Deducting Pa Income Taxes

If you pay PA income tax, the IRS allows you to claim a deduction on your federal tax return for them. You can claim a state income tax deduction if you itemize deductions on your federal return.

To determine if you should itemize your deductions, add up your calendar-year deductible expenses, including your state income tax expense, to see if they are greater than the standard deduction amount for your filing status.

Due to the Tax Cuts and Jobs Act, state and local tax deductions, including state income taxes, are limited to $10,000 per year.

Pa Revenue Dept Offers Free Tax Filing Online

PITTSBURGH — Tax season is here. It’s time to get ready to file those federal income taxes.

The IRS is warning it could be a difficult tax season because of a resurgence of COVID-19 infections and less funding from Congress.

The deadline is extended again this year. The IRS wants your taxes filed by April 18.

For state taxes, the Pennsylvania Department of Revenue is reminding taxpayers about the free website for filing.

MyPath offers options for filing, making payments and access to other services. You can find that website by clicking here.

Eligible Pennsylvanians can also apply for rebates on their rent or property taxes. The state’s Revenue Department just opened up applications.

The program is designed to help older Pennsylvanians, widows, widowers and adults with disabilities.

You may qualify for rebates worth hundreds of dollars. To find more information on that, .

- In:

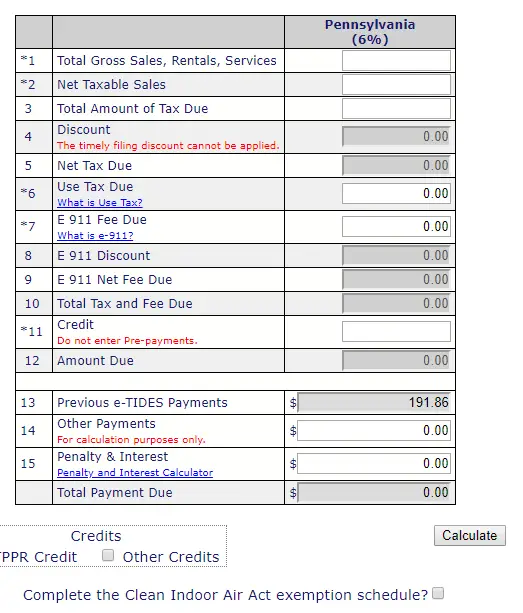

Filing Your Pennsylvania Sales Tax Returns Online

Pennsylvania supports electronic filing of sales tax returns, which is often much faster than filing via mail.

Pennsylvania allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official Pennsylvania e-TIDES website, which can be found here . You should have received credentials to access your Pennsylvania e-TIDES account when you applied for your Pennsylvania sales tax license.

Simplify Pennsylvania sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Don’t Miss: Tax Preparation License

Do You Have Any Tax Preparation Advice

Should I prepare my own return? Are there other options?Many people find preparing their annual tax return themselves a challenging and rewarding annual process. For others, the prospect of doing this without outside help is daunting.

Filing your taxes does not need to be stressful. There are several computer programs you can purchase or download that explain what to do step-by-step. If you do not have access to a computer, tax forms and publications are available at public libraries, post offices and from the IRS, free of charge.

You can also use tax preparation services or consult with financial experts, like certified public accountants or tax attorneys, when filing your return. Reputable tax professionals can assist with complex returns, and their expertise often provides peace of mind to consumers with concerns about their taxes.

If you choose to use a tax preparation service, always ask for a breakdown of the various fees upfront before the return is prepared. The fees may include a charge for preparing the return, for electronic filing and, for automatic deposit of refunds in your bank account. Services like electronic filing and direct deposit are not required, but may be worth the extra cost to you, because they speed up the process.

What else should I remember at tax time?Remember to safeguard any paperwork that includes personal and financial information like your tax returns and forms to protect you from identity theft.

Money Advisories

Sales And Other Taxes

Pennsylvania’s state-level sales tax is 6%. Allegheny County imposes an additional 1% local sales tax and Philadelphia adds 2%, but the average local sales tax rate is still just .34% for a combined state-and-local average of 6.34%.

As of 2021, the state had the third-highest gas tax in the U.S. at 58.7 cents a gallon.

Pennsylvania has taxed cigarettes at a rate of $2.60 per pack since 2016. On the bright side, this tax raises many millions of dollars annually for the Children’s Health Insurance Program and the Agricultural Conservation Easement Purchase Fund.

You May Like: How To Calculate Taxes For Doordash

What Are The Filing Deadlines And Extension Process

Pennsylvania goes by the federal income tax return filing deadline set by the Internal Revenue Service . Since the federal tax day occurs on Good Friday in 2022, your state return needs to be filed by , which is the next business day.

You can receive a one-time extension for an extra six months to complete the Pennsylvania tax filing process by . Be aware, however, the state keeps the original deadline as your tax payment due date.

The extension happens automatically if you have no state income tax liability and already got a federal extension. Otherwise, you must first pay your state taxes and either request the extension online when you make an electronic payment or fill out Form 276 to send with a money order or check. The paper form would go to the PA Department of Revenue Bureau of Individual Taxes at this address: P.O. Box 280504, Harrisburg, PA, 17128-0504.

If You Owe And Cant Pay

If you owe taxes and cant pay before the due date, dont fret. The Department of Revenue allows you to set up a payment plan by calling its Collections Unit at 1-717-783-3000. However, youll incur a late payment penalty and interest on the amount due, which will continue to add up until you pay off the balance. You should pay as much as youre able by the due date in order to minimize interest and penalties on the unpaid balance.

You can make your tax payments by check, money order, debit card or credit card. Fees will be charged for some payment options.

You May Like: Restaurant Tax In Philadelphia

Yes You Can File Your Pennsylvania Income Taxes Online For Free Heres How

Tax Day is only a week away, and Pennsylvanians have options for preparing both state and federal taxes for free online.

This years deadline for filing personal income taxes is Monday, April 18. The date was extended from the usual April 15 because Washington, D.C., observes a regional holiday, called Emancipation Day, this Friday.

While providers such as eFile, FreeTaxUSA, H& R Block, and TurboTax offer some online services for free, the offering sometimes only covers simple returns and might not apply to the preparation of state taxes.

But in Pennsylvania, filers can prepare their state taxes free of charge at mypath.pa.gov. The Pennsylvania Department of Revenue hosts the service, which does not require a username or password.

The site allows users to file the Pennsylvania Personal Income Tax Return , make payments, respond to department requests for information, and check their refund status. The platform can handle a range of tax documents, including federal forms W-2 and 1099-MISC.

Taxpayers whose adjusted gross income is $73,000 or less qualify for free guided federal tax preparation services, too. The IRS lists eight free-file options on its website. It also offers a free fillable form for those whose adjusted gross income exceeds $73,000, though it warns users that they should know how to prepare their own tax returns using form instructions and IRS resources.

As of April 1, the IRS had issued 63 million refunds averaging about $3,200 each.

File And Pay State Taxes

Once you have a registered business tax account there are several options to filing and making tax payments.

Most businesses can use the Pennsylvania Department of Revenues e-TIDES portal to electronically file and pay their business taxes and update their business tax accounts with the department. The secure, encrypted site allows multiple filers both inside or outside your business to submit returns and payments on your behalf based on the permissions you choose.

Recommended Reading: How Much To Set Aside For Taxes Doordash

What Tax Deductions Are There In Pennsylvania

Pennsylvania doesn’t allow many of the deductions that are permitted at the federal level, including:

- Medical and dental expenses

There are four deductions allowed for Pennsylvania personal income tax. These are for contributions to a:

- Medical Savings Account

- IRC Section 529 Qualified Tuition Program

- IRC Section 529A Pennsylvania ABLE Savings Account Program

How Do You Pay Pa Income Tax

You can pay PA income tax the following ways:

+ Via electronic funds transfer from your bank account or by using a credit or debit card.

+ Via Electronic Funds Transfer : Pay Pennsylvania taxes directly through your personal savings or checking account through the departments e-Services Center.

+ Credit or Debit Card Payments: Visit www.officialpayments.com or call, toll-free, at .

Also Check: Doordash How To File Taxes

The Property Tax/rent Rebate

Pennsylvania’s property tax/rent rebate program offers rebates for paid property taxes to homeowners or renters who qualify:

- You or your spouse must be 65 years or older.

- A widow or widower qualifies at age 50 or older.

- Those age 18 and older qualify if they are permanently disabled.

- A qualifying homeowner’s annual income cannot exceed $35,000, and this includes half of their Social Security income.

- Renters cannot earn more than $15,000 annually, and the same Social Security rule applies.

Special rules were set in place in 2015 to prevent homeowners and renters from being disqualified on the basis of income due to Social Security cost-of-living adjustments.

The state encourages you to apply to find out. The worst that can happen is that your claim will be denied.

The maximum rebate is $650 as of 2021, down to $250 for those with higher incomes bumping up against the limits. But some senior homeowners can receive up to 50% more if they live in certain areas where the wage and income tax limits are very high , or in other areas if they pay more than 15% in property taxes.

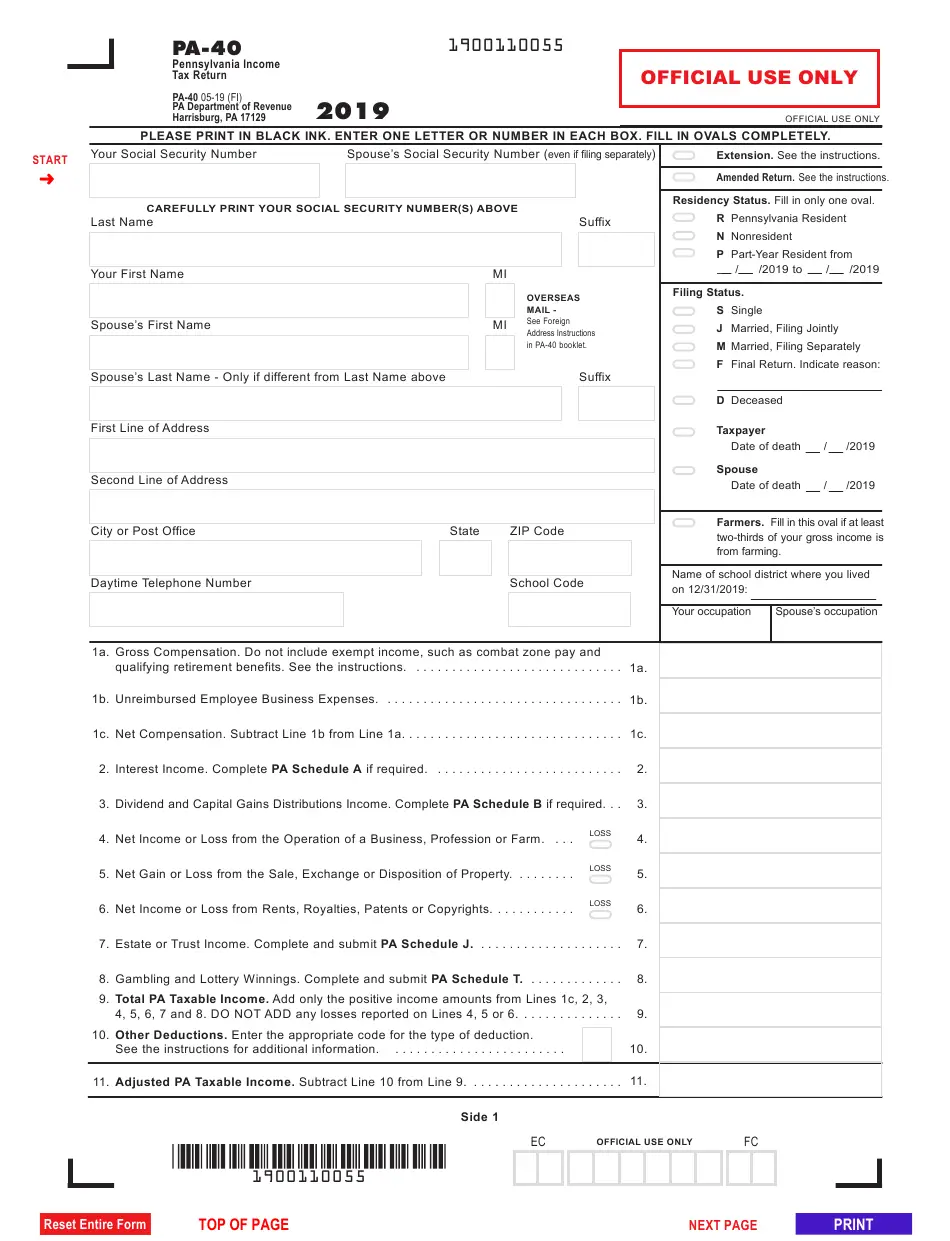

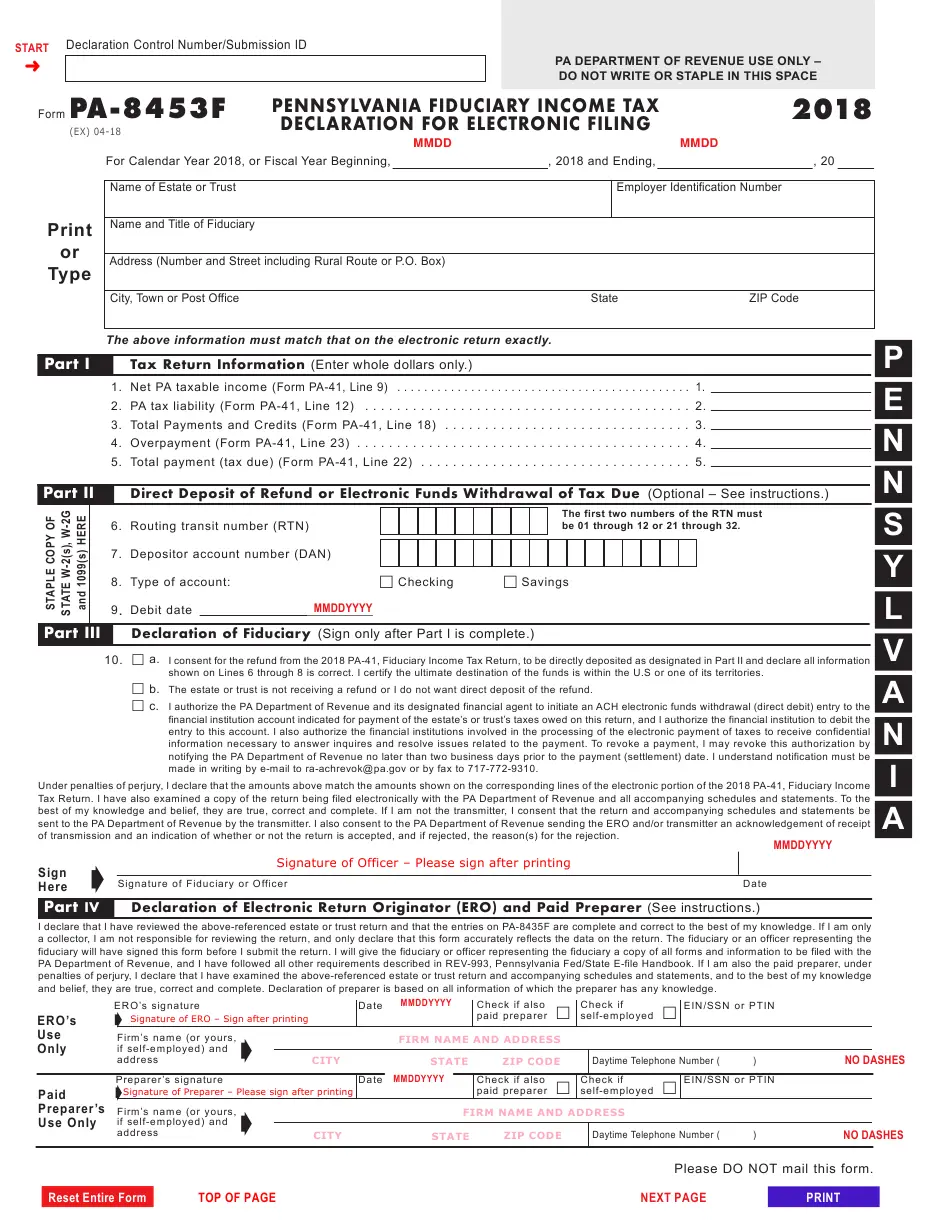

What Is The Pa State Form That Needs To Be Signed And Sent In Even If State Taxes Are E

Do not mail in signature forms to Pennsylvania. TurboTax will generate the signature forms, if needed. Sign and keepthem for three years.

Ifyou file the Federal/State returns electronically and the federal return isfiled with a Self-Selected PIN Form PA-8453 is NOTrequired. Otherwise, if you file the Federal/State returns electronically and the federalreturn is filed without the Self-Selected PIN , FormPA-8453 IS required. All pertinent information will populate the form. On theElectronic Filing Instructions, TurboTax has listed all possible attachmentsrequired by the Pennsylvania Department of Revenue for quick reference.

Also Check: Philadelphia Pa Sales Tax

Basics To Know About Filing State Taxes For Free

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance. does not participate in the Free File Alliance. Its always free to prepare and file federal and single-state income tax returns with Credit Karma Tax®, regardless of adjusted gross income. But a free Credit Karma account is necessary in order to use the service.

Where Do I Mail/e

By setting up a myPath account at mypath.pa.gov, you can use the state’s free electronic filing option. It supports various types of income, tax credits and deductions. You can find other free online tax preparation services that may come with income restrictions, or you can pay for these filing options. If you’d like the most guidance, you can hire a tax professional to e-file your PA income tax return.

If you use the state tax forms and need to mail a paper return, you’ll send it to one of these three PA Department of Revenue addresses specifying your refund or tax payment status:

- Sending payment voucher: Payment Enclosed, 1 Revenue Place, Harrisburg, PA 17129-0001

- Requesting tax refund: Refund/Credit Requested, 3 Revenue Place, Harrisburg, PA 17129-0003

- No refund or tax payment: No Payment/No Refund, 2 Revenue Place, Harrisburg, PA 17129-0002

You May Like: Doordash Tax Tips

Your Pennsylvania Sales Tax Filing Requirements

To file sales tax in Pennsylvania, you must begin by reporting gross sales for the reporting period, and calculate the total amount of sales tax due from this period. The state of Pennsylvania provides all taxpayers with three choices for filing their taxes. One option is to file online by using the Pennsylvania Department of Revenue. This online system can also be utilized to remit the payment. The online system Autofile can be utilized to both file and pay your business’s taxes online. The final option is to file over the telephone at 1-800-748-8299. Tax payers should be aware of several late penalties. The penalty for past due payment of sales tax is 5% a month from the date due until the date field to a maximum of 25%. If an underpayment penalty is warranted, it is imposed at the rate of 3% a month on the unpaid tax balance from the date filed to the date paid to a maximum of 18%.The state of Pennsylvania requires that every seller who owns a sales tax permit to file a sales tax return on the required day, even if it is a “zeroes-out” tax return, and there is nothing to report.

Deadline To File Pennsylvania Filing Taxes:

- Deadline: January 31, 2022

What are the Pennsylvania 1099-MISC state filing requirements? Find your scenario below.

Scenario 1: Payments do not meet federal threshold.

Recommended filing method: No filing required.

Scenario 2: There were/were not state taxes withheld, payments exceed federal threshold.

Recommended filing method: Direct-to-state eFile.

Deadline: January 31, 2022

Tax1099 fulfills: Yes

Cost: eFile $.50/form

When submitting your federal eFile through Tax1099, select to have us eFile your forms to the state, as well. Well automatically alert you to this filing requirement based on the information you enter into your forms.

Pennsylvania requirements for 1099-NEC

Cost: $0.50 per form electronically

Pennsylvania W2 State Filing Requirements

Recommended filing method: Direct-to-state eFile.

Deadline: January 31, 2022

Tax1099 fulfills: Yes

Cost: + $0.50 per form

Additional filing requirements: You may be required to submit Pennsylvania state reconciliation form REV-1667 R. Tax1099 offers this form for $4.99 through the platform.

NOTE :

1) We will no longer be filing via paper when using the 9 digit FEIN to the state of PA. You can still use the 9 digit FEIN and we will e-file to the state of PA. If you have an existing state issued 8 digit state ID for PA, however, you will need to use that. If you use the 9 digit FEIN, but have an existing 8 digit state ID, the state of PA will reject your filings.

Read Also: Reverse Ein Lookup

Volunteer Income Tax Assistance

Individuals who would prefer to have a trained volunteer assist them with completion of their tax return should check into resources that may be available locally, including the Volunteer Income Tax Assistance program. Individuals earning up to approximately $57,000 are eligible for this free program. VITA sites are now closed for 2022. Please view PA 211s VITA program information to learn more. You can request an appointment starting in early 2023.

Nj Income Tax Pa/nj Reciprocal Income Tax Agreement

Compensation paid to Pennsylvania residents employed in New Jersey is not subject to New Jersey Income Tax under the terms of the Reciprocal Personal Income Tax Agreement between the states. Similarly, New Jersey residents are not subject to Pennsylvania income tax either. Compensation means salaries, wages, tips, fees, commissions, bonuses, and other payments received for services rendered as an employee.

The Reciprocal Agreement covers compensation only. If you are self-employed or receive other income that is taxable in both states, you must file a New Jersey nonresident return and report the income received. If you are a Pennsylvania resident and New Jersey Income Tax was withheld from your wages, you must file a New Jersey nonresident return to get a refund. To stop the withholding of New Jersey Income Tax, complete an Employee’s Certificate of Nonresidence in New Jersey and give it to your employer. You must enclose a signed statement with your New Jersey nonresident returns indicating you are a resident of the Commonwealth of Pennsylvania. Likewise, if you are a New Jersey resident and your employer withheld Pennsylvania income tax from wages, you must file a Pennsylvania return to get a refund. To stop the withholding of Pennsylvania income tax, complete Form REV-419EX, Employees Nonwithholding Application Certificate, and give it to your employer. More information is available on the Pennsylvania Department of Revenue website or by calling 1-717-787-8201.

Don’t Miss: What Can I Write Off As A Doordash Driver

Cell Phone & Electronic Device Policy

Effective April 24, 2017, the Board of Directors enacted a policy prohibiting the use of cell phones or other electronic recording devices by visitors in the lobby of either of the Tax Bureau offices. The purpose of this policy is to protect confidential taxpayer information which may be discussed or open to view in the office. Telephone calls and cell phone usage must be continued outside.

Dont Miss: Find Employers Ein

Retired And Senior Volunteer Program Needs Volunteer Tax Preparers

VITA volunteers receive tax training from the IRS and experienced volunteers to complete income tax returns using approved software for electronic filing. Additionally, online training and testing is available. All volunteers must pass a test and be certified by the IRS prior to assisting clients. VITA assistance is limited to individuals and families with low to moderate income . Individuals with farms, rental properties and deductible moving expenses are not eligible for assistance. Additionally, volunteers receive training to use the software to assist clients with their PA State Returns, local returns and PA Property Tax/Rent Rebates.

Training is available throughout the year, with the majority of the training conducted during November and January. Each volunteer is asked to donate a minimum of 4 to 5 hours per week in the Bellefonte and/or State College area during the tax season, February through April. This commitment is required for the volunteer to achieve the level of knowledge/proficiency necessary for tax preparation. On average, after achieving proficiency, a return should take approximately 1 hour to complete. Each volunteer should anticipate completing 50 or more returns during the tax season.

Centre County RSVP provides tax assistance throughout the county. Call the RSVP Office at 355-6816) for more information and to volunteer.

Dont Miss: Doordash Taxes How Much

Also Check: Florida Transfer Tax Refinance