Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

What Is The Middle Class Tax Refund

The Middle Class Tax Refund is a stimulus check that was passed into law in the 2022-2023 budget for the state of California. The stimulus check is a cash payment of $350 to $1,050 to more than half the residents of the state of California.

The Middle Class Tax Refund was marketed as an inflation relief payment, rather than a pandemic assistance payment. It was a smart move as much of the country looks to move beyond the pandemic .

As of 11/18/2022, there were nearly 7 million direct deposits and over 3.5 million debit cards issued with a total sum of $5.7 billion sent to 19.5 million people. If you are eligible, you should expect to receive your stimulus check between October 2022 and January 2023. The MCTR website includes a calculator to estimate your amount.

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct-deposited or mailed your refund.

The turnaround time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

You May Like: How To Do Your Taxes If You Are Self Employed

Start Tracking Right Away

Another myth is that theres no way to tell where your refund is until you get it and you’ll be asking ‘Where’s my refund?’ for a while. Reality: You can track your IRS refund status in fact, if you file using tax software or through a tax pro, you can start tracking your IRS refund status 24 hours after the IRS receives your return. If you’re thinking ‘Where’s my state refund?’ there’s good news: You can also track the status of your state tax refund by going to your state’s revenue and taxation website.

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more about identity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

Recommended Reading: Where Can I Find My Tax Return From Last Year

How Can I Check The Status Of My Refund

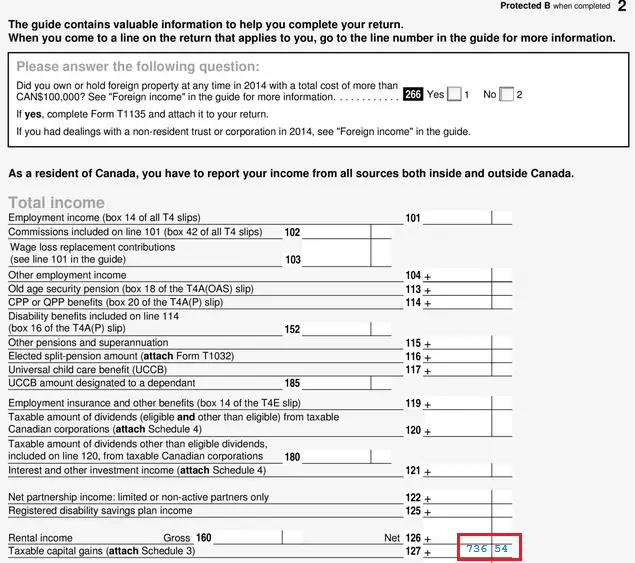

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Why Is Your 2020 Tax Return Important Why Not 2021

There are two main reasons why the 2020 tax return was chosen, Palmer said. One is that the 2020 tax filing is completely done, whereas tax filing and processing for 2021 is still ongoing. .

The other reason, Palmer said, is that the tax board received roughly half a million more low-income tax returns than usual in 2020, since more households filed tax returns to take advantage of pandemic-related assistance. So, by using the 2020 return, California will be able to reach several hundred thousand more people with these payments, according to Palmer.

Read Also: Are Legal Fees Tax Deductible In 2020

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

How To Figure Out If Youre Getting A Direct Deposit Or Debit Card

If youre unsure if you will be getting a direct deposit or a debit card, heres a good indicator: did you file your 2020 taxes electronically and receive your refund via direct deposit? If yes, then youre probably going to get the one-time payment by direct deposit.

The rest can probably expect to receive checks.

Don’t Miss: What To Bring To Do Taxes

Protecting Your Tax Refund

Although we try to process your refund within the timeframes stated above, it may take longer due to our rigorous fraud detection procedures. Each year, the Department detects new schemes to commit tax refund fraud, and our staff works hard to stop criminals from stealing your refund.

The Department employs many review and fraud prevention measures to safeguard taxpayer funds. These measures may result in refund wait times of more than of 10 weeks. We apologize for this inconvenience and are actively working to release these refunds.

Californians Warned Of Scams Targeting Inflation Relief Payments

SACRAMENTO — California residents should be aware of scammers targeting the state’s one-time payments aimed at reducing the effects of inflation, state Attorney General Rob Bonta said Monday.

Residents should avoid giving their personal information or paying money in order to receive their payment, according to the attorney general’s office.

Payments also cannot be sped up and do not need to be activated if distributed in the form of a preloaded debit card. Payments are being distributed through January 14, 2023, in the form of a direct deposit or a debit card.

“Unfortunately, there are some bad actors hoping to take advantage as Californians patiently wait for their direct deposit or prepaid debit card to arrive,” Bonta said. “Do not be fooled. Know what to expect and when, and take precautions to protect yourself and your loved ones from falling victim to a scam.”

Payments total between $200 and $350 per person, with amounts varying depending on household size and how many dependents are included on a person’s 2020 tax return.

Information about how much eligible state residents should receive can be found at .

First published on November 28, 2022 / 2:26 PM

Also Check: What States Have The Lowest Property Taxes

California Mctr Scams Increasing In Frequency

In related news, according to ABC7 Los Angeles, city attorney Mike Feuer has issued a warning to MCTR recipients to be wary of scam texts with links to activate or reactivate refund debit cards. These messages are often sent by criminals looking to steal personal information and funds.

Californians are so eager at this time of year to get this tax relief, said Feuer in an interview. It would be a fairly automatic gesture to simply click onto a link, when youre asked to activate a California prepaid debit card. Any of us could be vulnerable to this.

More From GOBankingRates

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times.

Also Check: How Much Is Tax In Georgia

Golden State Stimulus Ii

The Golden State Stimulus II check was another one-time check of $500, $600, or $1,100 based on your 2020 tax return as well as your eligibility for GSS I. Again, you didnt have to do anything to claim it as it was simply mailed to you based on the last three digits of your ZIP code.

If you qualified for GSS I and claimed a dependent, you received $500.

If you did not qualify for GSS I and did not claim a dependent, you received $600.

If you did not qualify for GSS I and claimed a dependent, you received $1,100.

Finally, if you qualified for GSS I and did not claim a dependent, you did not qualify for GSS II.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Read Also: How Much Do You Pay In Taxes For Instacart

When Will State Refunds Arrive For Californians

Per Californias Franchise Tax Board, taxpayers who electronically file their personal returns can expect their refund within three weeks, while those who mail in their personal tax returns can wait up to three months.

Both electronically filed and mailed business returns can take up to six months to see a refund.

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Recommended Reading: How Much Taxes Deducted From Paycheck Mn

How Much Will You Get

The relief amount varies depending on your filing status – married or single – and the number of dependents you have, however, payments range from $200 to $1,050.

The amount is based on your adjusted gross income from your 2020 California State Income Tax return.

To find out how much you qualify for, you can use the state’s handy tool here.

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

Also Check: Do You Pay Tax On Shipping

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

Don’t Miss: What Is The Tax Rate For Trusts

Residency Status Information For California Returns

Resident: Any individual who is:

- In California for other than temporary or transitory purposes, or

- Domiciled in California, but outside California for temporary or transitory purposes.

Part-year resident: Any individual who is a California resident for part of the year and a nonresident for part of the year.

Nonresidents: Any individual who is not a resident.

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Also Check: Is Freetaxusa A Legitimate Site

Recommended Reading: How Much Do You Have To Earn To Pay Tax

Important: The Gas Tax Rebate/inflation Relief Refund Is Not Administered By The State Controller’s Office For More Information Please Visit The Franchise Tax Board’s Website Dedicated To The Middle Class Tax Refund

The State Controllerâs Office administers the Gasoline Tax Refund Program for the State of California. The SCO reviews and processes refund claims from claimants who purchase gasoline in the State of California for off-highway, paratransit, export, or blended fuel purposes. Some off-highway purposes may include farming, construction, landscaping, and utility providers. To be eligible for a refund, the individual or business must use the gasoline as specified in Revenue and Taxation Code section 8101.

For further details and specific eligibility requirements, refer to Part 2 of Division 2, of the Revenue and Taxation Code.

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Also Check: What Is The Sales Tax Rate In Illinois

When California Stimulus Payments Are Being Sent

Direct deposit payments to people who previously received GSS direct deposit payments began on October 7. The FTB will continue sending those payments through October 25. For people who didn’t previously receive a GSS payment via direct deposit, but who otherwise qualify for direct deposit stimulus payments now, their payments will be sent from October 28 to November 14.

According to the FTB, direct deposit payments typically show up in your bank account within three to five business days from the issue date. However, that estimate may vary on a bank-by-bank basis. The FTB expects to issue approximately 90% of all direct deposit stimulus payments by the end of October 2022.

Debit cards will take longer to distribute. The FTB’s plan is to send cards in batches, generally depending on whether you previously received a GSS and your last name. According to the schedule, eligible people who previously received a GSS payment via debit card with a last name beginning with A to E will be issued a California stimulus check debit card between October 24 and November 5, 2022. If you’re last name begins with a letter from F to M, your card will be issued between November 6 and 19. Previous GSS debit card recipients with last names beginning with N to V will be issued a stimulus debit card between November 20 and December 3, while people with last names starting with W to Z will have to wait until December 4 to 10.

When You’ll Receive Your Payment

Direct deposit MCTR payments for Californians who received Golden State Stimulus I or II are expected to be issued to bank accounts from October 7, 2022 through October 25, 2022, with the remaining direct deposits occurring between October 28, 2022 and November 14, 2022. We expect about 90% of direct deposits will be issued in October 2022.

MCTR debit cards are expected to be mailed between October 25, 2022 and December 10, 2022 for Californians who received GSS I and II, with the remaining MCTR debit cards mailed by January 15, 2023.

We expect about 95% of all MCTR payments â direct deposit and debit cards combined â to be issued by the end of this year.

Recommended Reading: How Do I File Previous Years Taxes With H& r Block

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

How Can I Get Help

While the State of California Franchise Tax Boards online refund tracking tool may help you stay on top of your refunds status, it does have limitations. If you want to check the refund status of a past years return, you cant use the online tracking tool. And if you run into an issue with the online tracking tool say you dont see a refund status or it says you shouldve received a refund by now but you havent you can contact the FTB about your refund in three ways.

Also Check: Have Not Filed Tax Returns For Years