Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Refunds That Don’t Match The Amount Shown On Your Tax Return

All or part of your refund, including any amount for the Recovery Rebate tax credit, can be diverted to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts . To find out if this happened to your tax refund, or if you have questions about an offset, contact the agency to which you owe the debt.

The IRS can also adjust your tax refund amount if it makes changes to your tax return. The IRS will send you a notice in the mail explaining the changes. The “Where’s My Refund” tool will also note the reasons for a refund offset when it’s related to a change made by the IRS to your tax return.

If the tax refund you receive is not from your tax account, don’t cash the refund check or spend the direct deposit refund. Instead, you should send the refund back to the IRS according to the procedures on the IRS’s website.

Don’t Miss: Www Michigan Gov Collectionseservice

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment benefits provided a much-needed lifeline for thousands of Americans dealing with pandemic furloughs and layoffs in 2020. But on April 15 an unpleasant surprise might be waiting for people who got such aid.

According to Kathy Pickering, H& R Blocks chief tax officer, many first-time unemployment recipients dont know those payments count as taxable income for both federal and state returns.

Thanks to extended benefits that stretched up to 39 weeks in some states and additional weekly federal support payments, first of $600 and then $300, unemployment benefit recipients could be facing hefty tax bills theyre unprepared for and ill-able to afford, particularly if they are still out of work.

Legislation proposed by two Democratic Senators on February 2 hopes to prevent this by waiving taxes on the first $10,200 of unemployment benefits a person received last year. However, the bill has yet to be passed and no changes have been made to the existing tax code. So for now, its best to brace for a possible hit from Uncle Sam.

If you relied on unemployment compensation last year, heres what you need to know when you file your 2020 return: how that aid will be taxed ways to reduce your tax bill and your options if you cant pay in full by the deadline.

Donât Miss: Tn Unemployment Sign Up

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Also Check: Form 5498 H& r Block

Correspondence About Returns Or Refunds

If you want to respond

If you received an adjustment notice, you can respond online or by mail with supporting documentation. To respond online:

To respond by mail:

If you are entitled to an additional refund amount, we will issue you a separate check for that amount.

Note: If you received Form DTF-32, Notice to Owner of an Uncashed Check, you cannot respond online see Lost, stolen, destroyed, and uncashed checks.

If you received a letter other than an account adjustment notice , see Respond to a letter requesting additional information to learn what to include in your response.

If you already responded

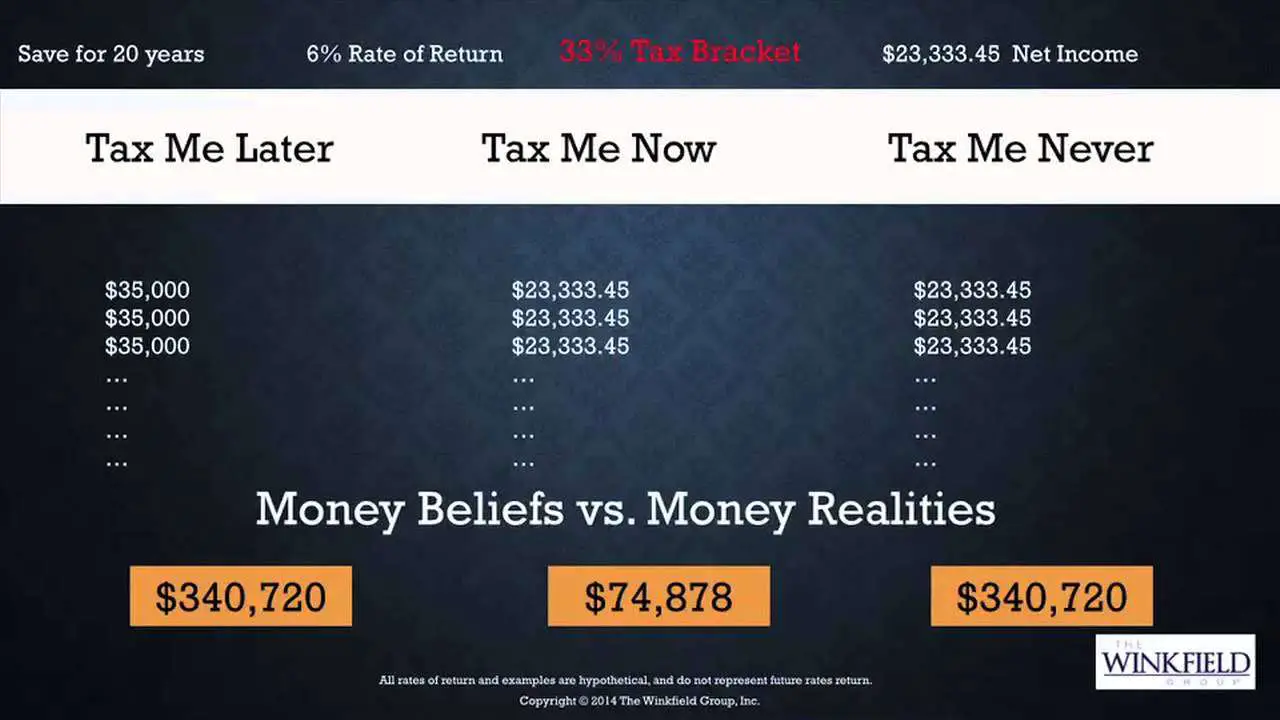

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

Also Check: Protesting Harris County Property Tax

How To Prepare For Your 2021 Tax Bill

You have the option of having income tax withheld from your unemployment benefits so you dont have to pay it all at once when you file your tax returnbut it wont happen automatically. You must complete and submit Form W-4V to the authority thats paying your benefits. Withheld amounts appear in box 4 of your Form 1099-G.

Federal law limits the amount you can have withheld from benefits to 10%. This may not be enough to adequately cover taxes on the benefits you received. If youve returned to work, you can opt to have extra tax withheld from your paychecks through the end of the year to help cover taxes owed on your unemployment benefits as well as your regular pay.

Your other option is to make advance estimated quarterly payments of any tax you think you might owe on your benefits. You have until Jan. 15, to make estimated tax payments on any benefits you receive between September and December the prior tax year. In fact, you must do so if sufficient tax wasnt withheld from your unemployment benefit payments. You could be charged a tax penalty if you dont pay as you go through either additional withholding or estimated payments during the tax year.

The tax you owe on your unemployment benefits might be minimal depending on how much you received. This is because unemployment doesnât replace 100% of your previously earned compensation.

Recommended Reading: How To Qualify For Unemployment In Tn

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Don’t Miss: Does Doordash Take Out Taxes For Drivers

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How Much Is Unemployment Tax In Ny

The 2021 New York state unemployment insurance tax rates range from 2.025% to 9.826%, up from 0.525% to 7.825% for 2020. The new employer rate for 2021 increased to 4.025%, up from 3.125% for 2020. All contributory employers continue to pay an additional 0.075% Re-employment Services Fund surcharge.

Recommended Reading:

You May Like: Do I Have To Pay Taxes On Plasma Donation

If You’re Waiting For Your Tax Refund The Irs Has An Online Tool That Lets You Track The Status Of Your Payment

Good for you if you already filed your 2020 tax return. It must feel nice to have that out of the way. But if you’re getting a refund, now you have to wait around for your payment to arrive. If you really need the money, the delay can really be frustrating. Fortunately, the IRS has a tool that can help reduce the anxiety that comes with waiting it’s called the “Where’s My Refund” portal.

The online tool will show the status of your tax refund within 24 hours after the IRS receives your e-filed return or four weeks after a paper return is mailed. In most case, it will tell you that your tax refund has either been:

- Received

- Approved or

- Sent .

In some cases, if the IRS is still reviewing your return, the tool may display instructions or an explanation of what the IRS is doing. Once your refund is processed and approved, the tool will give you an estimated date when you’ll get your payment.

If your refund is being deposited into your bank account, wait at least five days after the IRS sends the payment before contacting your bank to check on it. Some banks will credit funds more quickly than others. If you’re getting a paper check, it could take a few weeks before you receive it in the mail.

- Head of Household and

- Qualifying Widow.

Run Your Numbers In The Tax Refund Calculator/estimator

Answer the simple questions the calculator asks. You dont have to be 100% exact you have to give a reasonable estimate. If your tax situation changes, you can always come back to the calculator again.

As you answer the questions, you will see that the information you enter changes your refund amount. You will even have access to your total income, adjustments, deductions, and other significant numbers in the form of a tax summary.

Read Also: Doordash And Taxes

Enter Your Financial Details

Begin by entering how much youll expect to earn in total for this tax year. Then youll be able to estimate your taxes for the end of the year.

If you have a more complex financial situation, youll need to start adding income from other sources. For example, maybe you earn interest from your bank, or you have stocks that pay out dividends.

How Unemployment Affects Your Taxes Taxact

One question that may arise in your mind is: Does unemployment get taxed?

Well yes, the unemployment benefits are taxable. Long ago, unemployment benefits were exempt from income tax. Unfortunately, thats no longer true.

You dont have to pay Social Security and Medicare taxes on your unemployment benefits, but you do have to report them on your tax return as income.

You can choose to have income tax withheld from your unemployment benefits, if necessary, to avoid an unpleasant surprise next year when you file your return. Before you do, however, make sure thats necessary.

Read Also: Unemployment Tn Apply

Recommended Reading: Find Employers Ein

How Much Can I Contribute Into An Rrsp

You can contribute up to 18% of earned income from the previous tax year up to a maximum of $29,210 . It all depends on you and your future needs. The more you contribute to your RRSP, the more your investment will have grown over the years. The amount is not the only variable to take into account, you have to take into account your age, frequency of contributions, etc. In general, the earlier and more aggressively you pay into your RRSP, the more it can grow before retirement.

If you contribute to a group RRSP, your contributions will be deducted directly from your paycheque, which will generate tax credits.

Estimate Again Once Time Has Passed

Anytime something changes with your tax situation, you may want to come back to the calculator again. This will ensure that you are always on the right track financially. The more often you estimate your taxes, the better prepared you can be when it comes time to file.

Tax laws change throughout the year, but you can make sure that you are prepared using a tax calculator. By utilizing a tax refund calculator, you can have peace of mind knowing that your tax refund will be the best one possible.

Don’t Miss: Doordash 1099 Form

How To Maximize Your Tax Refund

There are several ways you can get a bigger refund on your taxes this year. Here are just a few of the best ways to maximize your refund.

Top 5 Tips to Get Your Maximum Tax Refund

Figuring out how to maximize your refund can involve some pretty in-depth knowledge. If the process seems a bit overwhelming, talking to a CPA or tax professional can help make sure you dont miss anything.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Don’t Miss: Do You Get Taxed For Donating Plasma

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Do You Have To Pay Taxes On Unemployment Benefits

The American Rescue Plan Act of 2021 changed federal tax requirements on 2020 unemployment benefits. For the latest information, see How Unemployment Benefits Are Changing in 2021.

Over 45 million new unemployment claims were filed in the 13 weeks following the declaration of a state of emergency due to COVID-19 in mid-March. For many, especially those filing for benefits for the first time, the fact that unemployment benefits are taxed at the federal, state and potentially even local levels might come as a bit of a shock.

How much youâll pay depends on your overall income for the year and several other factors. When you pay can also depend, as you can either have taxes withheld from your benefit payments like you would a regular paycheck, pay when you file your taxes or pay a quarterly estimated tax.

Also Check: How To Contact Unemployment Office

Don’t Miss: Do You Pay Taxes Working For Doordash

Unemployment Taxes At The State Level

If you live in a state that has a state income tax, you may need to pay state income taxes on your unemployment benefits in addition to federal income taxes.

For states that dont have a state income tax or dont consider unemployment benefits taxable income, you wont need to pay state income taxes on your unemployment benefits. These are 17 states that dont tax unemployment benefits:

| States that dont have any income taxes | Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming |

| States that only have income taxes for investment income | New Hampshire and Tennessee |

If you dont live in one of these 17 states, your unemployment benefits may be taxed by your state. Your states individual income tax rate can be found here. To learn more about your state individual income tax, visit your states Department of Revenue website or read Kiplingers State-by-State Guide on Unemployment Benefits.

Read Also: How To Sign Up For Unemployment In Missouri