How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

What Do These Irs Tax Return Statuses Mean

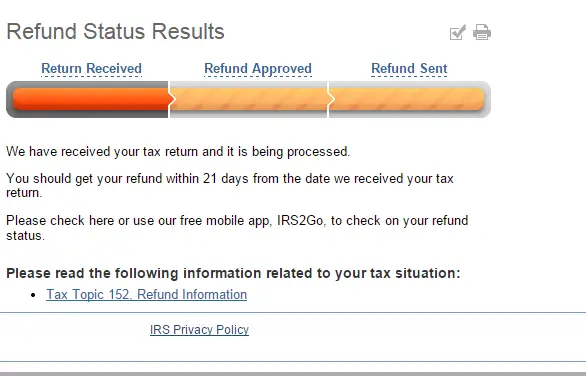

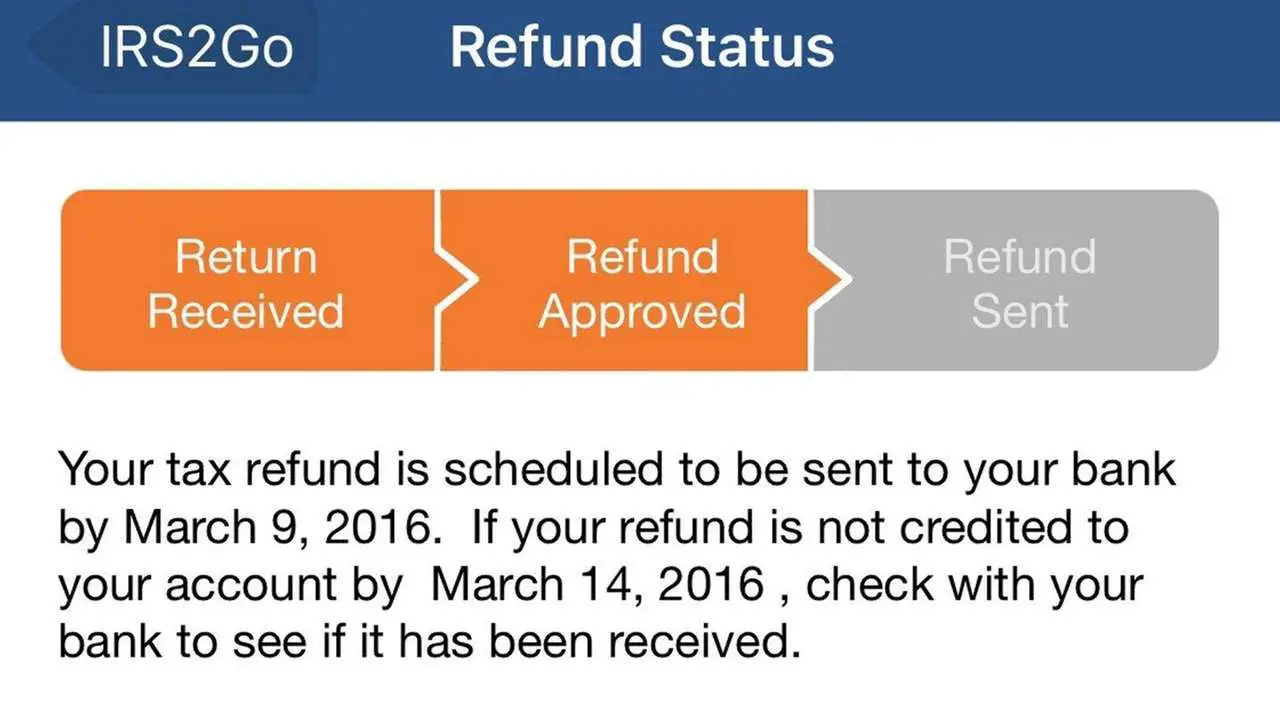

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Also Check: How To Get Pin To File Taxes

So How Do You Check Your Prior Year Tax Refund Status After Mailing Your Return To The Irs

Brace yourselves as many of you arent going to like Plan B. Youll need to call the IRS. Of course, you dont want to mail your return and call on your lunch break the following day. The IRS insists that you wait it out for at least 6 weeks after mailing your return to call and check on the status. When you call, make sure you have the following handy:

- tax year

- filing status

- exact refund amount

You can call 1-800-829-1040 and follow the prompts for a live representative. The person that you speak with will have direct access to your tax return and be able to provide you with a status update.

Tip: Request a tracking number when mailing your return. Itll give you peace of mind to know that it arrived safe and sound.

Let’s Track Your Tax Refund

Within 2 days of e-filing, the IRS may accept your return and begin processing it.

Within approximately 2 days of acceptance, the IRS will process your tax refund.

Refund sent or deposited by IRS

You should receive your tax refund from the IRS within 19 days* after acceptance. If you have not received it by this time, contact the IRS for assistance.

You can also check your refund status directly with the IRS’ Where’s My Refund Tool.

Still waiting on your refund?

Recommended Reading: Doordash Tax Form

What If I’m Looking For Return Info From A Previous Tax Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, youre refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns are available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

Recommended Reading: Does Doordash Take Taxes

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measure to prevent fraudulent returns and this has increased processing times.

Ways To Get Your Refund Faster

Theres no magic wand that will make your refund arrive instantly. But there are a couple of steps you can take to potentially speed up the process.

Read Also: Opi Plasma Center

The Irs2go Mobile App

You can access the Where’s My Refund tool from your laptop or desktop computer, or you can use the IRS2Go app if you prefer to use your mobile device. The app is available as a free download on iTunes, Google Play, and Amazon. You can use it to:

- Check your refund status

- Make a payment if you owe taxes

- Get free tax guidance

- Get security codes for certain online IRS services

The IRS issued more than 128 million refunds for tax year 2020 by Oct. 22, 2021. The average refund was $2,775. Overall, more than 167 million individual tax returns were processed.

How Can I Check The Status Of My Tax Refund

For your federal tax refund, use the “Wheres My Refund?” tool on IRS.gov/refunds. The free IRS2Go mobile app also has a refund-tracker tool. You can check the status of your federal tax refund within 24 hours after submitting your e-file return. If you mailed in your tax return, you can check within four weeks after mailing.

If you’re expecting a state tax refund, you can check its status on the Ohio Department of Taxation website at tax.ohio.gov/refund. Or, you can call the toll-free number 1-800-282-1784.

Some taxpayers may qualify for a Cincinnati tax refund. Learn more about city taxes and refunds at cincinnati-oh.gov/finance/income-taxes/.

Recommended Reading: Do I Have To Claim Plasma Donations On My Taxes

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

You May Like: What Home Improvement Expenses Are Tax Deductible

How To Get A Faster Tax Refund

Here are four things that can help keep your “Where’s my refund” worries under control.

Avoid filing your tax return on paper. It’s a myth that your IRS refund status will be “pending” for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering “where’s my refund?” by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Don’t let things go too long. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: Doordash How Much To Save For Taxes

Responses To How To Check A Prior Year Tax Refund Status

Hi Jeremiah,

I appreciate you reaching out via our blog! If you prepared your tax return with PriorTax, you can contact our customer service team to help you out. You can reach out via phone, livechat or email and one of our representatives will be able to assist you. Our phone number is 877-289-7580 .

Hi my problem is that. I never re ieved my tax return for the past year, due to someone filed use ok ng my name and i was sent, a letter from the irs and it explained what happene. I know that i since then have recieved many email and gmails refureing to my refund, when i could so badly use that money right now, i yet to recieve it at all. Ive also have recieved confermation from the irs that i soo. Would be receiving. My refund check and never have yet. Why i wish i knew, could you please check into or if you know soneone th a t can help me please that would be amazeing. Thank you have a blessed night.

Stasha Carpenter

I E-filed my 2016 state & federal taxes 1st week in February Received refund from state in 21/2 weeks and federal about 31/2 weeks. And have never filed my 2015 return until a little over a week ago.so in short they never held onto my 2016 refund until I filed my 2015 taxes.so hopefully beings my 2016 was already approved, maybe it will speed things up a little on my 2015 refund.who knows. Just as well to forget about because thats when it arrives Lol Lol

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Also Check: How To Buy Tax Lien Certificates In California

If Your Tax Refund Check Is Coming In The Mail Here’s How To Track It

You don’t have to check your mailbox every day to see if your refund check has arrived. Do this instead.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

With tax filing season behind us, the next step is waiting for your tax refund to arrive. And if you filed a paper tax return and didn’t set up direct deposit, your refund should come as a paper check in the mail. But when should you expect it to arrive?

The US Postal Service has a tracking tool that lets you know exactly when your tax refund will land in your mailbox. It’s called Informed Delivery, and the free USPS service sends you alerts for all new mail — and transmits images of the front of letters so you know exactly what’s arriving. It doesn’t take pictures of your incoming packages, but it does track them and will also let you add an electronic signature to receive packages when you’re not home.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Read Also: Can Home Improvement Be Tax Deductible

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15.

Are You Entitled To Receive Interest On Your Refund

Yes, the Canada Revenue Agency will pay you compound daily interest on your tax refund. The CRA will start paying refund interest on the latest of the following 3 dates:

- the date of the overpayment

- the 120th day after the end of the tax year if the return for the year is filed on time

- the 30th day after the date the return was filed if it is filed late

Don’t Miss: Plasma Donation Taxable Income

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

What If I Filed My Tax Return On Time But Haven’t Gotten My Refund

There are several reasons why your tax return may not have been completely processed yet, resulting in a delayed refund. You may have made errors on your return that required manual processing, or simply included an uncommon form. Regardless of the reason for the delay, if the IRS does not issue your refund within 45 days after receiving your return, the agency is required to start paying interest on your refund amount.

The 45-day time period starts on either the day that the tax return was due, or when your “processible” tax return was received by the IRS, whichever is later. If you electronically filed on time, the count started on April 18 if you filed a paper return, it began on the day that the IRS marked your return as accepted.

The bad news is that any IRS interest you receive with your refund will be taxable income, much like the interest you would earn from a checking or savings account. The good news is that interest on overpayments to the IRS will rise to 5% starting July 1. The IRS interest rate for overpayment is set at the federal short-term interest rate plus 3 percentage points. With the Federal Reserve raising rates by 0.75% in early June, a full point increase to the IRS interest rate will take effect next month.

You May Like: 1040paytax.com Legitimate