Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

Taxpayers Are Asking Irs: Where Is My Refund And Where Is My Stimulus Payment

Many taxpayers are still waiting for their tax refunds or stimulus checks, while the IRS works … through a backlog of tax returns.

getty

Ive received a number of letters from readers of this forbes.com column asking for help with both tax refunds and stimulus payments. They want to know, whats going on? I have some answers, but, unfortunately, no advice to each reader, as each delay could be situational, that is, unique to the person experiencing the delay.

Will Calling The Irs Speed Up My Tax Refund

No, it wonât. IRS phone representatives can only research the status of your refund 21 days after you file electronically, or six weeks after you mail your paper return.

Donât bother calling the IRS for your refund status until then, even if the Whereâs My Refund? tool directs you to call the IRS.

If itâs been more than 21 days , call the toll-free IRS refund line at +1 829 1954.

Read Also: Irs Forgot Ein

What About My State Tax Refund

What weve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund.

Generally, you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you filed a paper tax return, it may take as many as 12 weeks for your refund to arrive or longer, if your state has been or still is under social distancing restrictions. To find out the status of your refund, youll need to contact your state tax agency or visit your states Department of Revenue website.

Why Do Paper Returns Take So Long

Paper returns have to be input manually into the system for processing. Even when the IRS isn’t understaffed in the middle of a pandemic, the process normally takes six to eight weeks.

“Submitting a paper return circumvents the limited automation that the IRS has in place for cross-referencing returns with information received from third parties,” says Richard Lavinia, CEO and co-founder of Taxfyle. “Paper returns require this information to be inputted by hand and then manually reviewed by an IRS agent.”

Read Also: Wheres My Refund Ga.state

When Will You Get Your 4th Stimulus Check

In either case, those who receive the “increased” payment will receive the payments automatically. Processing of Plus-Up checks and direct deposits began on Friday, March 26, with the official payment deadline on Wednesday, March 31. So check your bank account or follow the fourth check in the mail if you think you qualify.

When You Should Call The Irs

The IRS online tools are all that most people need to track the status of a tax refund. But there are some exceptions. You might need to give the IRS a call in the following situations:

- Wheres My Refund?,Wheres My Amended Return?, or IRS2Go directs you to call.

- Its been more than 21 days since you filed electronically and youre eager to know the status of your refund or worried about theft or fraud.

- Its been more than 16 weeks since you mailed an amended tax return.

Keep in mind, calling the IRS wont speed up the processing of your refund. According to the IRS, if youre eager to know when your refund will arrive, youre better off using one of its online tracking tools. The IRS updates the status of refunds daily, generally overnight, so checking an online tool multiple times throughout the day probably wont be helpful.

Remember, phone representatives at the IRS can only research the status of your refund 21 days after you file electronically, six weeks after you mail a paper return, or 16 weeks after you mail an amended return.

Don’t Miss: License To Do Taxes

Ways To Get Your Refund Faster

Theres no magic wand that will make your refund arrive instantly. But there are a couple of steps you can take to potentially speed up the process.

Where’s My State Tax Refund

Forty two states levy an individual income tax, according to the Tax Foundation. The eight states that have no state income taxes are:

- Alaska,

- South Dakota

- Wyoming

Each state will have its own means of tracking the status of tax refunds. State tax refunds are processed separately from federal tax refunds and you will need to find your own state’s information to check on the status. You can start by looking at the state revenue sites, which the IRS lists here.

Don’t Miss: Protest Property Taxes In Harris County

How To Check The Status Of Your Refund

You can track your refund 24 hours after filing your tax return by logging into the IRS Wheres My Refund tool.

Youll need to provide some personal information including your Social Security Number or Individual Taxpayer Identification Number , and your filing status.

Also, make sure that the refund amount entered is the exact amount on your tax return to get the most accurate information.

Additionally, the agency has a free IRS2GO mobile app to find out where your refund is. This is said to be the fastest and easiest way to monitor yours.

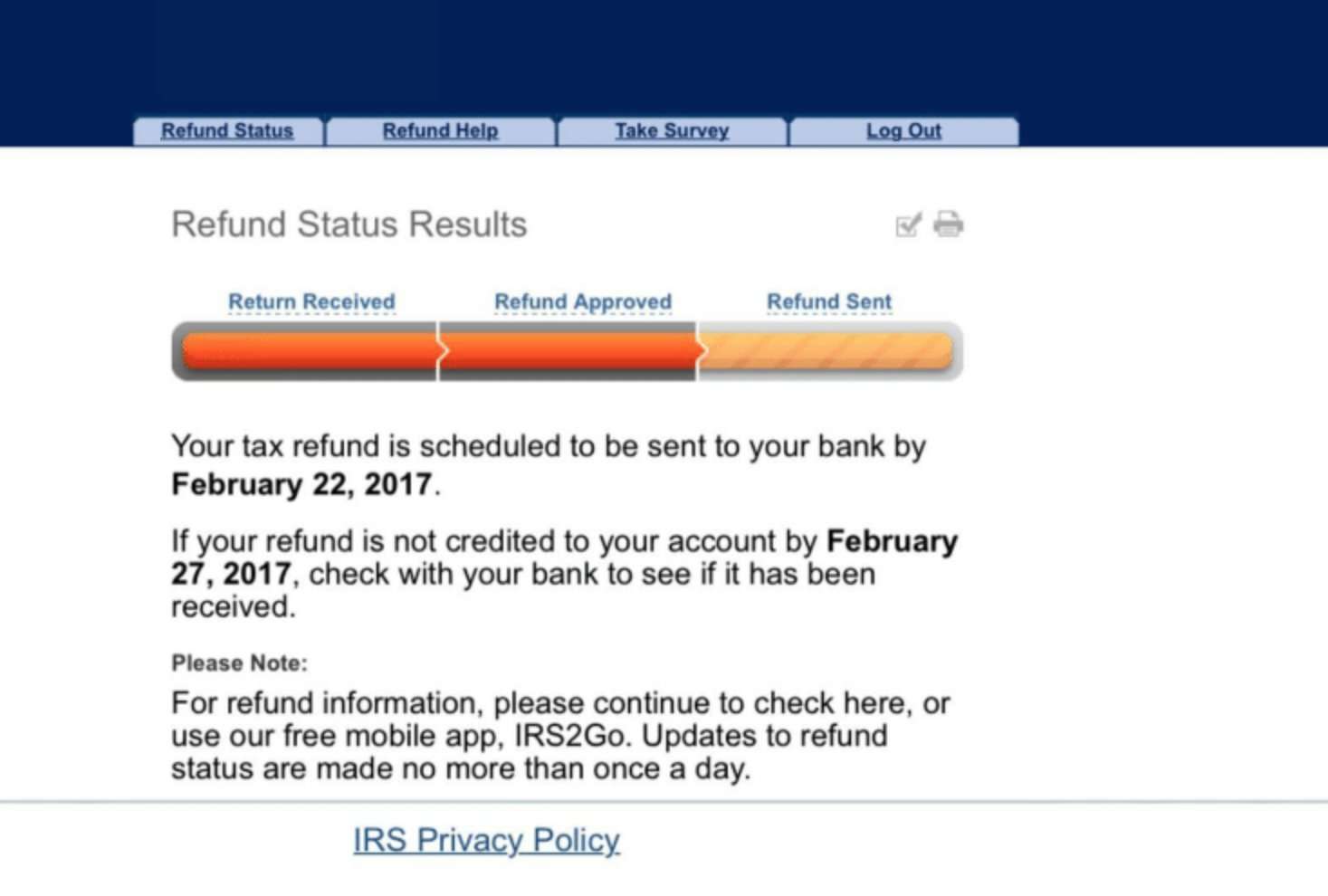

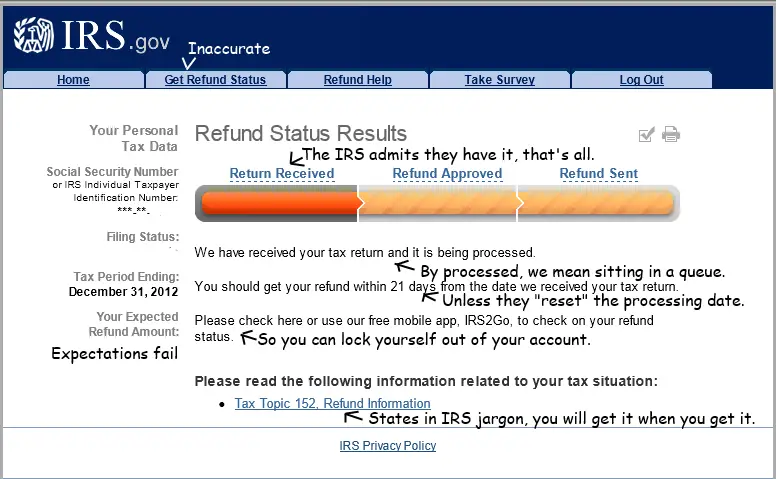

Whether you use the app or the website, you should see one of the following messages explaining your return status: Received, Approved, and Sent.

Received means that the IRS has your tax return and is working to process it.

Approved means it has been processed, while sent means that the refund is on its way to your mailbox, or to your bank through direct deposit.

Lastly, you can call the IRS to check in on your refund status at 800-829-1040.

However, the IRS has cautioned that phone assistance is “extremely limited” so, you may want to try another method.

How To Verify With The Irs That A Tax Return Was Received

Once youve put in the time and effort required to file your tax return, you want to make sure your work isnt lost in cyberspace or in the mail. If youre due a refund, you want your forms to arrive safely and be processed as quickly as possible. The Internal Revenue Service offers several ways for you to verify that your return has been received and that your IRS refund status is being processed.

Recommended Reading: Is Plasma Money Taxable

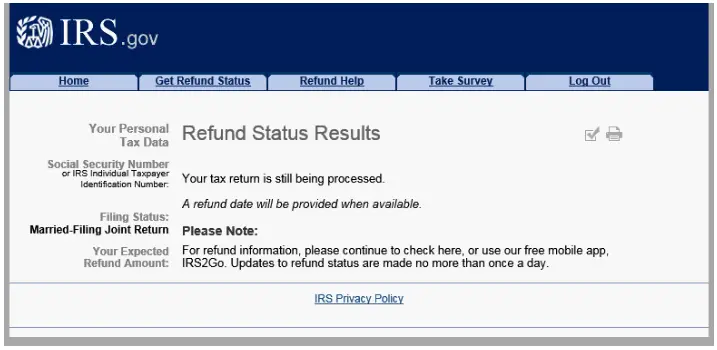

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Could Your Return Be Delayed For Other Reasons

The other delays that may be affecting your particular situation could be these items pointed out on the IRS website: if the return is affected by identity theft or fraud, contains errors or is incomplete. The IRS will contact a taxpayer by mail if more information is needed to process a return. What is unknown is when that might occur.

Read Also: Doordash Tax Deductions

Report And Verify Your Taxes

The IRS Where’s My Refund? hotline, app and website allow you to check only the status of a refund. If you had to pay taxes and you filed a paper return, your avenues for verifying that your return was received are fewer. If you paid the taxes you owed via check, watch your bank account to see when the check has cleared.

You may mail your tax return certified mail, return receipt requested. Or you could send it Priority Mail, which will provide you with a tracking number you can use to verify the returns receipt.

Tips

-

Due to limited staff as a result of the COVID-19 pandemic, mailing paper returns may take considerably longer than usual to be processed. E-filing results in much faster processing.

Additionally, you can submit your paper return to a representative at a local IRS field office and get an “accepted” time stamp, or ask the rep to look up the status of your previously-filed return.

Still Waiting On Your Irs Tax Refund How To Check The Status

- 8:29 ET, Aug 11 2021

THE frustrations for millions of Americans who are still owed tax refunds continues.

The latest data shows that the IRS had processed 15.6million additional returns in late July, meaning 20million are still waiting for their cash.

As of early June, average tax refunds were $2,775, according to data from an IRS filing.

In June, the IRS was dealing with roughly 35million unprocessed returns, according to a report by the Taxpayer Advocate Service.

Citing processing delays related to Covid-19, the IRS refund section states: Its taking more than 21 days for us to issue refunds for certain mailed and e-filed.

Mailed correspondence is also taking longer to process.

Some other reasons your tax return might be delayed could be because it has mistakes, isnt complete, or possible fraud or identity theft.

Moreover, it could take longer if you included an injured spouse allocation form.

Below we explain how to track down your refund if you’re still waiting.

Read Also: 1040paytax.com Safe

What Is A ‘plus

According to CNBC, some people received an additional payment on top of the incentive check already received. This is known as a “bonus”. This extra money went to people who owed extra money as a result of their tax returns for 2020. Example: Suppose you received your premium check based on your 2019 tax return.

Where’s My Stimulus Check How To Track The Status Of Your Stimulus Check

Your stimulus check is different than your tax refund. You can track the status of your stimulus check on the IRS website here:

You should be able to see whether a payment has been processed, whether a payment date is available and whether the payment will be issued via direct deposit or mail. The IRS says it updates payment statuses once per day, usually overnight.

Read Also: When Does Doordash Send 1099

Tips For Maximizing Your Tax Savings

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre filing your taxes, a tax filing service can make things easier. They can take a lot of the confusion out of the process for you and help you file a more accurate tax return. They can also help you find deductions or exemptions that you wouldnt have known about on your own. Popular software choices include TurboTax and H& R Block.

- If you find that youre regularly receiving large tax refunds, this may mean that youre paying too much in taxes in the first place. In that case, you may want to adjust the withholding amounts on your W-4 so you can keep more money throughout the course of the year. Big refunds are exciting, but why give the IRS a free loan?

Your Refund Has Been Offset To Pay A Debt

If you owe certain debtsincluding unpaid child support, unpaid state taxes, or delinquent federal student loansthe IRS can offset your refund by the balance owed. If your refund is offset, youll receive a notice from the U.S. Treasurys Bureau of the Fiscal Service advising you as to why your refund was taken and the agency to which the debt has been owed. You have the right to dispute the debt with the agency that received your refund.

You May Like: Efstatus Taxactcom

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

What Happens If I Owe The Irs Money Because Of The Child Tax Credit

If you received too much money from the IRS because of the child tax credit, you may have to repay some or all of it when you file your 2021 tax return. According to the IRS, when you file your 2021 tax return during the 2022 tax filing season, youll need to compare the total amount of the child tax credit payments you received in 2021 with the amount that youre eligible to claim on your tax return.

Find: Child Tax Credit How To Claim the Full Amount On Your 2021 Taxes

If the amount of your child tax credit exceeds the amount of your advance child tax credit payments, you can claim the remaining amount on your 2021 tax return. If the total amount of your advance child tax credit payments exceed the child tax credit that youre entitled to claim, you may need to repay some or all of this amount to the IRS.

According to the IRS, there are several possible reasons why you could owe money because of the child tax credit, including:

- A qualifying child who resided with you changed homes during 2021 and stayed more than half of the 2021 tax year with a different individual

- Your income increased in 2021

- Your filing status changed for 2021

- Your main home was outside of the U.S. for more than half of 2021

Find: More Young Americans Writing Wills Due to COVID Fears How Much Does Estate Planning Cost?

More From GOBankingRates

Also Check: Do You Pay Taxes On Plasma Donations

When To Check The Status Of Your Tax Refund

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized date after we process your return and approve your refund. The tracker displays progress through three stages:

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return PDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Recommended Reading: Cook County Appeal Property Tax

Check Refund Status Online

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option “Tax Refund for Individuals” in the box labeled “Where’s my Refund?”. Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return. If you do not know the refund amount you claimed, you may either use a Letter ID number from a recent income tax correspondence from the Department.

You will receive the Letter ID within 7-10 business days. After we have received and processed your return, we will provide you with an updated status as the refund moves through our system. It may take a few days for an updated status to appear. Please check back often to verify where your return/refund may be in our process.

The information in Revenue Online is the same information available to our Call Center representatives. You can get the information without waiting on hold.