Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRSWheres My Refund page. Youll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Is There Such A Thing As A Free Tax Extension

Yes, there is. If your adjusted gross income falls below the annual threshold, you can use the IRS Free File program to electronically request an automatic tax-filing extension. Higher earners can use the IRS free fillable forms, assuming they are comfortable handling their taxes. If thats not the case, there are several tax-software companies that offer free filing under certain conditions.

Don’t Miss: How To Reduce Federal Taxes

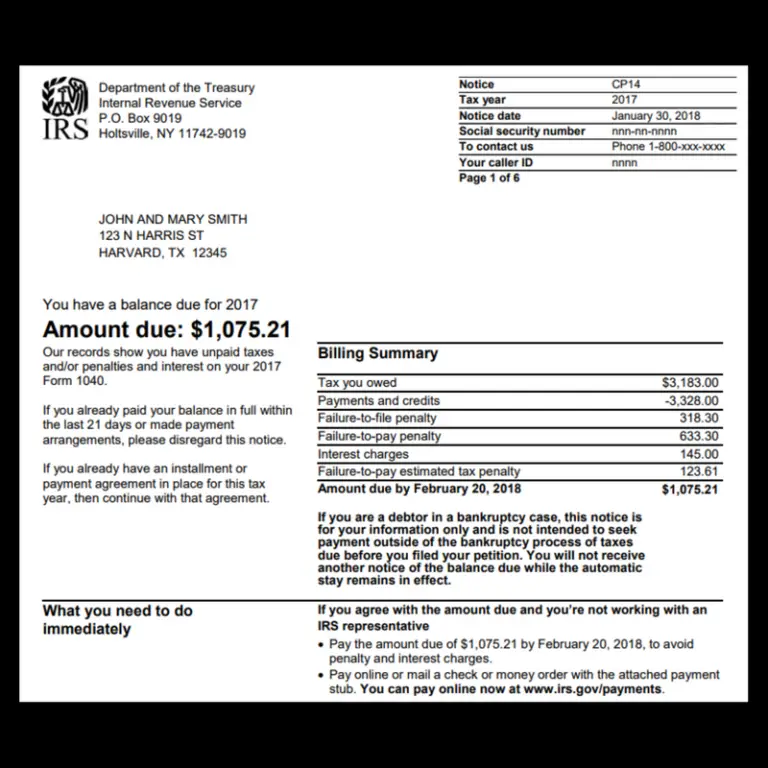

Make Irs Payments In Installments

How it works: If you cant pay your tax bill in full when its due, you can get on a payment plan with the IRS. There are two types of plans: short-term and long-term .

Cost: $0 to $225, depending on the plan you select, how you enroll and whether youre a low-income taxpayer

Pros:

-

Sign up online fairly easily on your own .

-

Most taxpayers qualify.

How To Pay Federal Estimated Taxes Online

Some individuals and business entities are required to make estimated tax payments to the IRS every quarter.

Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty.

If you want to avoid massive taxes due at the end of the year with penalties and interest, it is important to know 1.) if you need to make estimated tax payments and 2.) how much payments to make.

Also Check: Does Florida Tax Retirement Income

Paying With Your Return

From Your Bank Account Using Eftpsgov

You can schedule payments up to 365 days in advance for any tax due to the IRS when you register with the Electronic Federal Tax Payment System . As with Direct Pay, you can cancel or change payments up to two business days before the transmittal date.

EFTPS is a good choice if:

- You want to schedule all of your estimated tax payments at the same time

- Your payments are particularly large

- Payments are related to your business

The Treasury Department operates EFTPS. It doesnt charge any processing fees. It can handle any type of federal tax payment, including:

- 1040 balance due payments

- Corporate taxes

You must enroll with EFTPS, but the site saves your account information. You dont have to keep re-entering it each time you want to make a payment. Youll receive an email with a confirmation number for each transaction. EFTPS saves your payment history for up to 16 months.

You May Like: Navy Federal Internal Credit Score 100 To 450

You May Like: How To Pay My Car Taxes Online

What If I Cant Pay My Taxes

If you cant pay off your income tax bill by the time it is due, dont avoid the bill. File Form 9465, Installment Agreement Request, to set up installment payments with the IRS. You can complete the installment agreement online too. Completing the form online can reduce your installment payment user fee, which is the fee the IRS charges to set up a payment plan.

The IRS must allow you to make payments on your overdue taxes if:

- you owe $10,000 or less, or

- you prove you cant pay the amount you owe now, or

- you can pay off the tax in three years or less.

Additionally, you must agree to comply with the tax laws. You also cant have had an installment agreement with the IRS in the past five years.

Payments can be made by direct debit to your bank account, check or money order, credit card, debit card, or one of the other accepted payment methods. To be charged a lower fee, you may want to set up an online payment agreement and/or agree to make your payments by direct debit.

Extended Due Dates For Disaster Victims

Victims of certain natural disasters get more time to make estimated tax payments. This type of tax relief is typically authorized by the IRS after a disaster declaration is issued by the Federal Emergency Management Agency for a natural disaster. As a result, the deadline for making the first estimated tax payment for 2022 was pushed back to May 16, 2022, for victims of the severe storms and tornadoes in Arkansas, Illinois, Kentucky and Tennessee that began on December 10, 2021 and wildfires and straight-line winds in Colorado that began on December 30, 2021. Likewise, the deadline for the first 2022 estimated tax payment was shifted to June 15, 2022 , for victims of the severe storms, flooding and landslides in Puerto Rico that began on February 4, 2022.

For people impacted by the wildfires and straight-line winds in New Mexico that began on April 5, 2022, the first, second, and third estimated tax payment deadlines for 2022 were moved to September 30, 2022.

The second estimated tax payment deadline for 2022 was also pushed to September 1, 2022, for victims of the severe storms, tornadoes, and flooding in Oklahoma that began on May 2, 2022.

Both the second and third 2022 estimated tax payments were shifted to October 17, 2022, for taxpayers impacted by the severe storms and flooding in Montana that started on June 10, 2022.

Also Check: How To Figure Out Tax Percentage

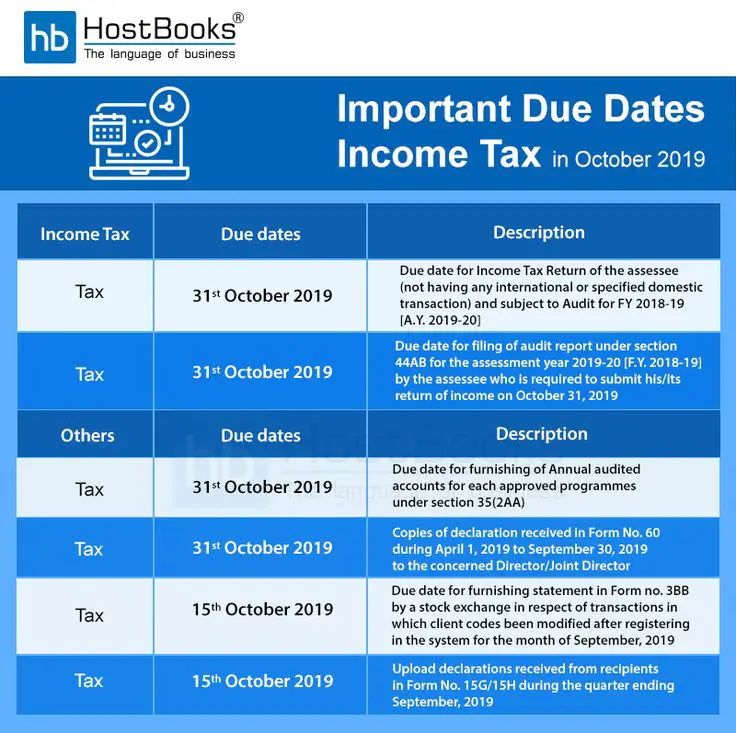

Every Tax Deadline You Need To Know

OVERVIEW

Make sure your calendars up-to-date with these tax deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2023.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

|

Key Takeaways Individual income tax returns are typically due April 15, unless the date falls on a weekend or holiday or you file Form 4868 seeking an extension until October 15. Independent contractors, gig workers, and self-employed people usually have to make quarterly estimated tax payments are pre-set dates throughout the year. Partnerships and S-Corps filing deadlines are typically either March 15 unless they operate on a fiscal year. A six-month extension to September 15 can be requested using Form 7004. |

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Don’t Miss: Do You Have To Pay Back Unemployment On Taxes

When And Where To File

If you are an employee and you receive wages subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040-NR at the address shown in the instructions for Form 1040-NR.

Most Federal Tax Returns Are Due People Who Cant Pay Should Still File On Time

IRS Tax Tip 2022-59, April 18, 2022

The filing and payment deadline for most 2021 federal tax returns has arrived. Taxpayers should file or request an extension of time to file and pay any taxes they owe by the April 18, 2022, deadline to avoid penalties and interest. Taxpayers in Maine and Massachusetts have until April 19, 2022, to pay to file their returns due to the Patriots’ Day holiday in those states.

Here are some tips for taxpayers who owe tax, but who can’t immediately pay their tax bill.

Taxpayers should:

- File their tax return or request an extension of time to file by the deadline.

- People who owe tax and do not file their return on time or request an extension may face a failure-to-file penalty.

- Taxpayers should remember that an extension of time to file is not an extension of time to pay.

- An extension gives taxpayers until October 17, 2022, to file their 2021 tax return, but taxes owed are still due the April deadline.

Recommended Reading: What Is The Difference Between Estate Tax And Inheritance Tax

The Electronic Federal Tax Payment System

The Electronic Federal Tax Payment System is a web service operated by the U.S. Treasury Department for processing federal tax payments. You must set up a profile account with your bank account information and wait to receive credentials in the mail, so it’s not an option if you’re right up against the payment deadline.

But once you’re set up, the site saves your account information, so you don’t have to keep re-entering it every time you make a payment. For this reason, EFTPS is particularly good for people who need to pay quarterly estimated taxes, such as those who are self-employed.

You can schedule a payment in advance. It will automatically be withdrawn from your bank account on the date you designate.

What About The Current Payment Freeze

The current freeze/deferment on loan payments was scheduled to end on December 31, 2022, until it was extended once again in response to the delays implementing the one time debt relief. Per the Biden-Harris Administration, Payments will resume 60 days after the Department is permitted to implement the program or the litigation is resolved. If the program has not been implemented and the litigation has not been resolved by June 30, 2023 payments will resume 60 days after that.

Have you thought about how youre going to handle your student loan payments when the payment freeze ends next year? Many people have gotten out of the habit of budgeting for this expense. Its important to make sure youre on the right repayment plan for your income and loans. We provide confidential and secure student loan counseling, available online and over the phone. Best of all, student loan counseling is free through March 31, 2023. Start today!

Also Check: Returned Check Fee Navy Federal

Don’t Miss: Can I File Past Years Taxes Online

Millions Of Payments Still Pending

Per the Orange County Register, the Franchise Tax Board said that as of Nov. 7, it still needed to distribute 18 million payments between then and mid-January 2023.

So, if you havent received your refund yet, its on its way. An updated schedule is posted on the FTB site, with payment issue dates dependent upon recipients last names and whether a resident previously received a Golden State Stimulus I and II check or not.

To be eligible for the California Middle Class Tax Refund, you:

-

Filed your 2020 tax return by October 15, 2021.

-

Meet the California adjusted gross income limits described on the Middle Class Tax Refund page.

-

Were not eligible to be claimed as a dependent in the 2020 tax year.

-

Were a California resident for six months or more of the 2020 tax year.

-

Are a California resident on the date the payment is issued.

The MCTR is based on 2020 state income tax returns, filing status and dependents. If you arent sure how much you will be receiving, you can use the estimate tool on the FTB site.

Pay As Quickly As Possible

If you owe tax that may be subject to penalties and interest, dont wait until the filing deadline to file your return.

Send an estimated tax payment or file early and pay as much tax as you can.

Even if you choose to file an extension, any taxes owed are still due on the filing deadline. Therefore if you dont pay by April 17, you are subject to those extra penalties and fees.

You May Like: Do You Pay Taxes On Cash Out Refinance

How Do I File Online

There are several ways to file online, depending on your income and your comfort level in dealing with the whole income tax process.

If your adjusted gross income was $72,000 or under, you can use the IRS Free File option. The site offers a number of third-party services that can help you put together and file your taxes free of charge. Of course, that is assuming the third party doesnt try to scam you into paying more than you have to back in April of 2019, ProPublica revealed that TurboTax and other suppliers were deliberately hiding the pages for their free services in order to convince taxpayers to purchase additional features. As a result, in early 2020, the IRS published rules prohibiting these practices. Still, it pays to be careful.

Free File is available for those whose income is $72,000 or under.

If your income is above $72,000, you can still use fillable forms provided by IRS Free File, but you dont get the support of the free software, and you cant do your state taxes through this method. The forms will be available starting on January 25th.

If youre not a pro at filling out taxes, youre going to either have to use e-file with one of the available software solutions or find a tax preparer who can do it for you. In the case of the latter, the person or company who does your taxes needs to be authorized to use e-file if you dont already have a tax professional, you can find one at the IRS site.