Benefits Of Filing Past Years Income Tax Returns

There are a number of benefits that come with filing tax returns for the previous years:

- Loans Individuals who have filed their returns for past years will find it easier to get their loans approved by banks and financial institutions. The loan process becomes faster and less complicated.

- Proof Filing past years tax returns also act as a proof of an individuals income. Tax returns are valid documents that can be submitted whenever there is a requirement to validate an individuals income.

- Investments Individuals who have filed their tax returns for past years will also find it easier to make investments or conduct stock or share trading, since financial institutions look favourably on individuals who have their returns in order.

- Refunds In case an individual has been taxed beyond what his or her taxable liability is for the previous years, that individual can claim for a refund on the excess tax that he or she has paid for the past years.

- Travel Individuals who have filed their tax returns will also find it easier to obtain visas to travel abroad. Tax returns serve as a proof of financial abidance, which is a mandatory check when it comes to applying for a visa.

Recommended Reading: Do You Claim Plasma Donation On Taxes

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

How To Get Copies Of Tax Returns

Even though tax transcripts are free of charge and can be delivered much more quickly than copies of your tax return, there may be times when youll want the full return rather than just the transcript. While lenders will accept the transcript, you may prefer having a full copy of your previous returns for your own records.

- If so, you can request a copy of your tax return using IRS Form 4506, Request for a Copy of Tax Return.

- You can obtain copies of your tax returns for the current year and up to the six previous years. However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested.

- If youre filing the request by mail and plan to send a check, youll need to make your check payable to the United States Treasury. However, if youre impacted by a federally declared disaster, the IRS will waive the fee if the copies are needed to apply for disaster relief benefits or to file amended returns claiming disaster-related losses.

- For jointly filed returns, either spouse can request a copy. The signature for only the requesting spouse will be required on Form 4506.

- Heres a major reason why you should request tax transcripts, rather than copies of tax returns, if you can possibly avoid it: It can take the IRS, up to 75 days to provide copies of tax returns.

- If you need your tax information in less time, transcripts will arrive in only a fraction of the time.

Don’t Miss: What Percentage Of My Income Goes To Taxes

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

Q5 How Do I Request A Transcript For An Older Tax Year When It’s Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a “show all +” expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. To get older tax account transcripts, submit Form 4506-T.

Recommended Reading: How Do I Estimate Taxes For Self Employment

Q3 How Long Must I Wait Before A Transcript Is Available For My Current Year Tax Return

If you filed your tax return electronically, IRS’s return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks. If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call . Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return. The time frame for delivery is the same for all available tax years.

Q2 Can I Request A Transcript If I Filed Jointly With My Spouse And My Name And Ssn Was Listed Second On Our Tax Return

Yes, a secondary taxpayer may request any transcript type that is available.

Please note, only the account and the tax return transcript types are available using Get Transcript by Mail. Use Form 4506-T, Request for Transcript of Tax Return, if you need a different transcript type and can’t use Get Transcript Online.

Don’t Miss: Did The Tax Deadline Get Extended

Turbotax For Previous Years

If you filed tax returns with Turbotax, those returns are stored in your account. You must use the same account that you used during the filing process, according to the Turbotax community. Its not uncommon to create a new account in the new tax year, and this practice separates your returns across multiple accounts. Search through your email to find your Turbotax account setup and reset your password if necessary to log in.

Once you access the account used to file previous returns, Turbotax recommends selecting the Documents option on the left menu. The selection is located immediately below the Tax Home label. Next, access the drop-down menu to select the desired tax year for the return you want to retrieve. This menu only shows the years you filed returns through Turbotax.

At this point, you can open the file to view it in PDF form, or you can download or print it directly from the screen.

Also Check: Where Do I File My Illinois Tax Return

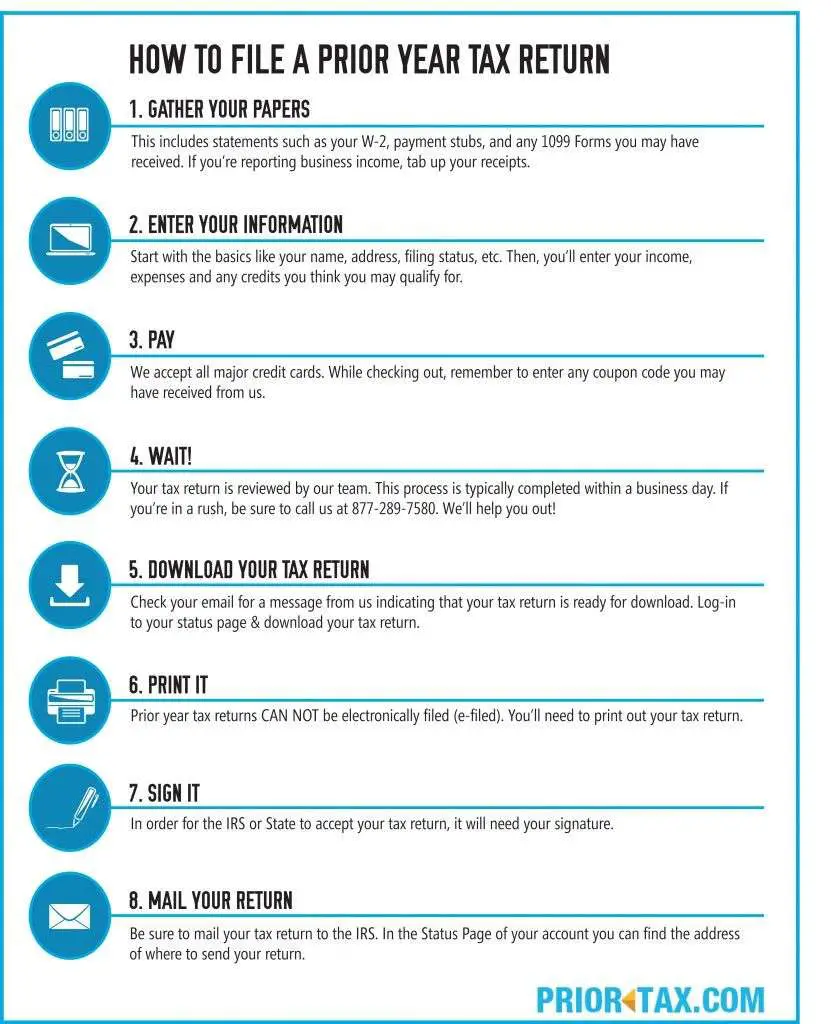

Complete The Right Tax Forms

IRS forms change from year to year, so you need to make sure you use the forms for the tax year you need to file. If you use online tax software to file a return, make sure you select the correct year in the software.

If youâre filing without the help of software, you can and instructions for completing those forms at IRS.gov.

You can also work with a professional tax preparer if you donât feel comfortable filling out the forms on your own.

You May Like: Will Student Loans Take My Tax Refund 2020

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didnt file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

If You Want To File A Petition With The Us Tax Court

- 400 Second Street, NWWashington, DC 20217

- You have 90 calendar days from the date of your CP3219N to file a petition with the Tax Court. The last day to file a petition is stated in your CP3219N. If the CP3219N is addressed to a person who is outside of the United States, the deadline to file a petition with the Tax Court is extended to 150 days from the date of the CP3219N.

- If you file a petition, attach an entire copy of the CP3219N to the petition.

- The Tax Court has simplified procedures for taxpayers whose amount in dispute, including applicable penalties, is $50,000 or less per tax year. You can find these simplified small tax case procedures from the U.S. Tax Court.

Recommended Reading: How To Take Taxes Out

Keeping Tabs On Your Old Tax Returns May Not Be Your Top Concern In Life Until A Situation Comes Up When You Need Them

For example, if you apply for a mortgage or student loan, you typically have to disclose your income but lenders wont always just take your word for how much you earn. Thats where your official tax records come in. They can serve as proof of your income when applying not only for loans but for things like rental housing, government benefits or other kinds of financial aid.

If you dont have a copy of your tax return on hand when you need it, no problem! You can use a few different methods to get your past tax information.

The first big question: Do you need a full copy of your tax return, or can you get by with a transcript?

Q4 Can I Use Get Transcript If Im A Victim Of Identity Theft

Yes, you can still access Get Transcript Online or by Mail. If were unable to process your request due to identity theft, youll receive an online message, or a letter if using the Mail option, that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

Read Also: How Can I Pay Taxes I Owe

Request Online With Masstaxconnect

This request requires that you log into MassTaxConnect.Please note:

- If you are not already a registered MassTaxConnect user, you will need to create a MassTaxConnect username and password by visiting MassTaxConnect and selecting “Create My Username”.

- Your request for a copy of a previously filed personal income tax return may take several days to process.

If You Need To Change Your Return

You can make a change to your tax return after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2022 for the 2019 to 2020 tax year

- 31 January 2023 for the 2020 to 2021 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Don’t Miss: How To File S Corp Taxes

Obtaining Copies Of Previously Filed Tax Returns

Individuals

To get a copy or transcript of your tax return, complete Form DCC-1 and send it to:

New Jersey Division of TaxationDocument Control CenterPO Box 269 Trenton, NJ 08695-0269

You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. We will only release the tax return to the person who signed the return or to an authorized representative. An authorized representative must provide a Form M-5008-R that covers the return being requested. To pick up a copy/transcript of your return you must provide a photo ID . If you are not the person who signed the return , we wont be able to provide you with a copy. However, we can process your request and will send copies to the individual who signed the return at the address on file with the Division of Taxation.

Businesses

Any return filed through the On-line Services Filing and Payment Services can be obtained by logging on with your Business Identification Number and assigned PIN number.

Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

New Jersey Division of TaxationDocument Control Center

Can I File 2012 Taxes On Turbotax

TurboTax 2012 is Up to Date: You Can Start Your Taxes Today! The TurboTax Blog.

Can I do my 2014 taxes on TurboTax?

Now Accepted: You Can File Your 2014 Tax Return with TurboTax Today! TurboTax is accepting tax returns today so that you can get closer to your maximum tax refund. Last tax season about 75% of taxpayers received a tax refund close to $3,000.

Can I still file 2019 taxes on TurboTax?

Yes, with the 2019 TurboTax CD/Download software which is available at our past-years taxes page. TurboTax Online and the mobile app can no longer be used to prepare or file 2019 returns.

Read Also: What Is My Income Tax Rate

Q4 What If I Cant Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at 800-908-9946 to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Also Check: How Can I Pay My Taxes Owed

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Read Also: How To Retrieve 1040 Tax Return

How To File Taxes For A Previous Year

Few business owners enjoy dealing with taxes. Tax law is complex, and you might think the time spent managing taxes could be better spent growing the business and making money. So itâs not hard to understand how some administrative tasks, like keeping up with bookkeeping and filing tax returns, get bumped to the sidelines.

Also Check: Can I File 2016 Taxes

Read Also: How To Pay Delinquent Property Taxes

Filing Prior Year Tax Returns

For most individuals, filing an annual tax return is a requirement. If a taxpayer misses their filing date or is unable to pay the taxes they owe at the time, which they are due, they should still file and/or pay, even if they are several years late.

The IRS is able to criminally prosecute taxpayers who do not file a return. This action must be taken within six years from the date at which the tax return was required to have been filed.

It is important to note, that the IRS may be able to collect tax that is past due and is greater than six years, although the law may limit the ability to collect this as time passes.

Taxpayers can file a tax return as far back as needed, but refunds can only be claimed within three years of when the original return was due. The same is true for . Consequently, if you delay filing your taxes too long, you may not be entitled to credits or refunds.

Filing Older Tax Returns Taxpayers file prior year returns in much the same way that they file timely tax returns. Sometimes, however, gathering the necessary information can be difficult. You can request a tax transcript from the IRS to get prior year tax return information, and you can contact former employers to ask for prior wage information. Generally, employers keep such records for at least three years after the wages were earned, but occasionally some employers maintain records longer.

You May Like: How To Find Tax Refund From Last Year