Youll Have To File A Separate Extension For State Taxes

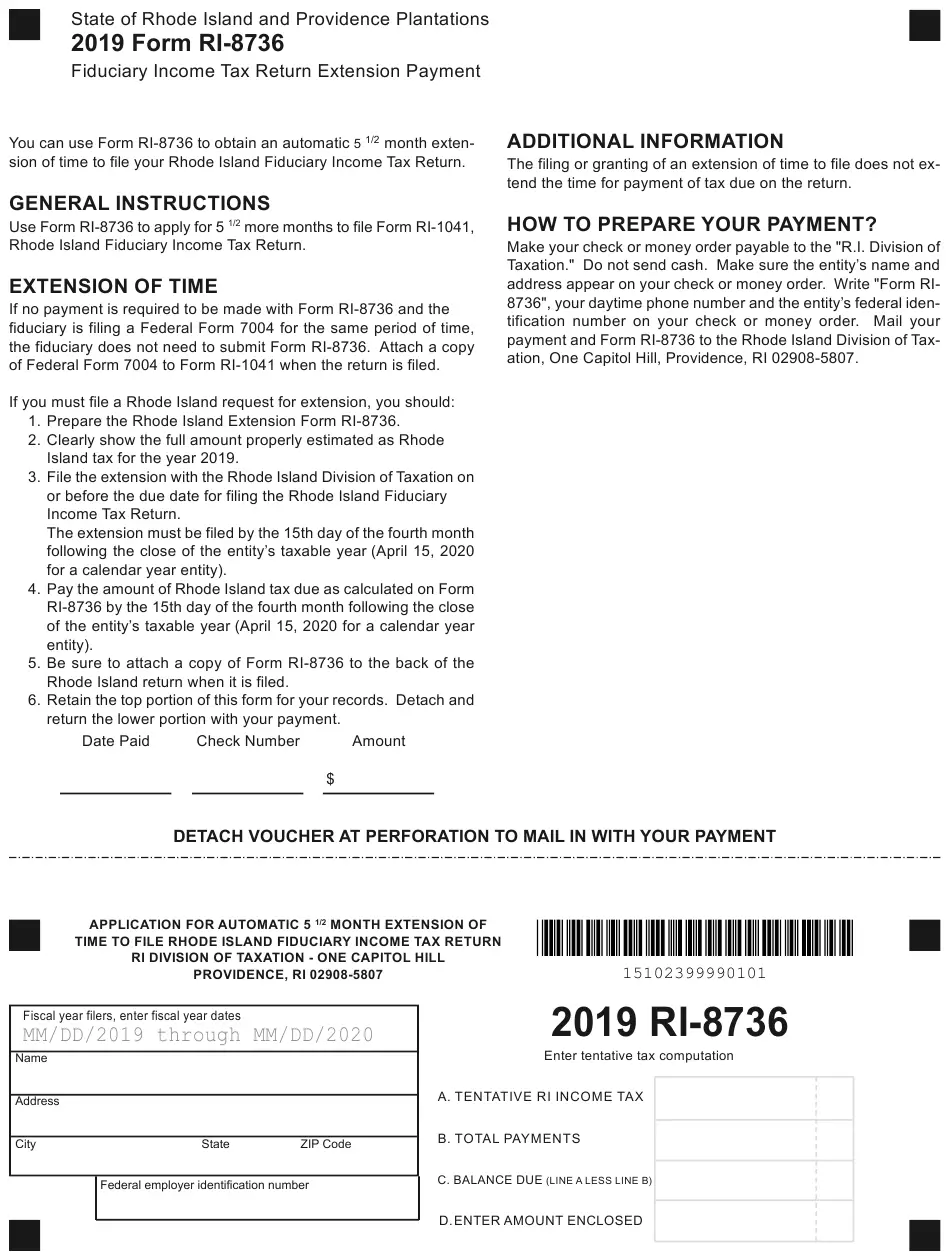

Extensions granted by the IRS only apply to your federal taxes. Youll also need to request one from your states revenue office. The rules regarding the extension deadlines, penalties and interest vary from state to state. Check the website of your stated department of revenue to see how long you have to file and what its going to cost you if you dont pay right away.

Is There A Deadline To File Taxes Canada

Each year, every citizen in Canada files his or her own income tax and benefit returns. The deadline for filing and paying taxes is April 30, 2022. the deadline is June 15 if you are self-employed. However, April is the deadline for you to request your refund and taking your time getting it will make no sense.

How To Get A Tax Refund

Tax Foundation

Did you know that the IRS may return some of your payments? You could be due for a tax refund if the following conditions apply to you:

- You have too much income tax withheld

- Your last payment submission went above the estimated taxes

- Your business has carry-backs on net operating losses

- You have business credit adjustments or capital losses

You can simply file for a tax refund via your e-filing software. On the other hand, you may send a written request to the IRS. Of course, doing this electronically is much faster than snail mail.

Recommended Reading: Doordash Deductions

Extension Of Time To File

An extension of time to file a return may be requested on or before the due date of the return. The extension is limited to six months. You may receive another 6-month extension if you are living or traveling outside the U.S. You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.

Extensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Complete the Military Combat Zone on your Extension of Time to File, FR-127.

Note: Copies of a federal request for extension of time to file are not acceptable.The extension of time to file is not an extension of time to pay. Full payment of any tax liability, less credits, is due with the extension request. If the tax liability is not paid in full with the extension, the request for an extension will not be accepted, and the taxpayer will be subject to a failure-to-pay penalty and interest on any tax due.

Preserve Your Tax Refund

Some people end up filing several years late, and there’s a three-year deadline for receiving a refund check from the IRS if it turns out that you’re due one. This three-year statute of limitations begins on the original filing deadline for that year .

The refund statute of limitations is also extended by six months when you file for an extension, which can preserve the ability of taxpayers to receive their federal tax refunds, even if they’re behind with submitting their tax returns.

Don’t Miss: Door Dash And Taxes

How Do I Apply For An Extension To File My North Carolina Income Tax Return If I Received An Automatic Extension To File My Federal Individual Income Tax Return

Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the N.C. individual income tax return, Form D-400. In order to receive the automatic state exension, you MUST fill in the “Federal Extension” circle on page 1 of Form D-400. The taxpayer must certify on the North Carolina tax return that the person was granted an automatic federal extension. You can use the Income Tax Estimator tool to estimate the amount of income tax you may owe.

Application For Extension In Date For Filling Income Tax Return

To file an Application for Extension in Date for Filling Income Tax Return, first, you need to login into your IRIS portal. You can log in by simply putting your CNIC and password. After logging click on the Declaration tab on Menu at the top of the screen.

When you click on the declaration tab a drop-down menu will appear. In the drop-down menu Select 119 / 114 .

On the next screen, you have to click on the Period button and select the relevant year.

When you click on the period button a Tax Periods list will appear. Now Click on the select link shown against the tax period.

After that, a whole new form will open up and in this form, you must the reason for File Application for Extension in Date for Filing of Income Tax Return. Explain your reason wisely in the contents box down there.

When you write down your reason in the content box Click on the Submit button on the menu at the top of the screen. After that click on the Print Button on the menu at the top of the screen to get a print of the application.

Please note that Your application shall be forwarded to the relevant Tax Office and when the concerned officer passes an Order on your application, the order will be available in your Inbox on the IRIS portal.

You May Like: Restaurant Tax In Philadelphia

How To File A Tax Extension For A Federal Return

Filing an extension to submit your federal tax return is one of the easiest tax chores you can face. It’s a simple matter of completing and submitting a single form, and it gives you a little breathing room.

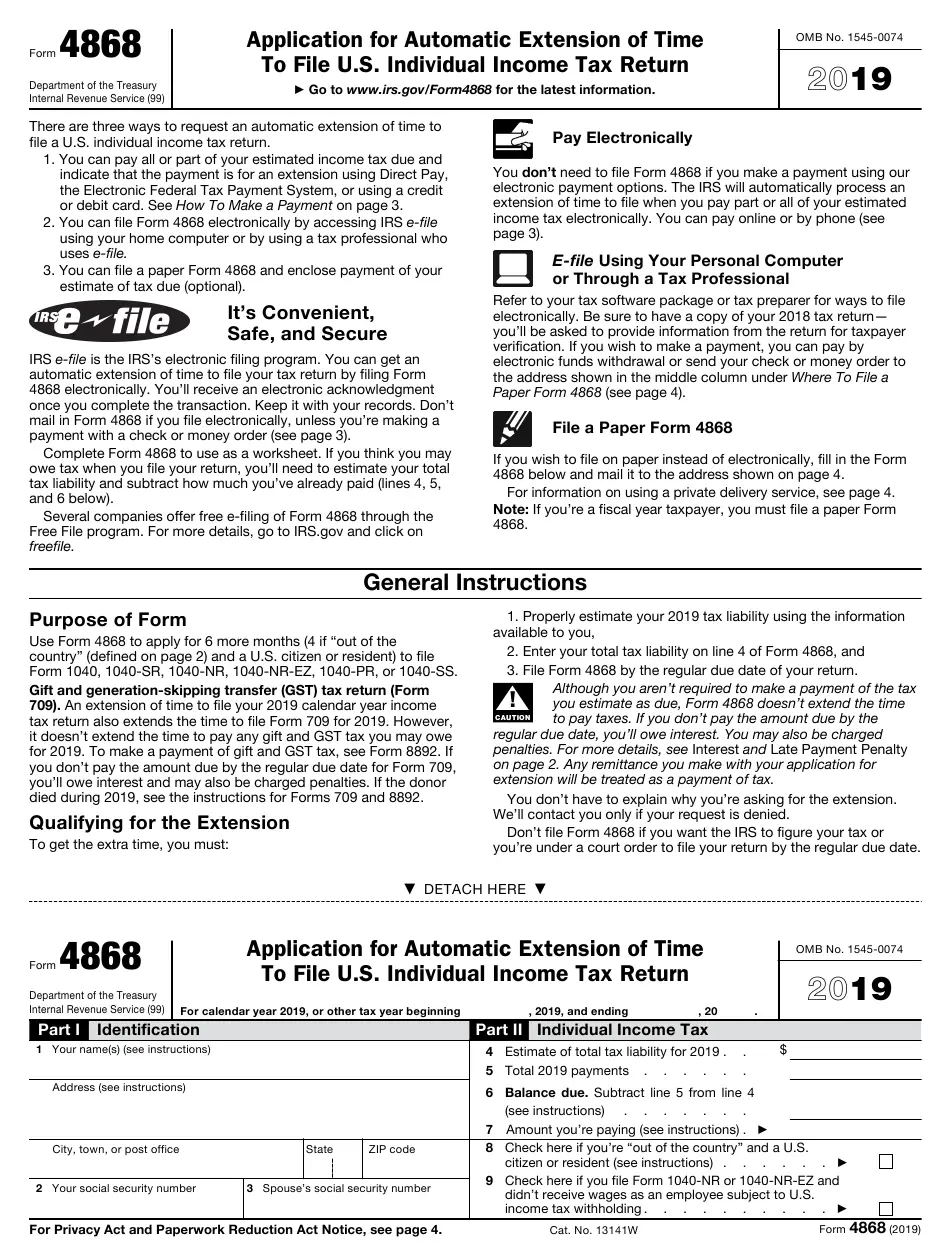

Maybe you’ve been busy and you’ve forgotten about the deadline looming, or maybe you’re still tracking down the documents you need to prepare your return. You know that you might not have them by April 15or at least you don’t want to risk not having them. And that’s okay. Just file IRS Form 4868 instead.

Small Business Tax Extensions Rules

- If you are self-employed and filing for an extension for your personal taxes, you will have until the Oct. 15 deadline to file the paperwork for your individual tax return. However, any taxes you owe are still due on April 15.

- You must continue to fund your SIMPLE IRA until year end.

- Your individual 401 plan must be set up by your businesss fiscal year-end. You can make employer/profit sharing contributions up until your businesss tax filing deadline, plus extensions. Additionally, your individual 401 plan operates on a business tax year. For many business owners this is January 1 through December 31, giving your plan an effective date of January 1 of the year the plan is established.

- You can set up a SEP plan for a year as late as the due date of your business’s income tax return for that year.

- Remember that the IRS requires that we code SEP or SIMPLE contributions in the calendar year they are received. An employer may, however, report the contribution for the prior plan year when filing their tax return. For more information on the IRS requirements, please see Instructions for Participant on the back of Form 5498 Line 8 or Line 9 .

- Remember that individuals cannot make prior year contributions to a traditional and/or Roth IRA past the April 15 deadline.

- Work with your tax preparer to file the correct forms for requesting an extension.

Your advisor and tax preparer can help answer your questions about your tax situation.

related information

Recommended Reading: Reverse Ein Lookup

More Time To File Not More Time To Pay

Its important to remember that the Form 4868 extension gives you more time to file, not more time to pay. You will still have to pay your taxes by that year’s original due date, even if the IRS grants an extension to file later.

If you think you may owe taxes when it comes time to file your return, you should estimate how much you will owe and subtract any taxes that you have already paid . If your estimate is on the high side and you end up overpaying, you will get a refund when you eventually file your return. You’ll also avoid potential penalties and interest accumulating, which is what can happen if you underestimate your taxes due.

When you file Form 4868, youll need to pay the estimated income tax you owe. Sometimes it’s better to be overly generousyoull get refunded anyway and underestimates increase the risk of paying interest on money owed.

You can pay part or all of your estimated income tax online using a debit or credit card or through an electronic funds transfer using Direct Pay. It’s also possible to mail a check or money order to make your tax payment, even if you file electronically. Make the check or money order payable to United States Treasury and include a completed Form 4868 to use as a voucher.

You do not need to file a paper Form 4868 if you submitted one electronically and are not mailing a payment.

File By Paying Electronically

If you plan on paying your taxes online, you can get an automatic six-month extension without filling out any other forms. This is by far the fastest, simplest way to get an extension on tax filing. Rather than going through the IRS Free File system , you can just select the âextensionâ option when paying through the IRS payment portal. Itâs as simple as that. Your six-month extension will begin right away, no need to apply for anything.

Also, filing online and setting up direct deposit for your bank account is the fastest way to get your tax refund, even if youâre filing with an extension.

Youâll still need to provide your basic contact and tax information, but you wonât need to file for an extension and pay your taxes as two separate steps.

Hereâs what the process looks like:

Read Also: Doordash Income Tax

What Does It Cost To File A Tax Extension

It’s free to file a tax extension in any way that’s best for you: electronically or mailed. But not filing an extension and not filing your taxes by April 18 could be costly, which we’ll cover later.

Regardless of how much you owe, a tax extension is not a payment extension. In order to avoid a penalty, you’ll need to have paid at least 90% of the tax for the current year or 100% of the tax shown for the prior year, whichever is less.

For married couples filing jointly with adjusted gross income of $150,000 or higher, the withholding must be at least 110% of the total tax owed for the prior year . Generally, you can avoid the penalty if you owe less than $1,000. Special rules apply for certain individuals like farmers, fishermen and certain household employers.

Top Credit Card Wipes Out Interest

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay 0% interest for a whopping 18 months! That’s one reason our experts rate this card as a top pick to help get control of your debt. It’ll allow you to pay 0% interest on both balance transfers and new purchases during the promotional period, and you’ll pay no annual fee. Read our full review for free and apply in just two minutes.

Don’t Miss: Appeal Taxes Cook County

Filing For An Extension Online

To file for a tax extension separate from paying your taxes online, youâll need to fill out IRS Form 4868. The IRS offers a few tools to do this online. If your income is below $72,000 you can use Free File software, but if your income is above $72,000 youâll have to settle for the Free File fillable forms.

IRS Form 4868

Remember, youâll still need to pay your taxes by the April 18, 2022 deadline. So to file for an extension, youâll also need to estimate your total taxes owed and subtract the total amount of tax youâve already paid.

Filing For A Tax Extension: Form 4868

If you need an extension of time to file your individual income tax return, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

The deadline is the same as the date your tax return is normally due. In most years, that’s April 15 or the next weekday.

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were automatically granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

Requesting an extension is free and relatively simple, and it can be done either electronically or on paper. Either way, you will need to provide identification information and your individual income tax information .

There are also checkboxes to indicate if you are either a U.S. citizen or resident who is out of the country or if you file Form 1040-NR, which is an income tax return that nonresident aliens may have to file if they engaged in business in the U.S. during the tax year or otherwise earned income from U.S. sources.

Like all other tax forms, Form 4868 is available on the IRS website. Visit the “Forms, Instructions & Publications” section for a list of frequently downloaded forms and publications, including Form 4868.

Also Check: How To File Taxes As A Doordash Driver

Easy Options For Filing An Extension

Option 1: E-file your federal tax extension in minutes withTurboTax Easy Extension

Using TurboTax Easy Extension, you can:

- E-file your federal extension

- Make a payment of any tax due directly from your checking or savings account

- Print a PDF copy of your e-filed extension

- Receive notifications when your extension has been accepted by the IRS

- Get easy instructions on how to file a state extension by mail

Note: Once your extension is approved, youll have until October 17, 2022 to file your return. If youre expecting a refund, it will not be processed until once you have completed your tax filing. If you think you owe, the estimated amount of taxes due will need to be paid to the IRS by the tax return filing due date.

Option 2: Print and mail your completed IRS extension form

If youd rather mail your extension directly to the IRS, simply refer to IRS Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, complete and print the form, and send it to the IRS address for your state.

If you owe federal taxes, include your estimated payment with your Form 4868 and mail itpostmarked by April 18, 2022 to avoid any penalties or interest. Then complete and file your return on or before October 17, 2022.

How To File For An Extension On My Taxes

Nasdaq

For the 2021 tax year, individual income tax returns are due by Monday, April 18, 2022. However, the IRS acknowledges that not all taxpayers can meet the deadline for one reason or another. Maybe you’re waiting for documents you need to submit with your return, or maybe you need extra time to track down receipts.

To accommodate situations like this, the IRS allows a six-month tax extension for anyone who needs one. So if you need more time to file your 2021 tax return, here’s what to know about filing an extension, and other important details.

What a tax extension is and isn’t

First, it’s important to realize that a tax extension gives you more time to file your tax return, not more time to pay any balance you owe. Your 2021 tax payment is still due on the normal April tax deadline.

A tax extension gives you six months from the usual standard deadline of April 15 to file your tax return. So, the extended tax deadline is October 15 — unless a weekend gets in the way, which it does in 2022. To make a long story short, if you file an extension this year, you have until Monday, Oct. 17 to file your 2021 tax return.

Also Check: How To Take Out Taxes For Doordash

Time Limit For Filing An Appeal

You have 90 days from the date of the CRA’s notice of confirmation, notice of reassessment or notice of redetermination to appeal to the Tax Court of Canada.

You may also appeal to the Tax Court of Canada if the CRA has not issued a decision within 90 days from the date you filed your income tax objection or within 180 days from the date you filed your GST/HST objection.

The Time Limits and Other Periods Act has allowed for the temporary extension in some cases to the deadlines noted above. For more information on deadlines and any other information on the resumption of business at the Tax Court of Canada, please refer to the Tax Court of Canada website.

What A Tax Extension Is And Isn’t

First, it’s important to realize that a tax extension gives you more time to file your tax return, not more time to pay any balance you owe. Your 2021 tax payment is still due on the normal April tax deadline.

A tax extension gives you six months from the usual standard deadline of April 15 to file your tax return. So, the extended tax deadline is October 15 — unless a weekend gets in the way, which it does in 2022. To make a long story short, if you file an extension this year, you have until Monday, Oct. 17 to file your 2021 tax return.

Before we move on to the “how,” one final point to keep in mind is that while you’re technically requesting an extension, it’s an automatic process. If you file an extension by the April 18 tax deadline, you’ll receive the additional time.

Don’t Miss: Efstatus Taxact 2016