Where To File Payments

The best way for a business to pay their quarterly taxes is through EFTPS, the Electronic Federal Tax Payment System. This gives you a secure online platform for scheduling or filing your payments directly and keeping track of your past filings.

All you need to set up an account is your social security number or employer identification number. Register for an account online or over the phone, and youll receive a secure PIN for your account in the mail.

Direct payments can also be made to the IRS online without an account, but you will have to record and keep track of your payments yourself.

You Dont Need To Pay Estimated Taxes If

Youâre an employee If youâre an employee, your employer should be withholding quarterly taxes on your behalf. That being said, sometimes they can get the amounts wrongâfill out Form-W4 and give it to your employer to make sure that theyâre deducting the correct amount.

Youâre a special case If you meet three very specific conditions below, then you donât have to pay estimated quarterly taxes:

- You did not owe any taxes in the previous tax year, and did not have to file a tax return

- You were a US citizen or resident for the entire year

- Your tax year was 12 months long

If you donât meet all of the criteria for non-payment above, then youâre one of the many Americans who needs to pay estimated quarterly taxesâread on!

Should I Pay In Equal Amounts

Usually, you pay your estimated tax payments in four equal installments. But you might end up with unequal payments in some circumstances:

- If you had your previous year’s overpayment credited to your current year’s estimated tax payments

- If you don’t figure your estimated payments until after April 15 when the first one is typically due

- If you unexpectedly make a lot of money in one quarter

Don’t Miss: Michigan Gov Collectionseservice

Case B: If You Didn’t Pay Enough

Here’s a tricky circumstance: you did make payments, but the problem is that you did not pay enough. In this case, the situation can get more complicated.

In this situation, there will be some complicated calculations between what you paid and what you failed to pay, underpayments that were outstanding, various penalties to consider.

It can be rather difficult for the average taxpayer to figure out, which is why the IRS allows you to leave that estimated quarterly tax box blank. It’s best to do this rather than messing it up and paying less than you owe – ending up with even more penalties. Don’t fret over overpaying estimated taxes, as you’ll just get a refund at the end of the year.

Ultimately, you can also get a self-employment income tax software to make those calculations for you. You can enter the inputs, and the software will automatically calculate things for you. You’ll probably have to pay for a verified, accurate software, but usually, the results are worth it.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: 1099 Nec Doordash

Plan Ahead To Meet Your Quarterly Estimated Payment Obligations

Small business taxes can be confusing. Your state and local tax authorities may also require quarterly estimated payments, although the deadlines and methodology may differ from federal requirements. It is important to understand your obligations so you can be proactive about meeting them. If you need assistance calculating your estimated tax liability or have questions, ask a lawyer for help today.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

Make Sure You Pay Your Estimated Taxes On Time To Avoid Penalties

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

A Tea Reader: Living Life One Cup at a Time

You May Like: Pastyeartax

What Happens If You Skip Payments

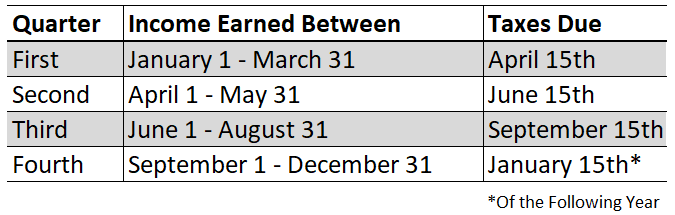

If you are required to file quarterly tax payments and you forget or just decide to skip out on paying them, then you’ll have to pay an underpayment penalty. In order to avoid paying an underpayment penalty, you’ll need to make your payments on time and send in the proper amount. Here are the due dates for estimated taxes.

How Will I Know If I Need To Make An Estimated Payment

If you are required to file a tax return and your Virginia income tax liability, after subtracting income tax withheld and any allowable credits, is expected to be more than $150, then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income.

Recommended Reading: Irs Employee Search

Who Makes Quarterly Estimated Tax Payments

Upon beginning work for a new employer, one of the first things salaried and hourly employees are asked to do is fill out Form W-4, which allows the employer to withhold income taxes from each paycheck throughout the year, both on wages earned from that employer and from other sources of income. When that employee files his or her annual income tax return, taxes that were overpaid throughout the year are returned to the taxpayer in the form of a refund, or, if an insufficient amount of money was withheld throughout the year, the remaining balance will come due on Tax Day.

Many people, however, receive income from sources other than an employer, such as self-employment income, interest and dividend income, unemployment compensation, Social Security benefits, rental income, and alimony, among others. In general, if a taxpayer is expected to owe at least $1,000 in federal income taxes but does not have a way to have those taxes withheld throughout the year by an employer , then that individual is required to remit estimated income tax payments throughout the year. Most individuals who make quarterly estimated tax payments to the federal government must also make payments to their state, but each state sets its own requirements. As such, the responsibility falls on taxpayers to know when their states estimated tax payments are due, and to pay special attention to whether any applicable state due dates come before the extended federal due date.

Will I Owe Taxes If I Received A Ppp Loan Which Was Forgiven

Part of the tax relief provided under the CARES Act included forgivable Payroll Protection Program loans for qualified small businesses. If recipients used loan proceeds for certain types of business expenses, up to the entire loan amount may be forgiven.

Discharged indebtedness is generally categorized as taxable income under the Internal Revenue Code. However, the CARES Act specifically excluded forgiven PPP loans from taxation. In other words, if you received a PPP loan and it was forgiven, the loan proceeds are not taxable.

Whats more, in January 2021, the IRS clarified and actually reversed previous guidance, stating that expenses paid with forgivable PPP loan proceeds may be tax deductible if the expenses would otherwise be eligible for tax deductions.

Don’t Miss: How To Buy Tax Lien Certificates In California

If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2021 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2021 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

How Do You Calculate Quarterly Taxes

In order to pay your quarterly taxes, you first need to figure out exactly how much you owe. In many cases, the numbers will depend on the state along with the tax year that you are in. Because of this variety, the IRS often offers a tax calculator for you to use, or even calculates how much you owe.

With that in mind, if you plan to make those calculations yourself, you need to be thorough. Here are the steps you should take if you need to pay quarterly taxes:

Note: you can also determine how much taxes you’ll owe at the end of the year by using Bonsai’s online self-employed tax calculator. Just plug in your filing status, what State you are in, how much money you are planning to earn, etc and our tool will calculate everything for you.

Also Check: How Much Will A Roth Ira Reduce My Taxes

What Are The Different Ways I Can Pay My Quarterly Taxes

There are several ways you can remit your second quarter estimated tax payment. First, you can print and mail your 1040-ES form with a check. If you would rather pay online, you can do so using your bank account or with a . Another option is to pay using your phone or tablet using the IRS2Go app.

You could also use the IRS Electronic Federal Tax Payment System to make federal tax deposits, installment agreement payments , and quarterly estimated tax payments. In fact, you can use the EFTPS system to pay your estimated taxes more frequently than quarterly, making payments on a weekly, bi-weekly, monthly, or other periodic basis which may help some taxpayers with budgeting.

How Can I Avoid Penalties

The IRS lays out the circumstances under which penalties can be waived. The main circumstance is all of the following applying to you:

- You are over 62 years old or have a disability

- You have a reasonable cause for not making your payment

- You did not willfully neglect your payment deadline

The other likely cause for a waiver would be if your missed payment:

- Was the result of a natural disaster

- Was the result of your death

- Was the result of another unusual situation

The IRS reserves the right to make the final decision on whether or not to waive your penalties.

If you think you may be eligible for a penalty waiver, you need to request one from the IRS using Form 2210. The form must be submitted with your tax return, alongside a written explanation for why you missed your payment.

Another way to avoid the underpayment penalties for W-2 wage earners, is to adjust your income tax withholding rate throughout the year. You can adjust their income tax withholding by changing the Form W-4 on file with their employer. The process to change your Form W-4 varies by employer, but essentially, if you report any amount of Other Income on the new W-4 form, more income tax will be withheld from your paychecks. If you reduce the Other Income amount, or add an amount to the Deductions line, then the amount of income tax withheld from your paycheck will be reduced.

If none of the above apply to you, there are no other ways of avoiding underpayment penalties.

Don’t Miss: Www Michigan Gov Collectionseservice

Who Is Required To File Quarterly Taxes

If any of the following apply to you during the year, you may have to pay quarterly taxes:

- You expect to owe $1,000+ on taxes.

- You made $400+ in self-employed/1099 income.

For the full details, check out the IRSâs clarification:

- âIndividuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.â

- And âCorporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.â

There is one exemption to having to pay quarterly taxes, even if you are self-employed. Suppose you had zero tax liability for the previous year, as long as it covered a 12-month period, and you were a U.S. citizen or resident for the entire year. In that case, you are not required to make estimated tax payments in the current year.

What Happens If I Miss A Quarterly Estimated Tax Payment

If you owe more than $1,000, the IRS wants its owed taxes paid during the year. Any missed quarterly payment will result in penalties and interest. Waiting until the end of the year to file and pay taxes may lead to other financial issues if you fail to reserve enough funds to satisfy your tax debt.

Read Also: How Much Are Taxes On Cable And Internet

What Are Estimated Quarterly Taxes

Estimated quarterly taxes are taxes that many self-employed people have to pay each quarter, or four times a year. This is based on how much money they estimate theyll make that year.

The estimated quarterly taxes include income tax, self-employment tax, and other applicable taxes.

Unlike employees where their employer withholds income tax, self-employed people need to withhold and pay their own taxes. Thus, to make sure they receive the proper compensation from your income, the government requires quarterly installments.

If You Stay Organized You Dont Have To Get Organized

The best way to prepare for quarterly taxes is to keep track of all your business mileage and expenses with well-kept records. Then, the more deductions you have, the lower your taxable income will be, and the less youâll owe to the IRS. Everlance is the #1 app for tracking mileage & expenses.

With Everlance, you can automatically capture your car mileage and business expensesâwhich likely equal thousands of dollars of deductions. When preparing for taxes, download your mileage and expense records. Then, hand them over to your accountant or import them directly into your tax preparation software. Money saved! ð

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

Who Pays Quarterly Tax Estimates

Your expected taxes at the end of the year should indicate whether you have to pay each quarter. Heres a breakdown of the threshold for owing quarterly taxes:

- If you expect to owe $1,000 or more at the end of the year: Individuals including sole proprietors, partners or S corporation shareholders are generally required to make estimated payments when their expected tax liability is $1,000 or more. The exception is farmers or fishermen, who must follow different rules for estimated tax payments.

- If you expect to owe $500 or more at the end of the year: Corporations fall under a lower threshold for compliance. If you are incorporated and expect to owe at least $500 in taxes when you file your corporate tax return, you are required to pay quarterly estimated tax payments.

When Are Quarterly Taxes Due For 2021

Make sure to pay estimated taxes on time. Each quarter, you’re expected to pay taxes for that quarter’s payment period. Here are the due dates for 2021:

1st Quarter:

- Payment period: January 1 â March 31

- Tax payment is due April 15, 2021

2nd Quarter:

- Payment period: April 1 â May 31

- Tax payment is due June 15, 2021

3rd Quarter:

- Payment period: June 1 â August 31

- Tax payment is due September 15, 2021

4th Quarter:

- Payment period: September 1 â December 31

- Tax payment is due January 15, 2022

The four estimated tax payments are usually due each year on the 15th of April, June, September, and January. If that date falls on a weekend or federal holiday, the filing deadline is pushed to the following business day. If you donât pay on time, then you may be subject to a penalty.

Read Also: Doordash Dasher Taxes

When To Pay Estimated Quarterly Taxes

For 2022, here’s when estimated quarterly tax payments are due:

|

If you earned income during this period |

Estimated tax payment deadline |

|---|---|

These dates dont coincide with regular calendar quarters, so plan ahead. And you dont have to make the payment due in mid-January if you file your tax return and pay what you owe by the end of the month.

You can make payments more often if you like, Kane says.

I think it’s easier to make 12 smaller payments than four larger payments,” she says. “If you owe $1,200 for the year, I would rather pay $100 a month than $300 four times a year. And if we’re talking bigger numbers, it gets pretty extreme.

When Are 2021 Q2 Estimated Taxes Due

4 min read

You are, in most cases, required to make estimated tax payments to the IRS if you are self-employed, or if you expect to owe the IRS $1,000 or more when you file your 2021 tax return in 2022. You do not need to make estimated tax payments in 2021 if you had no tax liability for the 2020 tax year, you were a U.S. citizen or resident for the entire year, and your 2020 tax return covered a 12-month period for income. Heres what you need to know about filing estimated taxes for the second quarter of 2021.

You May Like: Efstatus.taxact 2013