What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Check Your Refund Status Online In English Or Spanish

Where’s My Refund? – One of IRS’s most popular online features-gives you information about your federal income tax refund. The tool tracks your refund’s progress through 3 stages:

You get personalized refund information based on the processing of your tax return. The tool provides the refund date as soon as the IRS processes your tax return and approves your refund.

It’s Fast! – You can start checking on the status of your return sooner – within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return.

It’s Up-to Date! – It’s updated every 24 hours – usually overnight — so you only need to check once a day. There’s no need to call IRS unless Where’s My Refund? tells you to do so.

It’s Easy! – Have your tax return handy so you can provide your social security number, filing status and the exact whole dollar amount of your refund.

It’s Available! – It’s available 24 hours a day, 7 days a week.

Find it! – Download the IRS2Go App by visiting the iTunes app store or visit Google Play or

Página Principal – ¿Dónde está mi reembolso? at IRS.gov

If you do not have internet access, call IRS’s Refund Hotline at 1-800-829-1954.

Caution: Don’t count on getting your refund by a certain date to make major purchases or pay other financial obligations. Even though the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days, it’s possible your tax return may require more review and take longer.

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

You May Like: Why Is My Tax Refund So Low

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

Living Abroad Confused About Filing Your Us Taxes Leave It To The Experts At H& r Block Expat Tax Services

For U.S. citizens abroad, expat tax rules can be a headache. Have more questions or confused on how expats file taxes? Ready to file? No matter where in the world you are, weve got a tax solution for you. Get started with our made-for-expats online expat tax services today!

Was this article helpful?

Read Also: How To Find Tax Id Number Online

How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Recommended Reading: When Do Taxes Need To Be Paid

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Check The Status Of A Refund In Just A Few Clicks Using The Wheres My Refund Tool

IRS Tax Tip 2022-26,February 16, 2022

Tracking the status of a tax refund is easy with the Where’s My Refund? tool. It’s available anytime on IRS.gov or through the IRS2Go App.

Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Recommended Reading: Does 16 Seer Ac Qualify For Tax Credit

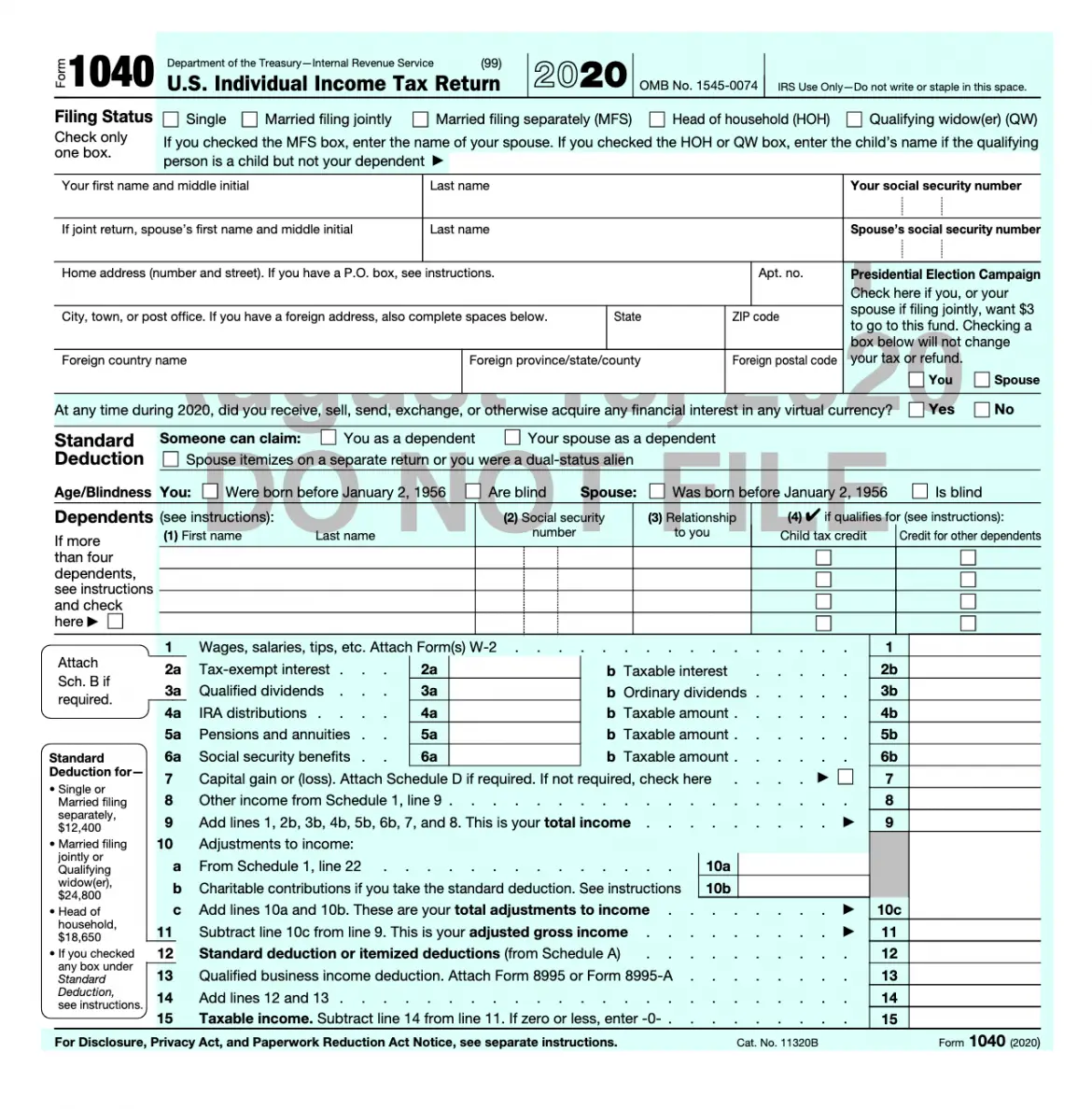

Optimizing Your Tax Bracket

At the most basic level, a person who makes more money falls into a higher tax bracket, and a person who makes less money falls into a lower one.

But your financial situation isnt only determined by income: its also affected by your lifestyle, spending, and factors like student loans. The tax system accounts for these additional factors through tax deductions and tax credits. By taking advantage of these, you may be able to fit into a lower tax bracket and reduce your tax bill. You may also be able to defer taxes, resulting in a higher tax return down the line. Some investors can also offset taxes on crypto and other investments that experience losses.

Deductions lower your taxable income. Many taxpayers choose to take the standard deduction, which is a set amount by which your taxes are reduced. This applies to most taxpayers who meet filing status criteria. However, other taxpayers, particularly those with complex assets, instead choose to calculate itemized deductions. Itemized deductions allow you to write off various specific expenses. These include charitable donations, property taxes, medical bills, and mortgage interests. Claiming these deductions is more labor-intensive than taking the standard deduction, but depending on which ones apply to you, the itemized deductions might be more effective at moving you into a lower tax bracket or maximizing your income tax return.

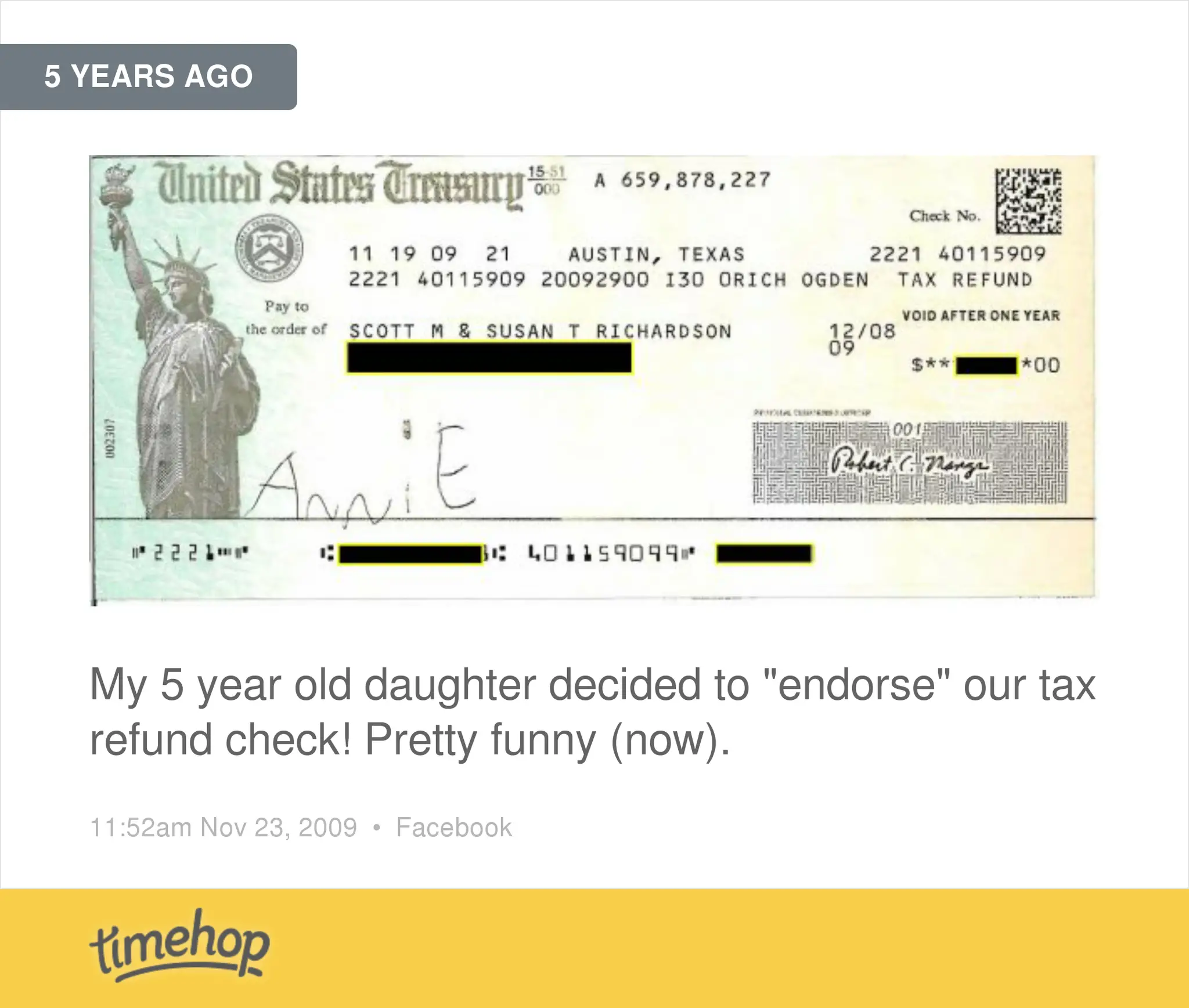

My Refund Check Is Now Six Months Old Will The Bank Still Cash The Check

A check from the NC Department of Revenue is valid up to six months after the date on the check. If a check date is older than six months, you should mail a letter along with the refund check to NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh, NC 27602-1168. Your check will be re-validated and re-mailed to you.

Also Check: How To Calculate Federal Tax

What An Accepted Tax Return Means

When you e-file a tax return, the IRS completes a basic check of your information before accepting your return. Robert Farrington, founder of The College Investor explains it like this:

“Accepting your tax return simply means that the IRS has looked at your name and Social Security number, and compared to make sure it hasn’t already been filed this year. If it passes that check, your return is allowed in for processing. That’s all ‘accepted by the IRS’ means. This process takes less than 24 hours, and usually happens within a few minutes.”

Farrington also notes that different tax software providers may have different processes for both batching and sending to the IRS, and notifying customers about when their returns are accepted.

Quick tip: If you make less than $73,000 a year, you can use IRS Free File to send in your tax return electronically at no cost.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

You May Like: How To File New Jersey State Tax Extension

Checking The Status Of A Federal Tax Return Online

Irs Tax Refund Schedule For 2020 Returns

If youre asking yourself, When will I receive my tax refund? keep this in mind: The IRS issues nine out of 10 refunds in less than 21 days, according to its website. However, this timeline only applies if you file your federal tax returns electronically. If you file through regular mail, then expect to wait around six weeks to receive your refund.

Another important thing to note: If your tax return requires additional review, you may have to wait longer to receive your refund.

You May Like: Where Can I Get Income Tax Forms

What Are Some Common Tax Forms Us Expats Need To Know About

Now that you know you have to file, you should get to know some of the common forms U.S. expats use to file their taxes.

How To Track The Progress Of Your Refund

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

Recommended Reading: Do Federal Tax Liens Expire

What Do I Do If I Havent Received My Refund

If you havent received your tax refund even though its been long enough since you filed your return, your best bet is to contact the IRS to figure out what could have happened. Here are a few possible scenarios:

For mailed refunds:

- If you moved and didnt notify the IRS, the refund check was probably mailed to your last known address and may have been returned to the IRS.

- It could have been lost or stolen.

For direct deposit refunds:

- The bank account information was incorrect.

- Youre a victim of tax return preparer fraud .

How To Diy Your Expat Taxes With Our Made

If you have a simple situation, you may want to go the DIY-route with our online tax service designed specifically for expats. Heres how to do it:

Recommended Reading: How Much Tax Should I Have Paid