Schedule B Other Return Information

Form 1120S includes Schedule B, Other Information. The information required on Schedule B mainly includes:

- information about any stock the corporation owns in other corporations

- information about any ownership interest the corporation has in any partnerships

- whether the corporation’s total receipts for the year were less than a certain amount, and

- whether corporation’s total assets at the end of the year were less than a certain amount.

Regarding the last item, if the corporation’s total assets at the end of the year are less than the designated amount, the corporation doesn’t need to file additional Schedules L, Balance Sheets per Books, or M-1, Reconciliation of Income per Books With Income per Return, with its 1120S.

File An S Corporation Return And A Personal Tax Return Every Year

S Corporation owners need to file a personal tax return using Form 1040 every year. Additionally, they must also file a Form 1120-S: U.S. Income Tax Return for an S Corporation.

Are you wondering, “Can I file my own S Corp taxes?” You can file your own S Corp taxes if you know how to fill in a Form 1120-S, but there are very few software applications that allow you to do this, and the form can be complex. If you’re not confident about filling in that form, then Incfile’s business tax preparation service or a CPA can help.

We hope you’ve found this guide to S Corporation taxes useful. They’re a powerful type of business entity that can reduce the tax you pay. Due to their complexity, remember to check out Incfiles tax service for a complete and hassle-free way to complete your end-of-year filings.

Paul Maplesden

Paul is a freelance writer, small business owner, and British expat exploring the U.S. When hes not politely apologizing, he enjoys hats, hockey, Earl Grey Tea, mountains, and dogs.

What Type Of Corporation Files A 1065

For tax planning purposes, business partnership earnings, losses, deductions, and credits appear in IRS Form 1065. LLCs, foreign partnerships with U.S. income, and foreign entities filing this form are all U.S. corporations. The groups receive funding from nonprofits and local governments. As part of a completed Schedule K-1, partnerships must also provide a copy.

You May Like: How Does Taxes Work With Doordash

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

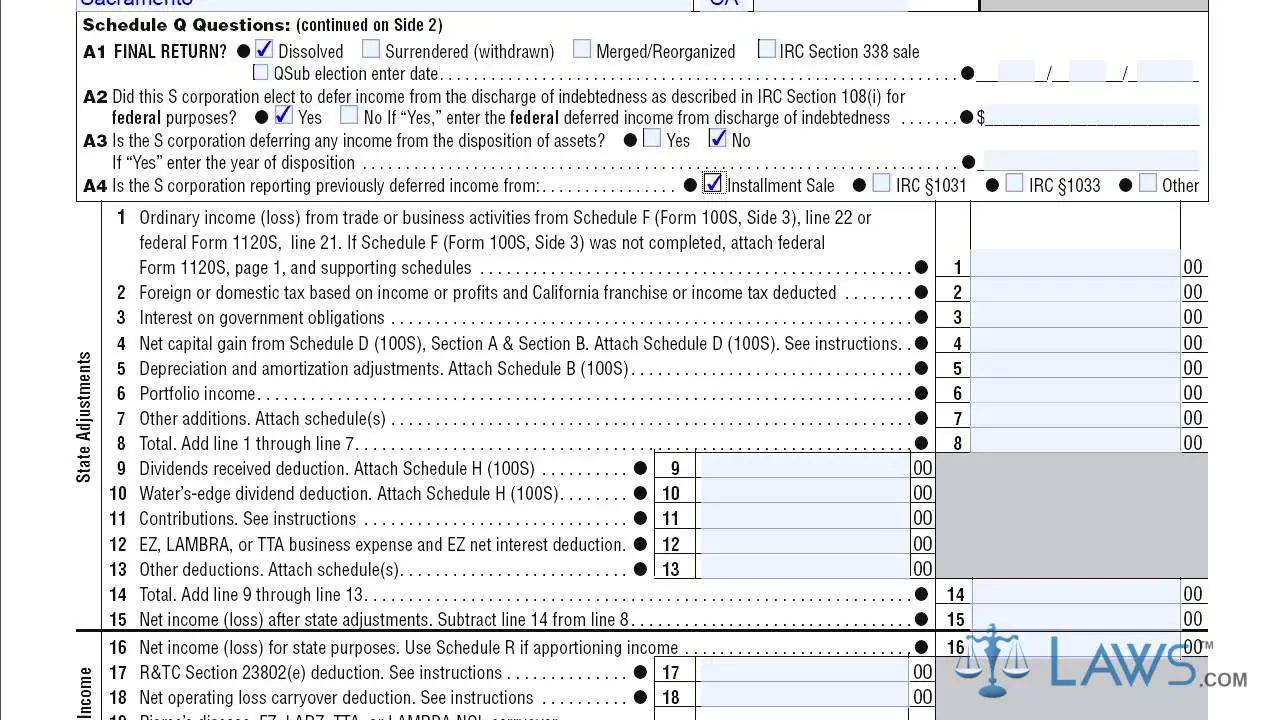

Paying Tax As A New York S Corporation

Under the corporation franchise tax , you pay a fixed dollar minimum tax based on New York receipts.

Under the corporation franchise tax on banking corporations , you pay the higher of:

- the tax on entire net income, computed as if the S corporation had not made the federal S corporation election, reduced by the Article 22 tax equivalent or

- the fixed dollar minimum tax of $250.

A license fee or maintenance fee may also apply if you’re a corporation formed outside of New York.

The metropolitan transportation business tax doesn’t apply to a New York S corporation.

S corporations may earn tax credits that flow-through to the S corporation shareholders to be claimed on the shareholders’ individual returns.

Don’t Miss: How Can I Get My 1099 From Doordash

How To Form An Llc

Below are several of the steps involved in forming an LLC. However, please check with your local state since they may have additional forms and requirements.

It’s important to note that the above list is not comprehensive since each state may have additional requirements. Once established, many states require LLCs to file an annual report, which the state may charge a fee. These fees can sometimes run in the hundreds of dollars per year.

Pay Quarterly Estimated Taxes On Distribution Amounts

Your payroll service will only take care of the federal and state taxes that you pay on the amount you take out of your business as a salary. That means youll still owe federal and state income tax on the profits that remain in your business or that you take out as distributions. Heres our guide to paying your quarterly estimated taxes.

Also Check: Form 5498 H& r Block

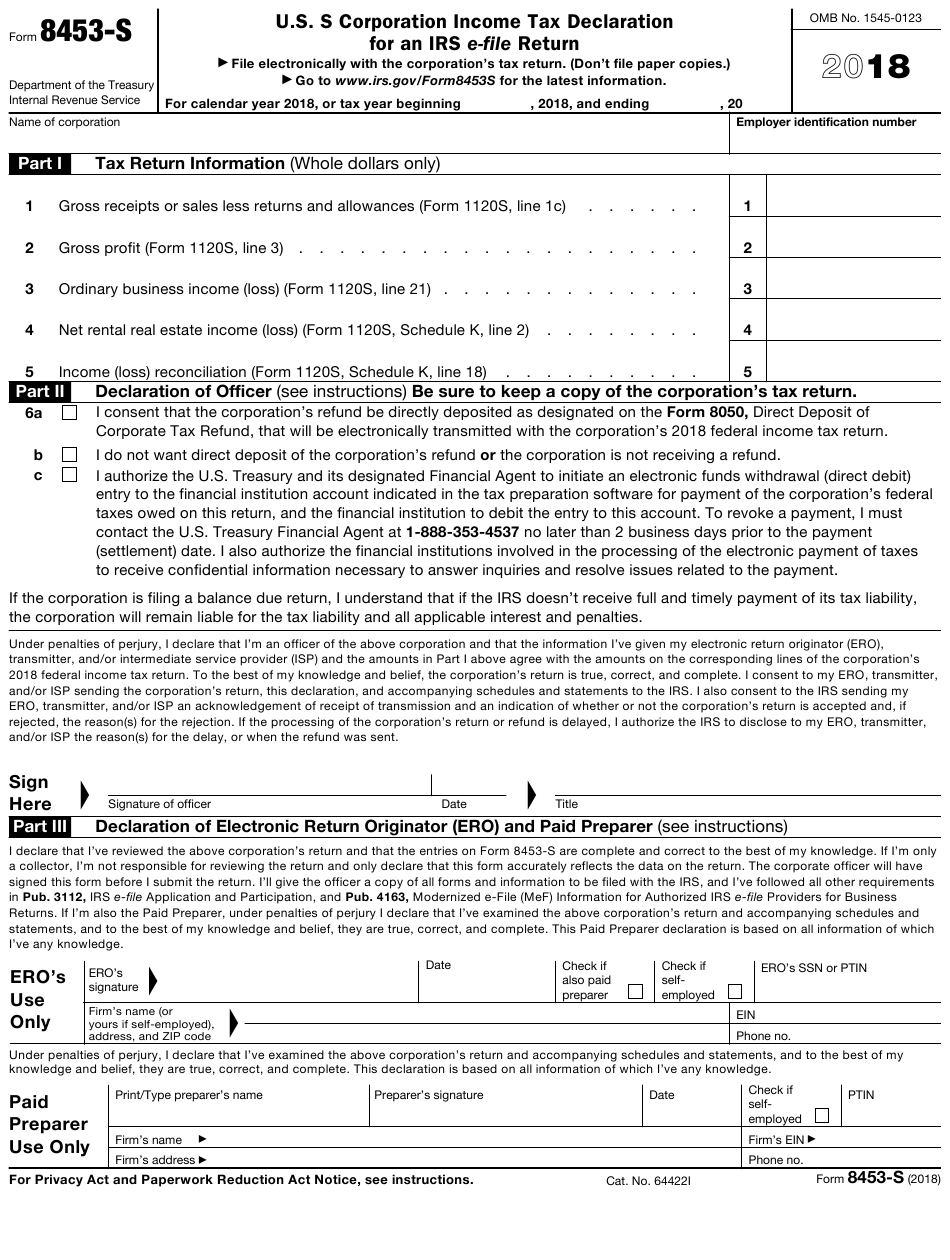

S Corp Tax Return Forms

S corps use IRS Form 1120-S, U.S. Income Tax Return for an S Corporation, to file their federal income tax returns.

To fill out the form, the IRS requires you to provide various pieces of information.

These include, but are not limited to:

- Your companys gross receipts and profits

- Officer compensation

- The cost to manufacture or produce your companys products and/or services

- Employee salaries and wages

- Any estimated tax payments you made during the tax year

- Any refundable credits you are carrying over from previous tax years

- Information about your business, including its name, when it was incorporated, and when you made the S corp election

- A statement showing profits and losses

- A balance sheet for the company

- Your companys business activity code and your EIN, which the IRS uses to identify your company for tax purposes

- A list of payments to independent contractors who your company paid $600 or more

Prepare Your Financial Statements

One of the first things your tax professional will ask for are financial statements. Even if youre using tax software to do your business taxes, youll want completed financial statements before you get started.

Your profit and loss statement and balance sheet contain most of the information you need to complete your tax filings. Youll want to keep your accounting software open during the process so you can examine your expenses more closely.

Don’t Miss: Doordash Write Offs

Who Qualifies To Make The New York S Election

To qualify for New York S corporation treatment, your corporation must:

- Be a federal S corporation.

- Be a general business corporation taxable under Article 9-A or a banking corporation taxable under Article 32 of the New York State Tax Law, or be the parent of a QSSS that is taxable under Article 9-A or Article 32. Insurance corporations taxable under Article 33 or any corporation taxable under Article 9 can’t elect to be a New York S corporation.

- Get consent to the New York S election from all of the corporation’s shareholders.

can’t make the New York S election. Only the parent corporation of the QSSS can do so.)

General Relief Rules For S Corporation Elections

The following requirements must be met to qualify for late S corporation election relief by a corporation or entity classified as a corporation:

- The entity intended to be classified as an S corporation, is an eligible entity, and failed to qualify as an S corporation solely because the election was not timely

- The entity has reasonable cause for its failure to make the election timely

- The entity and all shareholders reported their income consistent with an S corporation election in effect for the year the election should have been made and all subsequent years and

- Less than 3 years and 75 days have passed since the effective date of the election .

In addition, if the electing entity is requesting a late corporate classification election to be effective on the same date that the S corporation election was intended to be effective, the requesting entity must also meet the following additional requirements:

- The entity is an eligible entity as defined in Treas. Reg. § 301.7701-3

- The entity failed to qualify as a corporation solely because Form 8832 was not timely filed and

- The entity timely filed all required federal tax returns consistent with its requested classification as an S corporation.

If the entity qualifies and files timely in accordance with Rev. Proc. 2013-30, the Campus can grant late election relief. If the entity does not qualify under the provisions of the Revenue Procedure, its only recourse is to request a private letter ruling.

You May Like: Filing Taxes For Doordash

Getting Help With Corporate Income Taxes

Income taxes for corporations and S corporations are complicated. It’s usually best to get help from a CPA or tax professional who is familiar with corporate taxes rather than attempt to prepare this return on your own. Review basic information about business taxes that you should know before you enlist the help of a CPA, enrolled agent, or another qualified tax preparer to prepare your corporation’s taxes.

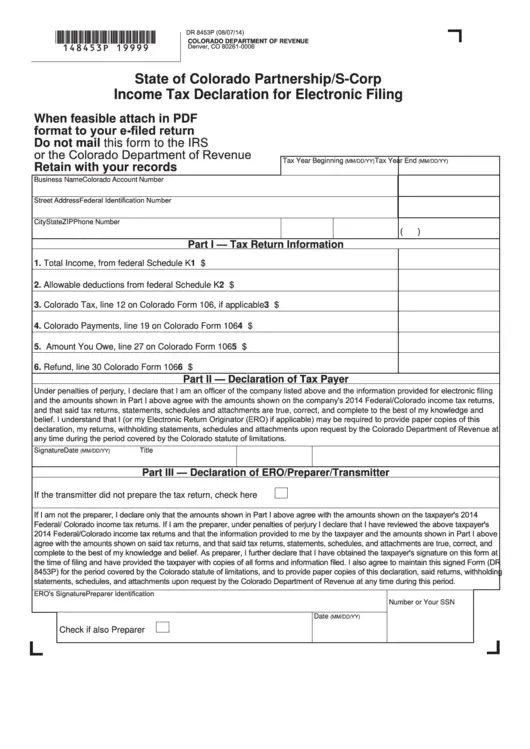

Using Tax Preparation Software

Over 90% of corporations file their return electronically. To do so, you must use CRA certified software. We certify commercial software to ensure that it meets our specifications. To find a list of certified software, go to Software.

A return prepared by certified software can then be electronically filed using:

- the CRA’s Corporation Internet Filing service

- My Business Account, if you are a business owner

- Represent a Client, if you are an authorized representative or employee

If you cannot file electronically, you can print the T2 Bar Code Return and mail it to the CRA.

You May Like: Doordash Tax Filing

When And How Do Corporations Pay Income Tax

For information on extended payment deadlines due to COVID-19, go to Income tax filing and payment deadlines.

Corporations have to pay income tax in monthly or quarterly instalments, unless the total of Part I, Part VI, Part VI.1, and Part XIII.1 taxes payable for either the previous year or the current year is $3,000 or less.

The balance of tax the corporation owes for a tax year is due within either two or three months of the end of that tax year, depending on the circumstances of the corporation.

Interest and penalties apply to late payments. To be on time, you have to make instalment payments and other payments on or before the due date by using one of the several methods for making payments:

- your financial institution’s online or telephone banking services

- the CRA’s My Payment service at My Payment

- by using My Business Account and selecting Calculate instalment payments. Once you have finished the step-by-step process, you will be provided the option to select a Proceed to pay button to pay instalments towards your account. Currently only available for business owners

- by pre-authorized debit using My Business Account

- in person at a Canadian financial institution or, for a fee, at a Canada Post retail outlet. To do so, you have to use a remittance form, which you can request online in My Business Account.

Maintain Your Llc Taxed As An S Corporation

The process is not done after the LLC formation is complete.

Be sure to properly maintain your LLC for the life of its existence.

This means stay on top of all tax and annual report requirements.

If you would like us to properly handle the formation of your LLC, call us at 989-5294 or simply securely order online now to get the process started:

You May Like: Doordash Independent Contractor Taxes

Find Out What Tax Forms S Corporations Are Required To File With The Irs

S corporations are pass-through tax entities. That means that instead of an S corporation itself paying federal tax on its business profits, the obligation to pay those taxes passes through the corporation to the individual shareholders. However, this doesn’t mean S corporations themselves are simply ignored by the IRS. On the contrary, an S corporation definitely is recognized by the IRS as a separate entity from its shareholdersand is required to file various returns and other forms with the IRS.

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS.

S Corporation Tax Returns

S corporations must usually take a calendar year-end date to agree with the personal tax year-end, unless it can establish a reasonable business purpose for a different date. The filing date and tax return due date are the 15th day of the third month after the tax year-endin other words, taxes are due March 15 for almost all S corporations.

Don’t Miss: How Do Doordash Drivers Pay Taxes

Is It Better To Be Taxed As A Partnership Or S

Neither structure can pay corporate taxes for its business. As general partners, startups have an advantage over most other business structures as theyre more convenient to operate. When companies expand and obtain higher profits, tax incentives may be enhanced more dramatically when forming S corporations.

What Information Is On Tax Form 1120s

The information on Form 1120S falls into three general categories: income, deductions, and taxes and payments.

Heres an overview of some of the main information the IRS requires you to provide.

- Your business gross receipts and gross profits

- Compensation of officers and salaries and wages

- Returns and allowances

- Cost of goods sold

- Any refundable tax credits carried over from previous years

Form 1120S also has multiple schedules that you may need to include when you file.

- Schedule B: Schedule B includes any canceled or forgiven non-shareholder business debt, whether a qualifying subsidiarys S-corp status was terminated or revoked, and any 1099 payments to independent contractors that worked for your business during the year.

- Schedule K: Schedule K lists each shareholders share of income, deductions, credits and other items from the business. This form will also detail the amount of pass-through income that will be reflected on your personal tax return.

- Schedule L: Schedule L provides an overview of your business balance sheets, including cash, inventory, loans to shareholders, liabilities, mortgages and capital stock.

- Schedules M-1 and M-2: Schedule M-1 reconciles the business income shown in its accounting records with information thats been reported on Schedule K. Schedule M-2 details any adjustments, including reductions, distributions, accumulated earnings or profits, that are part of your business financials.

You May Like: Doordash Mileage Taxes

Figuring S Corporation Income And Expenses

To figure S corporation income, divide the S corporation’s items of income, loss, expense, and credit into two categories:

- Items used to figure nonseparately stated income or loss.

The separately stated items and the nonseparately stated income or loss are collectively known as passthrough items because they are passed through to the shareholders on a pro rata basis.

Does An S Corp Have To File A Tax Return If No Income

The owner of a S Corp is required to file IRS Form 1120-S. IRS returns for S corporations are filed. In addition to following the same rules for filing taxes without income, both C and S Corps follow the same rules. If you did not have income, you still need to file the corporation income tax return, regardless of whether you had expenses.

Recommended Reading: What Does It Mean To Grieve Taxes

Fill Out Page 1 Of Form 1120

Once youâve inputted your contact information, dates of incorporation and S corp election, etc. into the general information fields at the top of the form, youâll be presented with three different labeled sections:

Income

This section will ask you about all of your companyâs revenues for the year, which is information youâll get from your income statement.

Deductions

This section will ask you for your businessâ deductible expenses for the year, which youâll also get from your income statement .

Tax and payments

Youâll only have to fill this section out if your company began the year as a C corporation and filed for S corp status during the current tax year. Youâll use this section to list any estimated taxes you paid during the year and calculate any taxes you owe or overpaid due to the switch.

How Do I File My Taxes As An S Corp

Form 1120S, U.S. Income Tax Return for an S Corporation is the tax form S corporations use to file their federal income tax return.

1120S is a five page form from the IRS, which looks like this:

Youâll need the following information on hand before filling out 1120S:

- General information about your business, including your date of incorporation and the date you elected S corp status

- A profit and loss statement and a balance sheet for your business

- Information about any payments you made to independent contractors totaling at least $600 for the year

Page one of 1120S is divided into four parts:

The top third of the form containing fields A-F is where youâll input your contact information, dates of incorporation and S corp election, your assets, etc.

The Income section will ask you about all of your companyâs revenues for the year, which is information youâll get from your income statement.

The Deductions section is where youâll record all of your businessâ deductible expenses for the year, which youâll also get from your income statement .

The Tax and Payments section applies to corporations that began the year as a C corporation and filed for S corp status during the current tax year. Youâll use this section to list any estimated taxes you paid during the year, and calculate any taxes you owe or overpaid due to the switch.

There are also six schedules attached to 1120S, the first three of which are mandatory:

Don’t Miss: Csl Plasma Taxable