the year, it will be deductible on your 1040 at tax time, also according to NerdWallet.3

Now there’s also the qualified business income deduction which allows self-employed individuals and business owners to deduct a portion of their business income on their taxes. This is for people who have pass-through income, or business income they report on their personal tax return, such as sole proprietorships, partnerships, S corporations and limited liability companies, as explained by NerdWallet.3

Read Also: How Do I Do My Tax Return Online

Dont Activate The Debit Card

The goal with all of these strategies is to limit your access to your tax money. To that end, itâs best to not even activate the new debit card or store it in your wallet.

Think of it this way: The second the money gets transferred into your tax account, it no longer belongs to you, it belongs to Uncle Sam. Cutting off access points will remove the temptation to spend whatâs not yours.

Claim Your Business Write

Hereâs where youâll:

- â Report your earnings from self-employment

- â Write off your business expenses to determine your businessâs total taxable income

You can learn more about how to fill it out in our complete guide to Schedule C.

If youâre claiming a home office, you might also have to fill out Form 8829.

You May Like: Where Do I Mail My Irs Tax Return

How Is An Independent Contractor Paid

After an organization has properly classified their new worker as an independent contractor and established the terms of compensation, its time to set up the actual payment process. Every situation is different, but the general steps are as follows:

Why 1099 Workers Start Paying Taxes At $400

For most people, taxes only kick in if you earn more than the standard deduction. Thatâs about $12,000 if youâre single and $25,000 if youâre married.

So why only $400 for freelancers and contract workers? Itâs because self-employment earnings get taxed differently than other kinds of income.

Read Also: How Much Do Cpas Charge For Taxes

See An Online Tax Calculator For A Quick Estimate

There are several online tax calculators that enable you to estimate your taxes for the year which you can then divide by four. Other calculators perform the entire quarterly estimated tax breakdown.

- Nerdwallet provides a fast, free annual federal income tax calculator. Once you have your annual tax liability, you can determine what you need to pay by dividing by four.

- Calculator.net provides a more detailed annual federal income tax calculator. Once again, just divide the final figure by four.

What About Independent Contractor Form 1099

As an independent contractor, you dont fill out Form 1099 you receive it from your clients.

In other words, business owners need to report payments to nonemployees through Form 1099-NEC if the payment totaled $600 or more per tax year.

So, if youve received $600 or more from a single client during the year, they are obliged to file Form 1099-NEC to the IRS and provide you with a copy as well.

You can then use the information in the form to report your income and calculate your taxes.

If the payer neglects to send you Form 1099-NEC, be sure to remind them on time.

However, bear in mind that if a client paid you more than $600 during the year and didnt send you a 1099, youre in no trouble. Form 1099 is their tax obligation, and theyre the one who will be facing penalties for neglecting to report nonemployee compensation.

NOTE: Even when a client doesnt have to report yearly payments to you , you still need to report all your income, even if you did not receive a 1099 for it. Likewise, if you are due a 1099 and dont receive it, you still need to report the payment to the IRS.

Don’t Miss: What Does It Mean When Your Tax Return Is Accepted

Use The Safe Harbor Rule

The Safe Harbor Rule provides that the IRS will not penalize you for underpaying your quarterly estimated taxes if your payments are over 90% of your tax bill from the prior year. To calculate how much to set aside under the Safe Harbor Rule, take 100% of the amount of taxes you paid last year and divide by four, and you have your quarterly payment.

Of course, if you end up owing more taxes at the end of the year, you still must pay them. Therefore, some people set aside 30% of their expected income each quarter.

Compare Your Business Income Stream To The Previous Year

If youve been in business for a while, it will be much easier to calculate your taxes. This is especially true if your income stream is pretty steady, as you can make proper estimates based on your tax obligations from the previous year.

If youve expanded your business, your fiscal information from the previous year can still help you estimate your taxes for the current one, as youll have a reference point to start from.

Don’t Miss: How Do I Know What Tax Bracket I Am In

Who Pays The Self

You’ll pay self-employment taxes if you made $400 or more in net earnings from self-employment, including as a business owner, freelancer or independent contractor. Many self-employed workers receive IRS 1099 forms from their clients that state how much they paid them throughout the tax year.

You’ll also pay self-employment taxes if you earned $108.28 or more in income from working with a church.

It’s possible to earn both self-employment income and income from a full-time job in the same year. Many people today work both full-time for an employer and run a side hustle. For instance, taxpayers might work in an office five days a week but also drive for a ride-sharing app on evenings and weekends. That ride-sharing income is considered self-employment income.

Is Working 1099 Worth It

1099 contractors have a lot more freedom than their W2 peers, and thanks to a 2017 corporate tax bill, they are allowed significant additional tax deductions from what is called a 20% pass-through deduction. However, they often receive fewer benefits and have far more tenuous employment status with their organization.

Also Check: How To Get Comps For Property Tax Appeal

Why 1099 Workers Pay More Taxes

When you work as a W-2 employee for a company, you automatically have 7.65% of your income withheld from your paycheck for taxes. This is known as FICA and covers:

- ðµ Social Security taxes

- ðµ Medicare taxes

At the same time, your employer is paying the IRS an additional 7.65%.

But when you work for yourself, there is no employer footing that half of the bill â you are your own employer. Which means you need to pay both halves, for a combined total of 15.3%.

This combined tax rate is commonly called self-employment tax and yes, it is the bane of every freelancerâs existence.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

Recommended Reading: How To File Taxes With An Itin Number

How To Fill Out A 1099

The company you worked for throughout the year will total your earnings on each 1099 MISC form. Throughout the year, you should collect and track your earnings, either in the form of paystubs or invoices from employers.To lower the amount of tax you pay, track your business expenses and hold onto receipts where you can. It’s vital that you enter your business expenditures onto your 1099 MISC form to calculate your exact taxable income.

How Much Should I Set Aside For Taxes As A 1099 Contractor

You dont want to come up short at tax time, so make sure you have enough money left over to cover your taxes. Many small business owners set aside 30% of their gross income to cover tax payments. Setting aside a percentage of your income in this fashion is a prudent move. You can adjust the percentage as you see fit, but you should have enough to cover your taxes if you save 30%. This is more than enough for most taxpayers, so you could end up owing less than you saved. In this case, you can take the leftover balance and pretend its your own personal tax refund!

Recommended Reading: How To File Tax Return For Free

Including 1099 Income On Your Tax Return

How you report 1099-MISC income on your income tax return depends on the type of business you own. If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule CProfit or Loss From Business. When you complete Schedule C, you report all business income and expenses. Reporting business expensessuch as fees paid to professionals, purchases of business supplies or equipment, and business office expensesreduce the net income from your business.

The net income from your Schedule C is reported on Line 3 of Schedule 1 of your personal income tax return along with all other sources of income, including income as an employee and investment income. Your personal income taxes are determined by your total adjusted gross income.

If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.