Understanding The Current Federal Income Tax Brackets

Our current tax brackets were adjusted when Congress passed new legislation in 2017 that changed the brackets and how taxes are filed. The tax reform passed by President Trump and Congressional Republicans lowered the top rate for five of the seven brackets. It also increased the standard deduction to nearly twice its 2017 amount.

For the most recent taxes filed, for the 2021 tax year, the standard deduction was $12,550 for single filers and married filers who file separately. Joint filers will have a $25,100 deduction and heads of household get $18,800.

How The Brackets Work

In the American tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income, called tax brackets. There are seven tax brackets in all. The more you make, the more you pay.

Moving to a higher tax bracket doesnt mean you pay that rate on all your income. For example, a single taxpayer will pay 10 percent on taxable income up to $10,275 earned in 2022. The top tax rate for individuals is 37 percent for taxable income above $539,900 for tax year 2022.

A New Top Tax Rate For The Future

Will the top income tax rate go up in the near future? It will if President Biden gets his way. Last year, as part of his American Families Plan, the president proposed increasing the highest tax rate from 37% to 39.6%, which is where it was before the Tax Cuts and Jobs Act of 2017. He was not able to get that change passed last year. In fact, it wasn’t even included in the huge spending and relief package unsuccessfully pushed by the Biden administration in 2021 the Build Back Better Act.

The administration’s failure to pass the Build Back Better Act didn’t affect the president’s desire to increase the top federal income tax rate, though. Raising the top rate back to 39.6% beginning with the 2023 tax year was included once again in Biden’s budget proposals release in March 2022. Under the budget plan, the 39.6% rate would apply to taxable income over $450,000 for married couples filing a joint return, $400,000 for singles, $425,000 for head-of-household filers, and $225,000 for married people filing a separate return. These thresholds would still be indexed for inflation each year after 2023 under Biden’s plan.

Don’t Miss: Do You Pay Taxes On Life Insurance Payout

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Don’t Miss: How Do I Claim Home Office On Taxes

Tax Brackets For : What Is My Tax Bracket

We may receive a commission if you sign up or purchase through links on this page. Here’s more information.

The United States imposes a progressive income tax system, which means that a taxpayers tax rate increase as his or her income increases.

A tax bracket is an income range along with the corresponding tax rate that is assessed on that income based on ones filing status.

There are currently seven federal income tax brackets.

How Do Tax Brackets Work In Ontario

In Ontario, tax brackets are based on net income for income tax purposes. There are 5 tax brackets:

- First: $45,142 or less

- Second: over $45,142 up to $90,287

- Third: over $90,287 up to $150,000

- Fourth over $150,000 up to $220,000

- Fifth: over $220,000 and over

Each tax bracket has a different rate of tax associated with it. If your net income falls in the second bracket, you will be taxed on the rate for the first bracket for the first $45,142, and the second bracket for the balance.

Recommended Reading: What Is The Sales Tax In Arkansas

How Federal Tax Brackets Work

The most important thing to understand about Canadas federal income tax brackets is that the rates apply only to the earnings that fall within each tiersort of like a ladder.

So, for example, if someone made $40,000 this year from all their sources of taxable income they are in the lowest federal bracket for 2020 and will pay 15% in federal tax, or about $6,000.

But someone who falls into the second federal bracket, lets say with an annual income of $90,000, still pays the same 15% on their first $48,535 in earnings. Its only the income over and above that first bracket limit that will be taxed at the higher second bracket rate of 20.5%.

To use the table above, start by finding which range your income falls into. Then subtract the minimum dollar value of that range from your annual income, and multiply by the applicable tax rate. Finally, add the maximum total tax from the previous bracket to approximate your 2020 federal taxes.

Heres how that looks for a $90,000 earner in the second bracket:

$90,000 annual income $48,536 2nd bracket minimum= $41,465

x 2nd bracket rate of 20.5%= $8,500.32

+ 1st bracket maximum total tax of $7,280= $15,780.32 total federal taxes payable

Heres another example for someone in the top bracket earning $500,000:

$500,000 annual income $214,368 5th bracket minimum= $285,632

x 5th bracket rate of 33%= $94,258.56

+ 4th bracket maximum total tax of $49,645= $143,903.56 total federal taxes payable

When Do Ontario Tax Brackets Change

Any changes to tax rates or income brackets must be announced in a budget. Both federal and provincial governments can make changes to their level of taxation, tax deductions or credits, programs and exemptions, but they are always done in a budget announcement. They do not come into force until the budget bill receives Royal Assent.

You May Like: How To Review My Tax Return Online

How To Read Your Bracket

A lot of people think that their tax bracket determines the tax rate they’ll pay on all their income. But that’s not how it works. Tax brackets apply only to the income that falls within their range. For instance, if you’re single with taxable income of $9,850, you’re in the 10% tax bracket, and you’ll pay tax of 10% of $9,850, or $985. However, if your taxable income goes up to $10,000, you’ll move up to the 12% bracket. Some fear that means you’ll pay $1,200 in taxes. But you only pay 12% taxes on the income from $9,875 to $10,000, or $125 of income. That leads to tax of $987.50 plus $15, or $1,002.50 in total.

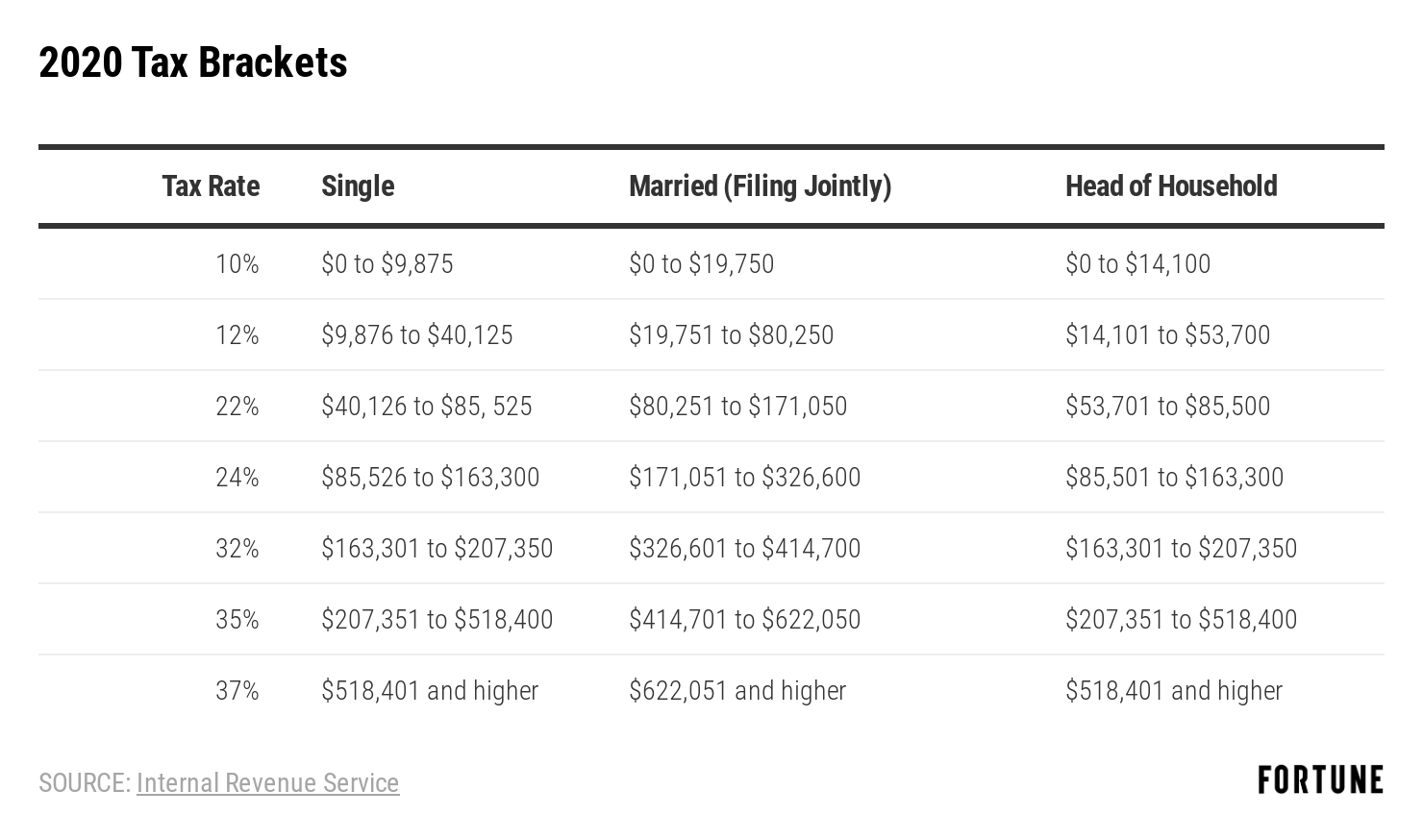

Below, we’ll look at the tax brackets that will apply for the 2020 tax year for various filing statuses.

How The Tax Brackets Work

Suppose you’re single and had $90,000 of taxable income in 2021. Since $90,000 is in the 24% bracket for singles, is your 2021 tax bill simply a flat 24% of $90,000 or $21,600? No! Your tax is actually less than that amount. That’s because, using marginal tax rates, only a portion of your income is taxed at the 24% rate. The rest of it is taxed at the 10%, 12%, and 22% rates.

Here’s how it works. Again, assuming you’re single with $90,000 taxable income in 2021, the first $9,950 of your income is taxed at the 10% rate for $995 of tax. The next $30,575 of income is taxed at the 12% rate for an additional $3,669 of tax. After that, the next $45,850 of your income is taxed at the 22% rate for $10,087 of tax. That leaves only $3,625 of your taxable income that is taxed at the 24% rate, which comes to an additional $870 of tax. When you add it all up, your total 2021 tax is only $15,621.

Now, suppose you’re a millionaire . If you’re single, only your 2021 income over $523,600 is taxed at the top rate . The rest is taxed at lower rates as described above. So, for example, the tax on $1 million for a single person in 2021 is $334,072. That’s a lot of money, but it’s still $35,928 less than if the 37% rate were applied as a flat rate on the entire $1 million .

Read Also: Where Do I Get Federal Tax Forms

Bc 2021 And 2020 Personal Marginal Income Tax Rates

BC Income Tax Act s. 4.1, 4.3, 4.52, 4.69

The Federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of1.010.

The BC tax brackets and personal tax credit amounts are increased for 2021 by anindexation factor of 1.011.

The indexation factors, tax brackets and tax rates have been confirmed to Canada Revenue Agencyinformation.

The BC 2020 Budgetadded a new high tax bracket for 2020 for taxable incomes over $220,000, whichis indexed after 2020.

Tax Tip: read the article Understanding the Tables of Personal Income Tax Rates,especially if you are trying to compare the rates below to the marginal taxrates in the Basic Tax Calculator.

British Columbia Personal Income Tax Brackets and Tax Rates 2021 Taxable Income

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Recommended Reading: How Do I File My California State Taxes For Free

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

How To Identify Your Tax Bracket

How much tax you’ll pay is determined by where you live in Canada, and how much income you declare from all sources. Importantly, your provincial rate is determined by the province you are living in on December 31 of the tax year. So, if you move from Ontario to Nova Scotia in July, and you find yourself living in Nova Scotia on December 31, you would fall under the Nova Scotia provincial tax rates.

Read Also: Is Credit Karma Safe For Taxes

How Do I Know What Tax Bracket Im In

If you calculate your net income after deductions and compare it to the chart above, you will know how much tax you will need to pay. Find the tax bracket where your income falls. If your income falls in the first tax bracket, you will only be taxed on that tax rate. If your income falls in a higher tax bracket, you will be taxed on the lowest tax bracket rate to the maximum for that bracket, on the second tax bracket to the maximum amount for that bracket, and so on progressively until you reach the bracket your income belongs in.Remember that there are different rates for federal and provincial taxes.

How Canadian Tax Brackets Work

Your tax bracket is based on taxable income, which is your gross income from all sources, minus any tax deductions you may qualify for. In other words, its your net income after you’ve claimed all your eligible deductions.

Once you know what your taxable income is, you’ll then apply the relevant federal and provincial rates to your net taxable income. You should calculate your federal income tax first, your provincial rate second, and then add the two together and presto!

Your marginal tax rate is the combined federal and provincial income taxes you pay on all sources of income at tax time. The tax rate varies by how much income you declare at the end of the year on your T1 General Income Tax Return and where you live in Canada.

Don’t Miss: How To Set Up Tax Payment Plan

Busting A Tax Bracket Myth

Some people think if they earn more money, they are in a higher tax bracket. They believe they pay more taxes and may actually have less money left over than they would if they had earned less.

Using the example above, you can see thats not true.

Each dollar you earn only affects the tax rate and taxes owed on additional income. It does not change the rate applied to dollars in lower brackets.

Unless you are in the lowest bracket, you actually have two or more brackets. If you are in the 24 percent tax bracket, for example, you pay tax at four different rates 10 percent, 12 percent, 22 percent, and 24 percent.

Based on the tax brackets, you always have more money after taxes when you earn more. But, of course, rates are not the only factor in your final tax bill. You can lose tax benefits that phase out at higher income levels, such as education for higher education. In some tax scenarios, it might make sense to avoid higher tax brackets if possible.

It pays to use TaxAct as a planning tool to see how different levels of income affect your tax benefits and final tax bill.

Thanks For The Info Now What

Knowing where you sit in the federal and provincial tax brackets can be helpful, but what if your income has changed or varies from year to year? And what if you get a raise?

Understand what tax bracket youre in and what it means to you, says Zakharia, adding that if you make more money one year , you dont need to freak out. It is true that the more money you earn, the more you will be taxed, especially if that nudges you into the next tax bracket. But not all of your income gets taxed in the higher bracket, its just the amount in that range, says Zakharia. In other words, if you make $100,000, youre not paying 26% federal tax on the entire $100,000, just on the small portion over $97,069. And the same for the provincial tax, too. For Quebec residents, you just consult the chart above if you move into another tax bracket.

If your side hustle is your own self-employed business, taxes obviously wont be automatically deducted from your paycheque. It is your responsibility to set aside money to pay income tax on your net earnings on a quarterly or annual basis. Be sure to report all your income, otherwise you may have to pay a penalty of 10% on the amount you didnt report.

You May Like: How To Check State Tax Refund

Whats Your Marginal Tax Rate

The highest tax rate that applies to your income is called your . So in the example above, the single taxpayers marginal tax rate is 22%, because thats the rate that corresponds to the highest bracket that applies to their taxable income.

Identifying your marginal tax rate can help you understand the potential tax impact of earning more money or taking certain tax deductions. Keep in mind that a marginal tax rate of 22% doesnt mean youre actually paying 22% tax on all your income.

Effective tax rate can be a more accurate way to think of your tax liability.

What Is A Surtax

You may look at the Ontario and PEI tax rates, and think to yourself, well, thats pretty low. But personal income in these two provinces is taxed a second time with a surtax.

For PEI residents, the surtax is 10%, if your income is more than $12,500 annually. Take your income and multiply it by 0.10 to calculate the surtax.

For 2020, the Ontario surtax is a bit more complicated . If your base provincial tax is below $4,830, you pay no surtax. If your base provincial tax is between $4,830 and $6,182, you pay 20% on the portion of provincial tax owed that is over $4,830. Finally, if your base provincial tax exceeds $6,182, you pay 20% on the portion of provincial tax owed that is between $4,830 and $6,182 , plus 56% on the portion of provincial tax owed over $6,182.

Thankfully, most personal tax programs figure this out automatically.

| Provincial Tax Owed |

|---|

| 56% |

Also Check: How To Report Self Employment Income On Taxes