Learning About The Exceptions

Do you pay capital gains when you sell a house? A popular capital gains tax exception is the personal residence exemption. If you cover a set of requirements that make you eligible for this exemption, you can make up to a certain amount from selling your home without having to pay any tax on the sale. The amounts that you can receive from the sale in order to qualify are up to $250,000 if you are registered as a single taxpayer or up to $500,000 if you pay taxes as a married couple or a joint filer.

Another requirement to be able to use this exemption is to have proof that the property being sold has been used as a home by you and has been your primary residence for no less than two years over the past five. Furthermore, you are not allowed to use this exemption numerous times but you can be partially exempt, depending on the situation.

There are other ways to avoid capital gains tax, including a like-kind exchange, in which you exchange one property for another. However, this option does not always exclude tax gains completely but rather delays the payment.

Information About Texas As A Business Location

One thing about Texas that continues steadily is its popularity as a location to conduct business. The figures for the state’s unemployment and the growth of its job market attests to its desirability as a state for business opportunities. The unemployment rate as of 2015 showed a rate of 4.1 percent, which was one percentage point lower than the national unemployment rate.

Several reasons promote Texas as a favorable state for businesses. These include:

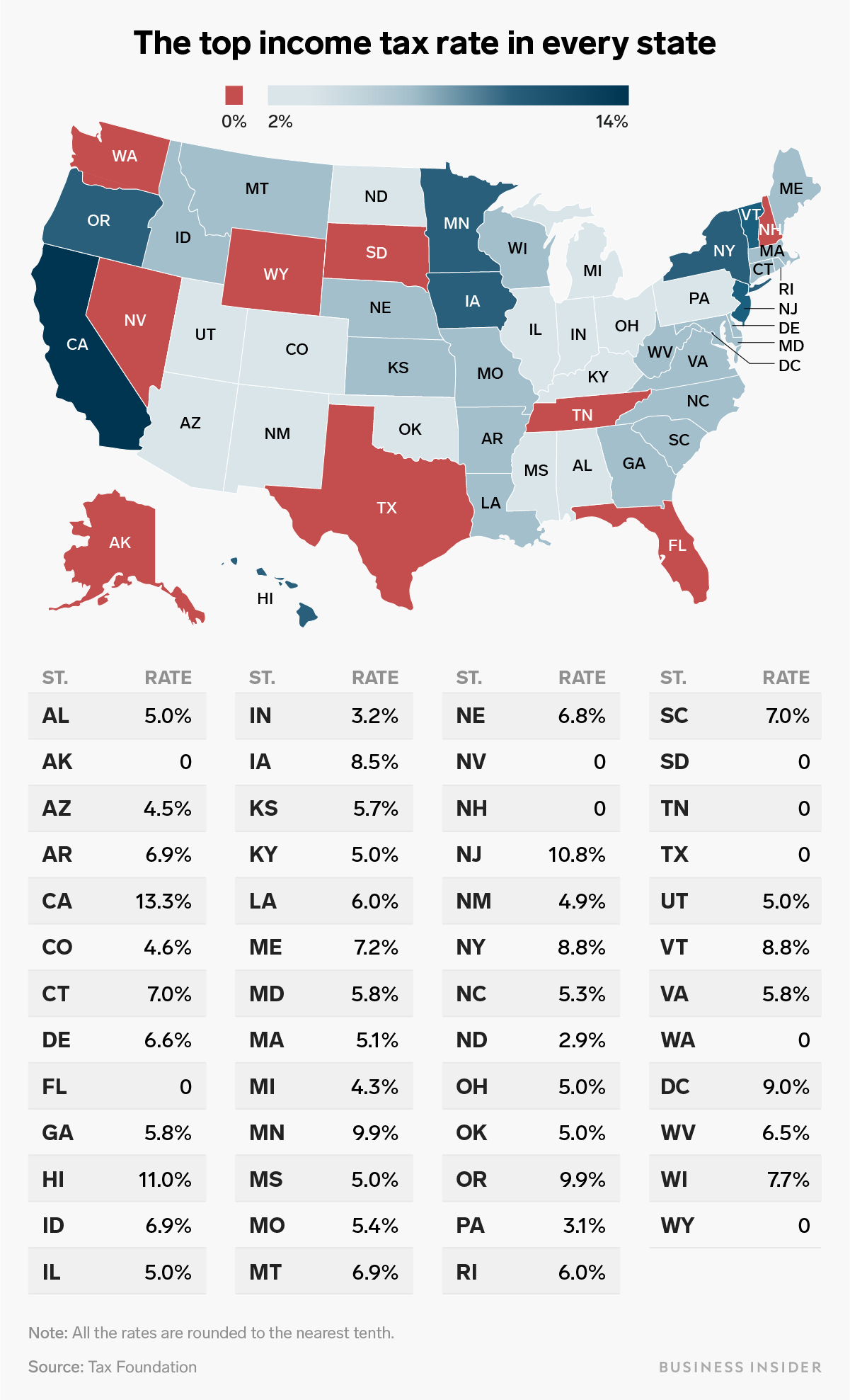

- A positive tax climate.

- Texas has low business taxes, and personal income is nonexistent.

- Businesses can keep more of the company’s profits due to low taxes, and businesses can use personal income taxes as an incentive when hiring new employees.

- In some cases when the revenues of a business do not exceed certain thresholds, the tax rate drops to zero.

- Small businesses just starting out have an opportunity to flourish and grow in the Texas tax climate.

What Is Taxable In Texas

Tangible personal property sold within the state of Texas is subject to sales tax.

In addition, certain services are also taxable. At the time of this writing, these services are:

- Amusement Services

- Cable And Satellite Television Services

- Motor Vehicle Parking And Storage Services

- Nonresidential Real Property Repair, Restoration Or Remodeling Services

- Personal Property Maintenance, Remodeling Or Repair Services

- Personal Services

You May Like: Doordash State Id Number For Unemployment California

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas’ taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

Reason Number Two Property Values Are On The Increase

How Are Property Taxes Calculated in Texas in Relation to Property Values?

Property tax is determined as a percentage of your homes value, so the more your home increases in value, the higher your property tax bill. For example, a home in Austin that is appraised at a value of $250,000 will pay around $4,933 per year. If this same homes value increases to $275,000, the annual property tax bill will increase to $5,426. This is great for selling your home but is a substantial increase in annual taxation if youre not. If you do find that your home has been overvalued, you can lodge a formal protest to have the property re-evaluated.

You May Like: Taxes On Doordash

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Missouri sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

Recommended Reading: Do They Take Taxes Out Of Doordash

What Is A Franchise Tax Account

A franchise tax is a levy paid by certain enterprises that want to do business in some states. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some limited liability corporations. Franchise taxes are paid in addition to federal and state income taxes.

How To Claim Texas Lottery Payouts

There are multiple ways that winnings can be collected.

Prizes of $599 or lesscan be claimed:

- At any Texas Lottery retailer

- At any local claim center

- At the Texas Lottery headquarters in Austin

Prizes of between $600 and $2.5 millioncan be claimed:

- At any local claim center

- At the Texas Lottery headquarters in Austin

Prizes of between $2.5 million and $5 millioncan be claimed:

- At the Dallas, Fort Worth, Houston and San Antonio claim centers

- At the Texas Lottery headquarters in Austin

Prizes of over $5 millioncan only be claimed at the Texas Lottery headquarters in Austin, with players needing to make an appointment first.

Note that any prizes claimed as annuities must be claimed at the Texas Lottery headquarters.

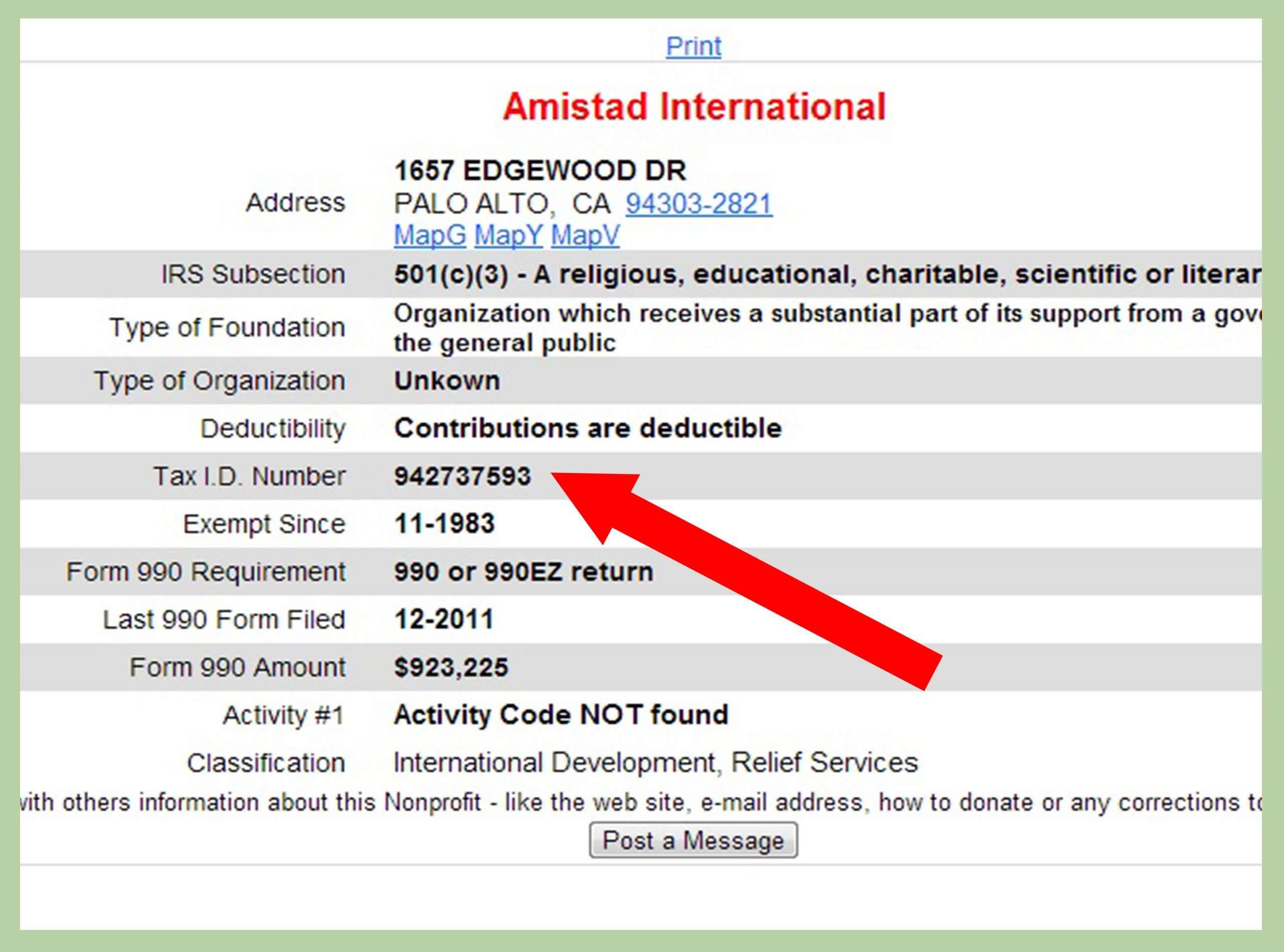

All prizes exceeding $25 that are claimed by mail must be accompanied by a completed claim form and proof of social security or a tax ID number.

Also Check: Cook County Appeal Property Tax

An Overview Of Texas Sales And Use Tax

Sales tax is a tax paid to state and local tax authorities in Texas for the sale of certain goods and services. First adopted in 1961 and known as the “Limited Sales and Use Tax”, sales tax is most commonly collected from the buyer at the point of sale. Municiple sales tax was enacted in 1967.

As a business owner selling taxable goods or services, you act as an agent of the state of Texas by collecting tax from purchasers and passing it along to the appropriate state or local tax authority. As of March 2019, sales and use tax in Texas is administered by the Texas Comptroller of Public Accounts.

Any sales tax collected from customers belongs to the state of Texas, not you. Its your responsibility to manage the taxes you collect to remain in compliance with state and local tax laws. Failure to do so can lead to penalties and interest charges.

Use tax is similar to sales tax, but applied where goods are consumed rather then where purchased.

In most cases, sales tax is collected at the point of purchase. However, there are a number of cases when this may not be the case:

In each of the above cases, a use tax may now be required to collect sales tax. In such instances, the tax burdon shifts to the consumer who is required to

Use tax laws in Texas apply to goods purchased out of the country but consumed in Texas.

To summarize, use tax is due when goods are purchased tax free by a merchant and then converted for use, consumption, or enjoyment by that same merchant.

Tips For Better Address Searches

- Check the spelling of the street name

- Use “Springwood St” instead of “Spring Wood St”,

- Use “Manor Rd” instead of “Maynor Rd”,

- Use “Belmont Dr” instead of “Bellmont Dr”,

- Use “Lemmon Ave” instead of “Lemon Ave”

You May Like: License To Do Taxes

Nership And Sole Proprietorship Taxes

Most Texas small businesses that are partnerships pay the franchise tax, while sole proprietorships do not. The litmus test in a partnership is whether the business is directly owned by individuals, with the business income distributed directly to those individuals. In these situations, Texas treats partnerships like sole proprietorships and does not impose the franchise tax.

In such cases, the business owners must pay federal income tax on this income but not state tax, since Texas does not tax personal income.

The majority of partnerships in Texas, including LPs and LLPs, are subject to the franchise tax.

For business owners in Texas considering forming a partnership, a qualified tax accountant can help determine how to structure the partnership for the most favorable tax treatment given the individual circumstances.

Texas Sales Tax Calculator

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Texas has a 6.25% statewide sales tax rate,but also has 815 local tax jurisdictions that collect an average local sales tax of 1.345% on top of the state tax. This means that, depending on your location within Texas, the total tax you pay can be significantly higher than the 6.25% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas:

Read Also: How Much Are Taxes For Doordash

File Your Sales Tax Return

Now that youve registered for your Texas seller’s permit and know how to charge the right amount of sales tax to all of your customers, you are all set to file your sales tax return. Just be sure to keep up with all filing deadlines to avoid penalties and fines.

Recommended: Hiring a business accountant can help your business file tax returns as well as issue payroll and manage bookkeeping. Schedule a consultation with a business accountant today to save thousands of dollars on your taxes.

What If You Need Help Paying Your Texas Property Taxes

Of course, if you currently have a low income, the fact youre not paying income tax is cold comfort. As the cost of basic essentials rises but your household income does not, you may wonder how youre going to pay your property taxes.

Before you panic, find out if youre eligible for one of six Texas property tax exemptions. If youre over 65 or disabled, check with your tax preparer to see if you qualify. You could save a significant amount of money and discover youre able to manage your taxes in Texas.

If youre not exempt and in danger of becoming delinquent on property taxes in Texas, you could incur debilitating fees and interest. Help is available with property tax assistance from Tax Ease.

Recommended Reading: Michigan.gov/collectionseservice

Texas Property Tax Rates

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. They are calculated based on the total property value and total revenue need. In a given area, however, they typically do not change drastically year to year.

Texas levies property taxes as a percentage of each homes appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

In the table below, we look at each countys effective tax rate, which is equal to the amount of property tax that homeowners actually pay as a percentage of their homes value. The table also includes the average annual tax payment and average home value in each Texas county.

| County |

|---|

Looking to calculate your potential monthly mortgage payment? Check out our mortgage calculator.

Maximum Compressed Tax Rates

| 2022 Maximum Compressed Tax Rates | |

| Category: | Funding Implications Tax rate compression |

|---|---|

| Next Steps: |

This letter details matters regarding tax rates for the 2022 tax year and the related state funding implications for the 20222023 school year based on Texas Education Code §§48.255, 48.2551, and 48.2552, and 19 Texas Administrative Code §61.1000. It is important to remember that Tier One tax compression does not impact the overall level of funding a district is entitled to. Rather, tax compression only impacts the balance of state and local share of a school districts total Tier One entitlement. This notice does not apply to open-enrollment charter schools.

You May Like: Doordash Filing Taxes

Who Sets The Appraisal Value For My Property

The value of your home is based on the appraisal of a tax assessor. Your local government hires the assessor, who bases the value of your home on similar homes in your area. You can get some idea of your homes value just by seeing what other houses in your neighborhood are selling for. This is one of the factors an assessor may use to value the property in your area.

Local Use Of Property Tax Receipts

Figure 3 shows the various ways local governments spend their revenue from taxes and other sources. Almost half of the revenue funds education. Other significant expenditures are 8 percent for social services and 8 percent for public safety . Local governments spend 16 percent of their budgets on utilities, but utilities are largely paid from user fees, not taxes.

Read Also: Reverse Ein Lookup Irs

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Texas Sales Tax Rates By City

The state sales tax rate in Texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

Texas has recent rate changes .

Select the Texas city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Texas was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Recommended Reading: Ein Reverse Lookup Free

What Is A Capital Gains Tax In Texas

By nwdempsey

The real estate market is a tempting arena to do business in, especially when it comes to property investing. Considering the generous financial rewards that property investors are able to make on the market, paying a tax on the property sale is no surprise or issue. But did you know that there are also capital gains on selling your house in some U.S. states?

Thats right, you dont have to be a real estate investor to be taxed for selling a house. So do you pay capital gains for selling your house? Making a home sale in Texas comes along with a set of distinctive regulations and responsibilities. In this article, we will provide an explanation of what capital gains are, uncover what this tax is in Texas, and help you stay informed about your tax liabilities.

Texas Sales Tax Deadlines

Once a businesss sales tax application has been approved, it will receive a letter with instructions on how often it must file a sales tax return. Returns may be due monthly, quarterly, or yearly.

Monthly Filers: Due on the 20th of the following month.

| Period |

|---|

Annual Filers: Due on January 20 for the previous years taxes.

If a due date falls on a Saturday, Sunday or legal holiday, the deadline is extended until the next business day.

You May Like: Do I Need To File Taxes For Doordash

Texas Sales Tax Nexus

A sales tax nexus is a term that means that a retailer as a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or other agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.