Where Can I Get Irs Tax Forms

The easiest way for most people to get tax forms is online. The IRS provides a web page specifically for this purpose. You can find the most common tax forms here, including all the versions of Form 1040, which is the individual tax return.

The IRS also links to the instructions for completing these forms. You can also search for forms by name or number.

How Do I Track My Maine Tax Refund

To track the status of your Maine 1040ME income tax refund online, visit the Maine Revenue Services website and use their Refund Status Information service. Maine Revenue Services updates their income tax refund status information each Tuesday and Friday night.

To track the status of your Maine income tax refund for 2021 you will need the following information:

- Social Security Number

- Amount of your refund

The requested information must match what was submitted on your 2021 Maine Form 1040ME. To track prior year refunds, you will need to contact the Maine Revenue Services service center by phone, email, or mail.

To contact the Maine Revenue Services service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2021 Maine Form 1040ME instructions to obtain the proper phone number and mailing address.

Two States Can’t Tax You On The Same Income

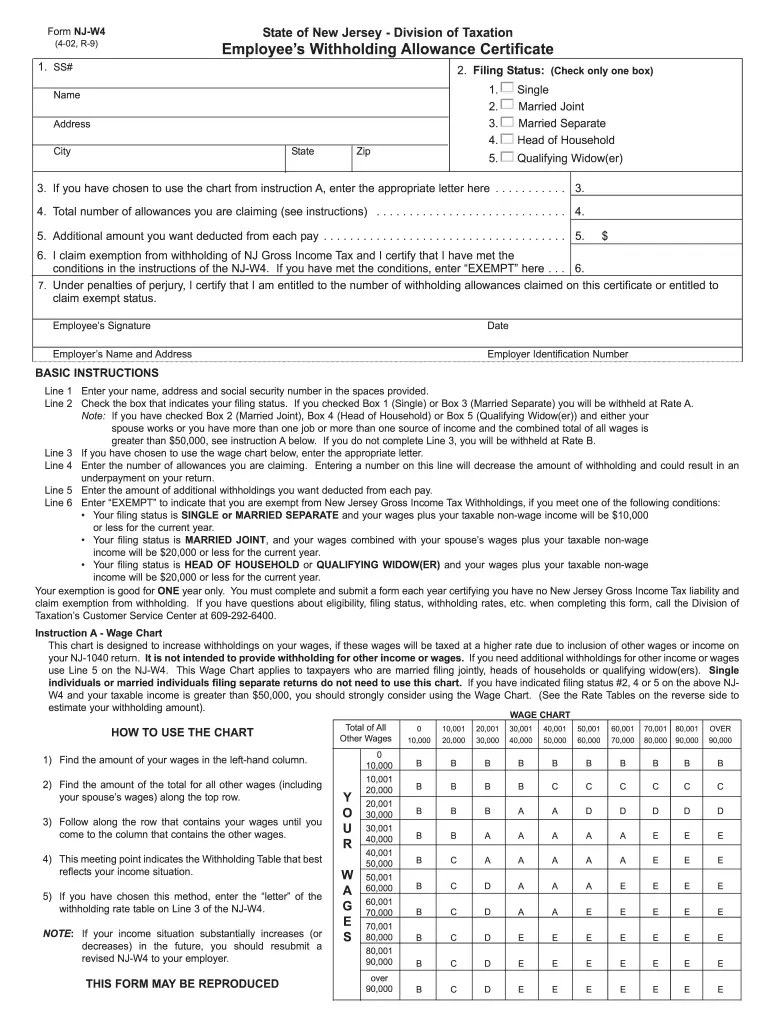

Some taxpayers must file a tax return in the state where they live, as well as a nonresident tax return in the state where they work if they live in one state but work in another. This might be the case even if they didn’t actually work in the other state for an employer but otherwise received some type of income or compensation there.

It might be time-consuming to file multiple returns, but it’s not particularly difficult or challenging, and you won’t pay taxes to both states thanks to a 2015 U.S. Supreme Court decision.

Don’t Miss: Www.efstatus.taxact.com

Allocating Your Tax Liability

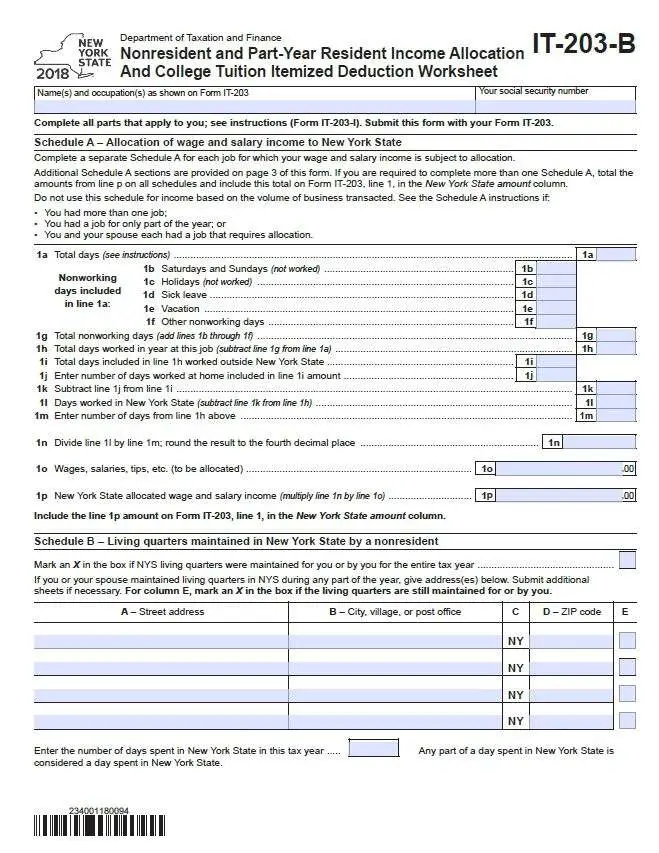

Some states, such as Delaware, allow you to offset your nonresident income by your federal itemized deductions after adjusting for nondeductible items such as state and local taxes. These returns then have you multiply your actual tax liability by your “nonresident percentage” to come up with your tax liability as a nonresident.

Other State Tax Forms

In addition to income taxes, most states collect revenue from other types of taxes that require their own forms. For example, your state may impose an estate tax similar to the federal estate tax. If so, the state can create its own rules that require you to file an estate tax return even if the federal government doesnt require one.

Similarly, some states impose an inheritance tax on beneficiaries who receive money or property when a friend or family member passes away, and will require you to report your inheritance on specific forms. Although these are just two examples, there is an array of other state taxes that individuals, businesses and trusts must prepare state tax forms for each year.

You May Like: Is Door Dash Self Employed

Individual Income Tax Forms

2021/2022 Forms will continue to be added as they are approved.If the form is not linked it is not yet available.

File Your 2021 Connecticut Income Tax Return Online!

There are free, online state income tax filing options available to you, including the DRS Taxpayer Service Center.

Benefits to electronic filing include:

- Simple, secure, and can be completed from the comfort of your home.

- Can reduce return errors.

- Results in an immediate confirmation that your submission has been received by DRS.

- If you are expecting a refund, electronic filing is the quickest way to receive the refund.

Please consider an electronic option to file your state income tax return this year. Thank you!

Instruction Booklets

Where Do I Pick Up Tax Forms

Federal tax forms are available on the website of the Internal Revenue Service, at IRS Taxpayer Assistance Centers and at community locations, such as local libraries, post offices, banks and grocery stores. Taxpayers can also call the IRS and request tax forms by mail.

In addition to providing forms, these locations also offer IRS publication materials that include instructions and advice for filling out the forms and filing taxes. State tax forms may be available from state government websites, which may also offer a paperless e-filing option for both state and federal taxes. The IRS and state tax agencies provide the forms free of cost.

You May Like: How Much Are Taxes For Doordash

If You Moved During The Year

You’ll probably have to file a part-year return instead of a nonresident return if you moved to another state during the year so you have income from two states. Many states have a separate tax form for part-year filers, but you’ll simply check a box on the regular resident return in others, indicating that you didn’t live in the state for the entire year.

A part-year resident return should be noted with “PY” on the state’s website where tax forms are made available if it offers such a return. You’ll still have to divide your income between the states.

Tax Forms For Federal And State Taxes

OVERVIEW

TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes. And the great thing is they guide you through your tax return so you don’t need to know which tax forms to file. You can also find all federal forms and state tax forms at the links below.

Don’t Miss: Tax Write Offs For Doordash

Where Can I Obtain Michigan Individual Income Tax Forms Including Estimated Tax Forms

All forms and instructions may be viewed and/or downloaded from our Web site. In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services county offices.

Fillable forms can be downloaded, printed and mailed, but not submitted electronically. View electronic filing options.

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, you’ll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

Also Check: Efstatus Taxact 2016

Where Can I Get Maine Tax Forms

Printable Maine tax forms for 2021 are available for download below on this page. These are the official PDF files published by the Maine Revenue Services, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2021 Maine tax forms.

To get started, download the forms and instructions files you need to prepare your 2021 Maine income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2021 Maine tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all Maine state tax forms at 100%, actual size, without any scaling.

| Residency Information and Income Allocation Worksheets, Instructions for Worksheet B |

Get A Copy Of A Tax Return

ALQURUMRESORT.COM” alt=”Where can i file my nys tax return for free > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”Where can i file my nys tax return for free > ALQURUMRESORT.COM”> Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Read Also: How Do You File Taxes For Doordash

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

The following information on your correspondence will help us generate a quick response to your inquiry:

How Do I Get A Copy Of My 2019 Tax Forms

How do I get a copy of my 2019 tax forms to have copies for my records and, to know what the filing status of my tax forms with state of CA and Fed? I need these documents together with the file status of them. Your help in obtaining these documents will be greatly appreciated.

Read Also: How Much Is Taxes For Doordash

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Corporate Estimated Tax Payment Voucher

- Must be filed electronically through MassTaxConnect. This paper version is for informational purposes only. See TIR 16-9 and TIR 21-9 for more information.

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Read Also: Does Doordash Send 1099

Taxes Paid To Another State

The U.S. Supreme Court ruled in 2015 that two states cannot tax the same income. New Jersey can’t tax you on income you earned in Pennsylvania if you pay tax to Pennsylvania on the income you earned there. Maryland was hit particularly hard by this decisionin fact, the suit was brought by the state of Marylandas were a handful of other states that had historically collected tax from residents who worked elsewhere.

States have since been required to provide tax credits for taxes paid to other states. You can subtract this amount from your overall taxable earnings. Be sure to take this credit on the return you file in your home state.

State Income Tax Forms

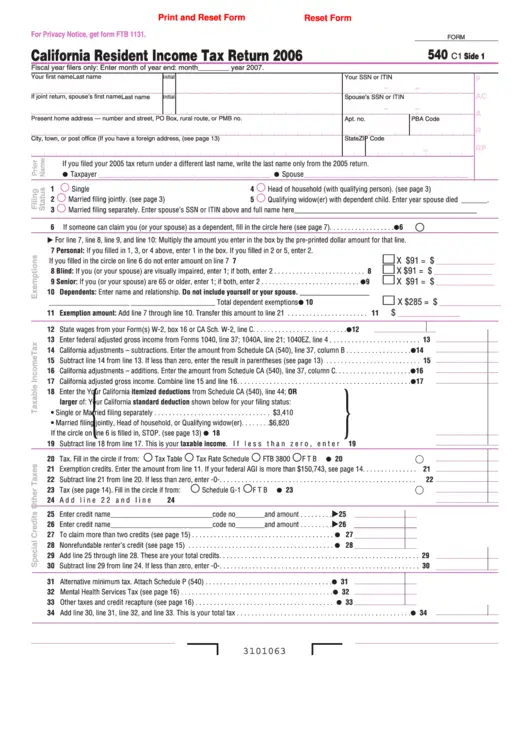

Printable 2021 state tax forms are grouped below along with their most commonly filed supporting schedules, worksheets, 2021 state tax tables, and instructions booklet for easy one page access. State income tax form preparation begins with the completion of your federal tax forms. Most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. If you have not done so already, please begin by printing your federal Form 1040EZ, Form 1040A, Form 1040-SR, or Form 1040.

Also Check: How Does Taxes Work With Doordash

Filing A Return For Mistaken Withholdings

You can report zero income for that state on your nonresident return if you’re filing a nonresident return because taxes were withheld by mistake. This might be the case if your home state and your work state have reciprocity, but you neglected to officially notify your employer that you’re exempt from taxation in your work state.

This results in zero tax liability. You’ll have a refund balance when you enter the amount mistakenly withheld from your paycheck for the nonresident state.

Personal Income Tax Forms Current Year

Due in part to the pandemic, the Delaware Division of Revenue anticipates delays in processing paper returns for the 2022 filing season. As a result, please consider filing your return electronically instead of submitting a paper return. The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

File Online FREE!No income requirements. Faster refunds.

Due in part to the pandemic, the Delaware Division of Revenue anticipates delays in processing paper returns for the 2022 filing season. As a result, please consider filing your return electronically instead of submitting a paper return. The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

2021 Fillable Forms / Instructions

Recommended Reading: Doordash Driver Tax Deductions

How To Get Forms

With the continued growth in electronic filing and to help reduce cost, the North Carolina Department of Revenue will no longer mail paper tax forms and instruction booklets with preprinted labels to individuals. If you still wish to use a paper form, the Department has several options available to help you obtain paper copies of individual income tax forms and instructions:

- To download forms from this website, go to NC Individual Income Tax Forms.

- To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week.

- You may also obtain forms from a service center or from our Order Forms page.

If you use computer software to prepare your income tax return, go to List of Approved Tax Forms of Software Developers to determine if the software being used has been approved by the Revenue Department. Computer-generated forms that cannot be processed in the same manner as the Department’s forms will be returned to you with instructions to refile on an acceptable form.

Where Can I Get Tax Forms

- Obtaining tax forms is one of the first steps in completing returns for many people. Find out where you can get tax forms and where you probably can’t.

Older adults may remember when tax forms were readily available in locations such as public libraries and post offices. The IRS also used to automatically mail forms to tax payers. But it’s not as easy to get your hands on a physical copy of these forms today. Find out where you can get tax forms below.

Recommended Reading: Do You Get A 1099 From Doordash

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Some States Have Reciprocity

Several neighboring states have entered into reciprocity agreements with each other. These agreements allow income earned in one state to be taxed in the other, eradicating the need for tax credits to compensate for these taxes. Employers would make withholdings from pay only for taxes owed to the employee’s state of residence.

The following states have reciprocity with at least one other state:

- Arizona

- West Virginia

- Wisconsin

New Jersey ended its reciprocity with Pennsylvania in January 2017, but that agreement has since been reinstated.

Read Also: Is A Raffle Ticket Tax Deductible

Guidelines For Reproduced And Substitute Paper Tax Forms

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators Secure Exchange System website. The SES website is a secure way to provide files to those that reproduce our forms.

Access to the SES website will be granted upon receipt and approval of:Form QA-1, DOTAX QA Form Testing Approval Transmittal

Printed reproduced or substitute Hawaii tax forms must adhere to certain requirements to insure they are consistent with the official forms and compatible with our processing system.

Any printed reproduced forms that have crucial inconsistencies with the official version which results in an unprocessible tax return will be returned to the taxpayer. The taxpayer will be notified that their tax return cannot be processed and the taxpayer must resubmit the tax return using an approved reproduction of the form. There is no perfection period for paper forms.

Click here to look up your Vendor ID number.

If you have any questions, please email us at

IMPORTANT! The forms posted on the SES website cannot be used or filed until they are posted on DOTAXs Tax Forms and Publications web page. Most forms will be posted on January 2, 2019.

830 Punchbowl Street, Honolulu, HI 96813-5094

M-F: 7:45 a.m. to 4:30 p.m.