Washington Retail Sales Tax

If you sell physical products or certain types of services, you may need to collect retail sales tax and then pay it to the Washington’s Department of Revenue. Washington retail sales tax is collected at the point of purchase. The listed retail sales tax rate for Washington is 6.5%, but could vary depending on the region, county or city where you’re located.

You’ll typically need to collect Washington retail sales tax on:

- Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc.

- Certain services your business might provide

Most states do not levy sales tax on goods that are considered necessities, like food, medications, clothing or gas. Check with the Department of Revenue to confirm whether your business is required to collect Washington retail sales tax.

Washington State Use Tax

Use tax applies when sales tax hasn’t been paid is what the Washington State Department of Licensing tells us. So, when you purchase a vehicle from a private party, you are required to pay use tax when said vehicle is transferred to you.

Sales Tax Handbook states that if the vehicle’s purchase price is not in line with its true value, the value is calculated as close as possible to the selling price of similar vehicles. The total amount of collected use tax is determined based on the vehicle’s fair market value.

If you believe that a vehicle is worth less than the average fair market value and you purchased the vehicle for well below this amount, you can use an affidavit or a verified appraisal from the seller. By doing so, you can get the vehicle’s market value lowered.

If you are in the military and on active duty, you could be automatically exempt from paying any use tax when you purchase a vehicle.

Washington State Spirits Tax

There are two taxes on spirits in Washington. The first is a sales tax of 20.5% for retail sales and 13.7% for sales made in restaurants and bars. The second is a volume tax, called the spirits liter tax, which is equal to $3.7708 per liter or $2.4408 per liter . Those taxes combined give Washington one of the highest liquor taxes in the country.

Recommended Reading: How Much Is Sales Tax In Wisconsin

Washington Sales Tax Rates By City

The state sales tax rate in Washington is 6.500%. With local taxes, the total sales tax rate is between 7.000% and 10.500%.

Washington has recent rate changes .

Select the Washington city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Washington was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Personal And Real Property Taxes

Property tax was the first tax levied in the state of Washington and its collection accounts for about 30% of Washingtons total state and local revenue. It continues to be the most important revenue source for public schools, fire protection, libraries, parks and recreation, and other special-purpose districts.

Property tax is administered by local governments. County assessors value and assess the tax, and county treasurers collect it. For questions about paying your property tax or your property valuation, please contact your local county officials.

State law requires assessors to appraise property at 100% of its true and fair market value in money, according to the highest and best use of the property. All real and personal property is subject to tax unless specifically exempted by law.

Details on the property tax system can be found in the homeowners guide.

Real property tax deferrals and exemptions are allowed for senior citizens and disabled taxpayers.

Personal property is also taxed, although most personal property owned by individuals is exempt. Personal property tax applies to personal property used when conducting business or to other personal property not exempt by law.

Don’t Miss: How Long Can You Wait To File Taxes

Washington State Income Taxes

There are no income taxes in Washington State. While the idea to enact an income tax has been floated in the state legislature and at the ballot box over the years, none of the proposed measures have passed. This means that once youve finished your federal tax return, youre done with your taxes for the year.

Tax Policy In Washington

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Washington |

| Total state expenditures State debt Washington state budget and finances |

Washington generates the bulk of its tax revenue by levying a general state sales tax and select sales taxes . The state derives its constitutional authority to tax from Article VII of the state constitution.

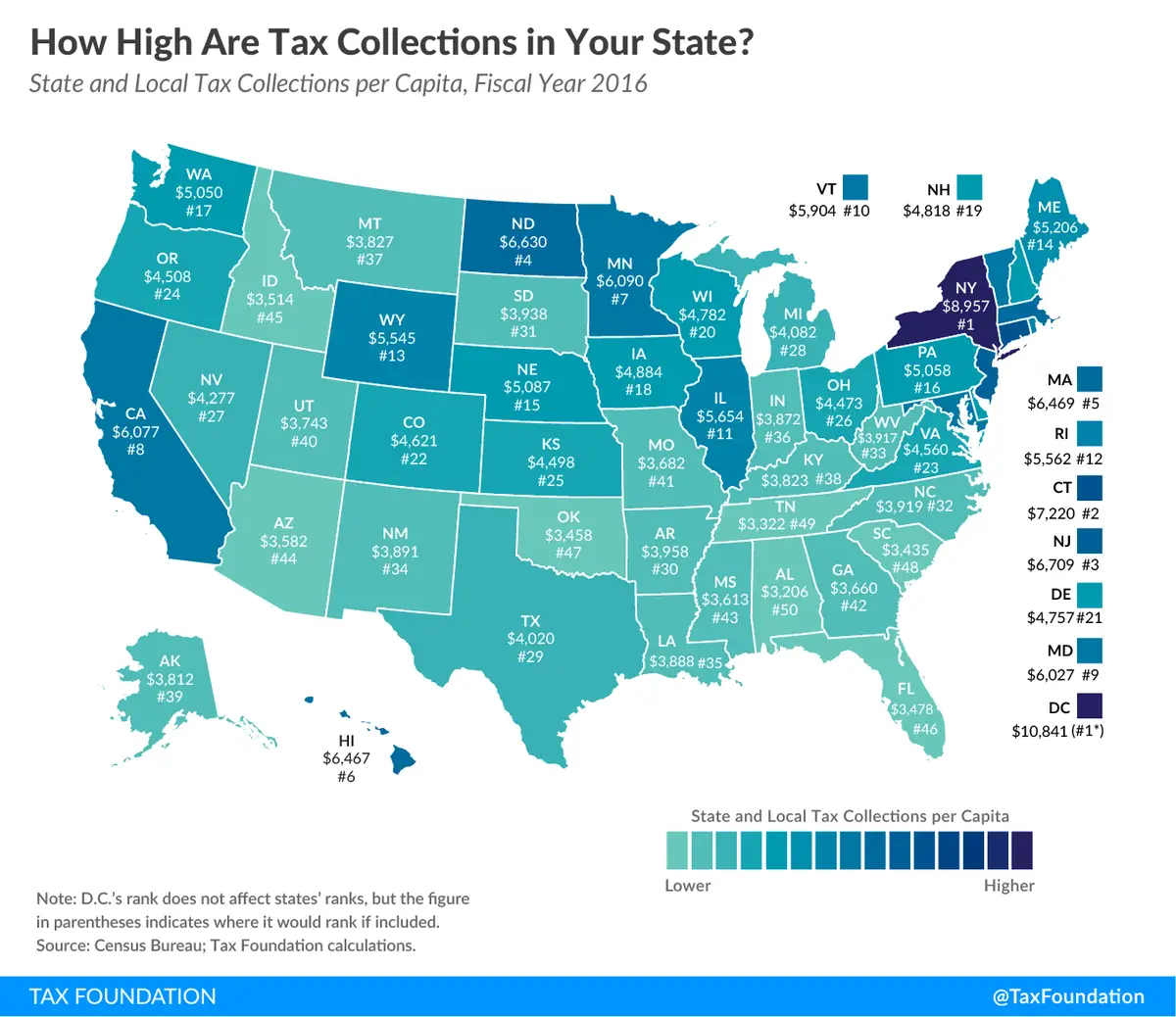

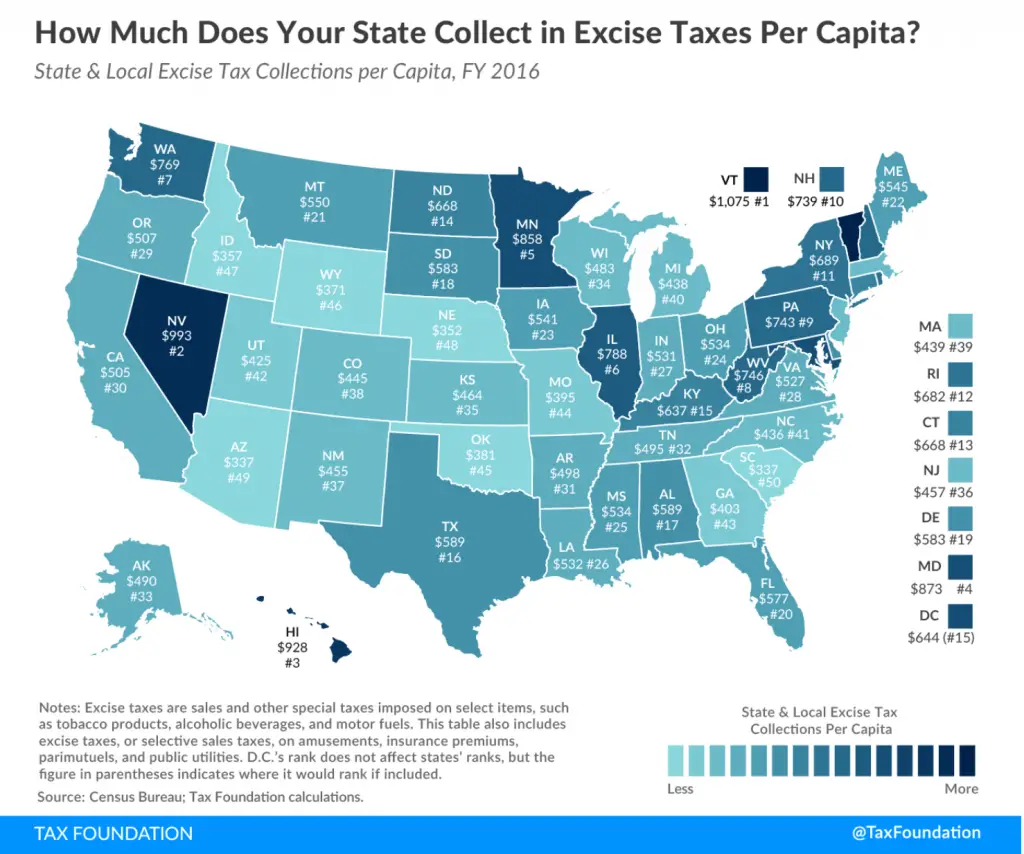

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Don’t Miss: What Are The 2020 Income Tax Brackets

Spokane Washington Sales Tax Rate

spokane Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Spokane, Washington?

The minimum combined 2022 sales tax rate for Spokane, Washington is . This is the total of state, county and city sales tax rates. The Washington sales tax rate is currently %. The County sales tax rate is %. The Spokane sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Washington?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Washington, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Spokane?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Spokane. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Wa Dor Issues Proposed Rule On Marketplace Facilitator Requirements

The State of Washington has imposed sales tax reporting and collection obligations on marketplace facilitators since October 1, 2018. The Washington DOR recently issued a draft, proposed regulation explaining marketplace facilitators tax collection and reporting requirements. It also includes guidance on sales information provided to marketplace sellers, liability relief, and audits. A public hearing on the draft regulation is scheduled to be held virtually on April 28, 2021. The DOR is also accepting written comments. The intended date of adopting the proposed regulation is May 24, 2021. See the draft proposed rule for additional details.

Read Also: How Much Taxes Deducted From Paycheck Mn

What Is The Washington Corporate Net Income Tax Rate

Washington charges a gross income tax of 1.8% on your revenue after your first $35,000 of gross receipts. Washington calls this a business and occupations tax, or better known in the state as a B & O tax. This is tracked by your Washington state UBI number .

There are basically no deductions. Washington state will deduct the money you made in another state and paid taxes for there, which can make it a very attractive state to own a national company in.

Wa Capital Gains Tax To Take Effect Jan 2022

In early 2021, Washington passed a 7% tax on sale or exchange of long-term capital assets such as stocks, bonds, other investments, and tangible assets if profits exceed $250,000 annually. The tax applies only to individuals and can be liable for tax due to their ownership interest within an entity that sells capital assets. This only applies to gains allocated to Washington and takes effect on January 1, 2022 and the first payment due is on or before April 18, 2023. A few exemptions include real estate, assets held in retirement accounts, and assets used in trade. Deductions that apply are the standard deduction for $250,000 per individual, married or domestic partnership, long term capital gain, and charitable donations more than the $250,000 per year.

Read Also: How To File 2016 Taxes

Wa Adopts Marketplace Facilitator Rule For Sales Tax Purposes

Effective July 2, 2021, the Washington Department of Revenue has adopted Wash. Admin. Code§458-20-282, to provide guidance on the taxation of marketplace facilitators. The rule provides applicable definitions, examples of persons who are considered marketplace facilitators and discusses the tax collection responsibilities of facilitators. Liability relief, the provision of information to marketplace facilitators and audits are also discussed. For more information, please visit the Washington Department of Revenue website.

May 13, 2021

Wa State Governor Signs Into Law Capital Gains Tax

On May 4, 2021, a new law in Washington State was enacted that will institute a Capital Gains tax from the sale or exchange of stocks, bonds, and other assets. This new tax levy is effective beginning January 1, 2022.

A single tax rate of 7% would apply to all levels of such income that exceed the standard deduction of $250,000. The standard deduction of $250,000 is available for each individual and married couple, and spouses who file joint returns for federal purposes are required file the same for purposes of the Washington Capital Gains tax. There are some limited exceptions to the tax, which includes real estate, as well as interests in certain qualifying entities owning real estate. Also, a credit would be allowed against taxes due under the Washington Business and Occupation tax if such transaction is subject to both tax regimes.

The tax not only applies to individuals who are considered domiciled tax residents, but also to individual owners of pass-through entities in which capital gains are allocated. The states Department of Revenue estimates the tax would apply to about 7,000 state residents a year and would raise about $445 million starting in fiscal year 2023. The new legislation is expected to face stiff legal challenges as the state constitution prohibits a graduated tax on income. Governor Inslee reportedly said, Yes, I am confident that it is constitutional.

Takeaway

Recommended Reading: How Do I Report Tax Evasion

Washington State Vehicle Sales Tax On Car Purchases

According to the Sales Tax Handbook, a 6.5 percent sales tax rate is collected by Washington State. On top of that is a 0.3 percent lease/vehicle sales tax. This means that in total, the state tax on the lease or purchase of a vehicle adds up to 6.8 percent.

Cities and counties in Washington State collect sales taxes on vehicle leases and purchases, so the sales tax you pay includes the local sales tax rate of any where from 0.5 percent to 3.5 percent , depending on where you reside. Local governments in Washington State are also permitted to collect a local option sales tax of up to 4 percent.

Northwest Chevrolet explains that the vehicle sales tax for several of the major cities in Washington State is as follows:

- Fife sales tax: 10.2 percent

- Tacoma sales tax: 10.4 percent

- Olympia sales tax: 9.0 percent

- Puyallup sales tax: 10.2 percent

Washington Sales Tax Rates

Washington sales tax rates vary by location. There is a state sales tax as well as various local rates.

Washington Sales Tax Rate: 6.5%Maximum rate for local municipalities: 10.6%

Washington is one of the more complicated states for determining sales tax. This is due to the way Washington defines tax boundaries and the multiple rates within the state. In addition to the 6.5% state sales tax, there is also a county tax in most counties and some municipal sales taxes. Washington uses destination-based sourcing rules, meaning that for orders shipped to a customers home, the rate is determined by the customers address.

Don’t Miss: Which Tax Return Did You Have From Last Year

Do Washington Vehicle Taxes Apply To Rebates And Trade

With many dealerships, you can trade-in your old car and receive a credit that will be applied to your new chosen vehicle. If you trade-in your old vehicle and receive a $5,000 credit on a $10,000 vehicle, you’ll only end up paying $5,000 for the new car. In Washington State, the taxable price of the new vehicle would only be $5,000 because your trade-in’s original value is not subject to sales tax.

Often, manufacturer rebates or cash incentives are offered on vehicles as a way to encourage sales. However, Washington applies its vehicle taxes before the rebates or incentives, so taxes will be paid on a vehicle as if it costs the full, original price.

Update To Pandemic Relief Loans In Washington

The State of Washington is exempting the value of pandemic relief loans or grants received by businesses since February 29, 2020 from the business and occupation tax, public utility tax, and sales and use tax. Federal Paycheck Protection Program loans and Economic Injury Disaster Loans are among the types of assistance that qualify for the exemption if the loans are forgiven.

Recommended Reading: What If I Am Late With My Tax Return

Overview Of Washington Taxes

Washington has no personal income tax. The state has some of the highest sales taxes in the country, though. Washington property taxes rank in the middle when compared to other states.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

No Income Tax In Washington State

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation and/or public utility tax. The businesss gross receipts determine the amount of tax they are required to pay. Businesses that make retail sales or provide retail services may be required to collect and submit retail sales tax .

Also Check: What Is New York State Sales Tax Rate

Washington Rejects Taxpayers Appeal On How To Source Credit Card Services

On April 12, 2022, the Administrative Review and Hearings Division of the Washington Department of Revenue held that Callahan, T.R.O.s sales are apportioned to the state for purposes of the Business and Occupation Tax when the end users respective billing addresses are in the state. In the instant case, Callahan, T.R.O. sells services to credit card issuers.Some of the issuers individual customers have a billing address in Washington. On audit, the Department of Revenue determined that the cardholders location should be where the benefit of the taxpayers services was received. This determination was upheld by the Departments Administrative Review and Hearings Division.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Read Also: How To Keep Track Of Miles For Taxes

Do Washington Residents Pay State Taxes

Seven U.S. states forgo individual income taxes as of 2018: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Residents of New Hampshire and Tennessee are also spared from handing over an extra chunk of their paycheck, though they do pay tax on dividends and income from investments.

How You Can Affect Your Washington Paycheck

While you dont have to worry about paying state or local income taxes in Washington, theres no escaping federal income tax. However, there are certain steps you may be able to take to reduce the taxes coming out of your paychecks.

The simplest way to change the size of your paycheck is to adjust your withholding. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year. You can also specify a dollar amount for your employer to withhold. There is a line on the W-4 that allows you to specify how much you want withheld. Use the paycheck calculator to figure out how much to put.

Another thing you can do is put more of your salary in accounts like a 401, HSA or FSA. If you contribute more money to accounts like these, your take-home pay will be less but you may still save on taxes. These accounts take pre-tax money, which means the money comes out of your paycheck before income taxes are removed. This reduces your taxable income. Payments you make for most employer-sponsored health and life insurance plans also pre-tax.

With no state or local income taxes, you might have an easier time saving up for a down payment for a home in Washington. If youre looking to make the move, take a look at our guide to Washington mortgage rates and getting a mortgage in Washington.

Recommended Reading: What Is The Date To Pay Taxes