How Do I Change My Address

If you haven’t submitted your return yet, please see the TurboTax Help article “How do I update my TurboTax account information?“ for guidance.

If you’ve already submitted your return, and the address on the return isn’t your current address, you should call the IRS at 1-800-829-1040 as soon as possible to advise them of your current address.

The IRS should be able to process your change-of-address information over the phone, but if they can’t, see the TurboTax Help article “How do I change my address with the IRS?” for guidance.

Has Your Mailing Address Changed This Tax Year

The Canada Revenue Agency requests notice of a change of address as soon as possible. You can update your information online using the CRAs My Account service, or by calling the CRA at 1-800-959-8281. The Agency also accepts address changes by mail. To change your address by mail complete and sign Form RC325, or send a letter to your local tax centre. Include your social insurance number, new address, date of move and be sure to sign the letter.

Using CRAs MyAccount service to submit a change of address

How To Inform Us About Your Change Of Address

Usually you don’t have to pass this on to us. We will automatically receive your new address if you inform your municipality.

If you move abroad or come to live in the Netherlands, you must also inform the municipality. You do not have to pass anything on to us.

Is your organisation relocating? If so, please inform the Chamber of Commerce.

Recommended Reading: Efstatus Taxact 2016

Update Property And Billing Information

Send Mail to a Different Address

If a notice has already been mailed, or if it is about to be mailed, the change will take effect on the next notice. Use the second link below to look up your notice online.

Correct My Property AddressIf your notice shows the wrong Property Address, please click on the following link. Be sure to select the borough and copy the Block and Lot numbers from your notice. Correct my property address.

Correct Owner NameEach owner name on your property’s tax account and deed should match.

If you live in the Bronx, Brooklyn, Manhattan or Queens, search our records online to see if your deed has been recorded correctly. Please contact the City Register if you cannot view it online or have questions. If you live in Staten Island, please send a copy of your deed to prove ownership.

Mail to:

Find And Change Property Information And Get A Tax Certificate

We send tax notices to the mailing address we get from BC Assessment.

If you change your address with another City department, this does not result in a change of address for your property tax notice, Vacancy Tax notice , utility bills, or BC Assessment notice.What is relevant to your property tax notice:

- Your mailing address

Contact one of the above organizations to set up an account.

You can also buy tax certificates from us in person by visiting the Property Tax Office on the main floor of City Hall.

When tax certificates are unavailable for property tax conveyancers

Tax certificates are unavailable directly from us or through authorized third parties each year during:

- The first two weeks of January for year-end processing

- Mid-May for the annual main tax calculation

- Mid-November for the annual advance tax calculation

Important note If a conveyance is occurring at those times, consider purchasing the tax certificate beforehand, or contacting 3-1-1 for the most current downtime information.

Recommended Reading: Pay Taxes On Plasma Donation

How To Change Your Address With Canada Revenue Agency

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards. This article has been viewed 195,069 times.Learn more…

When you move, it is important to change your address with Canada Revenue Agency . This should be done either prior to your move, or shortly afterwards. Doing this in a timely manner will ensure there is no disruption to your benefit payments, such as the Goods and services tax or Child Tax benefit payments.

What Is Form 8: Change Of Address

OVERVIEW

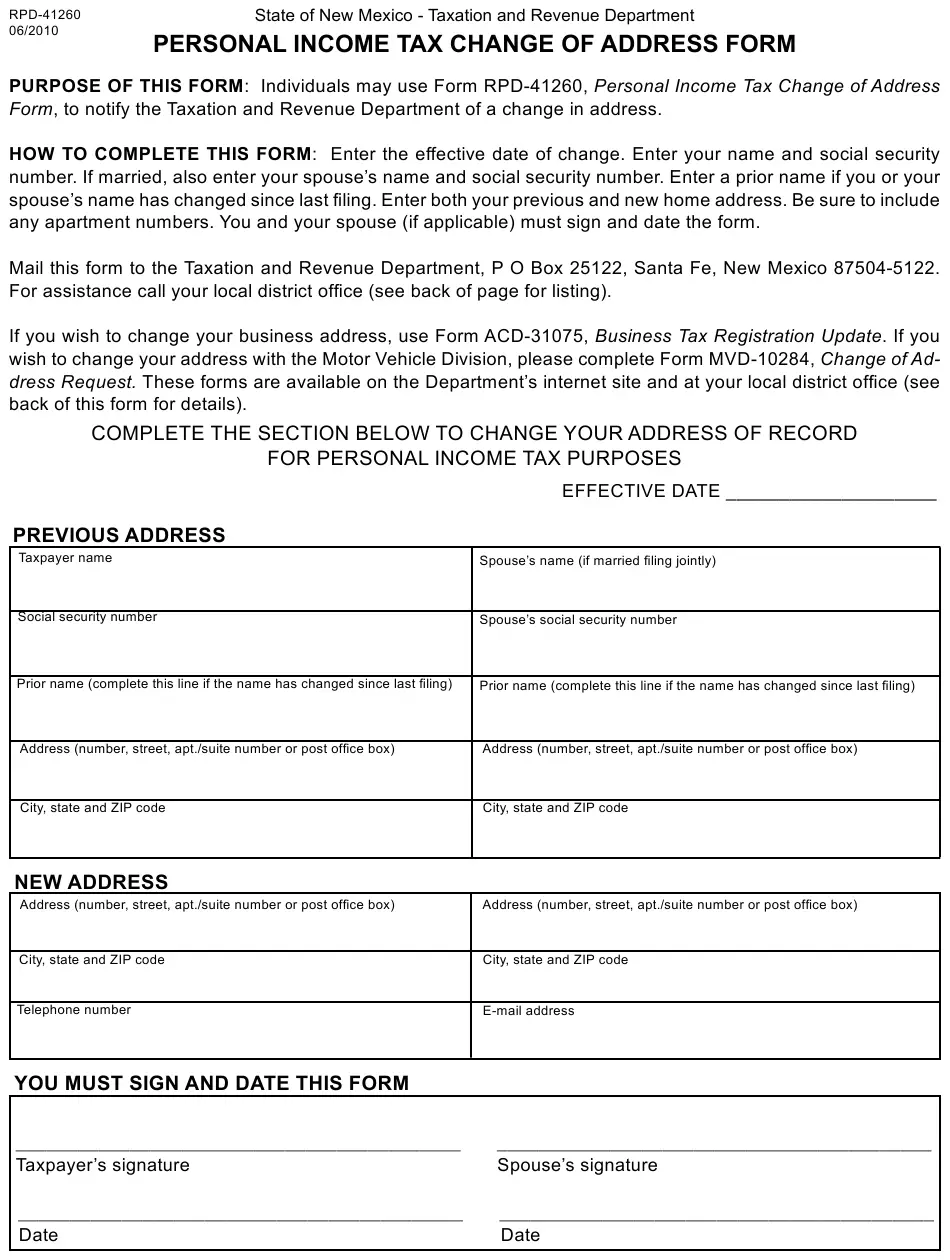

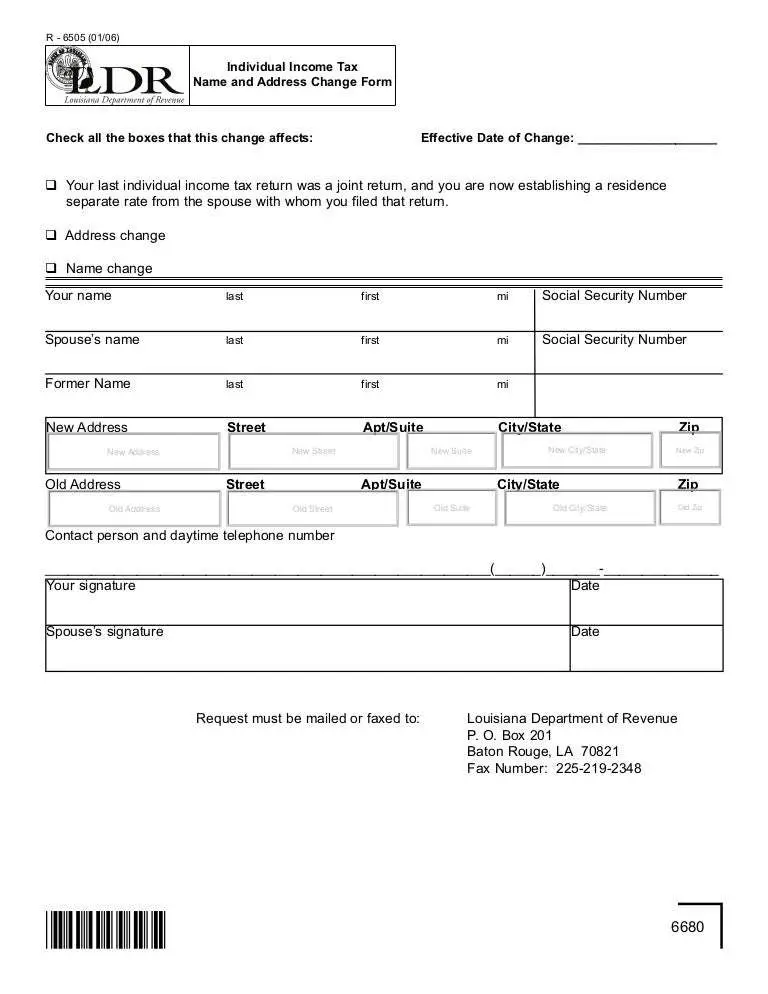

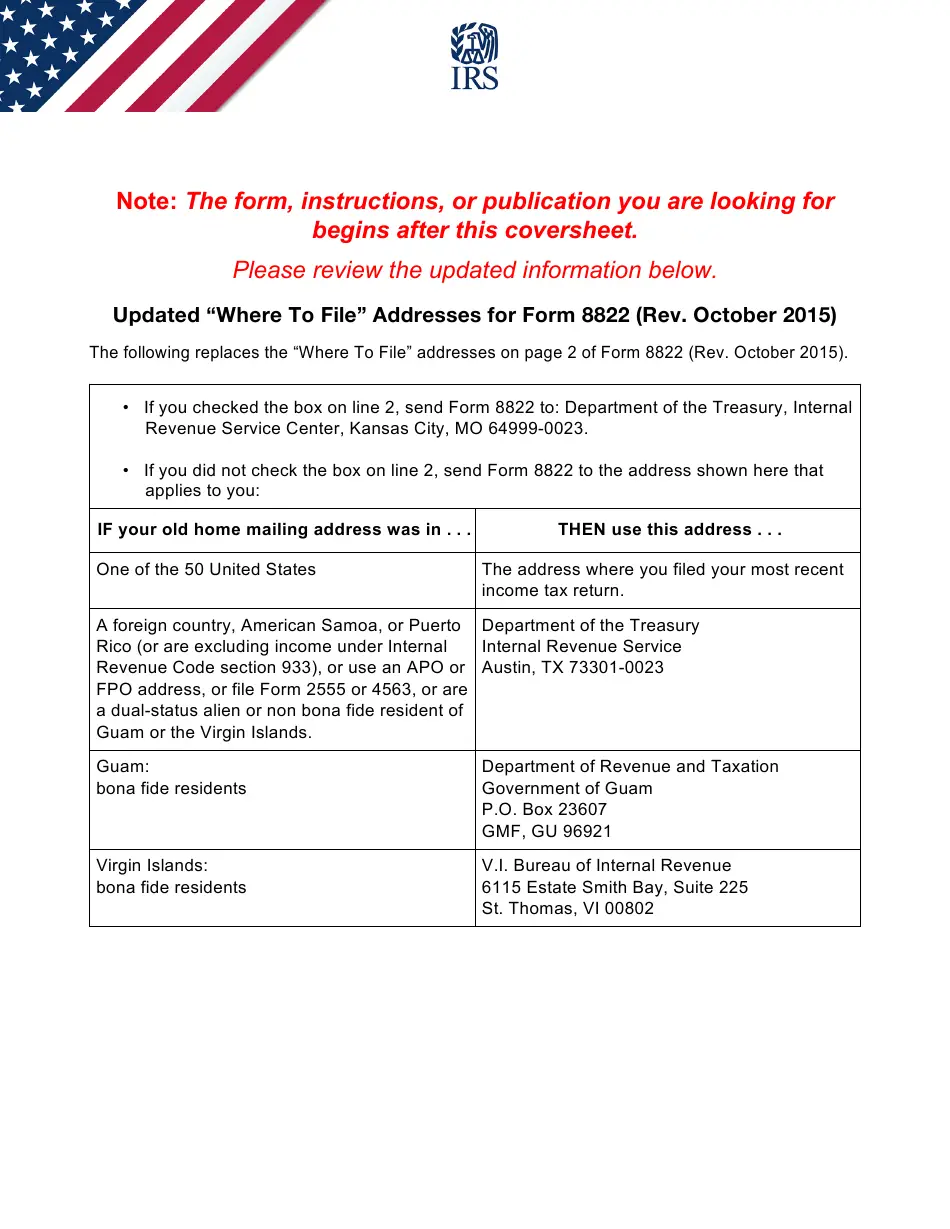

After moving into a new home, you may want to use Form 8822 to notify the Internal Revenue Service of your change of address. The IRS may send you notices, refunds paid with a paper check and other correspondence relating to your personal, gift and estate taxes. If you don’t let the IRS know that you moved, it sends all correspondence to your last known address, the one listed on your most recent tax return.

Also Check: How Do I Get My Doordash 1099

Update Your Online Banking Profile

The assessment roll number and utility account number are assigned to the property, not the owner or resident. Use the assessment roll number and utility account with the client number from your most recent bill for bill payment.

- If you have previously made payment through online banking for either your utility bill or property tax bill, ensure the account number has been removed or updated. If you move into a new property, your account number will change. You are responsible for misdirected or late payments, and fees are applicable.

Sometimes You Do Have To Report A Change

Choose your situation and see how you do it:

For both your private and business address, you can pass on a different address to receive our mail: a postal address.

You can do this using the form Passing on a postal address .

You can only use this form if you live in the Netherlands. Or if your company, foundation or association has its registered office in the Netherlands.

Also Check: How To File Taxes From Doordash

Alternatives To Form 8822

If you aren’t required to file a return, there may not be any reason for you to use Form 8822. But, if you usually file tax returns and you’re planning to file your next one soon, you can simply enter your new mailing address directly on the tax return form instead of using Form 8822. You also have the option of writing a letter to the IRS that includes the same information that Form 8822 requires.

Failing to update your mailing address with the IRS may have some consequences if time-sensitive materials are sent to your last known address.

- Under the law, you’re deemed to have received anything the IRS sends to your last known address.

- This means that the IRS doesn’t have to give you additional time to respond to a letter demanding that you pay additional tax, for example, just because you forgot to update your mailing address after you moved.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Change Of Address In The Netherlands

When you move to a new address in the Netherlands, you have to register your new address with the municipality within five days of moving. If you dont do this, you might be fined. Also, if your address is registered incorrectly, it could affect your benefits and taxes. But how do you register your new address in the Netherlands?

You May Like: Tax Form For Doordash

Do I Need To Notify The Tax Office If I Move To A New Address

You dont need to notify the tax office or the Department of Road Transport because the municipality will notify them for you. You will only need to inform the tax office when you receive rent benefit or when you are living / moving abroad .

It is also worth noting that your residence permit is only valid if your address is kept up to date!

Can’t I Just Phone Hmrc And Tell Them About My Change Of Address

Yes, as a self-employed person you can use the Income Tax General Enquiries helplines:

- 0300 200 3300 – if you’re in the UK

- 18001 0300 200 3300 – if you can’t speak or hear on the phone

- +44 135 535 9022 – if you’re phoning from outside the UK

Or your can use the self-assessment helplines:

- 0300 200 3310 – calls from the UK

- 03002003319 – textphone

- +44 161 931 9070 – calls from outside the UK

These helplines are available from 8am to 6pm every weekday and are closed at the weekend and on bank holidays. HMRC advises that it’s easier to get through before 10am.

HMRC uses speech recognition software to organise their calls, so when you first get through you’ll be asked the reason for your call. Just say ‘change of address’ and you should be understood and put through to someone that can help you.

Make sure you have your National Insurance Number beside you before you call the income tax helplines and your Unique Taxpayer Reference Number when you call the self-assessment helplines. It’s part of the security checks and the advisor won’t be able to help unless they can confirm you’re you.

Also Check: Efstatus Taxact Com Login

Notice Of Change Of Addresslm

Complete this form if you are an individual in business, a partnership, a corporation or any other legal entity that wishes to notify us of a change of address or telephone number with regard to a business registered for a Revenu Québec file.

serviceDid you know?

Using the service for changing your address with Revenu Québec in My Account for businesses or the Change Address online service is the simplest, fastest and most eco-friendly way to submit the information on the form.

Zone entreprise Change of address service

The Zone entreprise is designed to streamline administrative procedures for businesses and to facilitate their dealings with the government. If your business is registered for clicSÉQUR Entreprises , you can notify several government departments and agencies, including the Registraire des entreprises, of a change of address using the change of address service in the Zone entreprise.

Notefilesignature

This form can be signed electronically.

End of note

To complete the form, save it to your computer and open it in Adobe Reader.

End of noteNoteisa

Our downloadable documents may not comply with Web accessibility standards. If you are having problems using them, please contact us.

End of note

How To Change My Address For My Taxes In Canada

How to change my address with my bank?

Usually when we think about the companies we need to notify of our change of address, our financial institutions are at the top of the list. This article explains how to change your address with your bank accounts and credit cards

One website for all your address change | MovingWaldo.

Do you have any question concerning your address change? MovingWaldo has been the reference in this sector since 2015. In fact, our free online service allows you to communicate your new contact information to a selection of over 600 private companies and governmental institutions in less than 5 minutes! Lets just say there is a reason why RE/MAX and Sutton Quebec have chosen MovingWaldo has their official change of address partner.

To learn more about our free change of address service, .

Read Also: How Does Doordash Taxes Work

Ensure A Smooth Change

The IRS is authorized to use a taxpayer’s last known address when it’s sending documents or other communications. This means that any documents or notices sent to the address the IRS has on file are legally effective and binding on you, even if you’re no longer living there and don’t receive them.

You can avoid missing important government communications and facing unintended financial or legal penalties by taking steps to ensure that your change of address is processed smoothly and quickly:

- Hold off on filing your income tax return until after you’ve moved if you plan to relocate during the first four months of the year before the tax-filing deadline. You can file your tax return with your new address, and your refund check will be sent there.

- File both a personal change-of-address form and a business change-of-address form if you also have a business at your home.

- Couples who are separating should each file a change-of-address form, even if only one person is moving to a new address. That will enable the IRS to locate each taxpayer individually.

- The U.S. Postal Service will usually forward any letters or refund checks from the IRS if you notify it of your change of address, but you should still file a change of address with the IRS to ensure that there’s no miscommunication or lost paperwork.

Tell Hmrc When You Change Your Address

Use this service to update your address for:

- Income Tax

- State Pension

- tax credits and Child Benefit

To sign in you need a Government Gateway user ID and password. If you do not have a user ID you can create one when you update your address.

You need to wait until youve moved before telling HMRC about your new address.

You cannot use this service to update your details:

- for business tax

Youll have to update your details a different way.

Also Check: Highest Paying Plasma Donation Center Near Me

How Do I Change My Mailing Address

To change your mailing address in TurboTaxCD/Download EasyStep Mode, select Contact Info from under Introduction on theleft side menu.

To change your mailing address in TurboTaxCD/Download Forms Mode, you can do this on the top of the T1 General page inthe Identification section.

You must notify the CRA regarding the change ofmailing address before you NETFILE your return. You can update your infothrough the CRAs My Account service or by calling them at 1-800-959-8281.

Notifying The Tax And Customs Administration Of Changes In Your Income Tax Return

If you want to amend your income tax return, file a new tax return. Always inform the Tax and Customs Administration of any changes in your situation. This will prevent, for instance, your having to make additional payments later if you have received a provisional assessment.

Your situation changes if, for instance, your income increases or decreases. You should also inform the Tax and Customs Administration of other changes in your circumstances, such as a new address or bank account number.

You may also have to inform the tax authority in your country of residence of any changes. Contact your local tax authority to find out.

Recommended Reading: Www.1040paytax.com

Eliminating Licence Plate Stickers

We have eliminated licence plate stickers for passenger vehicles, light-duty trucks, motorcycles and mopeds.

Sticker refund

If you paid renewal fees for your licence plate sticker for an individually-owned vehicle between the period of March 1, 2020 to March 12, 2022, you will receive a refund cheque in the mail if eligible.

To exchange your existing vehicle permit for one showing your new address, you will need to visit a ServiceOntario centre.

A replacement fee may be charged if you do not bring your existing vehicle permit but wish to receive a new one.

How To Change Information Submitted Online

You can make changes to your tax return online through the CRA My Account service. Start by logging in to your account online with your User ID and password. Under the Quick Links, click on the link that says Change my return. Select the year youd like to change from the drop-down menu. You can do a search of your T1 General for changes youd like to make by entering the description or line number.

For example, you can enter employment income or 101 to bring up the line related to employment income. You can also browse the sections of your tax return and make changes manually.

You must follow all the steps for the changes to submit successfully. You can make a request for changes to one or more tax year in one submission. You receive a confirmation number once the CRA receives your request.

If you want to make further changes after submitting your request, wait until the request has been processed before submitting others. Processing time for changes submitted online is about two weeks.

Don’t Miss: How To Pay Taxes For Doordash

How To Update Someone Else’s Address

You can file a change of address on someone else’s behalf if you’re authorized to represent them in tax matters. You and the person you’re representing should both fill out Form 2848 for you to become their authorized representative. This grants you power of attorney regarding their tax matters.

What Happens After I Tell Hmrc My Change Of Address

Once HMRC has your new address, they update it across all their systems – which saves you a job. You don’t have to phone around, or email, every different department. HMRC changes your address for you in all of these records: National Insurance, income tax, benefits, tax credits and the Pension Service. Then they email you a confirmation of your change of details.

Read Also: Property Tax Protest Harris County

How To Change Information Submitted By Mail

You can also make changes to your tax return by mail. Complete and submit a T1 adjustment request form. If you prefer to submit your changes to the CRA by mail, include supporting documentation, such as receipts, that supports the change you are requesting in your tax return and your original claim.

When mailing your change request to your tax centre, include the T1 adjustment form or a signed letter outlining your request. Include the tax years you are requesting the change for. Also, include your Social Insurance number, your mailing address and the best phone number to reach you during regular business hours.

You can download a copy of the T1 adjustment form online on the CRA website. The processing time for changes submitted by mail is about eight weeks. It may take the CRA longer to process your request if it is submitted in later summer or fall, or if your request needs further review or additional documentation.