What Is A Property Tax

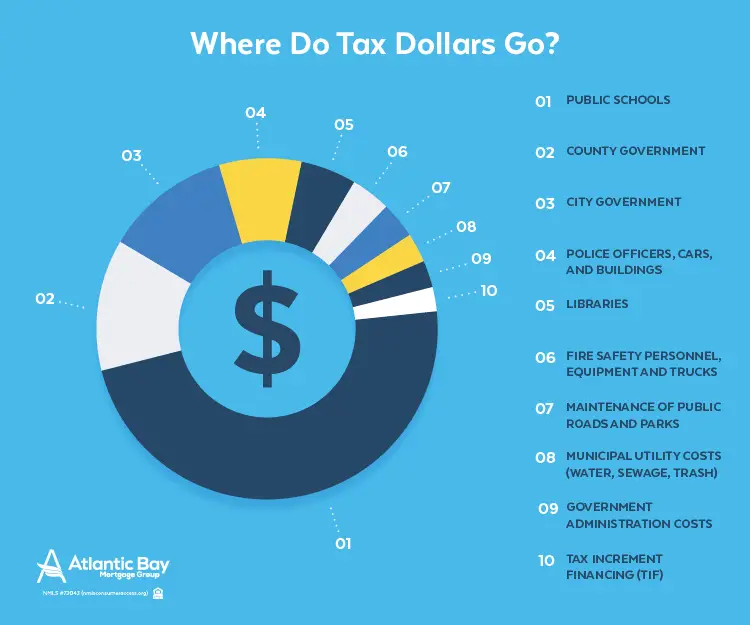

Local governments levy property taxes on property owners within their locality. Governments use taxes to provide taxpayers with various services, including schools, police, fire and garbage collection. Property taxes are calculated by applying an assessment ratio to the propertys fair market value.

Pennsylvania Property Tax Rates

Local tax authorities determine tax rates in Pennsylvania based on their revenue needs. Rates are expressed as mills. One mill is equal to $1 of property tax for every $1,000 in assessed value.

Since every county uses its own system to determined assessed values, mill rates in one are not comparable to mill rates in another. For this reason, it useful to look at effective tax rates. The effective tax rate is equal to the annual property tax as a percentage of home value. The table below shows the average effective rate for every county in Pennsylvania, along with median home values and median annual tax bills.

| County |

|---|

Looking for details on your potential monthly mortgage payment? Check out our mortgage calculator.

Can You Lower Your Property Tax Bill

If you disagree with a property tax bill on your home, you can contest it by challenging your homes assessed valuation. Youll need to show that the assessed value doesnt reflect your propertys true value. If successful, your appeal could result in a lower property tax bill.

-

Make sure the assessment data is accurate and matches with the details of your property.

-

Gather comparable listings or ask a real estate agent to pull records of comparable sales for you. Often, tax records are available online from the local tax assessor.

-

If youre unsatisfied, you might be able to pursue the case with an independent tax appeals board.

Learn more ways to capitalize on your home

-

Our home affordability calculator will show how much house you can afford to buy.

Read Also: Where To Send My 1040 Tax Return

Could You Lose Money If You Deduct Property Taxes

The Balance / Nusha Ashjaee

It may seem like one taxing authority or another wants a share from you. The Internal Revenue Service allows you to get some of your money back in the form of a property tax deduction for the cost of taxes that you must pay to local taxing authorities.

While the passage of the Tax Cuts and Jobs Act in 2018 imposed a cap on the amount you can deduct, the local property tax deduction is still available to homeowners.

Can You Get A Property Tax Deduction On A Second Or Third Property

You can claim a tax deduction for a second or third property as long as you live there for at least 14 days out of the year and it is not rented out longer than that. However, the total amount of deductions for state, local and property taxes still cannot exceed $10,000, including the tax on your primary residence. The second property must also meet all the qualifications of being considered a second residence.

Don’t Miss: Can You Pay Irs Taxes With Credit Card

Overview Of Property Taxes

Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAsset’s tools to better understand the average cost of property taxes in your state and county.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Residential Real Estate Tax Calculation Formula

The current statewide assessment rate for residential real estate property is 19%. To determine how much you owe, perform the following two-part calculation:

Heres an example of how this formula works

To calculate taxes owed on a $100,000 home at a 6.5694 total tax rate per $100 of assessed valuation:

Also Check: Can I Pay Property Tax Online

Is $97k A Year Enough To Live On Comfortably

In 2022, the federal poverty line was about $13,590 per year, excluding Alaska and Hawaii. With that in mind, a $97,000 salary sounds great.

However, that number merely describes the poverty line, not what it means to live comfortably. Its also difficult to say whether this is a good salary for every U.S. city, as the cost of living varies significantly depending on the state and city you reside in. Use the chart below, which lists the average household income per state, to determine whether your $97k yearly salary is reasonable for your area.

Property Tax Transparency Portal

The South Dakota Property Tax Portal is the one stop shop for property tax information, resources and laws. This system features the Property Tax Explainer Tool that provides a high level breakdown of some of the levies assessed within a specific jurisdiction, numerous DOR property tax facts, publications, forms, and multiple years of property tax data.

While the state does not collect or spend any property tax money, property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local government. Not only is the portal a great resource for finding property tax information, it also makes available data open and transparent for everyone. The previous Property Sales Search is still available for your property tax search needs.

To visit the site click here.

Don’t Miss: Do I Need To File An Extension For 2020 Taxes

Property Tax Estimator And Millage Rates

Property Tax Estimator Notice

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance . If you attempt to use the link below and are unsuccessful, please try again at a later time. Thank you for your patience while we upgrade our system.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan.

Overview Of Michigan Taxes

Michigan has some of the highest property tax rates in the country. The Great Lake States average effective property tax rate is 1.45%, well above the national average of 1.07%.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Read Also: How Much Tax Do You Pay On An Ira Withdrawal

Overview Of Oregon Taxes

Oregon has property tax rates that are nearly in line with national averages. The effective property tax rate in Oregon is 0.90%, while the U.S. average currently stands at 1.07%. However, specific tax rates can vary drastically depending on the county in which you settle down.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Let’s Look At An Example

Your community has a school district, a county government, and a city government who have determined how much they need to operate for the next year. They calculated their mill levies by taking the total revenue needed and then divided it by the total value of property in your community.

The school district has determined a mill levy of 1%. The county needs 3%. The city needs .5%. The total mill rate is 4.5 .

Your total property value is $200,000, which includes the land and your home.

Your property tax is $200,000 X 4.5/$1000 = $900.

You may be eligible for an exemption

Some states give you a tax break on property taxes in the form of a homestead exemption. The exemption allows you to shelter some of your property value from being assessed a tax.

For example, if you live in a state that gives you a tax exemption on the first $50,000 of your homes value and your home is worth $250,000, youll only be taxed on $200,000.

Check with your tax assessors office to see if youre eligible for a homestead exemption.

Now, lets look at homeowner’s insurance.

Recommended Reading: What Are The Current Tax Brackets

How Much Is Commercial Property Tax In California

The amount of commercial property tax in California varies depending on the location and assessed value of the property. However, the average commercial property tax rate in California is 1.19%, which means that the average commercial property tax bill in the state is $1,190.

Many taxpayers in California bear a large portion of the states overall property tax burden. Property tax bills fund the budgets of K-12 schools, counties, and community colleges. Property bills are frequently accompanied by a lot of paperwork, so knowing what the bill contains is critical. To approve the project, the local government must first obtain the approval of the majority of affected property owners. The majority of the time, assessments are not issued for services or facilities that are solely in the hands of the general public. The Mello-Roos property tax is primarily used to fund public services associated with residential and commercial development. The average property tax effective rate in California is 0.77%.

In the United States, an average of 1.02% is found. In California, homeowners typically pay between 125% and 15% of the propertys assessed value. California voters approved Prop. 13 in the 1970s. In California, homeowners can save 70% by claiming a $7,000 exemption on their primary residence taxes. In the state of California, the fiscal year runs from July 1st to June 30th. Property taxes are divided into two equal installments based on the fiscal years halfway point.

How Does A $97k Salary Compare To Other Salaries

The Bureau of Labor Statistics found that the median household income nationally was $58,260, which is obviously lower than a $97,000 salary. To get a better idea of how your salary compares to others, take a look at the table below.

| Salary |

|---|

| High school diploma or equivalent | Police officers protect lives and property. Detectives and criminal investigators gather facts and collect evidence of possible crimes. |

Read Also: How Long Do You Have To Pay Taxes

Who Pays Property Taxes On Commercial Lease California

Landlords and Tenants in California typically enter into leases that are classified as gross leases, which require the tenant to pay real estate taxes over a base year or on a triple net basis, with the tenant paying all of the real estate taxes (or a proportionate share if it occupies

The Tax Implications Of Short-term Rental Property In California

When leasing property, it is critical to understand the rental outgoings that must be paid by the tenant. In addition to rates, insurance, body corporate fees, redecoration charges, and reinstatement fees, they can include reinstatement fees. Costs can add up quickly and cost a lot of money, so you must know how they will be taxed if you want to make the most informed decision for your company. In order to claim rental property deductions for short-term rentals in California, property owners must meet certain requirements. In addition to having the property available for rent for at least 183 days per year and meeting certain occupancy requirements, the property owner must keep detailed financial records. However, if you want to take advantage of deductions for your business, doing so may be worthwhile.

How Do I Look Up Property Taxes In Nj

To look up property taxes in New Jersey, you will need to visit the county tax assessors office in the county where the property is located. You can find contact information for each county assessors office on the New Jersey Division of Taxation website. Once you have located the correct office, you will need to provide the assessor with the propertys address or parcel ID number. The assessor will then be able to provide you with the propertys tax information.

Recommended Reading: How Are Bitcoin Gains Taxed

The Tax Cuts And Jobs Act Limit

The TCJA limits the amount of property taxes you can claim. It placed a $10,000 cap on deductions for state, local, and property taxes collectively beginning in 2018. This ceiling applies to any income taxes you pay at the state or local level, as well as property taxes. All these taxes fall under the same umbrella.

Example Of A Property Tax Calculation

The tax rate for a property is determined by how many city and school districts a property lies within, and adding together the rates applied by each. This aggregate rate is referred to as the mill levy. Generally, every city, county, and school district has the power to levy taxes against the properties within its boundaries. Each entity calculates its required mill levy, and they are then tallied together to calculate the total mill levy.

The mill levy is the total tax rate levied on your property value, with one mill representing one-tenth of one cent. So, for $1,000 of assessed property value, one mill would be equal to $1.

For example, suppose the total assessed property value in a county is $100 million, and the county decides it needs $1 million in tax revenues to run its necessary operations. The mill levy would be $1 million divided by $100 million, which equals 1%. Or, if the city and the school district calculated a mill levy of 0.5% and 3%, respectively, the total mill levy for the region would be 4.5% or 45 mills.

To calculate a tax bill, two further steps are required. First, a propertys value is assessed via one of the methods described below. Then, the value is multiplied by the assessment rate, which varies by jurisdiction and represents the percentage of a property on which taxes are due.

Also Check: How Much Taxes Deducted From Paycheck Ma

How Much Will My Check Be For

- Single taxpayers who earned less than $75,000 and couples who filed jointly and made less than $150,000 will receive $350 per taxpayer and another flat $350 if they have any dependents. A married couple with children, therefore, could receive as much as $1,050. This is the largest bracket, KCRA reported, representing more than 80% of beneficiaries.

- Individual filers who made between $75,000 and $125,000 — and couples who earned between $150,000 and $250,000 — will receive $250 per taxpayer, plus another $250 if they have any dependents. A family with any children could receive $750.

- Individual filers who earned between $125,000 and $250,000 and couples who earned between $250,000 and $500,000 would receive $200 each. A family with children in this bracket could receive a maximum of $600.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Also Check: How To Figure Capital Gains Tax

Rules For The Property Tax Deduction

You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. The revenues raised must benefit the community as a whole or the government. The tax can’t be paid in exchange for any special service or privilege that only you would enjoy.

You must own the property to be able to claim the deduction. The tax isn’t deductible if you pay your mother’s property taxes for her because she is having trouble making ends meet. The tax on her property is not levied on you personally.