What Taxes Must Self

Like other taxpayers, self-employed individuals will file an annual return. However, they will usually make tax payments every quarter. Tax payments usually fall into two buckets: self-employment tax and income tax on profits from the business.

For 2022, the self-employment tax rate on net income up to $147,000 is 15.3%. This percentage is broken down into 12.4% for Social Security tax and 2.9% for Medicare tax. Also, if your net earnings exceed $250,000 and youre , $125,000 if youre married but filing separately or $200,000 for all other taxpayers, you must pay an extra 0.9% Medicare tax.

Keep in mind, usually only 92.35% of your net earnings are subject to self-employment tax.

The Difference Between The Federal Tax And Provincial Tax

Every Canadian pays a federal and provincial tax as income and inflation are different in different provinces. And as Canada has a progressive tax system, different tax treatments help the CRA provide appropriate benefits. The above BPA of $13,808 is the average for the entire country and, therefore, gives you tax relief on the federal tax bill. Ontarios BPA for 2021 is $10,880 as the inflation and income are different for its residents. Its minimum provincial tax rate is 5.05%. Hence, your provincial BPA tax credit comes to around $550.

The Rich Bear Americas Tax Burden

Most Americans would be surprised to learn that a 2008 study by economists at the Organisation for Economic Co-operation and Development found that the U.S. had the most progressive income tax system of any industrialized country at the time. Their study showed that the top 10 percent of U.S. taxpayers paid a larger share of the tax burden than their counterparts in other countries and our poorest taxpayers had the lowest income tax burden compared to poor taxpayers in other countries due to refundable tax credits such as the Earned Income Tax Credit and the Child Tax Credit.

Our income tax code has only gotten more progressive since then because of Washingtons continuing effort to help working class taxpayers through the tax code.

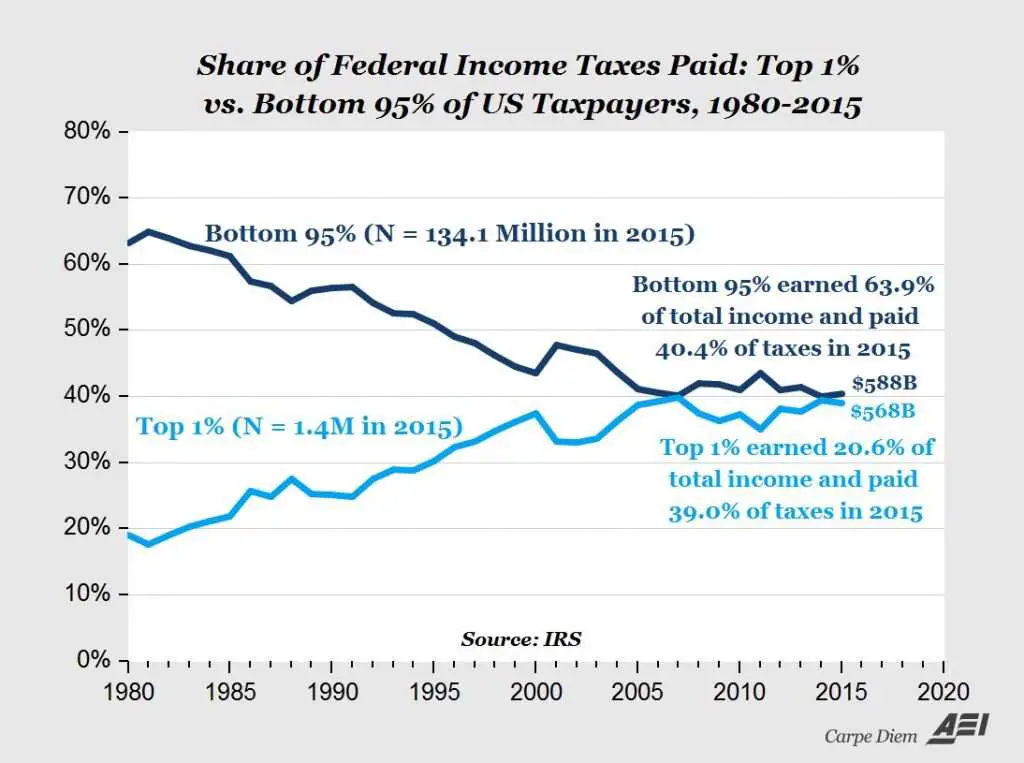

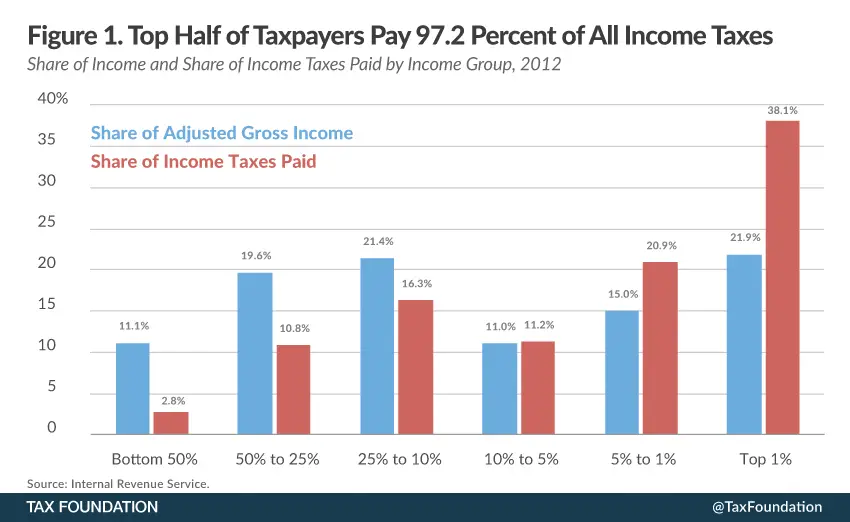

According to the latest IRS data for 2018the year following enactment of the Tax Cuts and Jobs Act the top 1 percent of taxpayers paid $616 billion in income taxes. As we can see in Figure 1, that amounts to 40 percent of all income taxes paid, the highest share since 1980, and a larger share of the tax burden than is borne by the bottom 90 percent of taxpayers combined .

In case you are thinking, Well, the rich make more, they should pay more, the top 1 percent of taxpayers account for 20 percent of all income . So, their 40 percent share of income taxes is twice their share of the nations income.

Don’t Miss: Filing Taxes For Doordash

Ratification Of The Sixteenth Amendment

In response, Congress proposed the Sixteenth Amendment , which states:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The Supreme Court in Brushaber v. Union Pacific Railroad,240U.S.1, indicated that the amendment did not expand the federal government’s existing power to tax income but rather removed the possibility of classifying an income tax as a direct tax on the basis of the source of the income. The Amendment removed the need for the income tax to be apportioned among the states on the basis of population. Income taxes are required, however, to abide by the law of geographical uniformity.

How Much Money Do You Actually Get Back From The Carbon Tax

Wednesday, February 9th 2022, 2:05 pm – Four years into the program, Canadians are still confused about how the carbon tax works.

The carbon tax has been around since 2019 in Canada even longer in some provinces and still most consumers remain unsure how the program works.

How much are you paying? Are you eligible for a rebate? If so, how do you get it and how much do you get?

These are the most common questions consumers have about the carbon pricing program, and they persist because the answers remain convoluted. Part of the reason for this is politics.

Carbon taxes can be a challenge politically, Matto Mildenburger, political science professor at the University of California Santa Barbara, told The Weather Network . This is because, as a policy, carbon taxes foreground policy costs while backgrounding the benefits.

Almost everyone is going to benefit from having a stable climate, but the focus of political debate centers on the tax, Mildenburger added.

According to Ontarios Federal Carbon Tax Transparency Act, every gas station pump in the province is required to display the provincial carbon tax sticker outlining the cost of the carbon tax on gasoline.

Mildenburger is the lead author on a major study describing how Canadas carbon pricing program impacts public support for climate policy.

In Canada, over 80 per cent of households come out as winners with the carbon tax and rebate program, Mildenburger told TWN.

Don’t Miss: Protesting Harris County Property Tax

Top 1% Pay Nearly Half Of Federal Income Taxes

The top-earning 1 percent of Americans will pay nearly half of the federal income taxes for 2014, the largest share in at least three years, according to a study.

According to a projection from the non-partisan Tax Policy Center, the top 1 percent of Americans will pay 45.7 percent of the individual income taxes in 2014up from 43 percent in 2013 and 40 percent in 2012 .

The bottom 80 percent of Americans are expected to pay 15 percent of all federal income taxes in 2014, according to the study. The bottom 60 percent are expected to pay less than 2 percent of federal income taxes.

Read MoreWhere the rich make their income

While the top 1 percent pay a larger share of taxes, they also earn an outsized share of income. According to the Tax Policy Center, they earned 17 percent of expanded cash income in 2014.

The high share of taxes paid by one-percenters is due partly to their share of income, but also to the progressive tax code, in which higher earners generally pay higher rates. The one percenters’ share of taxes is 2.7 times their share of income in taxes.

Read MoreWant a billion-dollar career? Choose this degree

There is no comparable historical data for the one-percenter tax payments prior to 2012. Yet the Congressional Budget Office, using a different calculation than the Tax Policy Center, found that the share of federal taxes paid by the top 1 percent of earners has increased dramatically since 1979 as the one-percenter’s share of earnings has also gone up.

So What Do Canadians Pay With The Carbon Tax

For simplicity’s sake, we will not concentrate on the carbon pricing aimed at industrial facilities, and instead look at how a carbon levy on fuel used for transportation or home heating affects the bottom line of every day Canadians.

It is important to note, though, that because some provinces meet their carbon pricing requirements through a system aimed at the big industrial emitters, the residents of these provinces see less of an increase to their prices than on average.

In Quebec, for example, the tax on gasoline for drivers is about half the federally mandated rate. Nova Scotia has almost no carbon tax on gasoline and a tiny hit of 31 cents per cubic metre for home heating. But since these provinces are not part of the federal plan, their residents do not receive a rebate.

Residents of all other regions except P.E.I., N.W.T., and Newfoundland and Labrador will pay the 8.8 extra cents per liter of gasoline and most will pay around an extra $1.50 per cubic metre for home heating.

Yet some of these provinces cushion the impact of the increases by lowering their own taxes on oil, gasoline, and propane, thereby saving consumers from bearing the financial burden.

As a result, only the residents of four provinces Ontario, Alberta, Saskatchewan, and Manitoba bear the full direct cost of the federal tax, which is why residents of these provinces receive the federal rebate, also known as the Climate Action Incentive .

Also Check: How To Get A License To Do Taxes

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

Why Is The Federal Income Tax A Progressive Tax

A progressive tax system is designed to distribute the tax burden more heavily toward those who have more income. Its supporters reason that taxpayers with higher wages have greater means to support government services, and it’s meant to support a thriving middle class. Detractors argue that this discourages people from earning more since they will have to pay a higher tax rate if they do.

You May Like: Does Doordash Take Out Taxes For Drivers

What Are Quarterly Taxes

Quarterly taxes, also referred to as estimated taxes, are a type of taxation you must pay in advance of the annual tax return. They work on a pay-as-you-go basis, meaning you pay them throughout the year. During each quarter, applicable taxpayers pay a portion of their expected annual income tax. As a result, these payments are estimations.

These regular tax payments are meant to cover Medicare, Social Security and your income tax. So, you should familiarize yourself with how those taxes break down: the income tax and the self-employment tax. Income tax follows the same income tax rates as salaried workers pay. Then, the self-employment tax clocks in at 15.3%. This covers both the Social Security and Medicare costs .

The Build Back Better Agenda Would Address These Inequities By Reforming Capital Gains Taxes And Providing Tax Cuts To Families

The Build Back Better bill now pending in the House of Representatives takes many important steps toward a fairer tax code. Millionaires tax rates would rise by 7.1 percentage points on average, according to the Joint Committee on Taxation this estimate does not count unrealized gains toward income. If policymakers want to ensure that the wealthiest Americans pay significantly more, they must reform the capital gains tax base to prevent the massive gains of the wealthiest Americans from escaping income tax.

President Biden proposes in Build Back Better to tax unrealized gains when an asset is gifted or bequeathed to heirs. Two other options are also under consideration in Congress to ensure that ultrawealthy Americans pay taxes on their large unrealized capital gains. Congress could: 1) tax the gains of ultrawealthy people as they accrue, not only when they are realized, through what is known as mark to market taxation or 2) repeal stepped-up basis and move to carryover basis, where no tax is due when an asset is handed down between generations but the original owners gain is taxed when an heir sells the asset. President Bidens plan and the Houses Build Back Better legislation also raise the top rate on capital gains.

Also Check: What Can I Write Off On My Taxes For Instacart

Americas Tax System Might Be Even Less Progressive

These figures may overstate the progressivity of the nations tax system for several reasons.

First, ITEP is not yet able to split out different income groups within the richest 1 percent. If we did, we might find that effective tax rates are surprisingly low for the very, very rich given that much of their income is capital gains and stock dividends, which are taxed at lower rates. Research by Emmanuel Saez and Gabriel Zucman finds that the very richest 400 taxpayers in the United States pay a lower effective tax rate than other groups. While they use very different methods than ITEP, their conclusions are not surprising.

Second, calculating the fraction of income paid in taxes is just one way to measure effective tax rates and measure the progressivity of the nations tax system. To ascertain the extent to which taxes are higher for those with more ability to pay, it might make more sense to define effective tax rates as taxes paid as a share of taxpayers net worth.

Saez and Zucman estimated that in 2019, the wealthiest 0.1 percent households would pay 3.2 percent of their net worth in taxes while the bottom 99 percent of households ranked by wealth would pay 7.2 percent of their net worth in taxes. In other words, when defining effective tax rates as taxes paid as a share of wealth, they find that the tax system is very regressive. This is unsurprising given that the concentration of wealth at the top is even more severe than the concentration of income at the top.

The Effect Of Credits And Deductions

Tax credits and deductions must also be taken into consideration because they heavily influence how much of an individuals income will ultimately be taxed.

The taxpayer with the $300,000 income can bring that figure down by claiming the standard deduction.

For a single filer, the standard deduction is $12,550 for 2021 and $12,950 for tax year 2022.

So their taxable income would drop to $287,450 in 2021 and $287,050 in 2022 .

The $15,000-a-year persons taxable income would drop to just $2,450 in 2021, assuming theyre also single and they claim the $12,550 standard deduction, while their 2022 taxable income after a $12,950 deduction would be only $2,050.

The six-figure taxpayer might potentially bring their taxable income down even more by itemizing instead. According to the most recent IRS data available, Taxpayers claimed $190.1 billion in itemized charitable donation deductions in 2019. The taxpayer who earns just $15,000 a year likely would not contribute much to that number. The same applies to the mortgage interest deduction, which resulted in $185.0 billion being shaved off taxpayers incomes in 2019. Low-income individuals generally dont pay enough interest on mortgages to give them a sizable tax deduction. Property and state taxes accounted for $139.0 billion in claimed tax deductions in 2019, and it stands to reason that the majority of that total can be attributed to people who paid the most in such taxeshigh-income individuals.

You May Like: Philadelphia Pa Sales Tax

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

When You Get Paid

As an employee, you receive payment in arrears. This means you get paid for the weeks you have already worked.

Payday is every second Wednesday. Your pay is for work completed up to and including the end of the day 2 Wednesdays before. This means that you get paid for 10 days, from Thursday to Wednesday, for work that concluded 2 weeks previously.

When you get paid More information

You May Like: How Do You Claim Doordash On Taxes

How Do I Calculate My Marginal Tax Rate

To calculate your marginal tax rate, you will need to look at the tax bracket table for the current year . First, calculate your adjusted gross income by subtracting the standard deduction or itemized deductions and any other allowable above-the-line deductions from your total income. Then multiply each portion of your AGI by the tax rate for each income level and add the totals for your total income tax obligation.

What Is National Insurance For Anyway

National insurance is a tax paid on earnings by employees and employers, and paid by the self-employed on profits.

It was introduced back in 1911 to support workers who had lost their jobs or needed medical treatment, and later expanded to fund the state pension and other benefits and contribute towards the NHS.

The government can also borrow from the national insurance fund to pay for other projects.

National insurance contributions are mandatory for people aged 16 or over, up until state retirement age, provided you earn over certain limits.

Currently, you have to pay national insurance if you earn either:

- Over £823 per month as an employee

- More than £6,715 a year in profit when self-employed

There are four main types of national insurance:

- Class 1. Payable by employees and employers

- Class 2. A flat rate payable for the self-employed

- Class 3. Voluntary contributions paid by people who wouldnt otherwise have to pay, but want to avoid gaps in their National Insurance record, and make sure they qualify for benefits such as the state pension or maternity allowance

- Class 4. Payable on profits above a certain level by the self employed

Do you pay NI on a pension? We explain the rules here.

You May Like: Doordash Tax Deductions