What Makes A Chapter 12 Bankruptcy Different Than A Chapter 7 Or Chapter 13

In a Chapter 12 bankruptcy, usually, the debtor is a family farmer or fisherman. To qualify as a family fisherman, at least half of their income from the previous year must be from fishing. To qualify as a farmer, at least half of a taxpayers income for the last three years must come from farming activities. In a chapter 12 bankruptcy, taxes are priority liabilities, and the taxpayer must pay them first.

Read Also: Filing For Bankruptcy In Illinois

Can You File Bankruptcy On Taxes

Yes, you can file bankruptcy to resolve back taxes, but not for all of your tax debts. Every chapter has a different set of requirements and processes. Chapter 7 is often a saving grace for anyone in over their head with insolvency because it completely eliminates all dischargeable back tax debts. This strategy is used for those who are unable to pay back income tax debt however, it is more difficult to get approved for than the other chapters of bankruptcy.

While you can file Chapter 7 for income tax debt, the same strategy will not work for payroll taxes. In addition, rules on previously unfiled tax returns are not uniform and newer liabilities are unable to be resolved. Chapter 7 is not the only way to handle bankruptcy and taxes with IRS, and you should consider other chapters before filing. Learning more about the different chapters of bankruptcy will help you determine which type can help you in your circumstances.

Can You Discharge Or Clear Taxes In Bankruptcy

Can you get rid of and eliminate tax debt owed to the Internal Revenue Service or State of California Franchise Tax Board or other taxing agencies, such as the California Department of Tax and Fee Administration ?

Or, as many often ask: Can you include taxes in a bankruptcy filing?

The answer is : YES! Certain tax debts are dischargeable, and those that are not can be managed in bankruptcy.

The relevant factors to determine dischargeability are:

- the age of the taxes ,

- the date of assessment of the taxes ,

- the dates you filed your required returns

- and whether you willfully attempted to evade payment of the tax by fraud.

Whether you can discharge these taxes in a bankruptcy case depends on a combination of the above and other factors, including which chapter of bankruptcy under which you file.

Don’t Miss: Doordash 1099 Nec

The Tax Assessment Was At Least 240 Days Old

Again, this often covers the same ground as the first two rules. The IRS must assess the tax at least 240 days before the taxpayer files for bankruptcy. The IRS assessment can arise from a self-reported balance due , an IRS final determination in an audit, or an IRS proposed assessment that has become final.

In other words, you reported what you owed, or the IRS has officially stated, “This is what you owe.”

Can I File Bankruptcy On Tax Debt

You may be able to file bankruptcy on some types of tax debt. For instance, you may be able to discharge income tax debt if certain conditions are met .

Note that you will need to pass the means test to qualify for a Chapter 7 bankruptcy in the first place. The means test compares your disposable income to the state median income for your household size. If your income is too high and you can’t pass the means test, you can file for Chapter 13 instead and develop a plan to repay your debts over the course of a few years.

Read Also: How To Get 1099 From Doordash

New York State Tax Lien

- Non-dischargeable tax debt is collectible for 20 years, with the 20 year period being renewed whenever a payment is made.

- Tax lien is created by filing of NYS Tax Warrant, which attaches for 10 years to all personal property in any location, and to all real estate located in the County where it is filed.

- New York State exemptions limit the State Tax Departments ability to collect, protecting many assets from seizure, including: the 10% limit on salary garnishments the $50,000.00 homestead exemption for residences the protections afforded qualified pension plans, profit sharing plans, IRAs and most retirement plans.

You May Like: Leinart Law Firm Reviews

What Debts Are Not Dischargeable If Creditors Object

Several debts are not exempt from discharge by default. Creditors must ask the bankruptcy court to determine whether or not their debts are dischargeable. These debts are discharged if a creditor does not raise a dischargeability issue or if the creditor raises an issue yet the court does not agree.

These debts include:

- Debts arising due to willful and malicious injuries

- Debts incurred from fraud or false pretenses

Recommended Reading: Do Doordash Take Out Taxes

Does Bankruptcy Clear Tax Debt

Filing for bankruptcy can clear tax debt depending on the nature and circumstances of your situation. Certain tax obligations may be discharged, forgiven, or managed in a bankruptcy filing. Here are some of the criteria that the IRS will consider when deciding whether or not you or your business is eligible for complete tax forgiveness.

- The dates you filed your required returns : The IRS is more likely to assist you when they see that you have made an effort to pay your taxes on time.

- The age of the taxes: The IRS is going to examine the date the returns were last due or meant to be filed.

- The date of assessment of the taxes.

- Willfulness: If the IRS has any reason to believe that you willfully attempted to evade payment of the tax by fraud they will immediately dismiss any tax forgiveness through bankruptcy.

Whether or not the IRS will grant tax bankruptcy discharge is directly tied to the above factors as well as any other miscellaneous factors that pertain to the particular chapter you choose to file under.

How Does A Debtor Obtain A Discharge

The debtor is normally discharged automatically unless there is a breach of fiduciary including objections to the discharge. Additionally, a debtor must ask the court and must prove that they cannot accept personal liability for the debt. All creditors, the trustee in the case, the U.S trustee, and the trustees counsel, if any, receive a copy of the discharge order from the clerk of the court, according to the Federal Rules of Bankruptcy Procedure. This discharge order is also given to the debtor and his or her counsel. The notice, which is merely a copy of the final discharge order, is vague about which debts the court has ruled are non-dischargeable, or not included in the discharge.

In addition, the notice advises creditors that their debts have been forgiven and that they should not pursue collection efforts any further. They are warned in the notification that further collection efforts may result in contempt charges. The legality of the order granting the discharge is unaffected by the clerks accidental failure to provide the debtor or creditor a copy of the discharge order within the period specified by the regulations.

The debtor may also speak to a bankruptcy attorney or law firm for legal advice on the different types of debt they are facing or if the creditor objects to any specified terms after the debtor has filed for bankruptcy.

Speak to an attorney or experienced law firm for legal advice regarding this matter.

Also Check: Calculate Doordash Taxes

Oak Creek Bankruptcy Attorney Answers Your Questions About Clearing Tax Debt

Filing for bankruptcy requires meticulous attention to detail and intimate knowledge of bankruptcy law. Attempting to file for bankruptcy by yourself can be frustrating and exhausting without the help of an experienced professional. Steven R. McDonald is the helping hand you need to re-gain control of your financial present and future.

Requirements For Discharge Of Income Taxes In Bankruptcy:

There are several prerequisites that must be met before any income tax can be discharged in bankruptcy.

All of the following requirements must be met to discharge any federal or state taxes for whatever periods taxes are owed:

There are many exceptions and events which can extend the time periods on the above rules, so you should not conclude without having actual transcripts analyzed by an attorney expert with tax discharge issues that your taxes will or will not be discharged in a case you file.

Even if you cannot get rid of your tax debt fully in a Chapter 7 bankruptcy case, you may be able to discharge some of it, and enter into a more favorable repayment plan for the taxes than you otherwise could outside of bankruptcy in a Chapter 13 or Chapter 11 case.

Recommended Reading: Is Plasma Donation Taxable

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Tax Debts And Bankruptcy

IRS, state, and local tax debts may be dischargeable through Chapter 7 bankruptcy if these debts meet certain requirements:

- The taxes are for federal or state income taxes or taxes on gross receipts.

- The return was due at least three years before filing for bankruptcy.

- The tax return was filed at least two years before filing for bankruptcy.

- The tax assessment was at least 240 days before filing for bankruptcy, unless there was a compromise offer with you or you had previously filed for bankruptcy.

- There was no fraud or willful evasion of taxes.

For Chapter 13, income tax debts are treated as non-priority debts and must also stand up to the same tests as those under Chapter 7.

You May Like: Taxes On Plasma Donation

When Tax Debt Is Not Dischargeable: Chapter 13 Reorganization Plan Treatment

Even if your tax debt is not dischargeable, however, all is not lost.

A Chapter 13 bankruptcy is a form of bankruptcy in which some types of debt you may owe are treated in priority over other types of debt.

A non-dischargeable tax debt will be paid in a Chapter 13 payment plan in full before any garden-variety unsecured liabilitiescredit card, medical, other unsecured debtsare paid anything at all.

If you have only X amount of disposable income to stave your creditors off with each month, a Chapter 13 will allow you to dedicate that money to your priority tax debt so that you are able to pay it off without worrying about your other creditors, and then pay in part or full and discharge the unpaid balance of the unsecured debt at the end of the Chapter 13 process.

Further, any tax debt paid will be paid at 0% interest in the Chapter 13 Plan. That is an improvement of at least a couple of percent on what the IRS charges for its non-bankruptcy payment plan arrangements every time.

Also Check: Epiq Corporate Restructuring Llc Letter

Interest Stops Accruing On Unsecured Tax Obligations

If the IRS has not filed a Notice of Federal Tax Lien NFTL against a Debtors assets prior to the date the Debtor initiates a Chapter 13 case, interest stops accruing on the unpaid tax liability. If the IRS HAS filed a NFTL, the tax obligation is secured by the lien, and interest must be paid on the tax debt to the extent of the value of the underlying collateral. For example, if you owe the IRS $8,000, and own property worth $5,000, interest would continue to accrue only on $5,000 of the tax debt. The remaining $3,000 portion of the tax debt would be unsecured.

Also Check: Is Donating Plasma Considered Income

Are Property Taxes Discharged Under Chapter 7

If we owe $ 300,000.00 in back property taxes, the property taxes will stay with the land, but the debtor will not be liable personally to pay those taxes following a Chapter 7?

Also, if you are a guarantor on an adult child’s student loans, are you liable for that debt following a Chapter 7 bankruptcy?

You say “usually ” discharged. Under what circumstances might they not be discharged?

I’m sorry, I am talking about the real estate taxes, not the student loans. We understand the student loans cannot be discharged.

But any property taxes incurred before filing would be dischargable?

Thanks. Have a nice day.

DISCLAIMER: Answers from Experts on JustAnswer are not substitutes for the advice of an attorney. JustAnswer is a public forum and questions and responses are not private or confidential or protected by the attorney-client privilege. The Expert above is not your attorney, and the response above is not legal advice. You should not read this response to propose specific action or address specific circumstances, but only to give you a sense of general principles of law that might affect the situation you describe. Application of these general principles to particular circumstances must be done by a lawyer who has spoken with you in confidence, learned all relevant information, and explored various options. Before acting on these general principles, you should hire a lawyer licensed to practice law in the jurisdiction to which your question pertains.

Federal Tax Refunds During Bankruptcy

You can receive tax refunds while in bankruptcy. However, refunds may be subject to delay, to turnover requests by the Chapter 7 Trustee, or used to pay down your tax debts. If you believe your refund has been delayed, turned over, or offset against your tax debts you can check on its status by going to our Wheres My Refund tool or by contacting the IRS Centralized Insolvency Operations Unit at 1-800-973-0424. The unit is available Monday through Friday from 7:00 a.m. to 10:00 p.m. eastern time.

You May Like: Is Freefilefillableforms Com Legit

Five Rules To Discharge Tax Debts

Dischargeable tax debts must meet five other criteria.

Tax debts are associated with a particular tax return and tax year, and bankruptcy law lays out specific criteria for how old a tax debt must be before it can be discharged.

Tax debt is dischargeable in Chapter 7 bankruptcies if it meets all five of these rules:

- The due date for filing the tax return in question was at least three years ago.

- The tax return was filed at least two years ago.

- The tax assessment is at least 240 days old.

- The tax return was not fraudulent.

- The taxpayer is not guilty of tax evasion.

Apply these criteria to each year’s tax debt to determine whether that year’s unpaid balance is dischargeable through bankruptcy. Some of your debts might be eligible, while others might not.

What Customers Are Saying:

Mr. Kaplun clearly had an exceptional understanding of the issue and was able to explain it concisely. I would recommend JustAnswer to anyone. Great service that lives up to its promises!

Gary B.Edmond, OK

My Expert was fast and seemed to have the answer to my taser question at the tips of her fingers. Communication was excellent. I left feeling confident in her answer.

EricRedwood City, CA

I am very pleased with JustAnswer as a place to go for divorce or criminal law knowledge and insight.

MichaelWichita, KS

Recommended Reading: Efstatus Taxact Online

It Is A Good Time To Learn Tax Resolution

Right now, the national debt is approaching $28 trillion, and there is no end in sight. Once the COVID crisis is subdued, Congress will look to the IRS to step up collections. Individual taxpayers and small business owners are their primary targets. It is a good time for you to learn how to handle tax debt situations in your practice and you keep the revenue.

To learn more about Tax Discharge Determinator and to take advantage of a free trial, . If this article raises any issues or questions that youd like to discuss about bankrupting taxes or if you have any questions about the TDD tool in general, please feel free to email me at or you can call me at 833-879-9210.

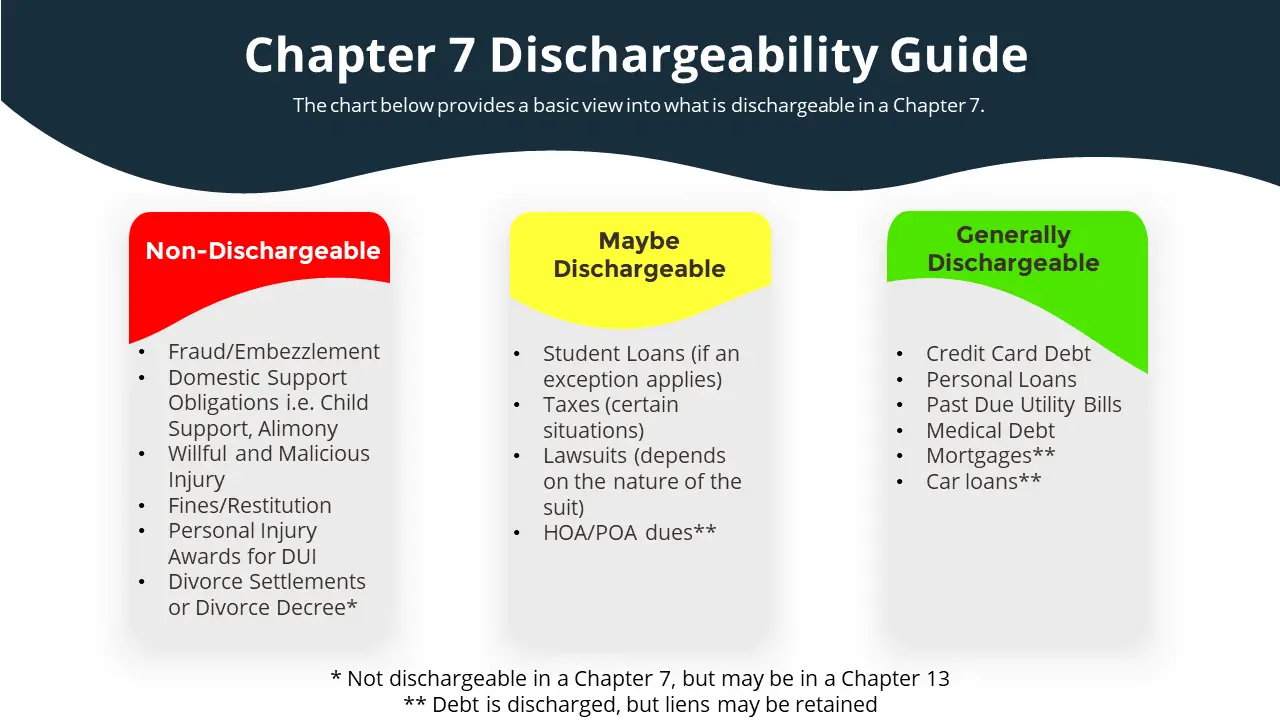

Debts Not Discharged In Chapter 7 Bankruptcy

The bankruptcy code is the law that governs bankruptcy filings in the United States. In the bankruptcy code, Congress has provided a list of certain debts that cannot be discharged through a bankruptcy. This means that even after successfully completing the bankruptcy case and receiving a discharge, the debtor will still owe these debts.

Here are some of the most common debts that survive a Chapter 7 bankruptcy.

Recommended Reading: How Do Doordash Drivers Pay Taxes

The Different Chapters Of Bankruptcy

There are six numbered chapters of bankruptcy filings. Chapters 7, 11, 12, and 13 are applicable to individuals in different circumstances.

Bankruptcy chapters 9 and 15 aren’t applicable to tax debts.

Chapter 7 is sometimes called a “straight” bankruptcy, because it provides for the full discharge of allowable debts. The bankruptcy court effectively takes control of your assets and liquidates them as necessary to pay off as much of your debt as possible. You’re no longer responsible for those unpaid balances after your bankruptcy discharged if you don’t have sufficient assets to cover all your debts.

Chapter 13 bankruptcy involves a multiyear, court-approved payment plan to repay your debts to the greatest extent possible. The goal is to pay them off in full, but some balances that can’t be paid can be discharged.

Chapter 11 allows for debt reorganization and a repayment plan similar to a Chapter 13 filing, but it is generally used by incorporated businesses or individuals whose debt is in excess of the limits for a Chapter 13 filing. That limit is $394,725 as of 2020.

Chapter 12 is intended for family farmers and fishermen who are financially distressed by expenses related to their businesses. It’s intended to be a quicker method of filing and designing a repayment plan. There are also limits to how long creditors can collect on debts under this chapter.